Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 12 Sep, 2024

By Dan Lowrey

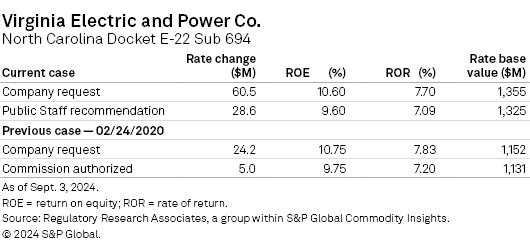

The North Carolina Utilities Commission Public Staff supports a $28.6 million increase in electric base rates for Virginia Electric and Power Co., about one-half of what the company requested. The staff's recommended increase is premised upon a return on equity that approximates prevailing national averages tracked by Regulatory Research Associates but is 100 basis points below that requested by the company.

➤ The Public Staff of the North Carolina Utilities Commission (NCUC) has evaluated Virginia Electric and Power's (VEPCO's) electric rate increase request and is recommending a rate increase of $28.6 million, or about one-half of what VEPCO requested. The staff recommends adjustments in several areas, with the largest reductions to revenue requirement resulting from a lower recommended authorized return on equity (ROE) and disallowances of coal ash costs.

➤ The recommended rate increase is premised on a 9.60% ROE, which is 15 basis points below the utility's currently authorized ROE but approximates prevailing nationwide averages tracked by RRA. It is also significantly below the 10.60% ROE requested by VEPCO.

➤ RRA considers the utility regulatory framework in North Carolina to be relatively constructive from an investor viewpoint.

The staff's recommended $28.6 million rate increase is premised upon a 9.60% return on equity (52.00% of capital) and a 7.09% return on a year-end rate base valued at $1.33 billion for a test year ended Dec. 31, 2023, adjusted for changes to certain revenues, expenses and investments through June 30, 2024.

The recommended 9.60% ROE approximates recent ROE determinations nationwide, as tracked by RRA. According to RRA, the average ROE authorized for electric utilities was 9.68% for rate cases decided in the first half of 2024, above the 9.60% average observed in full year 2023. Looking at the 12 months ended June 30, 2024, the average ROE authorized in all electric utility rate cases was 9.63%.

The recommended ROE is also 15 basis below VEPCO's currently authorized ROE of 9.75%.

Company rebuttal testimony is due Sept. 17, and hearings are scheduled for late September. In most instances, the NCUC has acted on permanent rate requests within seven months of the filing date. Thus, the commission could issue a decision before November. VEPCO wants the rates to become effective around Feb. 1, 2025.

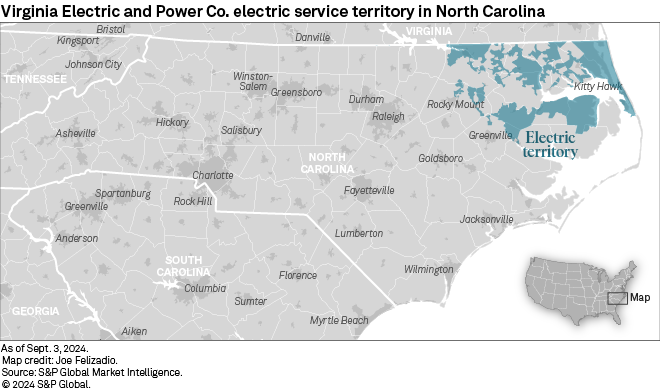

VEPCO does business in North Carolina as Dominion Energy North Carolina and serves more than 127,000 customers in the state, with a service territory of about 2,600 square miles in northeastern North Carolina, including Roanoke Rapids, Ahoskie, Williamston, Elizabeth City and the Outer Banks.

VEPCO is a subsidiary of Dominion Energy Inc.

Rate of return

RRA calculates that differences in the rates of return put forth by the company and the staff account for about $11.3 million of the $31.9 million revenue requirement difference between the company's supported $60.5 million increase and the recommended $28.6 million increase.

The staff estimated VEPCO's cost of equity using several models: a constant growth discounted cash flow (DCF) approach using consensus analysts' growth rate projections, a constant growth DCF valuation using sustainable growth rate estimates, a multistage growth DCF analysis, a risk premium model and a capital asset pricing model. The staff relied on the same proxy group developed by VEPCO.

The staff estimated the current fair market ROE for the company in a range of 9.10% to 10.10%. Based on the staff's assessment of VEPCO's overall risk profile and the results of the analytical methods, it recommends the utility be awarded an ROE of 9.60%, which was the mid-point of the estimated range. This compares with the 10.60% ROE proposed by VEPCO.

With respect to capital structure, the staff said VEPCO's proposed equity ratio of 53.45% exceeds the equity ratio for the proxy group used to estimate the company's ROE. Additionally, VEPCO's request significantly exceeds the typical common equity ratio authorized throughout the US for other regulated electric utilities, staff said. The staff recommended that VEPCO's equity ratio be reduced to 52.00%.

Rate base

RRA calculates that staff-proposed adjustments to the company's rate base account for about $3.2 million of the $31.9 million revenue requirement difference in the case.

Staff-proposed adjustments to cash working capital reduced the company's revenue requirement by $1.2 million. The company computed cash working capital using the lead-lag method calculated using 2021 data. In contrast, the staff adjusted the rate revenues, sales for resale revenues and other operating revenue lag days utilizing 2023 data. The adjustment also impacted uncollectibles, which reduced the revenue requirement by an additional $1.1 million.

Net operating income

The staff's recommended net operating income adjustments account for the remaining $17.4 million of the revenue requirement difference.

The staff recommended that the company's prudently incurred and properly accounted for coal combustion residuals (CCR) expenditures incurred during the period July 1, 2019, through June 30, 2024, be excluded from rate base and amortized over a 10-year period. VEPCO proposed to include these costs in rate base and amortize them over a five-year period. The staff said its recommendation was consistent with the commission's decision on CCR costs in the company's previous rate case and appropriately balances the recovery of these costs between ratepayers and the company. This adjustment reduced the revenue requirement by $4.2 million.

The staff also disputed VEPCO's accounting for annualized ongoing CCR costs and that VEPCO's method of utilizing a three-month period of costs as a proxy for future annual expenditures serves as a reasonable determinant of the ongoing level of such costs for ratemaking purposes. Thus, staff recommended the commission disallow the $8.4 million annual expenditure amount proposed by VEPCO for ratemaking purposes in this proceeding. Instead, it recommended that if ongoing levelized CCR expenditures are approved for recovery by the commission, the recovery of prospective costs should occur through an annual rider with no return and subject to cost prudency reviews.

The staff also made an adjustment to remove 50% of the expenses associated with the company's board of directors that have been allocated to the company, arguing it was appropriate and reasonable for the shareholders of larger utilities to bear a reasonable share of the costs of compensating those individuals who have a fiduciary duty to protect the interests of shareholders. VEPCO made an adjustment to remove 50% of the compensation and benefits of its top three executives who had the highest level of compensation allocated to the utility in the test year. The staff made a further adjustment to remove 50% of the compensation and benefits of two additional executives whose duties and compensation encompass a substantial number of activities that are closely linked to shareholder interests.

Rate case background

On March 28, VEPCO filed an application (Docket E-22 Sub 694) seeking a $56.6 million increase in non-fuel electric rates, premised upon a 10.60% return on equity (53.85% of capital) and a 7.66% return on a rate base valued at $1.35 billion for a test year ended Dec. 31, 2023, adjusted for changes to certain revenues, expenses and investments through June 30, 2024.

Drivers of the rate request are investments that have expanded the company's renewable generation portfolio and further reduced its carbon footprint, continued the company's efforts to enhance system reliability and helped ensure environmental compliance.

|

Since VEPCO's 2019 rate case in North Carolina, it has invested $1 billion to bring online 10 regulated solar facilities totaling approximately 544 MW in aggregate. It also brought online its first two utility-scale battery energy storage systems in service, with a total capacity of 32 MW, an approximate $63 million investment. Additionally, the Coastal Virginia Offshore Wind Pilot Project, with 12 MW capacity, came online in 2021 at an approximate cost of $295 million. The company also invested over $480 million in its nuclear fleet from 2019 through 2023.

VEPCO also seeks authorization to recover deferred CCR asset retirement obligation expenditures incurred from July 1, 2019, through June 30, 2024, representing investments in environmental compliance projects at its coal-generating sites to comply with federal and state law. CCR compliance costs during that period were about $621 million.

On Aug. 14, VEPCO filed supplemental testimony supporting a revised rate increase to reflect a different capital structure and weighted average cost of capital, the company's proposed changes to base fuel and base non-fuel revenues and an increase in the North Carolina regulatory fee. At the time, VEPCO said it supported a $60.5 million rate increase premised upon a 9.60% return on equity (53.45% of capital) and a 7.70% return on a rate base of $1.36 billion.

NC regulatory environment

North Carolina regulation remains relatively constructive from an investor viewpoint. In almost all of the major rate cases decided during the last several years, the NCUC adopted settlements, and in those cases that specified an ROE, the authorized return typically was slightly above the nationwide average for energy utilities at the time established. State law requires the NCUC to utilize a historical test year and a year-end rate base valuation in general rate cases but permits adjustments for "known and measurable" changes and allows the commission to include construction work in progress in rate base for a cash return.

Legislation enacted in 2021 provides utilities the ability to file multiyear rate plans and develop performance-based incentives. The companies may seek approval for increases of up to 4% over three years rather than initiating a new rate case each year. The legislation effectively solidified North Carolina's regulated energy monopoly system, maintaining the vertically integrated public utility model and commission regulatory authority. The law also provides securitization as an option to recover costs associated with retiring coal plants.

Gas utilities are permitted timely recovery of commodity and certain related costs, and the state's two major local distribution companies are authorized to employ revenue decoupling mechanisms. Also, the state's two largest gas utilities have been authorized to implement a rider that allows the companies to track and recover future capital expenditures they incur to comply with federal pipeline safety and integrity requirements outside of a general rate case.

For additional details, refer to the North Carolina commission profile.

For additional detail concerning RRA's regulatory rankings, refer to the latest "Quarterly State Regulatory Evaluations" report.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.