Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 12 May, 2022

By Celeste Goh

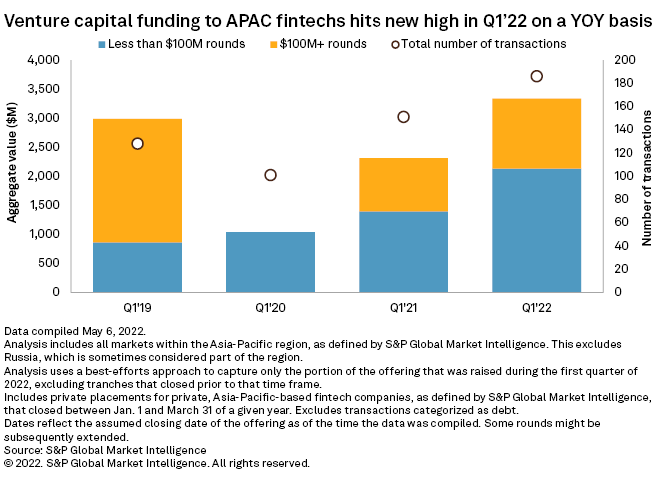

Financial technology companies based in Asia-Pacific raised $3.33 billion over 186 deals in the first quarter of 2022, surpassing previous deal values and volumes observed in the March quarter over the past three years. Digital lenders, the fintech segment that the pandemic hit hardest, appear to be back in vogue, topping all other fintech categories with $1.28 billion raised across 52 deals.

While year-over-year record-high funding levels in the first quarter paint a rosy picture of the fundraising environment for Asia-Pacific fintechs, a sequential comparison signals otherwise and is perhaps more indicative of what lies ahead. On a quarter-over-quarter basis, the first-quarter funding levels represent a 26% decline in dollar amount raised and 9.7% dip in number of deals. Fintech fundraising activity could see a further slowdown in subsequent periods in wake of an underwhelming public equity market and further rate hikes.

That said, mature fintechs, which seem to remain attractive to venture capitalists, may help offset some of the decline in funding levels. Several established fintechs continue to see fresh funding from new investors, and their persistent inclination for inorganic growth in this uncertain climate seems to suggest confidence in their ability to raise more capital.

Broadly, check sizes appear to be declining. In the March quarter, there were eight transactions with values exceeding $100 million, with these mega-rounds contributing to 36% of the total funding raised. In comparison, the previous quarter saw 11 mega-rounds that accounted for 55% of the dollar amount raised.

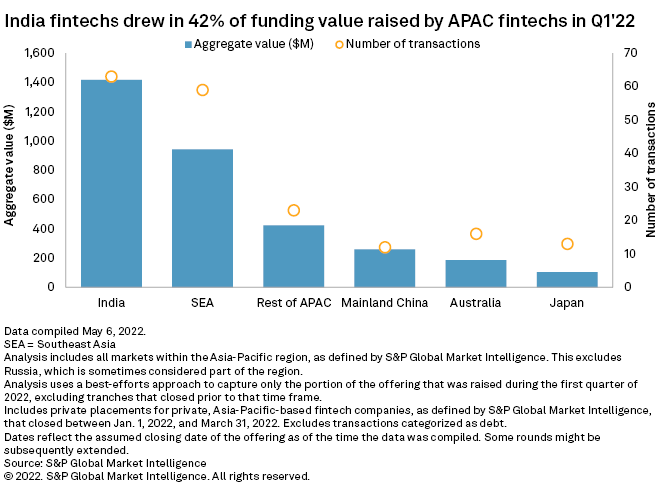

Like in previous quarters, India-based fintechs continued to dominate funding in Asia-Pacific, accounting for 42% and 34% of total deal value and volume, respectively, in the region. Funding to India's fintech scene was largely fueled by three fintechs that raised over $100 million in the first quarter. Pine Labs Pvt. Ltd., Oxyzo Financial Services Pvt. Ltd. and Credavenue Private Ltd. collectively contributed 38% of the $1.42 billion raised.

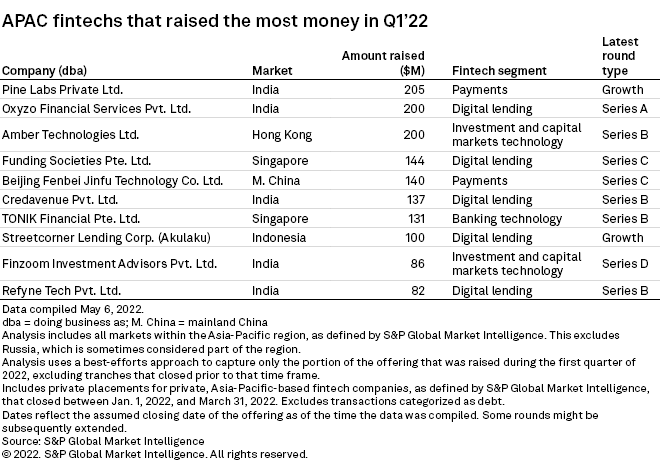

Pine Labs, which raised $700 million last year, received another $205 million in the first quarter across three separate rounds. Recent rounds saw participation from new investors, including State Bank of India, Vitruvian Partners LLP and Alpha Wave Global LP.

Pine Labs started as a point-of-sale payment provider but has been expanding aggressively into the online payment space lately. It will be using part of the fresh funding to further scale Plural, its online payments brand that launched in October 2021. With plenty of fresh funding in its coffers, Pine Labs appears to be open to inorganic growth. In February, it acquired Qfix, an India-based online payments startup and had also taken a majority stake in Synergistic Financial Networks Pvt Ltd., another payment fintech in April. Pine Labs had earlier filed for an IPO in the U.S. with the aim to list in the first half of the year. But it could reportedly delay its listing until year-end or even early 2023 amid bearish market conditions, according to Mint.

Oxyzo raised $200 million in a series A funding round at a valuation of $1 billion on a post-money basis. The small and medium business-focused digital lender was spun out of OFB Tech Pvt. Ltd., or OfBusiness, a mature business-to-business commerce platform, which partly explains the large fundraise and valuation that is perhaps uncommon for an early-stage financing round. That said, the lender's swift growth over the past two years likely contributed to investors' conviction in the firm. Between financial year 2020 and 2022 ending March, Oxyzo grew assets under management by 2.8x in local currency to $350 million while maintaining a low gross nonperforming assets ratio of 1.25%. In comparison, India's scheduled commercial banks registered a ratio of 6.9% in September 2021, with the central bank expecting the figure to rise to 8.1% by September 2022 under the baseline scenario.

Though its affiliation with OfBusiness might have given the lender some advantage in terms of access to SMEs using OfBusiness' platform, Oxyzo claims that over 70% of loans were issued to companies outside of OfBusiness. Oxyzo credits its success to an improving loan appetite, as well as its focus on issuing loans to businesses with a credit history, which helps with its loan recovery rate. Both Oxyzo and OfBusiness share a similar pool of investors like Alpha Wave Global LP, Tiger Global Management LLC, NVP Associates LLC, Matrix Partners India Advisors LLP and Creation Investments Capital Management LLC. A key exception is SoftBank Group Corp., which backed OfBusiness but did not participate in Oxyzo's recent financing round.

Credavenue, a subsidiary of Vivriti Capital Private Ltd., a non-banking financial corporation, bagged $137 million from a series B round that saw participation from several new investors, including Insight Venture Management LLC, B Capital Group Management LP and Dragoneer Investment Group LLC. Credavenue plans to seek inorganic growth with the fresh funding and has so far acquired majority stakes in two software-as-a-service companies this year. These include spocto Solutions LLP, a debt-recovery platform, and Bluevine Technologies Private Ltd., a credit underwriting company.

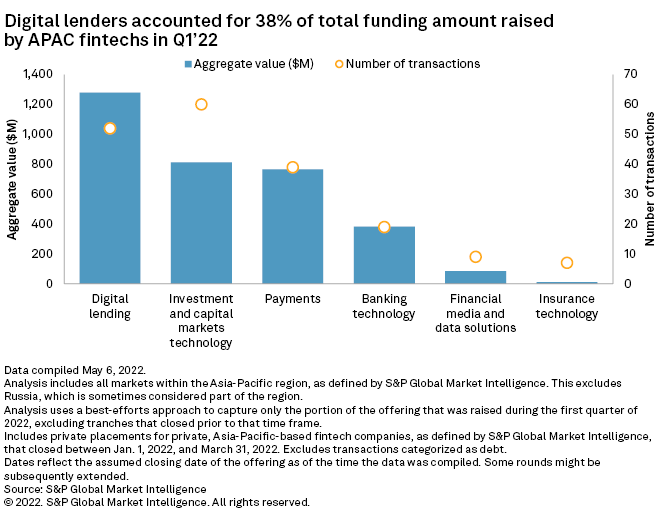

Funding for digital lenders topped payment fintechs in Q1

Payment fintechs had consistently led total fintech funding in prior periods but appear to have lost their shine in the March quarter, ceding the top spot to digital lenders.

The digital lending sector was the hardest hit fintech category at the height of the pandemic as investors feared that lending upstarts would be hit by a spike in loan defaults, particularly as many of their underwriting engines have yet to undergo a full credit cycle. But lending fintechs that have proven their resilience through the uncertain times might have spurred the return of investors' confidence.

Five of the top 10 fintechs by amount raised are digital lenders. The three most heavily funded lenders, Oxyzo, Funding Societies Pte. Ltd. and Credavenue, primarily focus on lending to SMBs and largely rely on third-party funding to extend credit. Streetcorner Lending Corp., or Akulaku, is a consumer financing platform that offers buy-now-pay-later services and cash loans. In 2021, the lender doubled its loan disbursements to over $2.2 billion while keeping its share of nonperforming loans over 90 days to 6.3%, a figure lower than pre-pandemic levels. Refyne Tech Private Ltd. is an earned waged access provider that allows employees to cash out on earned wages before their payday.

Investors' optimism in digital lenders, however, could be short-lived if recessionary fears and a rising rate environment dampens loan demand.

Conclusion

Macro headwinds like a rising rate environment and a waning stock market that we previously highlighted continue to persist and will likely weigh down on funding levels in subsequent periods. Despite near record-high levels of liquidity in the system globally, the smaller check sizes observed in the first quarter suggest that investors are more conservative and selective with their deal choices.

The recent closure of Fast AF Inc., a U.S.-based one-click payment checkout provider perhaps illustrates the importance of financial discipline in this unfavorable funding climate. The Stripe Inc.-backed company, which raised over $100 million last year, shut its doors in April as high cash burn rates and little revenue deterred investors from pumping more money into the company.

On a brighter note, fintechs with listing plans disrupted by the market rout were able to continue with growth pursuits. FinAccel Pte. Ltd., for instance, proceeded with its $200 million majority stake acquisition of Bank Bisnis despite scrapping its planned blank-check merger with VPC Impact Acquisition Holdings II. Similarly, Pine Labs continues to pursue inorganic growth even as its IPO plans have been pushed back.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.