S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 22 Jan, 2024

By Kym Nator

Achieving subscriber scale remains important in the long run, but many streaming players in Southeast Asia have pivoted their focus to finding the right balance between expanding customer bases and generating higher average revenue per user (ARPU).

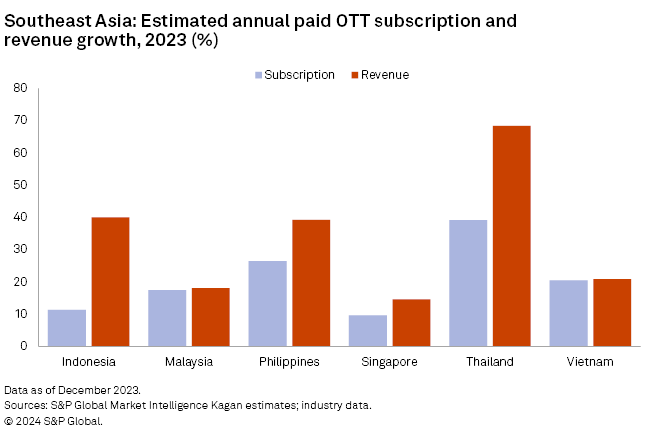

➤ S&P Global Market Intelligence Kagan projects that combined subscriptions for paid over-the-top video streaming services in Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam could eclipse the 50 million mark, potentially translating to a market value of about $1.90 billion at the end of 2024.

➤ Revenue growth and cost optimization are among the key themes shaping growth strategies for many of the top streaming operators in Southeast Asia this year.

➤ Partnerships with local third-party operators and content producers will also continue to play a critical role in driving growth for OTT players in the emerging Asia-Pacific region.

Compared to more mature OTT markets in other parts of the world, Southeast Asia still exhibits huge potential to sustain robust streaming growth, given the low household penetration of subscription video-on-demand services in most emerging markets. Since last year, however, some streaming services in the region have started to rein in efforts of pursuing paying audiences at any cost amid mounting pressure to maintain healthy profit margins.

Price adjustments to boost revenue

With expectations to reach streaming profitability by the close of 2024, Walt Disney Co. has increasingly leaned on price hikes to help elevate ARPU worldwide. Disney+ Hotstar, which was previously among the cheapest SVOD services in Southeast Asia, introduced a new premium tier priced nearly three times higher than its original subscription fee upon launch in major markets such as Indonesia and Thailand. Meanwhile, Netflix Inc. decreased monthly fees, reducing the cost of upgrading subscription plans for a big portion of users who were formerly on cheaper tiers with limited features. The service also debuted an extra member slot fee that typically costs the same as its entry-level plans in select emerging markets to monetize password sharing.

Despite contrasting approaches, the price adjustments rolled out by two of the biggest streaming providers in most Southeast Asian markets demonstrated a clear shift toward extracting more value from new and existing subscribers. Subscriptions to streaming services in Southeast Asia have generally remained affordable, providing enough room for other services to also raise fees, especially as average consumers become more accustomed to paying for access to premium video content.

Local, regional players remain competitive

Despite the presence of bigger global players, local and regional services still managed to thrive by capitalizing on the diverse culture, viewer preferences and income levels present around Southeast Asia. Local players such as Galaxy Play in Vietnam and Vivamax in the Philippines are still expected to stand out in their respective home markets this year, following commitments to release new original content more frequently. Hybrid online platforms such as Astro's Sooka in Malaysia and Emtek's Vidio in Indonesia leverage sports as a key driver of subscriber acquisition.

PCCW Ltd.'s Viu is poised to receive an additional funding of $100 million to help power its international expansion and other growth projects in Southeast Asia if Vivendi SE-owned Canal+ capitalizes on the option to become a majority shareholder later this year. Meanwhile, Chinese-owned regional players such as Tencent Holdings Ltd.'s WeTV will likely continue to lean on new interactive content formats and other value-added features that encourage interaction among subscribers to build loyal fan communities and differentiate their platforms from other services.

Licensing, co-productions drive local programming strategies

In 2022, Amazon.com Inc. embarked on an extensive localization initiative for Prime Video in Southeast Asia. It hired dedicated teams and announced original content slates from key markets such as Indonesia, Thailand and the Philippines. However, at the start of this year, Amazon revealed its decision to adopt a leaner operating model, consequently marking the end of its investment in original productions from the region. Previously announced projects that were scheduled over the next two years are still expected to push through. Moving forward, Amazon will instead license local and regional titles from Southeast Asia as it focuses resources on India and Japan.

Since local content is still an important differentiator, most of the top streaming operators will likely rely more heavily on licensing partnerships with domestic content producers as they maintain a more disciplined approach in growing content offerings from the region. Working together with local studios also allows international streaming services to tap into government-funded production incentives that could help minimize programming costs. Some of the Southeast Asian markets that increased the value of grants available for international co-production projects last year include Indonesia, Thailand and Singapore.

Telco, pay TV providers lead streaming aggregation

Many of the leading operators around Southeast Asia — including Telkomsel in Indonesia, Astro in Malaysia, Globe Telecom Inc. in the Philippines, StarHub Ltd. in Singapore and Advanced Info Service PCL and True Corp. in Thailand — have embraced the role of becoming OTT aggregators. This strategic shift has helped make it more convenient for their customers to stack subscriptions to a wide range of partner streaming platforms. Collaborating with local operators for distribution remains the easiest path to reach subscribers in the emerging Asia-Pacific region; however, streaming services might start rethinking the scope of these wholesale deals, given that they tend to generate lower ARPU compared to direct subscriptions.

Free ad-supported streaming prevails

Paid ad-supported streaming tiers might not gain much traction in Southeast Asia this year as most consumers in the region continue to embrace the freemium model championed by local and regional platforms. Global services such as Netflix and Disney are more likely to continue relying on mobile-only plans as the cheaper alternative to encourage untapped price-sensitive consumers to sample their platforms. As connected TV penetration creeps higher in Southeast Asia, programmers such as Disney and Warner Bros. Discovery Inc. could also look at launching free ad-supported streaming TV channels as an additional source of monetization for their content, especially since these companies have already shuttered many of their linear TV channels in the region.

Economics of Internet is a regular feature from S&P Global Market Intelligence Kagan.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.