Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 22 Jun, 2022

By Brian Bacon

Introduction

Users of Netflix Inc.'s online video service who access the service via a shared log-in tended to have less household income and use fewer subscription video-on-demand services on average, compared to long-term subscribers, according to data from Kagan's U.S. online consumer survey, conducted in March 2022.

* Kagan's U.S. Consumer Insights survey showed that Netflix users who indicated sharing a log-in tended to be younger, less educated and have lower income than other subs.

* Recent subscribers who signed up within the past year were also younger, but also more diverse than long-term subscribers (more than a year) or shared log-in users.

* Shared log-in users tended to use fewer SVOD services compared to other users, while recent subs use the most.

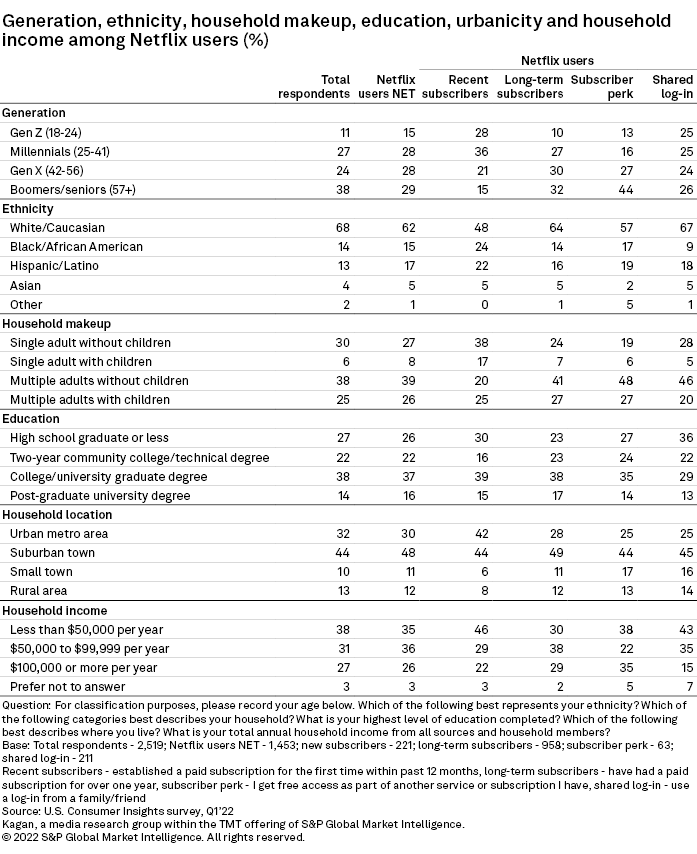

Shared log-in users on Netflix tended to be younger, with Gen Z at 25% compared to 10% of long-term subscribers. Households without children represented a larger share of shared log-in users, at 28% for single and 46% for multiple adult households, compared to long-term subscribers, at 24% and 41, respectively. Shared log-in users also skewed more toward less educated and lower-income households, with 36% holding a high school diploma or less and 43% earning less than $50,000 per year, compared to 23% and 30% for long-term subscribers, respectively.

Another point of interest for Netflix was the new subscribers it is drawing in. Recent subscribers to Netflix also tended to be younger than long-term subs, with Gen Z at 28% and millennials at 36% of subscribers surveyed who indicated they established a subscription in the past 12 months. Recent subscribers were also more diverse, with white respondents only making up 48%, compared to 64% of long-term subscribers. Households of single adults, both with and without children, represented larger shares of recent subscribers, at 38% and 17%, respectively, compared to 24% and 7% of long-term subscribers.

Recent subscribers also had a larger share of respondents with a high school diploma or less at 30% compared to 23% of long-term subscribers. When asked where they live, most recent subscribers to Netflix live in urban metro areas at 42% or suburban towns at 44%. Similar to shared log-in users, recent subscribers were also more likely to live in households earning less than $50,000, at 46%, compared to long-term subscribers.

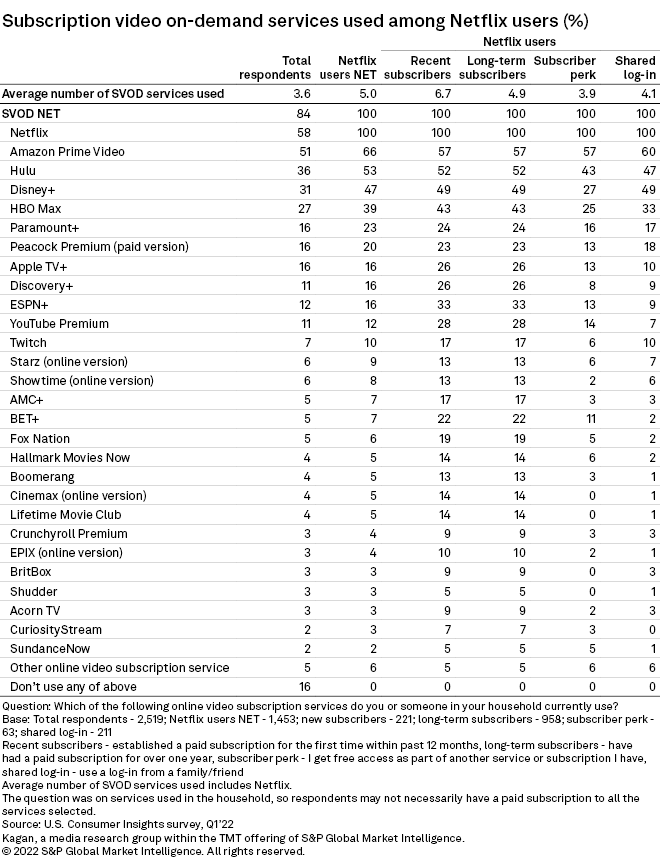

Including Netflix, total service users surveyed used an average of five SVOD services. New subscribers used more at 6.7 services, while those who indicated they receive Netflix as a subscriber perk to another service, including select wireless plans, used the fewest, at 3.9. Those who used a shared log-in were just a little higher with an average of 4.1 services used in the household.

Among all Netflix users surveyed, Amazon.com Inc.'s Prime Video, Walt Disney Co.'s Hulu and Disney+ were the most likely to be used at 66%, 53% and 47%, respectively. These services were also the most used among recent subscribers, long-term subscribers and shared log-in users. However, long-term subscribers were the most likely to use Prime Video at 70%. Netflix users who receive the service as a subscriber perk were the least likely of the Netflix user segments to indicate using several of these popular SVOD services, with Hulu at 43%, Disney+ at 27% and AT&T Inc.'s HBO Max at 25%.

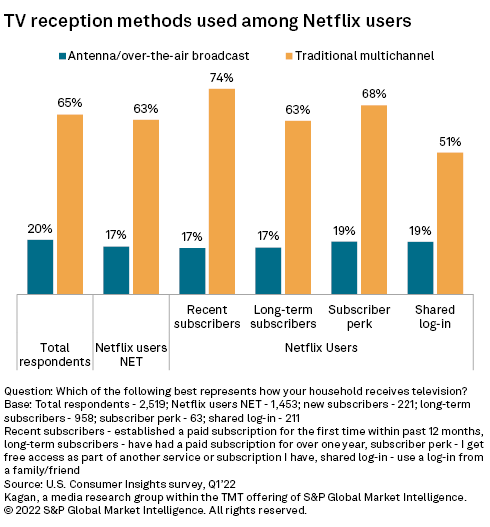

Recent subscribers to Netflix were the most likely to indicate they use a traditional multichannel service in their household at 74%, while those who share a log-in were the least likely at 51%. Since recent subscribers were more likely to live in households with children they might be seeking out content from multiple sources to entertain the whole family. Those who use a shared log-in for Netflix could just be cost conscious, since they were also the least likely to have a traditional multichannel subscription and were the most likely to live in lower-income households, compared to the other Netflix user groups.

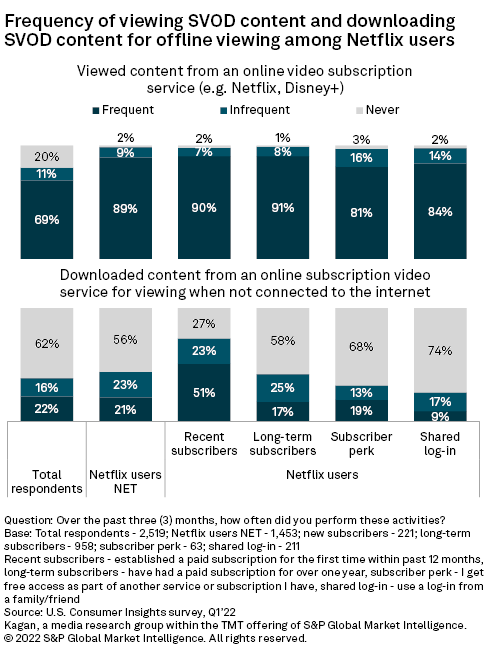

Most shared log-in users (84%) frequently stream video from SVOD services (at least once per week) although are less likely than recent and long-term subscribers at 90% and 91%, respectively. Shared log-in users were much less likely to download content from SVOD services, with 74% indicating they never download, compared to only 27% of recent subscribers.

Data presented in this article and the associated Excel banner file was collected from Kagan's U.S. Consumer Insights survey conducted in March 2022. The surveys included 2,519 internet adults with a margin of error of +/- 1.9 percentage points at the 95% confidence level. Percentages are rounded to the nearest whole number. Gen Z are adults ages 18-24; millennials, 25-41; Gen X, 42-56; boomers/seniors 57+.

Consumer Insights is a regular feature from Kagan, a media research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.