Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 May, 2020

Highlights

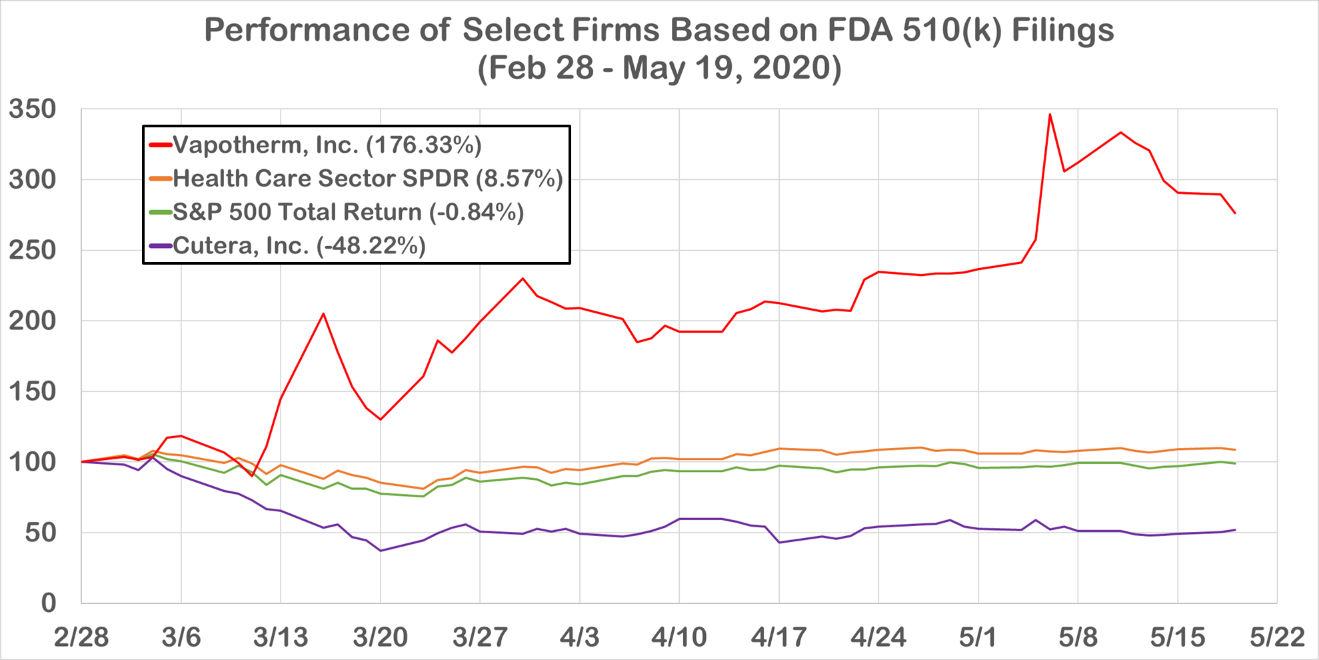

Elective and non-essential medical procedures are on an indefinite hold in many places. Simultaneously, essential medical services are in high demand, and likely to remain in demand for the near future. This dynamic creates winners and losers among Health Care device manufacturers and distributors.

Investors can identify potential opportunities in the Health Care Equipment and Services subsector by analyzing 510(k) premarket notifications, which are filings required by the U.S. Food and Drug Administration (FDA) for any company seeking to market a medical device in the United States.

One example of the aforementioned dichotomy is Cutera Inc. versus Vapotherm Inc. (Figure 1). The former specializes in devices used in cosmetic surgery and has declined 48% from February 28 to May 19. In contrast, Vapotherm, which specializes in products used to treat respiratory distress, has seen a 176% return over the same period. Vapotherm’s oxygen controller was awarded ‘breakthrough device’ status by the FDA on April 9.

Figure 1. Performance of Vapotherm, Inc. and Cutera, Inc. alongside the S&P 500 Total Return and the Health Care Sector SPDR (XLV)

Source: S&P Global Market Intelligence Quantamental Research. Data as of May 20, 2020.

Please access the complete list of Quantamental Research Briefs for the latest on COVID-19’s impact.

Download The Full Report

Research

Research

Products & Offerings

Segment