Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 18 Jan, 2024

By Heike Doerr

Only two new meaningful water and wastewater transactions were announced in the fourth quarter of 2023, and just one large transaction — defined by Regulatory Research Associates as those with a value of $10 million or greater — was finalized during the same period. Despite the lull, smaller transactions, which make up the lion's share of the sector's transaction volume, continue at a steady pace, and the long-term consolidation trend remains positive.

RRA has observed inherent variability in the timing of transaction announcements and completions. It can take years to solidify a deal and, in certain instances, more than two years to secure regulatory approval.

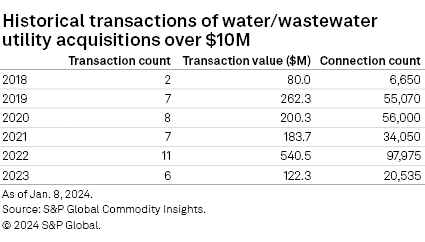

➤ In 2023, just six large water and wastewater transactions, valued at $122.3 million, were completed. In 2022, 11 large acquisitions by investor-owned utilities were completed, totaling over $540 million. There were seven transactions in 2021 for a total transaction value of approximately $184 million and 2020 saw eight transactions totaling approximately $200 million.

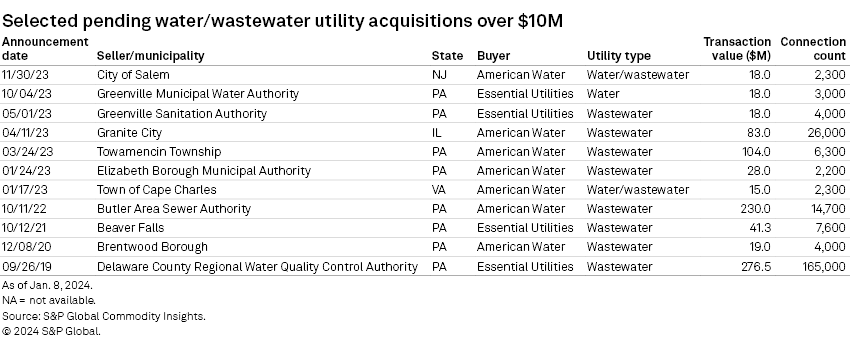

➤ RRA is tracking 11 pending large water utility acquisitions with a combined transaction value of $850 million. Two of the largest of these transactions, totaling over $310 million, had been expected to close by year-end. Interestingly, the number of pending large transactions and total transaction value has stayed mostly constant over the past 18 months.

➤ While long-term acquisition trends remain favorable, increased challenges in Pennsylvania, where water transactions have been the most frequent, are worth following.

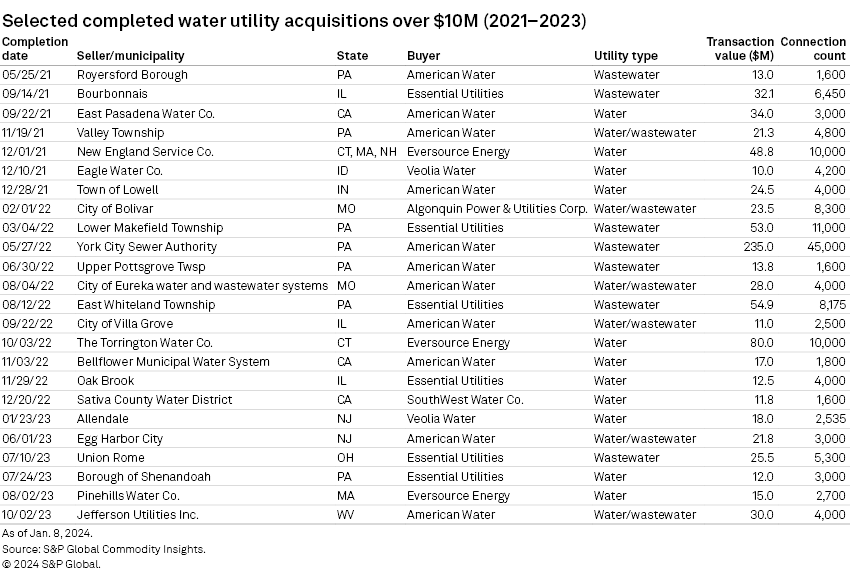

The acquisition of the York City Sewer Authority by American Water Works Co. Inc. accounted for almost half of the 2022 transaction value. Excluding this large acquisition, 10 transactions were completed, spanning five states, with a combined transaction value of $305 million. Details on the specific transactions completed from 2021 to 2023 can be found below.

Acquisition pipeline remains attractive

The messaging from the largest investor-owned water utilities remains unchanged. American Water continues to point to its pipeline of 1.3 million customer connections. Essential Utilities Inc. similarly characterizes its opportunities as active discussions with municipalities encompassing over 400,000 water and wastewater customers.

Over 50,000 water utility systems exist nationwide. Municipally owned systems account for approximately 85% of the industry, while the remaining 15% are investor-owned or held privately. Financially, municipal systems are challenged by limited government funding, competing for financial needs against other municipal services and the general unwillingness of elected officials to raise taxes. Operationally, smaller systems lack the expertise to meet increasingly stringent water-quality standards. With significant capital spending projects looming and insufficient federal funding, municipal owners have been more agreeable to divesting water and wastewater systems.

In recent years, the sector has experienced an expansion in the geographic footprint of transactions and diversity in the acquirers of water and wastewater systems nationwide. Fair market value legislation that enables the acquisition of municipal systems has served as the necessary catalyst to consolidate this fragmented sector and inject needed investment into the country's deteriorating water infrastructure. Given sector demographics, the lion's share of water utility acquisition activity will continue to stem from the acquisition of financially challenged, small, private systems and municipal utility systems by the largest investor-owned utilities.

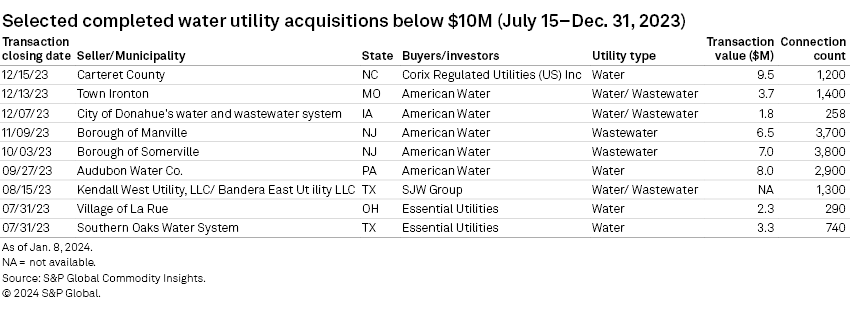

While larger transactions are taking longer to receive necessary regulatory approval and overcome legal hurdles, investor-owned water utilities across the sector continue to grow through smaller transactions nationwide. In aggregate, these smaller transactions comprise a meaningful segment of the water M&A landscape; the small transactions tracked by RRA in 2023 totaled more than $50 million — nearly 30% of the total transaction value for the year.

In December 2023, Corix Regulated Utilities (Us) Inc. subsidiary Carolina Water Service Inc of North Carolina completed the first fair market valuation transaction in North Carolina since the law was enacted in 2018.

Most recently, on Jan. 2, California Water Service Group announced that its subsidiaries in Hawaii and New Mexico had finalized smaller transactions.

Regulatory, legal challenges slow deal flow in Pennsylvania

Nearly three-quarters of the pending large transactions RRA is tracking are systems in Pennsylvania, with the two largest transactions in the state accounting for almost 60% of the pending transaction total.

American Water and Essential Utilities both having a meaningful presence in Pennsylvania, and the state has been a trailblazer in implementing legislation and regulatory mechanisms that have become widely adopted as best practices in other states. "Fair valuation" legislation, such as Pennsylvania's 2016 law known as Act 12, facilitates the acquisition of systems that have a high level of contribution in aid of construction on the balance sheet. Act 12 pertained to the acquisition of small natural gas systems with service issues but was expanded by legislation passed into law in July 2019 to cover water and wastewater utilities, thus facilitating the acquisition of small distressed systems.

Recently, the acquisition landscape has been more difficult, with legal challenges and local activists slowing the process of getting announced transactions completed.

On Nov. 9, 2023, American Water subsidiary Pennsylvania-American Water Co. Inc. (PAWC) received approval from the Pennsylvania PUC to purchase the Butler Area Sewer Authority wastewater system for $230 million. The approval follows a settlement reached in August. The transaction had been expected to close before year-end, however, the transaction was held up by a protest filed by a Butler, Pa., resident contesting the public benefit of the transaction.

PAWC's purchase of the 7,500-customer Towamencin Township wastewater system is currently tied up in litigation. On June 16, 2022, NextEra Energy Inc. announced that it was the winning bidder on the transaction. Towamencin Neighbors Opposing Privatization Efforts, an advocacy group, has been actively opposed to the privatization of the system. In March 2023, PAWC announced that it would take over the purchase of the wastewater system after NextEra backed out. In May 2023, voters passed a new local law forbidding township officials from selling the public sewer system. In August 2023, two residents sued the township for not complying with the law and proceeding with a potential sale. PAWC does not anticipate the transaction to be completed until mid-2024.

Essential's subsidiary Aqua Pennsylvania Inc. (Aqua PA) has faced legal challenges in its $276.5 million acquisition of the Delaware County Regional Water Quality Control Authority (DELCORA), first announced in September 2019. In May 2020, Delaware County, Pa., filed a lawsuit alleging that DELCORA did not have the legal authority to establish and fund a customer trust with the net proceeds of the transaction. The transaction faces multiple lawsuits, and the PUC approval process has been suspended pending their outcome.

Additionally, Aqua PA's already completed $54.4 million purchase of the East Whiteland wastewater system has come under a legal challenge that currently sits with the Pennsylvania Supreme Court. Shortly after Aqua PA acquired the wastewater assets, following PUC approval, the Office of Consumer Advocate filed an appeal of the PUC Order to the Pennsylvania Commonwealth Court. On July 31, 2023, the court ruled to reverse the PUC order that approved the acquisition. The company's motion for reargument was denied Sept. 26. The company, the PUC and the township filed an appeal to the Pennsylvania Supreme Court. In the interim, Aqua PA continues to operate and invest in the system.

A look at large completed transactions

The table below includes details on the larger water and wastewater transactions over recent years.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.