Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 8 Aug, 2024

By Keith Nissen

Eight in 10 Americans have embraced the digital economy by using financial apps for everything from online purchases and digital payments to mobile banking and more, according to S&P Global Market Intelligence Kagan's recent survey. Of particular note is the strong competition for all that consumer spending.

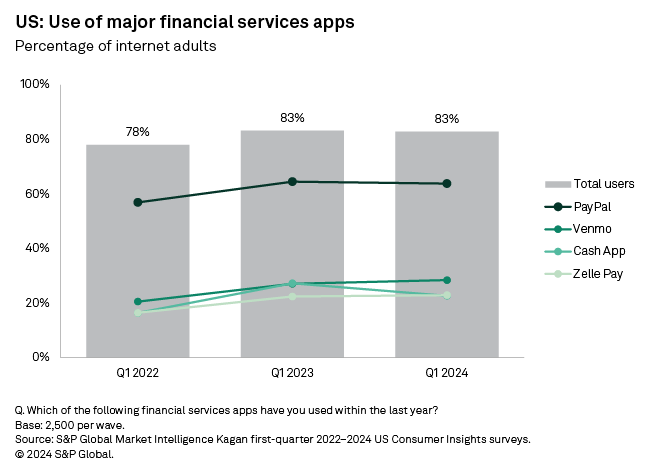

➤ In our latest 2024 US Consumer Insights survey, overall use of financial apps was flat year over year at 83%. Two-thirds of Americans use PayPal, the dominant financial app in the market.

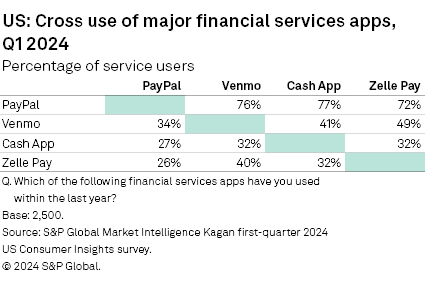

➤ Among users of other major financial apps, such as Venmo, Zelle Pay and Cash App, approximately three-quarters also use PayPal. Those who use financial apps use 2.4 apps, on average.

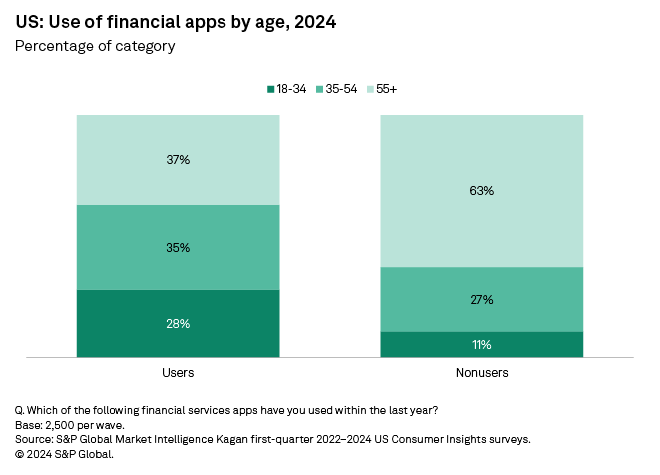

➤ Use of financial apps is split fairly evenly across all age groups. However, non-users are heavily skewed toward older Americans, 55 years of age and older.

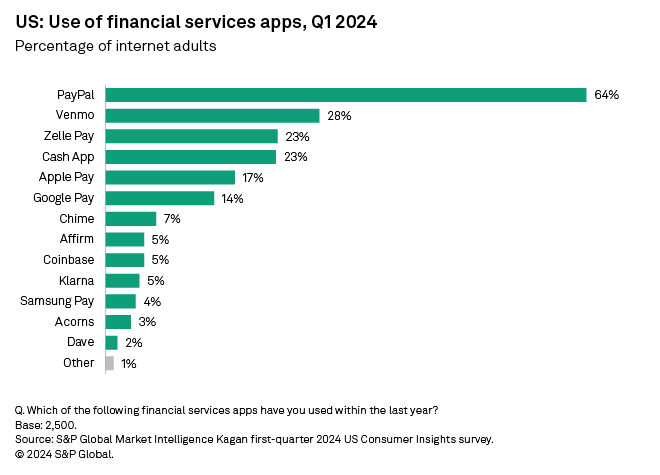

The S&P Global Market Intelligence Kagan first-quarter US Consumer Insights survey found that 83% of internet adults in the US have used a digital finance service app over the past year, up from 78% in 2021. Over the past year, there has been very little change in this market segment. For example, the use of PayPal remained flat at 64% over the past 12 months. The use of other popular digital payment apps, such Venmo (28%) and Zelle Pay (23%), was also flat year over year. Cash App users surged in 2021, up 11 percentage points to 27% in 2022, but receded slightly to 23% in 2023. Cash App is a general-purpose financial platform supporting digital payments, banking and investments.

In addition to the apps already mentioned, there is a long tail of competitors led by Apple Pay (17%) and Google Pay (14%). Other competitors offer specialized features/benefits, such as Klarna, which allows purchases to be split into four interest-free payments. Affirm supports buy now, pay later transactions. Chime offers an online platform for banking services provided through bank partners. Acorn is an online savings and investment app, while the Dave app is a daily money-management tool that also supports rapid access to cash advances. Coinbase is a secure platform for buying and selling cryptocurrency.

PayPal's market dominance is evident in the cross-use of financial apps. For instance, three-quarters of Venmo, Cash App and Zelle Pay users said they also use PayPal. Four in 10 Cash App users and half of Zelle Pay users also use Venmo. On average, consumers use 2.4 financial apps. Approximately two-thirds (62%) use two or more financial apps, and 37% use three or more financial apps.

Comparing users of digital financial apps with non-users shows that financial app users are spread fairly evenly across all ages. However, approximately two-thirds (63%) of non-users are adults 55 years of age or older. Furthermore, eight in 10 non-users (79%) have an annual household income below $100,000 and 39% have an annual household income below $50,000. The majority (53%) of non-users do not have a college degree.