Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 May, 2023

By Jason Sappor

In its monthly Nickel Commodity Briefing Service (CBS) report, S&P Global Commodity Insights discusses the nickel market within the broader macroeconomic environment and provides rolling five-year supply, demand and price forecasts.

Access the Nickel CBS May 2023 Databook.

➤ The London Metal Exchange three-month (LME 3M) nickel closing price fell to $20,934 per metric ton May 18, the lowest this year, after the release of bearish March-quarter trade data from top primary nickel consumer China.

➤ Given that Indonesia's stainless steel plants are cutting output due to weak demand in China, their main export market, we have downgraded our forecast for Indonesia's primary nickel demand in 2023 by 70,000 metric tons, to 380,000 metric tons.

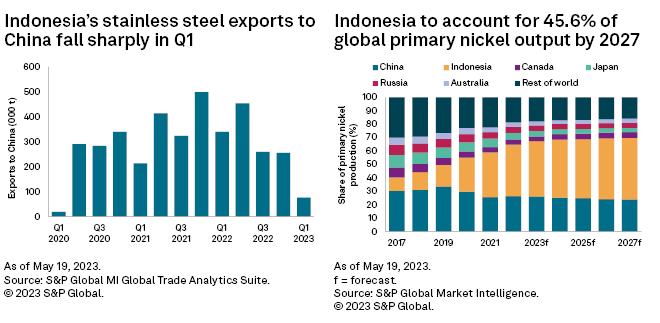

➤ We expect Indonesia to cement its position as the world's largest primary nickel producer over our forecast horizon, with its output forecast to expand at a compound annual growth rate of 10.5% between 2022 and 2027.

➤ Recent media reports that Indonesia's government has cut tax incentives for investment in domestic nickel pig iron (NPI) projects to increase the output of battery-grade nickel products with a higher nickel content emphasize that further changes in the country's nickel mining policy remain a risk to this forecast.

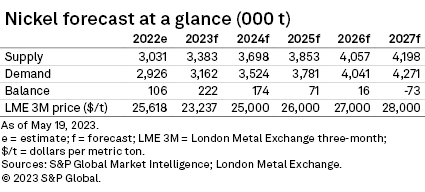

➤ We have lowered our average LME 3M nickel price forecast for 2023 to $23,237/t from $25,322/t in our April 2023 Nickel CBS, largely due to expectations that Indonesia's primary nickel consumption will be weaker than previously expected.

Analyst comment

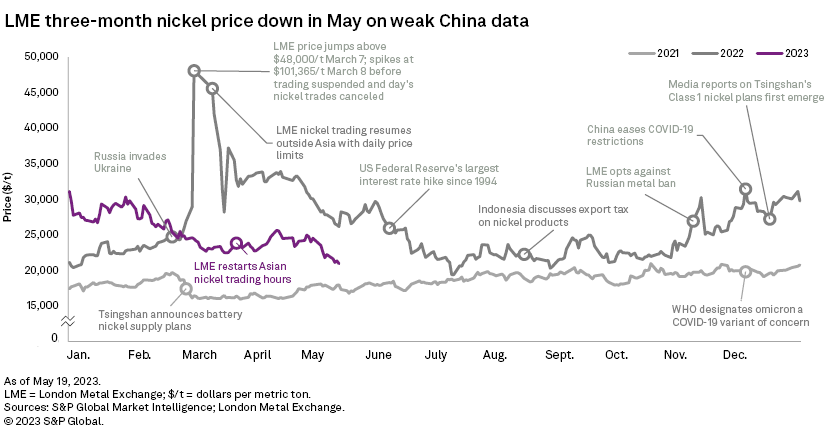

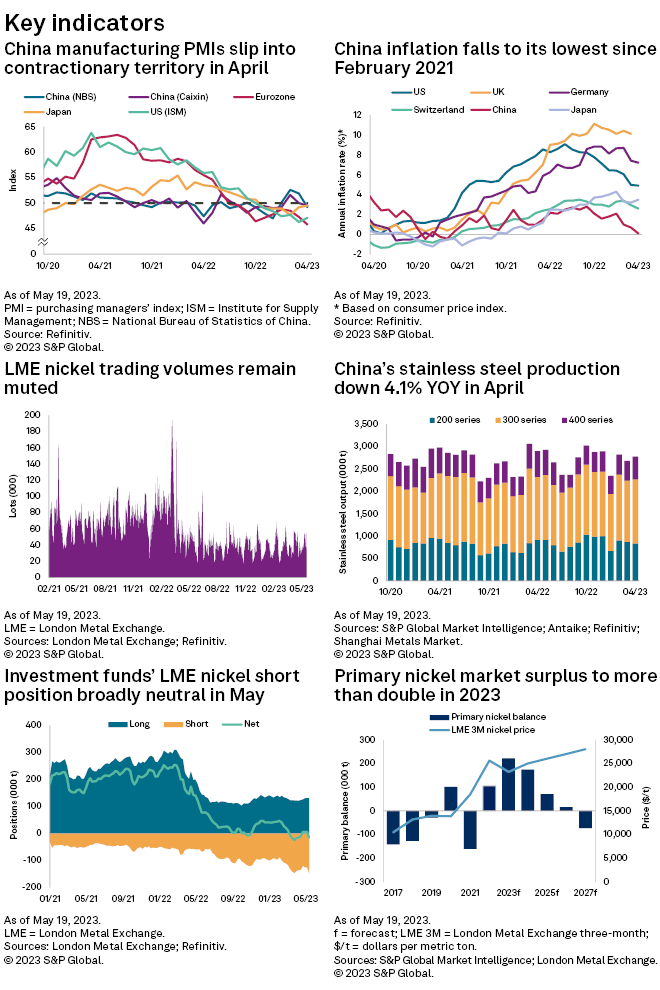

LME nickel prices came under renewed downward pressure in May as the release of disappointing trade data from top industrial metals consumer China further highlighted that the country's metals demand has failed to meet market expectations following its easing of COVID-19 restrictions in December 2022.

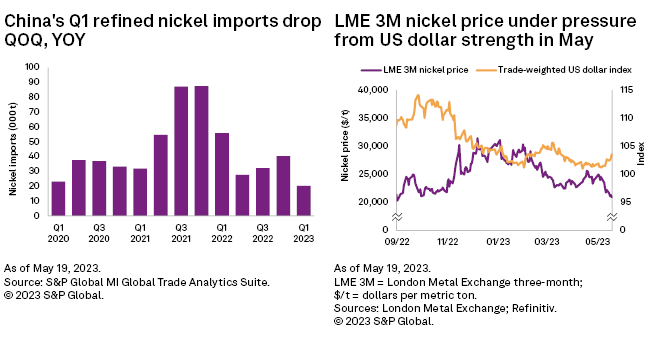

Despite data released in April showing that China's economic activity outperformed market expectations in the March quarter, trade data released May 10 revealed that the country's imports of key industrial metals were depressed during the same period. For instance, imports of LME-deliverable refined nickel, a primary nickel product that can be processed into battery-grade nickel sulfate for passenger plug-in electric vehicle batteries, plummeted 49.8% quarter over quarter and 63.7% year over year to 20,249 metric tons in the March quarter, the lowest since the same quarter in 2020. Given the negative implications of such data points for already-weak global primary nickel market fundamentals, the LME 3M nickel closing price reacted by falling to $22,531/t May 10 from $23,507/t May 9.

A series of downbeat economic data releases for China, including the country's slowest consumer price index rise since February 2021 in April, and US dollar strength amid worries over the US government's debt ceiling negotiations pushed the price down further, to $20,934/t May 18, the lowest so far in 2023.

Lackluster China metals demand has also negatively impacted the Indonesia stainless steel sector. Indeed, China-based Jiangsu Delong Nickel Industry Co. Ltd. cut stainless steel output at its PT Obsidian plant in Indonesia in response to muted end-user demand in China, the main export market for Indonesia's stainless steel products. As a result, Indonesia's stainless steel exports to China under Harmonized System (HS) code 7218 dropped 70.2% quarter over quarter and 77.6% year over year to 76,228 metric tons in the March quarter. Indonesia's total exports of such material consequently decreased 37.6% quarter over quarter and 29.0% year over year during the same period to 278,610 metric tons. Based on these trends, we have downgraded our 2023 forecast for primary nickel demand in Indonesia — the world's second-largest primary nickel consumer behind China — by 70,000 metric tons to 380,000 metric tons, representing a marginal 1.3% increase from 2022.

Indonesia's exports of ferronickel and NPI (HS code 720260) — primary nickel products that are traditionally key stainless steel inputs — fared better than its stainless steel exports in the March quarter, increasing 2.4% quarter over quarter and 45.1% year over year to 1.7 million metric tons over the period. Exports to China accounted for 97.8% of this material as Indonesian producers continued to fill the gap left by the decline in China's NPI output since Indonesia implemented its nickel ore export ban in 2020. The Indonesian government nevertheless again signaled its intention to limit the country's production of lower-nickel-content NPI in favor of higher-nickel-content mixed hydroxide precipitate — an intermediate nickel product that can be processed into nickel sulfate — by cutting tax incentives for investment in NPI projects, according to media reports in May. With global primary nickel consumption from plug-in EV batteries expected to increase from an estimated 251,000 metric tons in 2022 to 821,000 metric tons in 2027, according to our projections, this move is being driven by Indonesia's desire to save its nickel reserves for production of key EV battery nickel products to capitalize on surging global demand.

Although we continue to expect Indonesia to remain the world's largest primary nickel producer over our forecast horizon, with its output forecast to expand at a compound annual growth rate of 10.5% between 2022 and 2027, this recent development highlights that further changes to Indonesia's evolving nickel mining policy remain a risk to this forecast.

Outlook

Due to the downgrade to our forecast for Indonesia's primary nickel demand in 2023 and our expectations for further primary nickel supply growth in Indonesia, we predict the global primary nickel market to record a surplus of 222,000 metric tons in 2023 — larger than the surplus of 152,000 metric tons in our previous forecast. We have therefore lowered our average LME 3M nickel price forecast for 2023 to $23,237/t, from $25,322/t previously.

Despite our projections for the global primary nickel market to remain oversupplied for most of our forecast horizon, we expect LME nickel prices to average above historical levels over the period because we anticipate nickel's role in the broader green revolution of the global economy to support investor interest in the nickel market.

Another reason is related to the impact of the March 2022 historic LME nickel short squeeze. LME nickel trading volumes have remained depressed since the squeeze, resulting in heightened price volatility on the exchange. LME nickel prices have consequently traded at historically elevated levels. At the end of the March quarter, the LME 3M nickel price commanded a premium of $2,461/t over the price of battery-grade nickel sulfate in China; it typically traded at a discount before the squeeze. This was despite the LME 3M price having dropped 20.6% between end-2022 and March quarter-end to $23,838/t under downward pressure from weaker global primary nickel market fundamentals. Until the exchange successfully implements measures to revive nickel trading liquidity, we expect global primary market fundamentals to drive the direction of LME nickel prices from these historically high post-squeeze levels, contributing to a "new normal" of elevated LME nickel prices.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.