S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 22 Aug, 2024

By Steve Piper, Tanya Peevey, PhD, and Kristin Larson, PhD

The tenfold increase in the cleared price for the 2025–26 Base Residual Auction is estimated to boost revenue for wind, solar and gas plants within the footprint of the PJM Interconnection LLC. Updated capacity market parameters — including an increased aggregate reliability requirement and updated effective load carrying capability (ELCC) assignments — are responsible for the increase in the clearing price, which is forecast to remain high for the next 10 years.

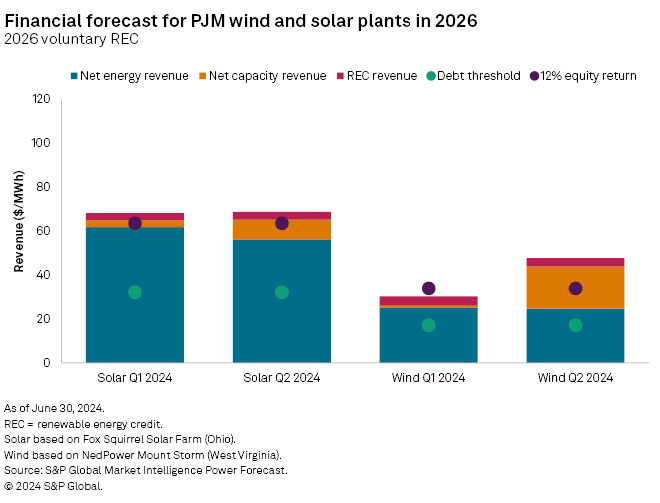

Despite the decrease in capacity credit, the higher capacity prices will impact the capacity revenue received for projects in PJM, generally increasing it. Financials for natural gas combined-cycle plants will increase substantially as the higher clearing price more than offsets the lower payment rate due to reduced ELCC. The increased capacity price will be responsible for smaller increases in wind and solar plant revenue, while changes in renewable energy credit (REC) prices will have a larger impact on renewable plants.

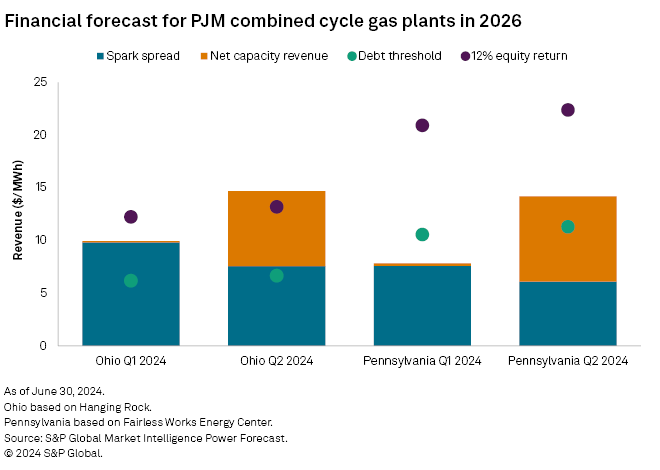

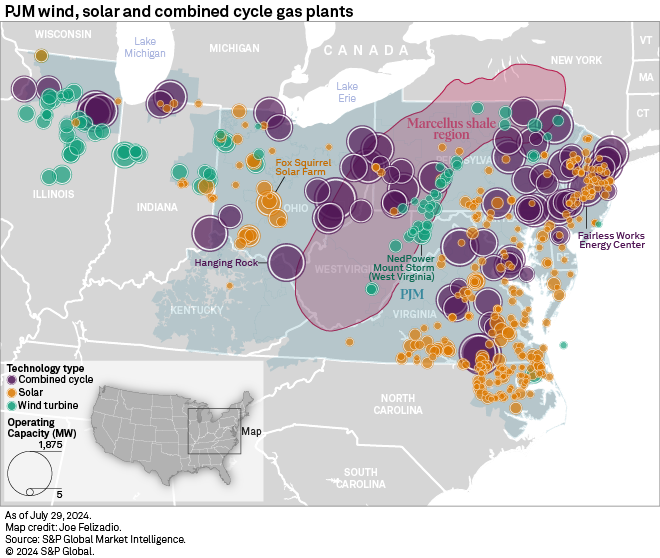

The Hanging Rock combined-cycle project in Ohio had about $10/MWh net revenue in 2026 based on the first-quarter 2024 forecast, and the total margin increased to more than $14/MWh in the second-quarter forecast. The first-quarter forecast returns meet the debt threshold, paying off some project debt but not equity-holders, while second-quarter financials exceed the equity return, enough to pay off the entire project's annualized capital investment. The returns were not as high for the Fairless Works Energy Center combined-cycle natural gas plant in eastern Pennsylvania, which has higher gas prices and is farther from the gas-producing Marcellus shale region of western Pennsylvania and Ohio. Fairless' capacity factor is about 10% less than Hanging Rock's. Fairless' forecast 2026 financial margins were less than $8/MWh in our first-quarter 2024 forecast but more than $14/MWh in our second-quarter forecast, thus exceeding the debt threshold with the higher capacity prices.

The higher PJM capacity prices in the second-quarter forecast would increase returns for combined-cycle plants in Ohio and Pennsylvania. Combined-cycle plants in states that are part of the Regional Greenhouse Gas Initiative, such as New Jersey and Virginia, pay penalties for their emissions and have even lower spark spreads. The increased capacity prices can increase the returns in those states to near the debt threshold. Regions of Virginia and North Carolina saw cleared capacity prices of $444.26/MW-day, while a small part of Maryland cleared at $466.35/MW-day, which would provide an additional boost to plants in those regions.

Wind and solar projects have excellent financial returns in PJM, and the returns are most impressive when compliance-based REC prices can be applied. In both the first- and second-quarter forecasts, solar project returns in 2026 have revenues higher than $68/MWh, meeting the needed equity return value. Total wind returns of $30/MWh in the first-quarter forecast fall below the equity return, but in the second-quarter forecast, they exceed it, with a total return of more than $47/MWh. These metrics are with a conservative forecast for REC values, i.e., the voluntary wind REC price and the Ohio REC price for solar. With higher REC prices from compliance markets over $35/MWh, the returns from solar and wind projects far exceed the equity returns for both quarterly forecasts.

Updates in the PJM capacity market led to a higher PJM capacity price forecast in the second-quarter forecast. This leads to more beneficial returns for combined-cycle projects, although location matters for the size of the returns. Wind and solar projects have nearly full returns with both forecast capacity prices. The returns are even stronger when wind and solar are eligible for higher compliance REC prices. While improved capacity pricing will result in better returns and incentivize new efficient peaking generation and retention of PJM's merchant fleet, significant future investment will still likely flow to green energy.

S&P Global Commodity Insights provides content for distribution on Capital IQ Pro.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.

Tanya Peevey contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.