Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 10 Mar, 2023

By Katherine Matthews, Jason Holden, and Ying Li

On Feb. 5, Newcrest Mining Ltd. announced to the market that it received a nonbinding indicative bid from Newmont Corp. to wholly acquire Newcrest through a scheme of arrangement. The transaction would be the largest gold mining merger in history, valued at just shy of $17.0 billion. In the now-rejected proposal, Newmont would exchange 0.38 share of its common stock to acquire each issued and outstanding share of Newcrest. Newcrest indicated that it is open to sharing some non-public information with Newmont, which could result in an improved offer. While we see some cost savings with the combined entity, the increased reserves and resources and greater exposure to copper are more important.

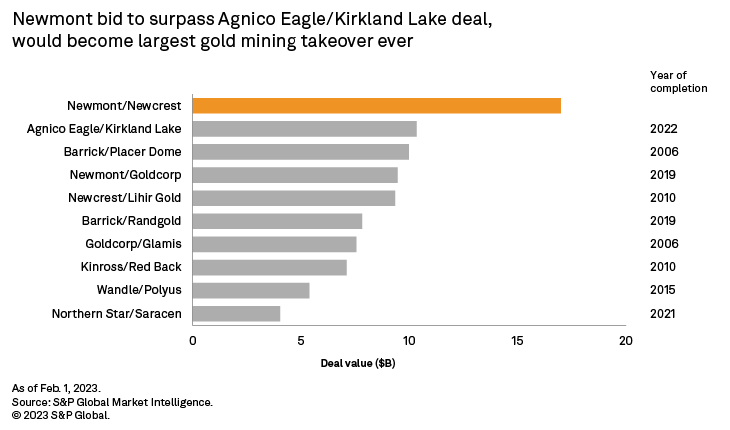

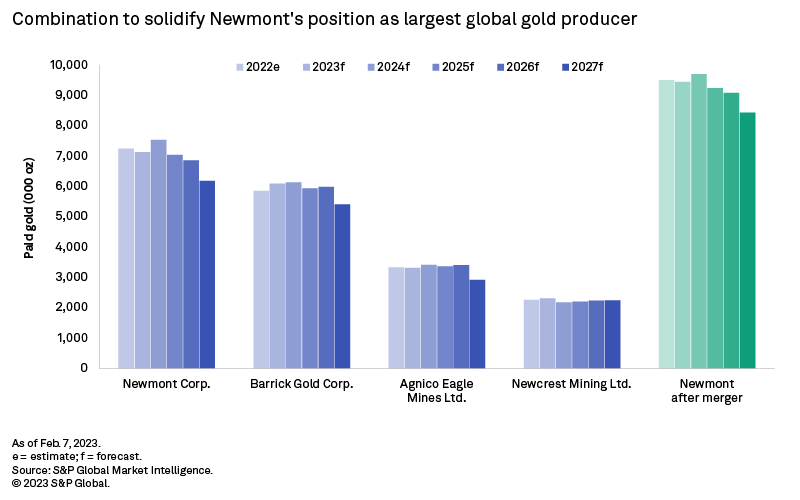

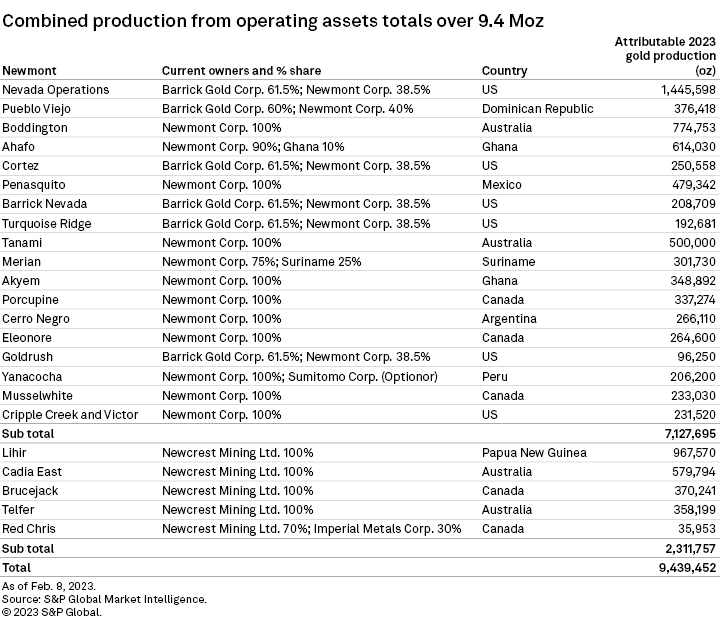

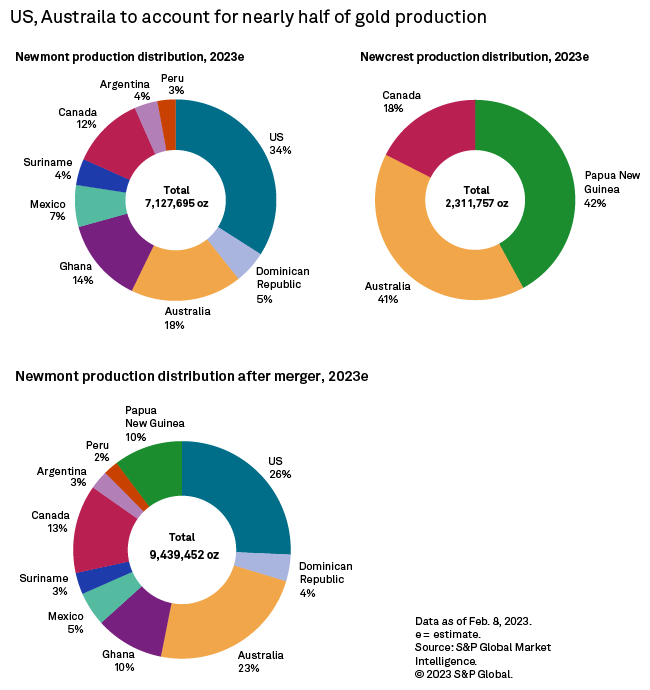

A post-merger Newmont, already the world's largest gold producer, would produce a projected 9.4 million ounces in 2023, with an estimated market capitalization of US$54.5 billion. The proposed merger would be larger than the 2022 deal between Agnico Eagle and Kirkland Lake, and the megadeal between Barrick Gold and Placer Dome in 2006. The offer implies a 21% premium to Newcrest's Feb. 3 closing price.

The tie-up would bring the two businesses back together after almost 25 years apart. Newcrest was founded in 1966 as the Australian subsidiary of Newmont. After merging with Australmin Holdings Ltd. and acquiring BHP Group Ltd.'s historical gold assets in 1990, Newcrest adopted its current moniker and was spun out as a separate entity. Had the offer of 0.38 Newmont share per Newcrest share stood, the merged entity would have been 30% owned by Newcrest shareholders. Newcrest noted Feb. 6 that it had already rejected an initial offer of 0.363 per share, as it did not provide its shareholders with enough value — the revised offer is up 4.7% from the original. It has been reported that Newmont is willing to slightly raise its takeover bid, with Newcrest now offering nonpublic information directly to Newmont to determine if the offer can be increased to a value reasonable to both companies.

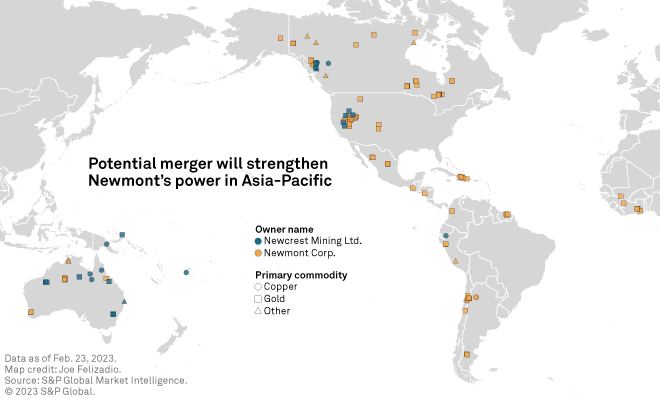

Newcrest has a high proportion of low all-in sustaining cost, or AISC, gold and copper mines in the Asia-Pacific region and North America, and a reasonable growth profile. Newcrest's operations consist of five operating mines — two each in Canada and Australia and a single operating mine in Papua New Guinea. The company also owns two advanced projects in Australia and Papua New Guinea.

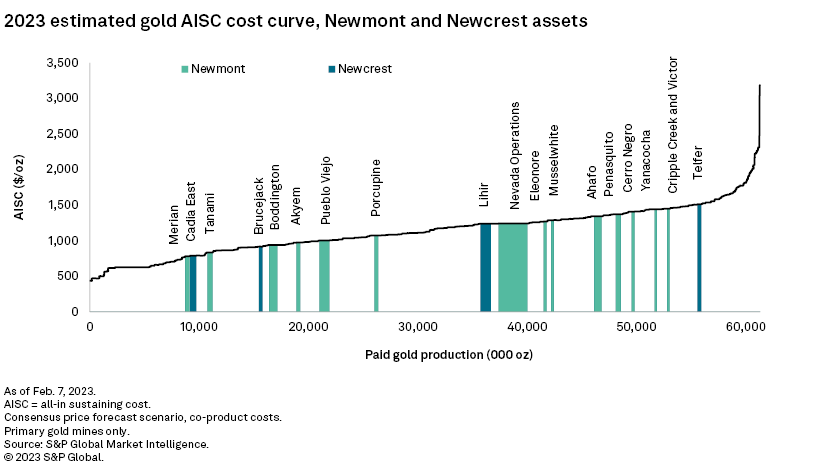

The merger would bring Newmont back into Australia and the Asia-Pacific region. Newcrest's gold operations are heavily focused in Australia, with 40.6% of annual production sourced from the region. Newmont also operates in the country, with its Boddington and Tanami mines comprising 17.8% of its annual production. Newcrest's long-lived Cadia East mine is the second-largest gold mine in Australia, with estimated AISC at a low $788.6 per ounce in 2023, which would complement Newmont's Boddington and Tanami mining complexes. Should the merger go ahead, it would result in Newmont owning three of the five largest gold mines in Australia by 2023 estimated production.

In addition, Newcrest has growth potential in an area dubbed the "Golden Triangle," a prolific gold region in British Columbia, with its Brucejack and Red Chris mines. Newmont owns the Tatogga project, a copper-gold porphyry deposit geologically similar to the Red Chris mine, situated approximately 20 kilometers to the southeast.

Papua New Guinea would be a foray into a new mining jurisdiction for Newmont, with acquisition of the Lihir and Wafi-Golpu assets. Newcrest has updated its feasibility study on the potential growth and low-cost production of Lihir Phase 14A, a much larger asset that is expected to add approximately 400,000 ounces of gold production over the next four years starting in 2024, with operations expected to continue beyond 2031.

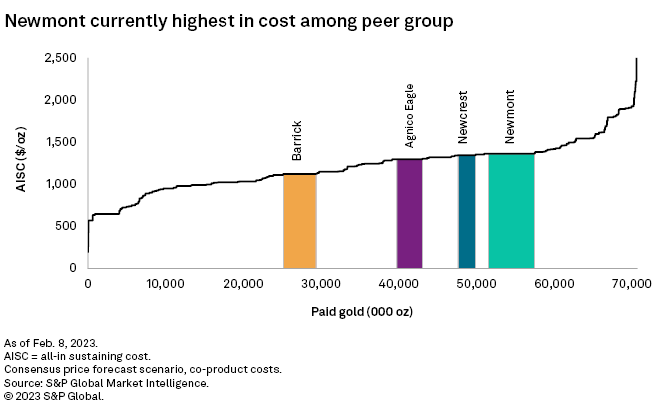

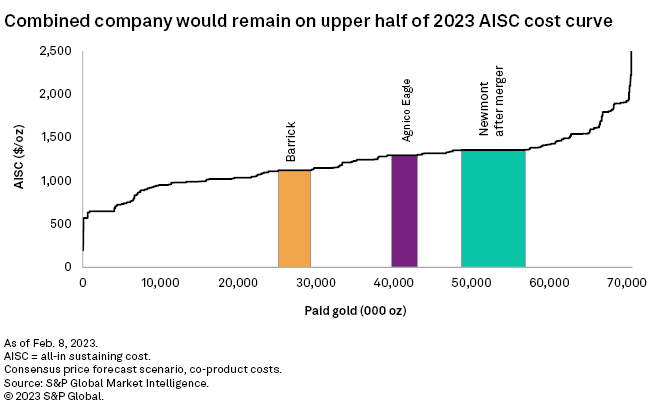

Looking at the forecast 2023 gold AISC cost curve, as Newcrest and Newmont sit close to each other, the merger will not make a significant cost saving for the combined entity in the near term. Should the takeover proceed, Newmont would still sit on the 69th percentile, at a higher cost than its main competitors, Barrick Gold Corp. and Agnico Eagle Mines Ltd.

Newcrest has current production guidance for 2023 of between 2.1 Moz and 2.4 Moz of gold and 135,000-155,000 tonnes of copper. A merger would solidify Newmont's position as the world's largest gold producer, with a projected 8.9% share of global gold production in 2023.

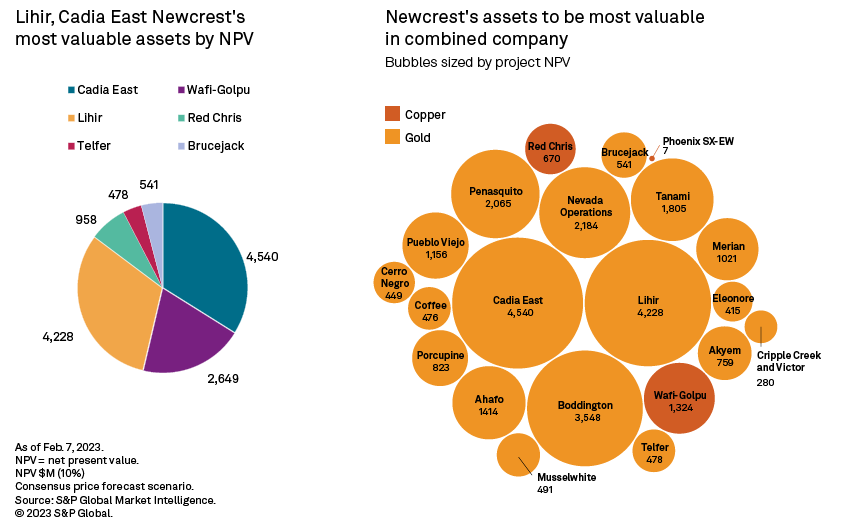

Newcrest has delivered incremental improvements, including low-cost production, boosting throughput and a strong exploration portfolio, particularly expanding reserves at the Lihir, Cadia East and Telfer mines in recent years. Reserves at the end of December 2022 were 56.2 Moz of gold and 7.7 million tonnes of copper, with current gold reserves amounting to more than 24 years of production at current rates.

We believe that the most attractive part of Newcrest for Newmont is its Australian assets. As mentioned previously, Cadia East is one of Australia's largest gold mines, with production costs in the first quartile. We forecast Cadia East to produce an average of 580,000 ounces of gold per year and to deliver 76.1% of Newcrest's copper production in 2023. Our modeling shows the copper revenue alone from Cadia East covers the site's operating costs.

Newcrest uses the Telfer gold mine in Western Australia for the existing processing infrastructure at its Havieron development project. Telfer has estimated 2023 production totaling 360,000 ounces of gold and 11,300 tonnes of copper. Currently, Telfer is expected to continue operations into 2025, but Newcrest is highly likely to extend the mine's life by developing the underground operations at Havieron, which could bring higher grades into play at the decade-long project via sublevel open stoping methods.

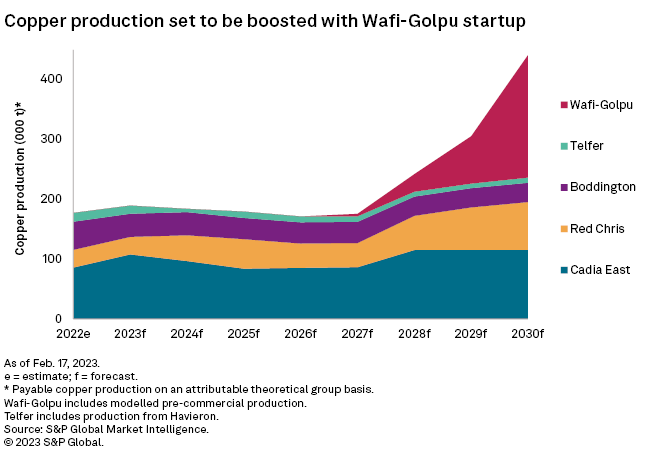

One opportunity with the potential merger is the acquisition of Newcrest's copper reserves, particularly at Cadia East and Wafi-Golpu. Newmont currently reports copper production at Boddington, with additional reserves held at projects including Phoenix, MARA and Norte Abierto. While it might not seem particularly significant at this stage, further broadening into copper could be considered a tactical move, with a projected global supply deficit in 2025-26 and beyond, tied to the ongoing global shift to decarbonization and greener energy demands.

With the number of new copper discoveries of sufficient quality and size trending downward, there will soon be a squeeze in the longer-term supply pipeline. Copper exploration budgets have increased since the COVID-19-related dip in 2020; however, explorers are focusing spending on near-mine and late-stage projects. This risk-averse approach is clear, with the 12 deposits identified in a recent copper exploration analysis only being discovered within the last 10 years. The Tatogga deposit, now falling under Newmont's list of assets following the takeover of GT Gold in 2021, ranks sixth out of the 10 largest discoveries since 2012, with a current resource just shy of 2.2 Mt of copper and a discovery year of 2017.

Newcrest declared copper production guidance for its 2023 fiscal year of 135,000-155,000 tonnes of copper, which it recently announced it is on target to attain. Newmont stated 2022 copper guidance sourced from Boddington was just shy of 50,000 tonnes. For the first nine months of 2022, the company produced 26,800 tonnes but guidance remained unchanged. Current rankings place Newcrest 36th in the world for copper output in 2021, while Newmont ranks 77th. Key rivals include Barrick Gold at 24th, but should the merger proceed, Newmont would re-rank 30th based on 2021 totals, placing it firmly between Ural Mining & Metallurgical Co. and Grupo México SAB de CV. The merger would result in an average fourfold increase in Newmont's copper production until 2027.

The biggest potential addition to the copper pipeline of the combined company is Wafi-Golpu. Environmental concerns at the project could be a challenge to its development. Permitting of the project has been on hold due to its deep-sea tailings management solutions. Newmont, as a newcomer to Papua New Guinea, may face challenges pushing Wafi-Golpu through to production. In addition, geopolitical issues and social unrest in Papua New Guinea could also increase operational risk.

Newcrest has extensive experience exploiting deposits via block caving methods, notably at Cadia East. Newcrest will also deploy this mining method at its Red Chris mine in British Columbia, a copper-gold porphyry system whose underground portion is amenable to extraction via block cave techniques, according to a pre-feasibility study. Red Chris has shared ownership, with Newcrest purchasing 70% of the operation from Imperial Metals Corp. on Aug. 15, 2019. Imperial retains a 30% joint venture interest and, upon completion of the transaction, stated that a key factor for selling to Newcrest was its experience in block caving operations. Unsurprisingly, this expertise is being touted as a consideration for Newmont. A downside to acquiring these large-scale projects is the capital intensity needed to develop them, particularly when using block caving. For example, Newcrest modeled development and expansion capital in 2023 of just over $1.0 billion; from 2023 to 2027, expenditure averages $1.2 billion per annum across five properties. Resequencing of projects and developments will therefore be likely, along with the potential for divestment of assets.

As shown above, Newcrest holds some of the world's most valuable assets by attributable net present value. While Newmont has some high-value projects, the largest are through joint ventures, such as Nevada Operations with Barrick Gold. The additional operations of Lihir and Cadia East, in particular, would give Newmont full control of some potential tier-one assets.

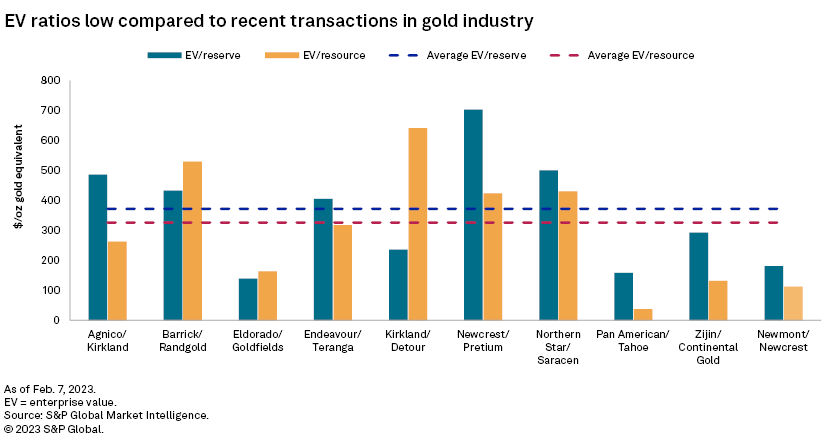

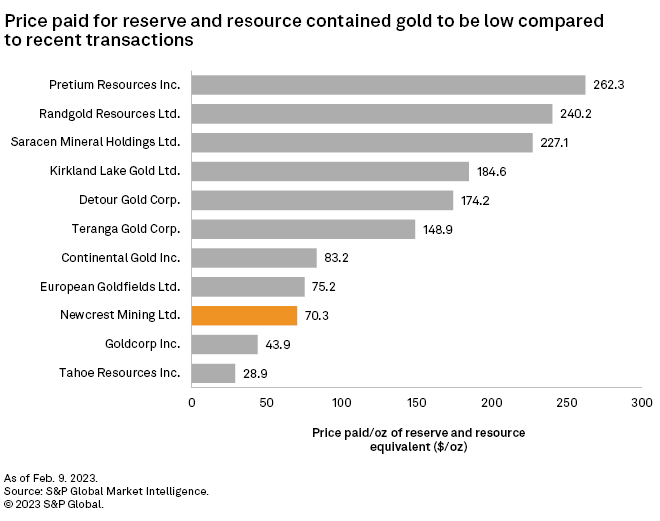

The enterprise value, or EV-to-reserves ratio for the Newmont and Newcrest merger is $181.3/oz of gold equivalent, significantly lower than the $372.6/oz of gold equivalent average for the nine comparable recent mergers considered in our study, including Barrick Gold's acquisition of Randgold Resources Ltd. and the Northern Star Resources Ltd. merger with Saracen Mineral Holdings Ltd. Again, if we look at the EV-to-resources ratio for the Newmont and Newcrest merger, it calculates at a low $112.7/oz Au eq. — $213.9/oz Au eq. below the average for the nine comparable mergers of $326.6/oz Au eq. Both these ratios emphasize the sentiment that the Newmont offer for Newcrest is low. Another ratio considered was the price paid per ounce of gold equivalent in reserves and resources. Newmont would be paying $70.3/oz in the potential merger, which is the third lowest in recent comparable transactions and far below the average of $139.9/oz.

After years of competition with Barrick Gold over scale and position, a successful acquisition of Newcrest would make Newmont the absolute leader in the gold industry in terms of production. Newcrest's copper contribution and pipeline of advanced projects could further improve Newmont's cost profile and provide additional growth opportunities. Through the proposed merger, Newmont would be positioned to take advantage of the expected upcoming copper deficit. The merger makes sense, but based on our analysis, Newcrest is wise to push for a higher price.

Manraj Lamba and Shunyu Yao contributed to this article.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Campaign

Research

Research

Products & Offerings

Segment