Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 5 Apr, 2023

By Adam Wilson

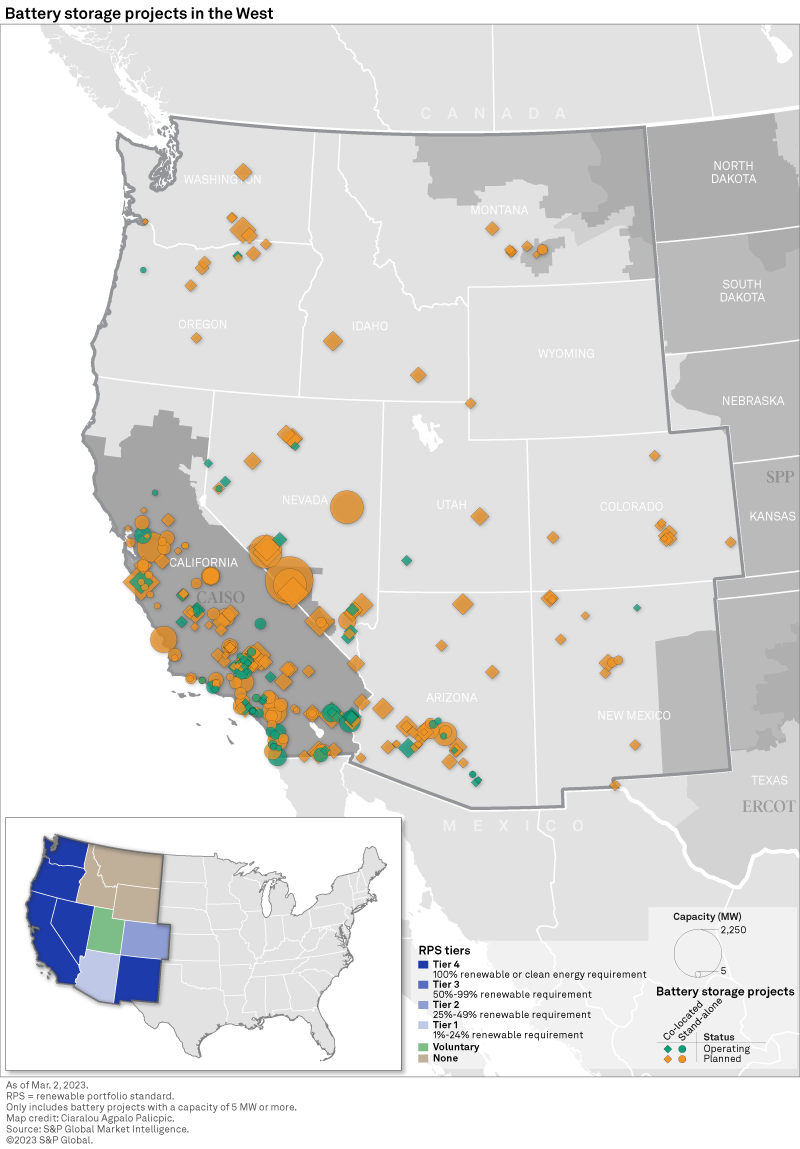

Utility-scale battery energy storage system capacity in the West region of the US is forecast to grow exponentially over the next decade, driven by aggressive renewable portfolio standards and related strong solar development, particularly across the sunshine-soaked desert southwest. The West is home to 6 GW of operating battery storage — 60% of the nationwide total. At over 32 GW, the pipeline of both stand-alone and colocated storage in the region is more than five times the installed base, however, as it tries to keep pace with the rapidly expanding solar fleet.

The Western US is home to the best solar resources in the country, and photovoltaic development has followed accordingly, with 30 GW in operation and another 51 GW in planning. This growing solar base is expected to lead to significant daytime generation surpluses, opening the door for the rapid expansion of battery storage. The West is home to just over 6 GW of operating storage capacity, but the pipeline has swelled to over 32 GW, with much of this capacity paired with a solar generator.

The robust solar fleet in the West provides lucrative returns for battery storage in the form of arbitrage as excess solar generation decreases daytime energy prices, leading to cheaper charging of batteries; the batteries can then discharge in the evening hours when energy prices are highest. Arbitrage revenue and capacity revenue combined are forecast to be enough for battery storage projects to make a full equity return on investment throughout much of the West — particularly in California, Nevada, Arizona and Colorado.

S&P Global Market Intelligence's "Battery Storage Investment Outlook in the United States" report examines the financial outlook for battery storage in Arizona, California and Colorado in the West. Arizona and California were targeted as their pipelines for solar and battery storage both rank in the top five in the US. Colorado lags behind, ranking 13th in planned battery storage capacity. A potential solar boom in the state, however, is expected to lead to robust arbitrage revenue, prompting a significant jump in storage development interest in the state.

Regional overview

Five states in the West — California, Nevada, New Mexico, Oregon and Washington — have 100% clean energy targets in place. This, combined with the best average solar insolation in the country, has made the region one of the premier destinations for utility-scale solar developers. California ranks first in the country with just under 18 GW of operating utility-scale solar, and Nevada ranks fifth with 3.6 GW. Arizona is close behind, ranking seventh at 3.2 GW, despite a relatively modest renewable portfolio standard (RPS) of 15% by 2025.

The pipeline for solar across the West has ballooned to over 51 GW, with 10 of the 11 contiguous Western US states having at least 1 GW of solar in the queue. This includes Idaho, Montana and Utah, which have no mandatory clean energy standard in place. Two-thirds of the planned solar capacity in the West is in just three states, however — Arizona, California and Nevada. Each of these three states has over 10 GW of solar in development.

Utility-scale storage is right on the heels of this solar wave, thanks to the frequently lucrative pairing of solar and storage. As a result, it is not surprising that California, which leads the US in installed solar, also sits atop the leaderboard in operating battery storage, with over 5 GW in operation. Over half of this capacity is colocated with other generation, mostly solar. California comprises over 80% of the West's operating battery energy storage system (BESS) capacity and roughly half of the country's installed base of storage.

Shifting to BESS capacity still in development, three of the top five states are in the West. Reiterating the trend of storage following solar development, Nevada, California and Arizona — which rank second, fourth and fifth, respectively, in planned solar — rank third, second and fifth, respectively, in planned storage capacity. Texas, which leads the country in solar capacity in the queue at 78 GW — six times more than second-place Nevada — also ranks first for BESS capacity in development at over 29 GW.

Most planned storage in the West is colocated with another generation source, specifically solar. The expected influx of photovoltaic capacity on top of an already robust operating solar fleet in the West is expected to begin to saturate the market and reduce the effectiveness of stand-alone solar, as indicated by the increasing curtailment rates across the region. In the territory of the California ISO specifically, 2022 renewable curtailment shattered records, surpassing 2,400 GWh; this was driven primarily by solar. While colocated storage is naturally intended to capture excess generation from its paired solar plant, stand-alone storage is also effective at gridwide curtailment reduction, as evidenced by the over 12 GW of planned stand-alone storage in the solar-rich states of California and Nevada.

California

Driven by the state's aggressive RPS — which requires 60% of retail electricity sales to come from renewable sources by 2030 and 100% carbon-free sources by 2045 — California has emerged as a leader in renewable energy deployment. The state ranks second, behind only Texas, in combined operating wind and solar capacity at nearly 25 GW. In planning, 2.5 GW of wind is in the pipeline in California, but the solar queue is more than four times larger.

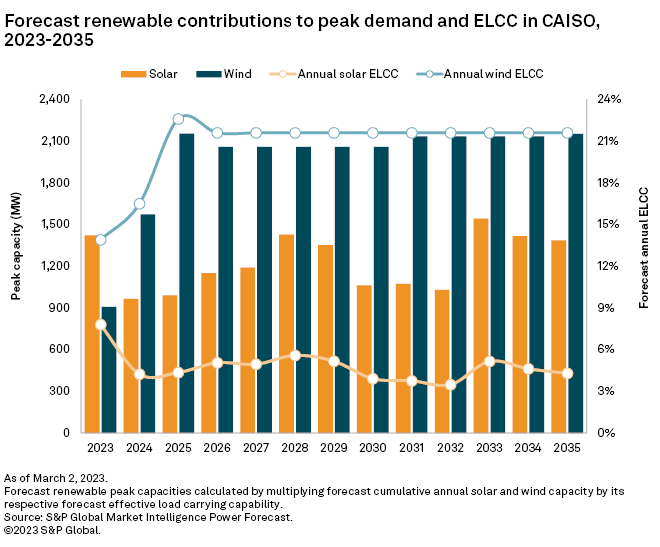

The pipeline for solar, combined with the installed base in California, would push the state's total to over 29 GW. Such an aggressive projected photovoltaic fleet in California is not surprising, given its clean energy targets. But due to the limited time frame during which solar can generate power, it does raise concerns of market saturation. This concern is quantified by a term known as effective load-carrying capability (ELCC).

ELCC is the measure of a generator's ability to supply load to the energy grid without affecting reliability. The ELCC for variable generators such as wind and solar tends to decline as more capacity is added to the grid. The decline is less dramatic for wind as it can theoretically generate power during all times of the day. Solar can only produce electricity during daylight hours and, even then, can be limited by factors such as cloud cover. As a result, the ELCC for solar tends to decline dramatically as more capacity is installed.

In CAISO, the ELCC for stand-alone solar in 2023 is 7.8%. This means a 100-MW solar system can reliably contribute only 7.8 MW to peak demand reduction. This is forecast to decline even more through 2035 as more solar is built. By 2032, the ELCC for solar in CAISO is forecast to drop to 3.5%. By contrast, the forecast ELCC for wind is forecast to remain steady at about 21% through 2035. As a result, despite forecast solar capacity being over three times higher than wind by 2035 — 32.2 GW compared to almost 10 GW — wind contributes more to peak demand through the forecast than stand-alone solar.

This is where the need for storage comes in. The ability of storage systems to capture excess solar generation during the day and dispatch in the evening when demand is still high makes them natural partners for solar. Further, solar-plus-storage in CAISO has what is known as a "diversity benefit." According to analysis done for the California Public Utilities Commission, solar-plus-storage systems in CAISO are forecast to have a greater ELCC than the combined totals of stand-alone storage and stand-alone solar facilities. Over half of the proposed storage in California is part of a solar-plus-storage system.

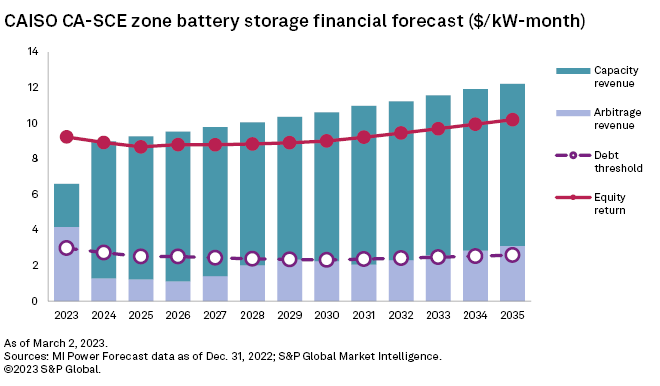

Shifting to the forecast economics for storage in California, BESSs have access to both capacity revenue and energy arbitrage revenue. Energy arbitrage revenue results from battery storage charging during off-peak periods when energy prices are lower and discharging power back to the grid during higher-priced on-peak periods. In CAISO, through 2030, excess wind generation overnight, along with daytime solar generation, pushes energy prices down during those periods, resulting in storage charging. After 2030, the retirement of the Diablo Canyon nuclear power plant will result in less excess overnight wind generation and thus lower charging for storage. Continued growth in solar, however, prompts a shift to higher daytime charging. These factors will cause arbitrage revenue for storage systems in CAISO to increase at a relatively steady pace between 2024 and 2035.

The Market Intelligence Power Forecast outlines two financial thresholds to measure the economic viability of a power plant. The lower target is the debt threshold which is the revenue required to pay off the project debt but not the equity-holders of the project. The full equity return line is what is required to pay off project debt, as well as 12% returns to equity investors.

Capacity revenue for storage, based on the resource adequacy market set by the California PUC, is forecast to increase from $7.71/kW-month to over $9/kW-month by 2035. Arbitrage revenue grows from $1.27/kW-month in 2024 to $3.10/kW-month by 2035. These two revenue streams are enough for storage projects to surpass both their projected minimum debt and full equity return thresholds beginning in 2024. Economics forecasts for storage projects in Arizona and Nevada are similarly favorable, with projects forecast to meet their full equity return targets by 2025 and beyond.

Colorado

Colorado does not have the same magnitude of solar in operation or battery storage in development as some of its Western US counterparts. Colorado has just over 1.3 GW of operating solar, ranking 12th in the country. To date, wind has been the renewable technology of choice, outnumbering solar 4-to-1 with 5.1 GW. The state ranks 13th in planned storage capacity with 704 MW. Signs show, however, that Colorado could become another future hotbed for BESS development.

Development interest for solar is rapidly increasing, with a pipeline of over 4.6 GW compared to 2 GW of wind in planning. Despite the growing queue for solar, the state only ranks 11th in planned capacity — indicative of the nationwide shift towards photovoltaic generation. The state's largest utility, the Public Service Co. of Colorado, is committed via parent company Xcel Energy Inc. to achieving 100% carbon-free generation by 2050. This target was codified in Colorado legislation in 2019. This, combined with robust average solar insolation, particularly in the southern half of the state, is driving increased development interest.

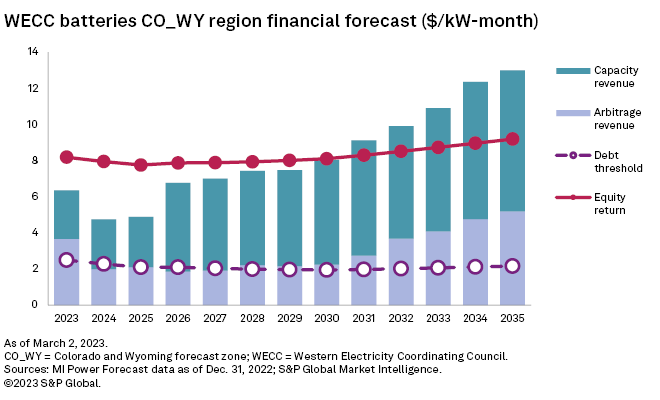

The Market Intelligence Power Forecast expects a rapid increase in solar, albeit a bit delayed. Robust development is not expected until 2028; afterward, growth is steady through 2035, with a cumulative forecast capacity of 6.5 GW. Forecast storage growth lags accordingly, with development beginning in 2030; by 2035, capacity jumps past 1.2 GW.

Excess daytime solar generation is expected to lead to lucrative arbitrage revenue potential in Colorado, as solar is forecast to account for up to 63% of midday hourly generation by 2035. This is an increase from a maximum hourly solar generation share of 25% in 2029. Remaining fossil-fuel peaker generation keeps storage growth somewhat in check. That said, the rapid growth of solar leads to a decrease in daytime average hourly energy pricing down to $53/MWh, while on-peak energy prices later in the evening hover near $86/MWh. This leads to strong arbitrage revenue for storage systems in Colorado. Further excess overnight generation from the state's wind fleet provides additional arbitrage opportunities for storage.

The economic outlook for storage is somewhat modest early in the period, with arbitrage revenue staying at or below $2/kW-month through 2027 and high reserve margins keeping capacity revenue below $3/kW-month through 2025. As a result, combined storage revenues surpass the debt service threshold but fall short of the full equity return target through 2029. Both arbitrage and capacity revenues are forecast to increase steadily after 2029 in conjunction with the forecast expansion of solar. By 2035, arbitrage revenue is over $5/kW-month — among the highest in the West. Adding in similarly strong capacity revenue of over $7/kW-month results in storage easily making a full equity return in 2030 and beyond.

A firm base of combined-cycle and peaking generation — along with lagging forecast solar growth — is expected to hinder battery storage development in Colorado through 2030. However, increasing commitments to carbon-free generation may accelerate the retirement of the state's last remaining coal plants as well as force out some natural gas generation. Further, the pipeline suggests solar development may ramp up sooner rather than later. Should these all come to fruition between now and 2030, strong financial returns should result in storage development interest skyrocketing in Colorado.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

Ciaralou Palicpic, Tony Lenoir, Chris Allen Villanueva and Qaiser Ali contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.