S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 5 Dec, 2023

By Jason Wang and Zheng Yulin

S&P Global Market Intelligence tracks and analyzes the risk dynamics in China's credit bond market on a quarterly basis.

Summary of New Bond Issuances in The Market

Throughout the third quarter of 2023, China’s credit bond market displayed varying risk characteristics and spread levels across diverse sectors and regions. Table 1 below presents a summary of new bond issuances by type for the third quarter.

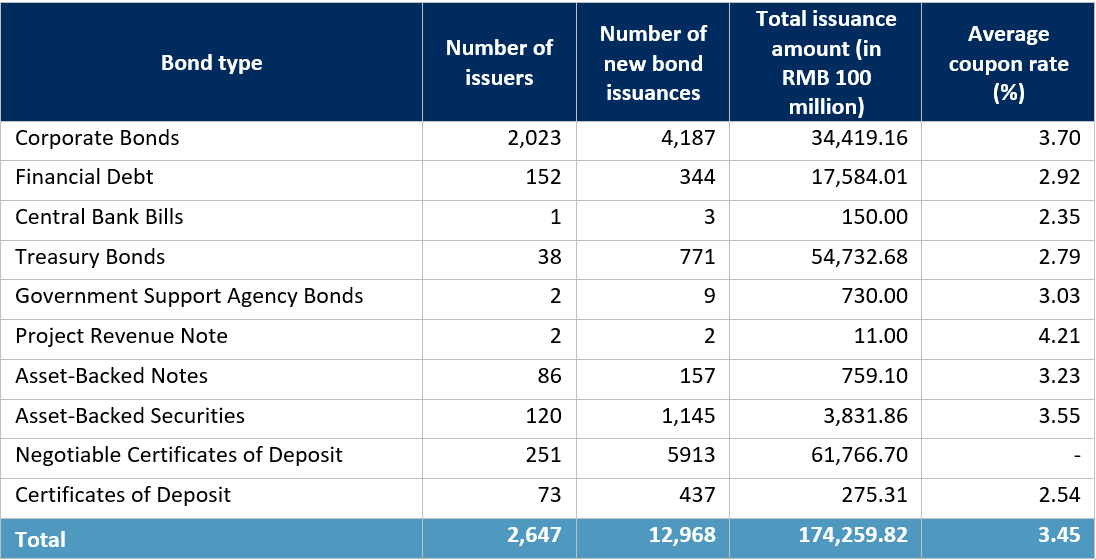

Table 1: New Bond Issuances by Type, Q3 2023

Source: S&P Global Market Intelligence China Credit Analytics Platform.

Among all types of bonds, the largest issuances were in corporate and government bonds, totaling RMB3.44 trillion and RMB5.47 trillion, respectively. Furthermore, during the third quarter the coupon rates for newly issued corporate bonds were marginally higher than those for asset-backed securities, with an average coupon rate of 3.70% versus 3.51%. Government and financial bonds had relatively low coupon rates, both below 3.0%. The total issuance volume in the market for the third quarter reached RMB17.43 trillion, comprising a total of 12,968 bond issuances. Table 2 below highlights the industries with the largest number of new issuances during the third quarter.

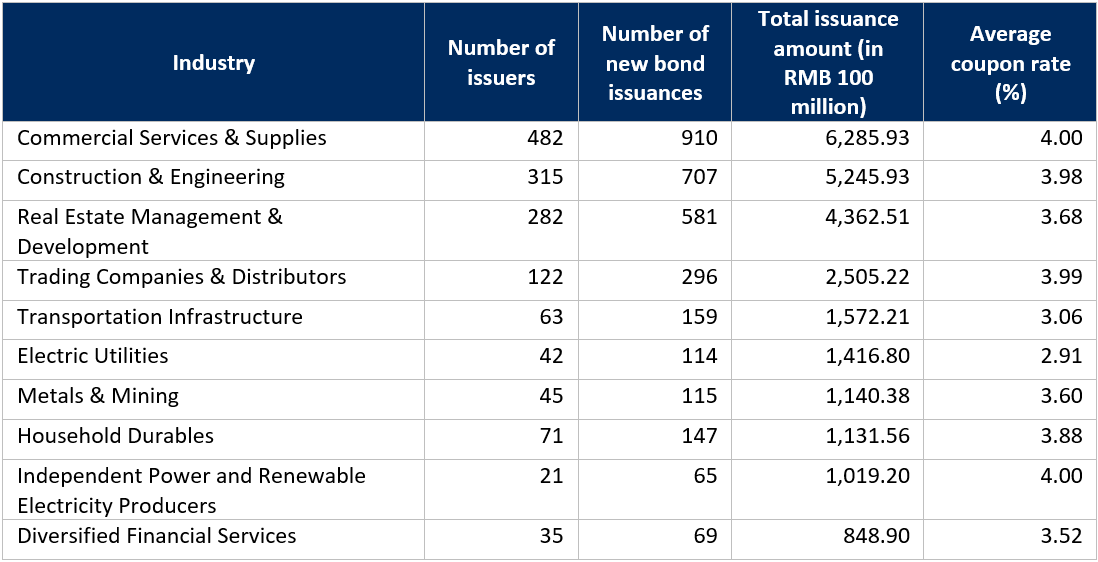

Table 2: Highest Industries for New Issuances in Corporate Bonds, Q3 2023

Source: S&P Global Market Intelligence China Credit Analytics Platform.

Industries, such as commercial services and supplies and construction and engineering, are the primary sectors for local government financing vehicles (LGFVs). As a result, the new issuance volume of bonds in these industries was notably higher compared to other sectors. For a detailed breakdown of new bond issuances by industry, please refer to the Appendix at the end of this report.

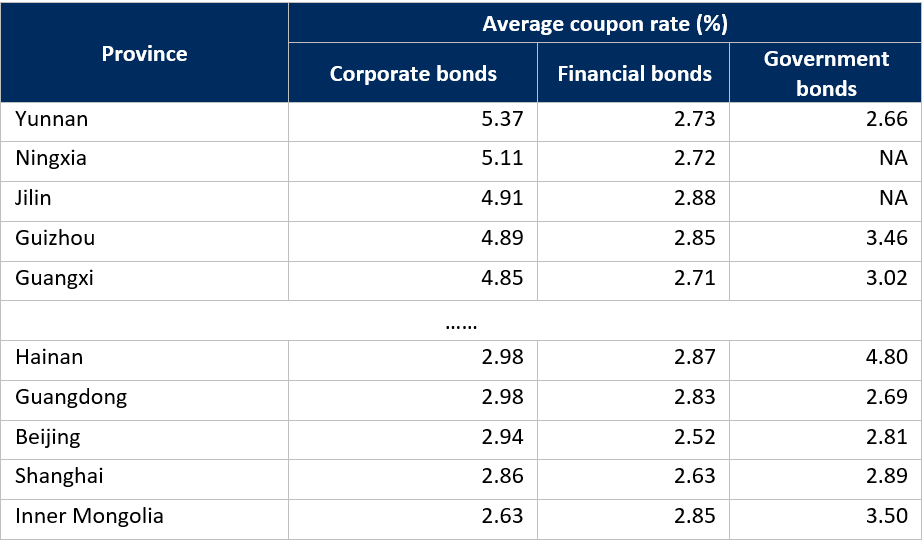

Data was also complied on the total issuance volume and coupon rates of newly issued bonds across different regions. Table 3 below highlights the top five provinces (autonomous regions, municipalities) with the highest and lowest coupon rates for corporate bond issuances.

Table 3: Top Five Provinces with Highest and Lowest Coupon Rates for Corporate Bond Issuances, Q3 2003

Source: S&P Global Market Intelligence China Credit Analytics Platform.

GICS Industry Spreads

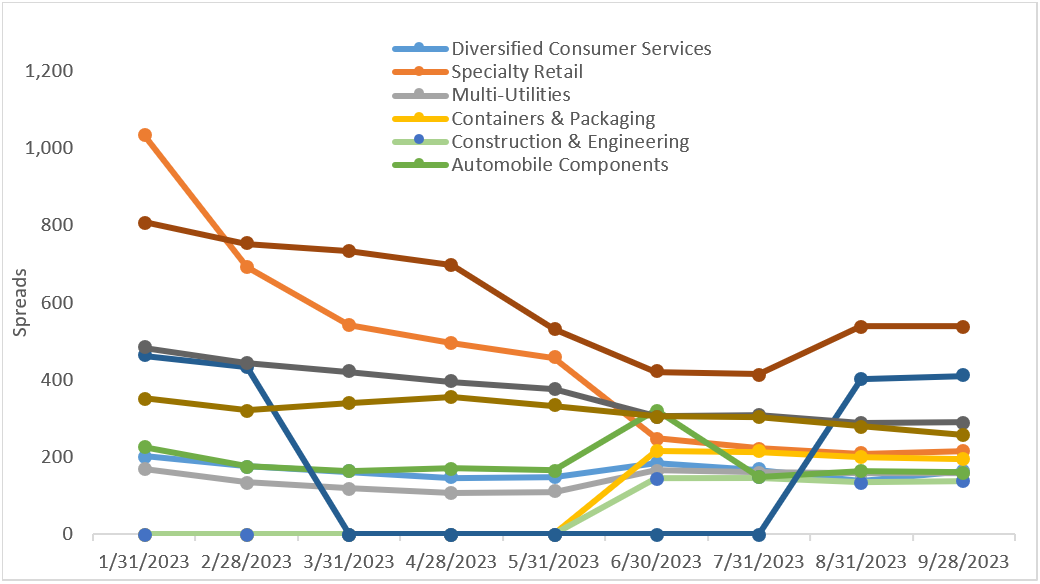

As of the end of the third quarter of 2023, based on the analysis of industry spreads, the average spread level in the overall market was 107 basis points (bps). Among the sub-industries, the top 10 industries with the largest spreads are shown below in Figure 1.

Figure 1: Top Ten Industries with Largest Spreads by End of Q3 2023

Source: S&P Global Market Intelligence China Credit Analytics

Report