Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 3 Feb, 2022

By Celeste Goh

Venture capital investments in Asia-Pacific-based financial technology companies surged to new highs in 2021. Flush with cash, well-funded fintechs have been making strategic acquisitions, a trend we expect to continue as they hunt for growth.

The strong rebound in Asia-Pacific fintech funding in 2021 seems to suggest investors' deepening conviction in the sector. As such, we believe that venture capitalists are likely to remain invested in the fintech space even as the recent market pullback clouds the outlook for IPO or blank-check exits.

The uncertain market conditions ahead, however, may encourage prudence, nudging investors toward mature fintechs that have demonstrated financial discipline. As established fintechs have exhibited a propensity to acquire for growth when flush with liquidity, we expect a robust M&A outlook as these mature firms continue to draw in private capital.

Private funding received by fintechs in Asia-Pacific more than doubled to $15.69 billion in 2021 from $5.87 billion in 2020. While this growth followed subdued funding activity in 2020, the 2021 figure also represented a 74% jump from 2019's pre-COVID-19 levels.

While large rounds of at least $100 million accounted for nearly 54% of total transaction value in 2021, a spike in transaction volume also contributed to the surge in aggregate amount raised. Fintechs in Asia-Pacific sealed 754 deals in the recent year, up 81% and 49% from 2020 and 2019, respectively.

Geographically, India extended its lead in fintech investments with $5.94 billion raised across 236 deals in 2021. The country also attracted the most funding in 2020, with $1.50 billion raised across 118 deals.

Southeast Asia-based fintechs were close behind and registered the biggest funding growth in Asia-Pacific in 2021. Fintech startups in Southeast Asia netted $4.70 billion across 217 transactions, up from $1.13 billion across 118 deals in the prior year.

Investors' interest in Chinese fintechs, on the other hand, appeared to have waned amid heightened scrutiny on the technology sector and China's plan to regulate overseas listings. In 2021, Chinese fintechs saw 73 fundraising deals. While this represented modest growth from the 68 transactions closed in 2020, fintech deal volume in China was down 42.5% from 127 transactions in 2019.

China's total fintech funding value in the recent year, however, declined by just 8% compared to pre-pandemic levels if we were to exclude Jingdong Digits Technology Holding Co. Ltd.'s outsized $1.92 billion round in the first quarter of 2019. This indicates that deal sizes have grown larger on average, suggesting that investors remain open to funding mature fintechs but are perhaps more cautious of early-stage startups.

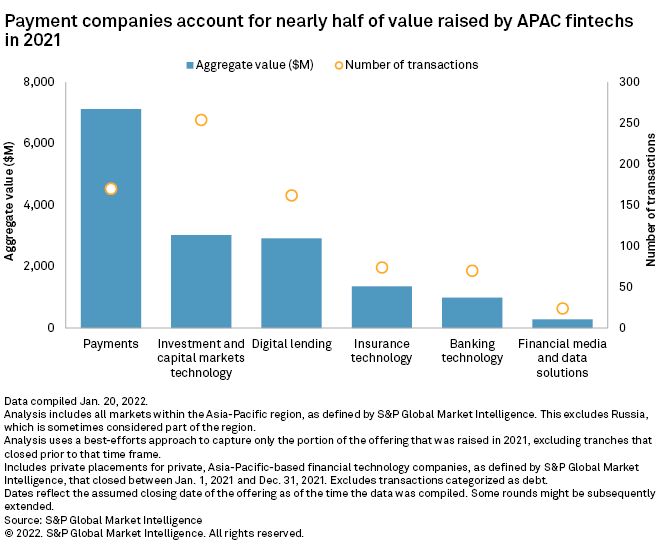

Among the six fintech categories tracked by S&P Global Market Intelligence, payment companies drew in the largest sum, accounting for 45% of the aggregate transaction value in 2021.

India-based payment intermediaries that enable online and offline merchants to accept various payment methods were the top three fundraisers in 2021, with each firm completing multiple funding rounds during the year. Pine Labs Pvt. Ltd. raised $700 million across two fundraises; Razorpay Software Pvt. Ltd.. drew in $535 million from three investment rounds; and Resilient Innovations Pvt. Ltd, which operates as BharatPe, completed two equity rounds totaling $477 million.

Well-funded fintechs splashing out on strategic purchases

In seeking product and geography expansion, companies are often faced with the build-versus-buy conundrum, but easy access to capital appears to be nudging fintechs toward the latter.

Pine Labs acquired Fave Asia Technologies Sdn. Bhd. to fast-track its expansion in Southeast Asia. Razorpay bought risk-management software provider TERA Finlabs to strengthen its lending proposition. Credit card payment company Dreamplug Technologies Pvt. Ltd., or Cred, bought expense management firm Happay to expand its product suite. Airwallex Pty. Ltd. purchased UniCard, which gives it access to a stored-value facilities license in Hong Kong. The cross-border payment fintech has been actively seeking payment licenses across Asia-Pacific to broaden its geographical footprint.

Large fintechs acquiring banks

Acquisition also presents a way for fintechs to obtain licenses that are otherwise hard to secure.

Fintechs have long made their banking ambitions known in markets that have issued digital bank licenses. In jurisdictions without a virtual banking regulatory framework, large fintechs have jumped on opportunities to acquire banks.

In India, BharatPe teamed up with Centrum Financial Services Ltd. to acquire Punjab & Maharashtra Co-operative Bank Ltd. The open bidding process came after the Reserve Bank of India placed PMC Bank under regulatory restrictions in 2019 after detecting financial irregularities. BharatPe's joint venture was awarded a small finance bank license by India's central bank in connection with the PMC Bank acquisition. The banking license gives the fintech an advantage over its peers.

In Indonesia, tech players have been taking advantage of the newly raised core capital requirement for banks to acquire smaller lenders. Under the new ruling by the country's Financial Services Authority, all local banks must have at least 3 trillion rupiah of Tier 1 capital by end-2022, a requirement that some smaller lenders might find challenging to meet without additional capital injection.

Ride-hailing and e-commerce operators including GoTo Group, Grab Holdings Ltd., Sea Ltd. and PT Bukalapak.com Tbk, as well as fintech lender WeLab Holdings Ltd., are among the tech firms that have acquired stakes in small Indonesian banks.

Tech companies acquiring stakes in banks can lead to productive relationships. Banks can target the internet platform's popularity to build their deposit liabilities and lending assets. The tech company can lean on the bank to support the growth of its financial services, although this entails exposure to the bank's balance sheet, limited to its equity stake. The close collaboration, in a best-case scenario, results in improved economics and higher growth rates for both.

PT Bank Jago Tbk, for instance, saw improved financials following its integration in the Gojek application. The lender netted its first quarterly profit for the period ended in September 2021 after posting six consecutive years of losses. Bank Jago is partly owned by GoTo, a technology company that came out of the 2021 merger of Gojek and Tokopedia.

That said, having a large captive user base is only one part of the profitability equation for digital banks. Our earlier analysis of money-making operators reveals that having a strong lending proposition would be pertinent in attaining sustained profitability.

Digital banking is a cash-intensive business. Few operators across Europe and Asia have managed to break even and among those that have, it took them an average of 25 months to record their first fiscal year of profitability. With several digital banks due to begin operations across various Asia-Pacific countries, we expect these entities to raise fresh capital.

Cooling IPO market but fintech M&A activity poised for growth

Private markets will continue to be a crucial source of financing for fintechs in 2022 as looming interest rate hikes and ensuing stock market volatility cloud the outlook for IPOs. Amid the market pullback, late-stage fintechs may opt to delay listing plans and instead turn to venture capitalists to fund their liquidity needs.

Aside from the traditional IPO, some fintechs have turned to special purpose acquisition companies to raise capital. But the outlook for blank-check deals looks increasingly murky. Though SPAC deals may offer greater certainty in the form of a pre-agreed valuation, poor market performance by fintechs post-SPAC merger may be a deterrent, as illustrated by recently terminated deals. Acorns Grow Inc. is perhaps the latest example. Citing poor market conditions, the U.S.-based savings and investment app called off its merger with Pioneer Merger Corp. The fintech will instead seek a private capital raise in the interim, with the eventual plan of going public via an IPO in the future, Barron's reported.

To some extent, private investors may take their cue from the equity markets and exercise more prudence under such unfavorable market conditions. But venture capitalists are likely to stay invested in the fintech sector, particularly as digital transactions are proving to become a mainstay. As a safeguard, however, private investors may lean toward later-stage fintechs that have demonstrated a viable path to profitability.

If this plays out, this could give rise to an accelerated pace of M&A activity within the fintech sector. Well-funded fintechs would be well positioned to make strategic acquisitions while younger startups that may struggle to attract funding and scale meaningfully might be open to being acquired.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.