Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 5 Jun, 2024

By Kristin Larson, PhD

The Electric Reliability Council of Texas Inc. is a rapidly advancing market for renewables deployment, with Texas ranking among the top states for wind, solar and storage installations. The state's small renewable portfolio standard was satisfied long ago, and subsequent development in the state has been driven by corporate offtakers, municipal utilities and supportive merchant economics. ERCOT has several operational solar and storage hybrid projects, and location matters for future energy revenue from those projects. We forecast that ERCOT's West zone will be most beneficial to hybrid projects.

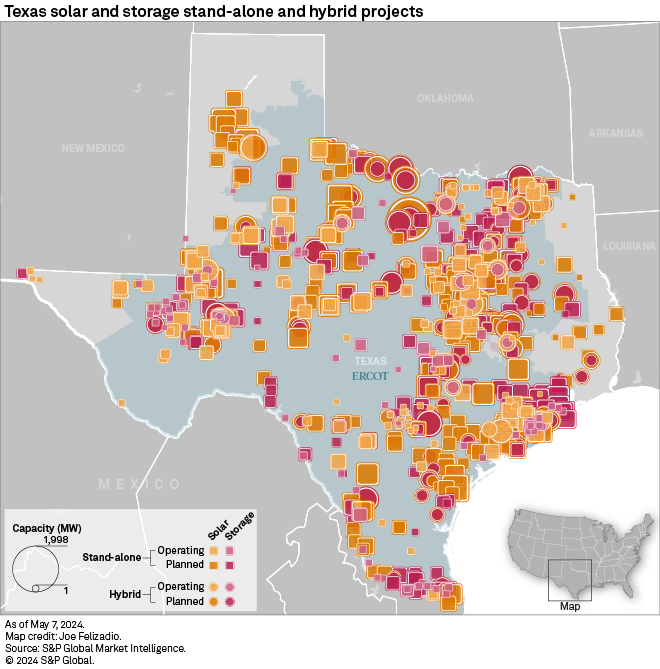

Solar and storage projects, whether hybrid or stand-alone, are found in all parts of Texas. ERCOT has over 30 GW of operating solar projects, and 26% of the solar capacity is colocated with a storage project. Planned solar projects in ERCOT include 57 GW of stand-alone solar and 27 GW of hybrid solar. Storage capacity has ramped up more recently, with 4.5 GW of storage installed, 23% of which is colocated with solar projects. The storage pipeline is almost 47 GW, with 38% hybrid.

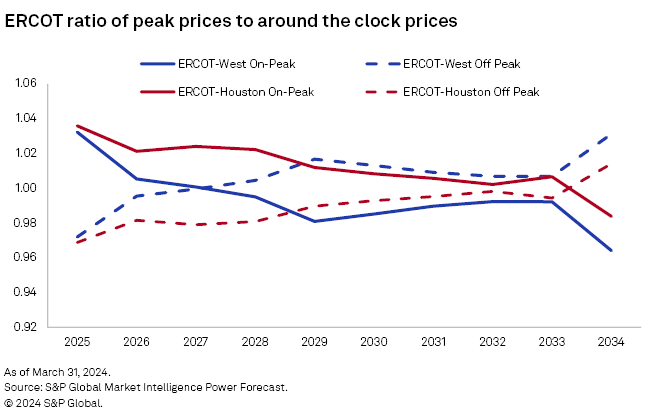

The arbitrage revenue available to hybrid solar and storage plants in ERCOT varies by location. Forecast annual average on-peak and off-peak prices, divided by the around-the-clock prices for the Houston and West zones in ERCOT, illustrate how arbitrage emerges and grows. Both zones start with on-peak prices higher than off-peak prices. This is the usual situation where higher demand in on-peak hours leads to higher prices in those hours and lower prices in off-peak hours. For the Houston zone, the on-peak prices are higher than the off-peak prices until 2034. In the West zone, there are more years with on-peak prices lower than off-peak prices, forecast to begin in 2028. Generally, we see the off-peak prices higher than the on-peak prices when there is a lot of solar production and solar generation share in the zone. The glut of solar generation midday leads to lower prices midday and possible curtailment of solar generation. Decreasing on-peak prices means decreasing prices captured by stand-alone solar projects. A solution to the decreased value of stand-alone solar revenue would be to pair the solar with a storage project. As a hybrid solar storage project, daytime solar generation can be used to charge the battery, which can be discharged at higher-priced hours later in the day and avoid or mitigate curtailment. The forecast reversal of on-peak and off-peak prices indicates that hybrid solar and storage plants are attractive, starting in 2028 in ERCOT-West.

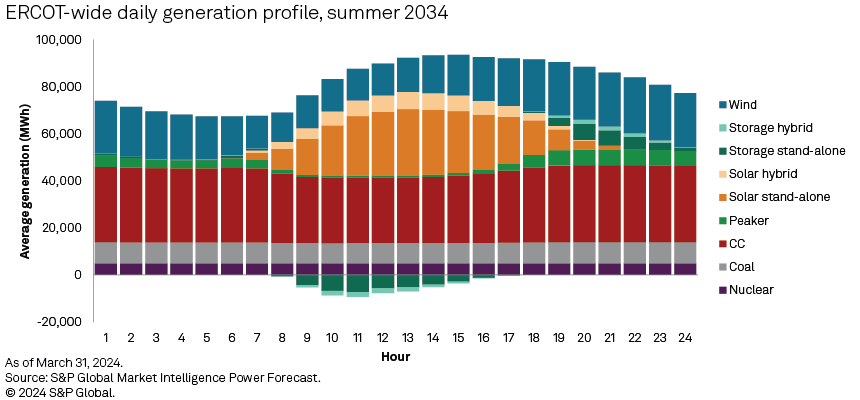

The average hourly generation in ERCOT for July 2034 by hour-of-the-day chart shows solar generates in the middle of the day, and storage also charges during the day. Gas peakers generate most hours but very little when the solar output is at its highest. Storage then discharges in the evening hours primarily. Hybrid storage is forecast to be a very small slice compared to stand-alone storage, charging during the day and discharging in the evening hours. Some excess solar is generated by the hybrid solar resource at the same time as the stand-alone solar fleet. The hybrid storage is limited to charge during the day from its companion solar plant to fully qualify for tax benefits. With stand-alone storage also charging during midday, it shows that this charging strategy is lucrative, and hybrid solar and storage plants are a moneymaking option in ERCOT in 2034.

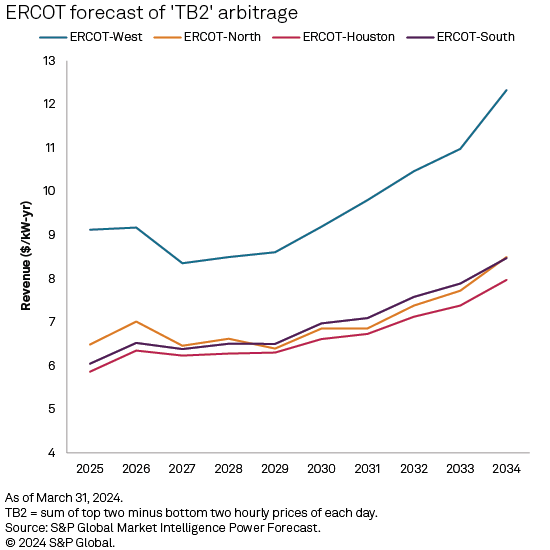

Top two/bottom two (TB2) is the hypothetical arbitrage earnings of a battery that charges during two low-priced hours and discharges at two high-priced hours every day. We use two hours in ERCOT since most of the installed batteries in ERCOT are two-hour batteries. We see higher profitability in the ERCOT West zone but some storage profitability in all regions. In Houston, gas generation is the marginal unit more than 90% of the time. In ERCOT West, renewables are on the margin 18% to 30% of the time. This gives more low-price hours in ERCOT-West that are good for storage charging and generate more arbitrage revenue for storage.

Location is a significant factor for hybrid solar and storage plants in ERCOT. ERCOT-West has a combination of factors that make hybrid solar and storage projects appealing in that region. The increased solar generation in ERCOT-West can drive down prices during midday, which decreases stand-alone solar revenue. The low prices while solar is generating and higher prices in other parts of the day create an arbitrage opportunity for hybrid storage projects that charge from solar generation and discharge at higher-priced hours. The hybrid solar and storage fleet is established in ERCOT and we expect growing financial returns based on energy revenues for these plants in ERCOT-West in particular.

Data visualizations by Chrisallen Villanueva.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Joe Felizadio contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.