Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 29 Feb, 2024

By Harry Terris and Xylex Mangulabnan

New York Community Bancorp Inc.'s recent woes have revived fears over the impact of high interest rates on the financial sector and intensified focus on two groups in particular: banks with heavy exposure to commercial real estate loans and banks graduating into size categories subject to tougher standards.

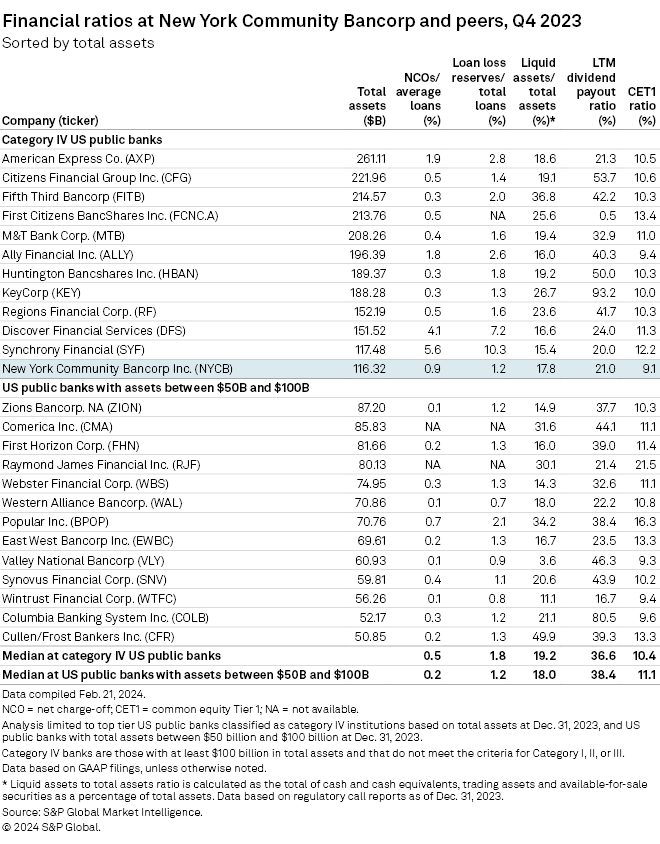

New York Community characterized a net interest margin-depressing liquidity build and other moves as necessary steps to catch up with norms at large peers. Data shows that compared with the next size tier, a group of banks approaching the $100 billion threshold has a lower median ratio of credit loss reserves to total loans and a lower median ratio of cash, trading assets and available-for-sale securities to total assets. The bank's reserve build also underscored strains on office loans and risks that banks face from exposure to multifamily loans.

New York Community's net charge-off rate of 86 basis points in the fourth quarter of 2023 — reflecting the souring of an office loan and a loan backed by a co-op apartment building — was startling for a company that has posted decades of peer-surpassing credit performance, and underscored commercial real estate strains across the industry that are likely to take years to resolve.

Meanwhile, a liquidity build, one of several steps New York Community undertook to move closer to norms at larger banks now that it has more than $100 billion of assets, helped damage its revenue outlook. The bank's earnings are its primary resource for absorbing credit costs, its executive chairman has observed.

New York Community reported that its deposits had grown through early February despite the "tough punches to the gut," and analysts have said the bank is the subject of a unique convergence of forces.

Still, a rebound in interest rates since 2023-end, propelled further by consumer price inflation that exceeded expectations, is expected to keep the pressure on commercial real estate (CRE) borrowers.

CRE property values could start to turn the corner as transactions activity picks up, even though valuations on bank balance sheets might not reflect recent increases in rates, BofA Global Research analysts said in a Feb. 9 report.

"To the extent the regulators take a more passive approach we think a mass re-valuation shock is unlikely to occur," they said. "If, on the other hand, the regulators begin to require a greater number of banks to materially remark their CRE holdings it could result in an escalation of fears surrounding CRE and continued stress on the sector."

|

|

|

|

Catching up

New York Community made moves on several fronts in the fourth quarter of 2023 to "align" itself with larger banks subject to stricter regulation, President and CEO Thomas Cangemi said during the company's earnings call.

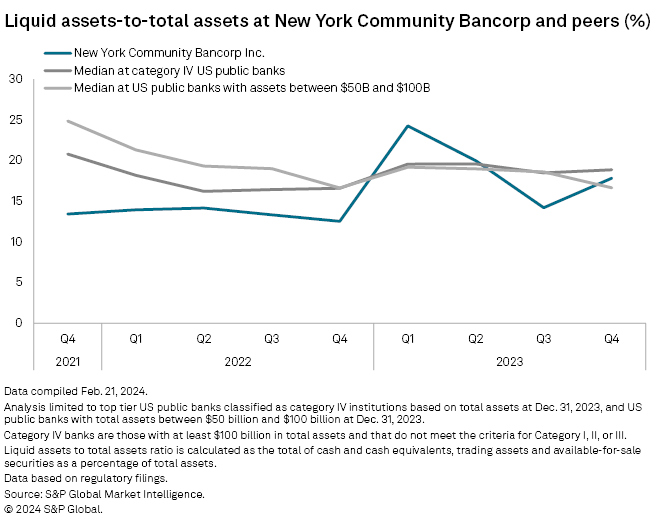

Its ratio of cash, trading assets and available-for-sale securities to total assets rose 3.6 percentage points sequentially to 17.8%, close to a median liquidity ratio of 19.2% for publicly traded peers in a regulatory category for banks of New York Community's size and complexity, according to data from S&P Global Market Intelligence. (The ratio at New York Community had spiked above peers after its acquisition of most of the failed Signature Bank, but dropped as a temporary build-up in custodial deposits related to the transaction reversed and it paid off some wholesale borrowing.)

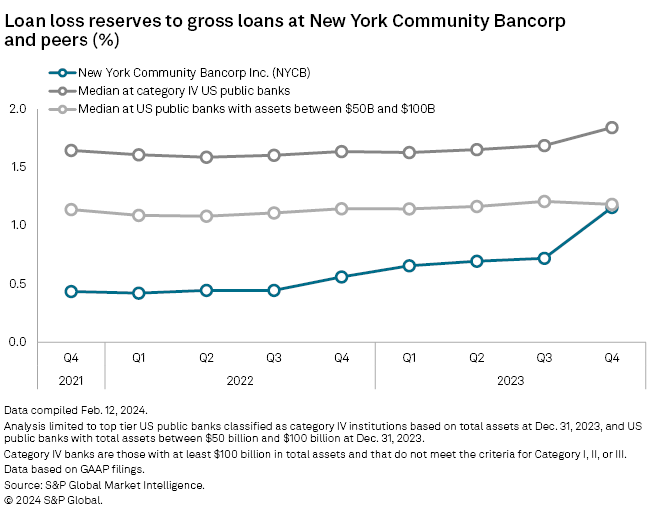

The bank increased its ratio of loan loss reserves to total loans by 44 basis points sequentially to 1.16%, reflecting weakness in the office sector and risk posed by borrowers in the multifamily sector who face sharp increases in interest rates. That compares with a median of 1.84% for the large peers.

New York Community's common equity Tier 1 (CET1) ratio was 9.10%, compared with the large peer median of 10.4%. The bank slashed its quarterly dividend to 5 cents per share from 17 cents, however, as it seeks to build its CET1 ratio to 10% by year-end, a step that also stands to bring its dividend payout ratio down closer to peers. (New York Community's payout ratio was 21.0% for 2023, a year that included unusually strong earnings in the first quarter, reflecting the Signature acquisition, and a loss in the fourth quarter. If the bank's fourth quarter had met the consensus forecast for EPS, its payout ratio for the period would have been 58.6%, compared with a median of 36.6% for the large peers in 2023.)

Broadly, banks approaching the $100 billion threshold tend to have lower loss reserve coverage, though the larger banks also tend to have a greater focus on consumers that typically require larger reserves. Liquidity and CET1 ratios are more comparable between the two size categories. A group of publicly traded banks with $50 billion to $100 billion of assets has a median ratio of loan loss reserves to total loans of 1.2%, a median ratio of liquid assets to total assets of 18.0%, and a median CET1 ratio of 11.1%.

Research by Keefe Bruyette & Woods concluded that profitability tends to drop among banks just crossing the $100 billion mark as they make the transition to tougher regulation, before ramping up again with greater scale.

New York Community's fourth-quarter 2023 results "brought these concerns for the banking industry to the front burner," Keefe Bruyette & Woods analyst Christopher McGratty said in a Feb. 12 report on First Citizens BancShares Inc.

First Citizens crossed the $100 billion threshold through its merger with CIT Group Inc., and then jumped above $200 billion of assets with its acquisition of most of Silicon Valley Bank.

McGratty assumed coverage of First Citizens with an "outperform" rating, saying it is "very different" from New York Community, with excess capital and liquidity and a diversified loan portfolio with strong reserve coverage, including a backup arrangement with the Federal Deposit Insurance Corp.

|

|

Stepping down

New York Community projected that its net interest margin (NIM) would decline to a range of 2.40% to 2.50% in 2024, down from a reported 2.99% in 2023, and that its ending period loans would drop by 3% to 5% in 2024 as it works to further reduce its concentration in CRE. The NIM outlook includes the liquidity build, which Cangemi said was coming at a "slight negative carry."

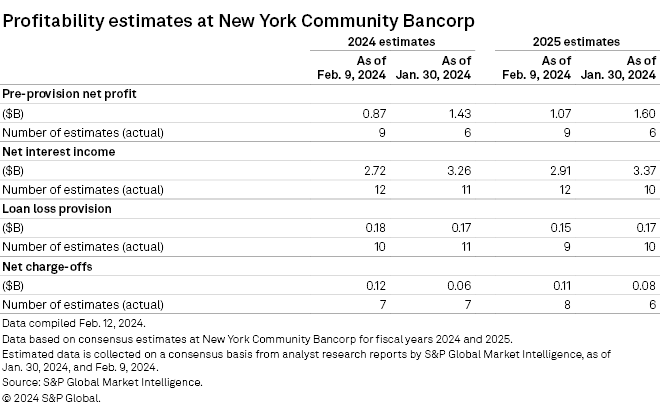

The guidance fed into severe reductions in analyst expectations for 2024. The consensus estimate for net interest income had fallen by 16.4% from before the earnings report as of Feb. 9, and the consensus estimate for pre-provision net profit had fallen by 38.8%, according to data from S&P Global Market Intelligence.

Analysts also jacked up the consensus projection for the bank's credit provision expense by 10.7% and the consensus projection for net charge-offs by 103.1%.

At $184.3 million, the consensus projection for the 2024 provision expense would still be far lower than the $833 million for 2023, which included the fourth-quarter hit. The consensus estimate for 2025 anticipates a further decline to $149.8 million.

|

|

|

|

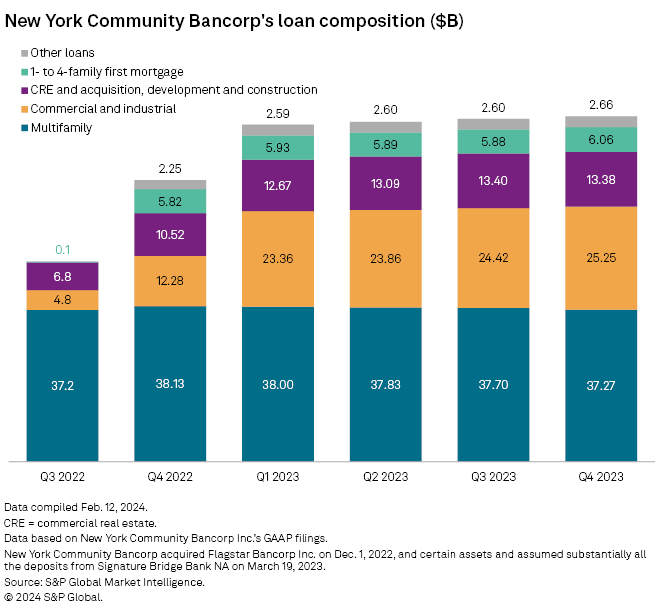

CRE concentration

New York Community's acquisition of Flagstar Bancorp Inc., which closed in the fourth quarter of 2022, and its acquisition of most of Signature in the first quarter of 2023, which did not include any of Signature's CRE loans, reduced the bank's CRE concentration considerably. Multifamily originations also plunged in 2023 as interest rates jumped, and the bank plans to allow multifamily borrowers without deposit relationships to refinance elsewhere.

"Everybody has known that being a multifamily lender exclusively was not a long-term strategy," Executive Chairman Alessandro DiNello said during a conference call on Feb. 7.

Nevertheless, multifamily loans still represented a hefty 44.0% of total loans at New York Community at the end of 2023, and other CRE loans, including $3.4 billion backed by office buildings, represented another 15.8%.

Strains in the office sector have been a focus for the industry for several quarters. New York Community said its allowance build in the fourth quarter increased its coverage ratio for the sector to about 8% from about 2%, putting it in the range of office reserve coverage ratios at banks including Wells Fargo & Co., PNC Financial Services Group Inc., Citizens Financial Group Inc. and Truist Financial Corp.

New York Community's multifamily exposure is more unique. The portfolio has historically produced minimal losses: The bank computed that its cumulative credit losses since 1993 totaled 135 basis points, compared with almost 2,500 basis points for the entire S&P US BMI Banks index.

The bank's $37.27 billion of multifamily loans include $18.3 billion backed by buildings that include rent-regulated units, however, which have come under new strains after rent regulation laws were toughened in New York City in 2019.

New York Community said that 14% of the loans in the rent-regulated portfolio were criticized, compared with 8.3% in the multifamily portfolio overall and 38% of office loans.

Analysts have quizzed other banks about their rent-regulated exposure. Webster Financial Corp. has about $1.35 billion of rent-regulated multifamily loans, with more than half originated after the 2019 change to the law, Chairman and CEO John Ciulla said during an earnings call on Jan. 23. "We don't see any credit story there right now," he added.

"We'll be laser-focused on reducing our CRE concentration as quickly as we can," New York Community's DiNello said.

He also defended the bank's recent acquisitions and the push it has made to transform itself. "It's not perfect," DiNello said. "But there's a lot of good work that's been done over the last two years to change the makeup of NYCB."

Article amended at 12:02 p.m. ET on Feb. 22, 2024. Values for liquid assets to total assets have been updated to reflect data from regulatory filings.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.