Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Feb, 2020

Highlights

While financial data tells us “how a company has done in the past,” shipping data provides a closer-to-real time indicator of “what a company is doing now.”

This new quantamental report illustrates how to find investment insights in Panjiva’s US seaborne and Mexican datasets using the US auto parts industry as a case study.

In addition to the findings, readers can access the SQL queries needed to recreate the paper’s use cases.

World merchandise trade accounted for an estimated $19.7 trillion in 2018, about 90% of which is by sea. While financial data tells us “how a company has done in the past,” shipping data provides a closer-to-real time indicator of “what a company is doing now.” Panjiva’s shipping data allows investors to track trends, identify anomalies, and assess risks for companies engaged in international trade. This paper illustrates how to find investment insights in Panjiva’s US seaborne and Mexican datasets using the US auto parts industry as a case study.

Findings include:

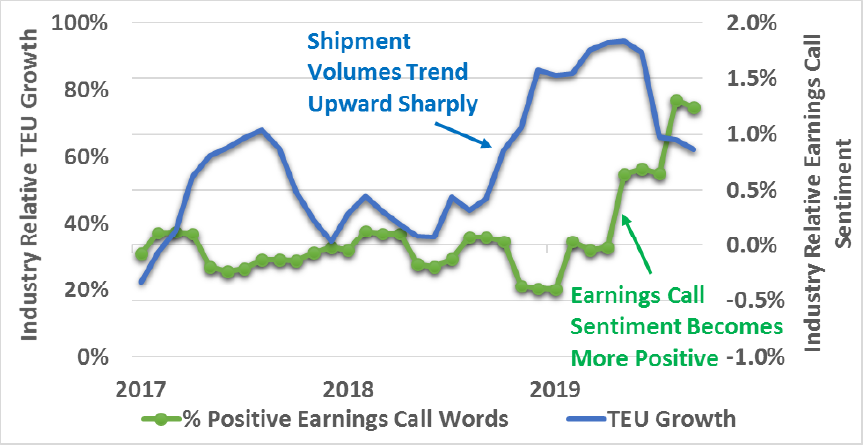

LCI Industries: Industry-Relative Import Growth vs. Earnings Call Sentiment, 2017-2019

To access the complete findings, as well as the SQL queries needed to recreate the paper’s use cases, click here.

Research

Event

Products & Offerings