Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 2 Apr, 2024

By Scott Robson

Highlights

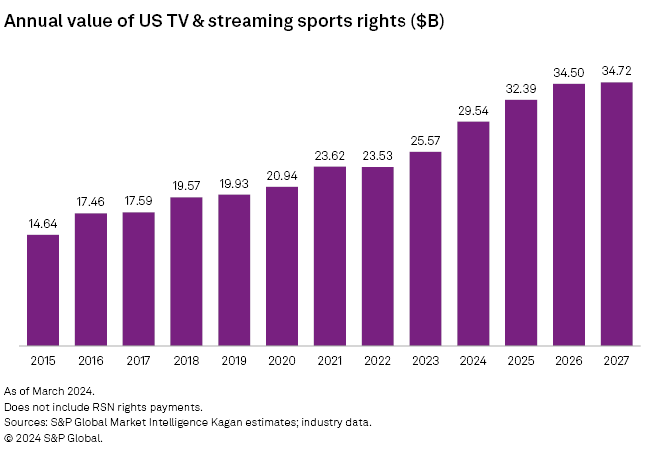

We estimate that US TV and streaming sports media rights payments will total $29.54 billion in 2024 across broadcast, cable and streaming services. This has risen from an estimated $14.64 billion in 2015 and is expected to grow to nearly $35 billion by 2027 as new deals are forged.

Looking at the current deals held by the major media companies, we estimate that Comcast Corp. spends more on sports than any other company in our database, globally. This has a lot to do with the company's investments in the NFL as well as global soccer content via Sky.

A steady tide of cord-cutting has eaten away at revenue generated from linear broadcasts of live sports, however, and increasingly nudged sports rights holders such as Comcast, Disney, Paramount and Warner Bros. Discovery to shift more and more live sports programming to their respective streaming platforms

Traditional pay TV subscriptions have been on the decline for a decade, resulting in dramatic declines to linear TV ratings. However, live sports content continues to keep audiences interested in what's on TV. Many new media rights deals were forged in recent years, bringing new players like Apple, Amazon and Alphabet into the circle of sports media rights holders, making the shift from traditional linear television to streaming platforms heavily reliant on the availability of live sports content.

Sports networks continue to invest in premier live sports programming despite a contracting subscriber base in the traditional cable bundle and a growing list of alternative pay TV services that appeal to cost-conscious consumers. We estimate that US TV and streaming sports media rights payments will total $29.54 billion in 2024 across broadcast, cable and streaming services. This has risen from an estimated $14.64 billion in 2015 and is expected to grow to nearly $35 billion by 2027 as new deals are forged. Our forecast shows even years rising faster than odd years due to spending on the Summer and Winter Olympics — 2021 is an outlier, as the 2020 Summer Olympics were held in 2021.

Looking at the current deals held by the major media companies, we estimate that Comcast Corp. spends more on sports than any other company in our database, globally. This has a lot to do with the company's investments in the NFL as well as global soccer content via Sky. Walt Disney Co. is a close second, spending an estimated average of $7.25 billion per year under the current media rights deals that it holds across major sports properties.

In the US, major sports rights deals for the NFL, NHL, NASCAR and MLB were extended in the last couple of years with hefty increases over the previous contracts. The current NBA deal expires at the end of the 2024-2025 season, and the league is looking for a major rights valuation increase if it can follow the NFL and capitalize on a changing TV landscape. The NBA is currently the second highest-paid professional sports league in the US; however, its current deal is less than one-third the value of the NFL's.

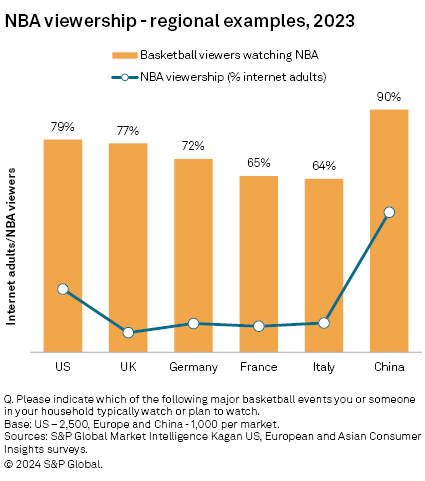

The NBA rights are currently held by Walt Disney Co. and Warner Bros. Discovery Inc., and while both companies will enter the bidding process on the next renewal, it is possible that others may join, including Comcast Corp.'s NBCUniversal Media LLC. It was announced in November 2023 that Disney will acquire Comcast's 33% stake in Hulu for over $8.6 billion, which could provide Comcast with the capital needed to scoop up a piece of the NBA's national programming. It has also been reported that streaming companies like Apple Inc. and Netflix Inc. could be bidding on the upcoming NBA rights deal, which could drive the price up to the reported $75 billion total that the league has been seeking over 10 years. The NBA is also looking to capitalize on its international appeal by forging lucrative global rights deals for fans outside of the US. The league is particularly popular in China as our survey data highlights below. Like the national US media rights deal, none of the NBA's current international rights deals go past 2025.

NASCAR also signed a new lucrative rights deal. The stock car circuit announced renewal pacts with Fox Corp.'s FOX Sports and NBCUniversal's NBC Sports while adding mid-season race coverage from newcomer Amazon.com Inc.'s Prime Video and a return by Warner Bros. Discovery Inc.'s TNT. In conjunction with an earlier deal with The CW (US) for its next-generation circuit, NASCAR scored a reported $7.7 billion in collective rights fees for the 2025 through 2031 seasons. The current 10-year deal with FOX and NBC Sports, which expires after the 2024 season, has an average value of $822 million. As such, $1.1 billion in rights fees would represent a 34% uptick in average annual value.

Looking at college sports, ESPN renewed its agreement with the college football playoffs in March, paying $7.8 billion over six years through the 2031-2032 season. The college football playoffs are expanding from four to 12 teams for the 2024-2025 season. ESPN also signed a $920 million deal with the NCAA to broadcast a package of 40 championships, including the women's NCAA basketball tournament. That deal will expire in 2032 at the same time as the current deal that Paramount Global and Warner Bros. Discovery have to broadcast the Men's tournament. The increasing popularity of women's college basketball has resulted in a bigger rights deal for the overall championship package.

Live sports programming has proven far more resistant to disruption from the likes of Netflix and Amazon than other entertainment fare such as TV series and films. Expensive, long-term sports rights deals have generally seen the same handful of traditional big media firms (Comcast, Disney, Fox, Paramount and Warner Bros. Discovery) vying for deals with leagues that has resulted in linear TV distribution of live sports still being the norm.

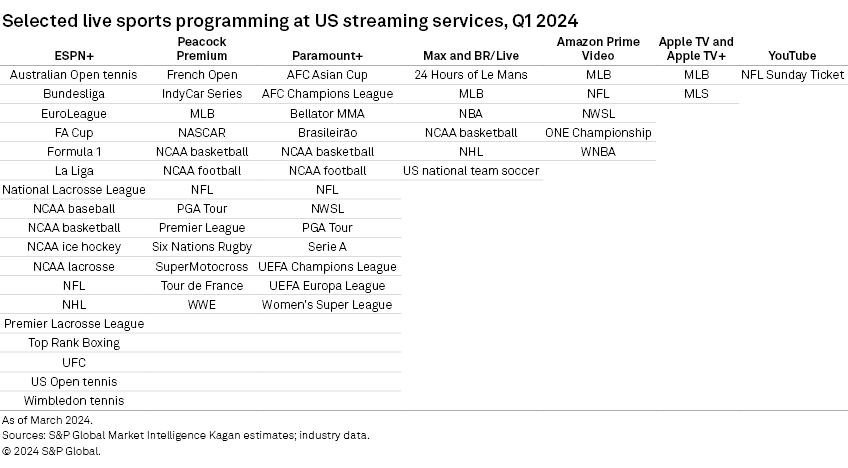

A steady tide of cord-cutting has eaten away at revenue generated from linear broadcasts of live sports, however, and increasingly nudged sports rights holders such as Comcast, Disney, Paramount and Warner Bros. Discovery to shift more and more live sports programming to their respective streaming platforms Peacock Premium, ESPN+, Paramount+ and Max. Amazon, Alphabet and Apple have successfully carved off rights for select NFL and MLB action and Netflix is increasingly dabbling in what it calls "sports entertainment" such as World Wrestling Entertainment (WWE), boxing and golf celebrity/exhibition contests.

PODCAST

Blog