Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 17 Jun, 2020

Highlights

The COVID-19 shockwaves emanating through the global supply chain continue to reverberate. The information that decision makers have traditionally relied have also been disrupted but is slowly showing signs of normalizing.

S&P Global Market Intelligence processes 64,000 financial documents each day, placing it in a central position in the information supply chain with a unique view into the specific areas and magnitude of information disruption.

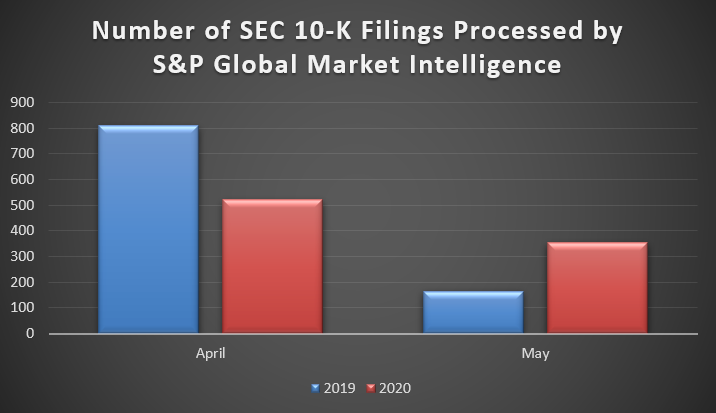

A significant source of information for both investors and decision-makers is found in company annual (10-K) filings. Many firms experienced delays in completing these filings in April, leading to earnings calls delays and reduced visibility. The timeliness of filings fell by over 300 in April but has since rebounded in May, largely driven by companies with smaller market capitalizations.

The COVID-19 shockwaves emanating through the global supply chain continue to reverberate. The information that decision makers have traditionally relied have also been disrupted but is slowly showing signs of normalizing. S&P Global Market Intelligence processes 64,000 financial documents each day, placing it in a central position in the information supply chain with a unique view into the specific areas and magnitude of information disruption.

A significant source of information for both investors and decision-makers is found in company annual (10-K) filings. Many firms experienced delays in completing these filings in April, leading to earnings calls delays and reduced visibility. The number of filings fell by over 300 in April but has since rebounded in May (Figure 1) largely driven by companies with smaller market capitalizations. This report examines delayed earnings and events, analyst forecast revision, and corporate key developments.

Figure 1: All US Public Companies

Source: S&P Global Market Intelligence Quantamental Research. Data as of May 31, 2020.

Please access the complete list of Quantamental Research Briefs for the latest on COVID-19’s impact.

Download The Full Report

Reserach

Research