S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 22 Nov, 2022

By Tim Zawacki

Introduction

Rapid increases in costs to repair and replace vehicles appears to have significantly impacted costs to close both new and older claims in the third quarter, an S&P Global Market Intelligence analysis of newly filed statutory financials by the No. 1 U.S. private auto insurer concludes.

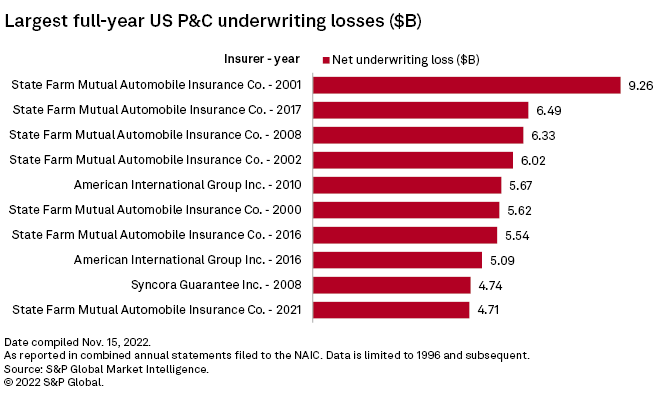

The State Farm Mutual Automobile Insurance Co. property and casualty group posted a net underwriting loss of $4.57 billion in the third quarter, an amount that was approximately $1 billion larger than any previous underwriting loss attributable to that group in a single quarter in at least the last 21 years. The group generated net underwriting losses of $3.22 billion in the second quarter of 2022 and $3.56 billion in the third quarter of 2021 amid inflationary pressures on the auto business and elevated catastrophe losses.

The top-tier mutual was responsible for $4.18 billion of the group's tally. This amount appears to rank as the largest net underwriting loss for any individual U.S. P&C insurer in any quarter in at least 21 years without adjusting for inflation, surpassing the $3.44 billion in red ink that Allstate Insurance Co. posted in the third quarter of 2005 when Hurricane Katrina struck the Gulf Coast.

Auto physical damage losses from Hurricane Ian undoubtedly had a negative impact on State Farm's historically challenging results, but data in the top-tier mutual's statutory filings suggest inflationary pressures played an even more significant role.

The State Farm group's private auto physical damage direct incurred loss ratio surged to 101.5% in the third quarter from an already elevated 88.9% in the first half of 2022. Prior to 2021, when the group's private auto physical damage direct incurred loss ratio climbed to 81.9%, its highest such result in a single calendar year from 1996 through 2020 was 77.6% in 2001. The year-to-date ratio was 93.3%. Direct incurred losses in this business line soared by $849.9 million between the second and third quarters, far exceeding a $196.5 million increase in direct premiums earned.

Given that flooded vehicle claims from Ian would generally be applicable to comprehensive coverage, we would assume the hurricane's effects on the private auto business would have negatively impacted the private auto physical damage line. The top-tier mutual, which accounted for 12.8% of the private auto physical damage direct premiums written in Florida in 2021, did not make reference to Ian in its quarterly statement. Florida's largest two private auto physical damage groups, GEICO Corp. parent Berkshire Hathaway Inc. and The Progressive Corp., reported catastrophe losses from Ian of $600 million and $570 million, respectively, inclusive of personal auto and boat claims.

State Farm Florida Insurance Co., the entity through which the group writes Florida homeowners business, also showed effects from Ian. That company's net underwriting loss of $221.1 million came within $10.4 million of the loss it posted in the third quarter of 2017 when Hurricane Irma hit Florida. Its direct incurred losses of $943.3 million exceeded its net incurred losses by 2.9x, reflecting the role played by reinsurance.

The group's private auto liability rose slightly from an already elevated level, increasing to nearly 97.8% from 97.5% in the second quarter. But it was 22.1 and 27.5 percentage points above the respective results for the first quarter of 2022 and the third quarter of 2021. Across private auto lines, the group's direct incurred loss ratio was 99.4% in the third quarter, up from 82.2% in the first quarter and 93.0% in the second.

Adverse reserve development might have arisen across the private auto lines, though quarterly statements lack granularity in that regard. The Allstate Corp., for example, primarily attributed its $632 million in unfavorable prior-year reserve reestimates in the third quarter to the bodily injury and physical damage coverages. For the former, according to Allstate's 10-Q, the company updated its assumptions related to the severity of third-party bodily injury claims, increased claims with attorney representation, litigation costs and higher medical inflation. For the latter, the company cited supply chain-fueled inflationary pressures and the length of time needed to resolve claims.

State Farm General Insurance Co. told the California Department of Insurance in a COVID-19 questionnaire associated with a September rate filing that it had been observing higher claims severity across coverages, including bodily injury liability. The group's quarterly statutory filings typically do not include substantive qualitative commentary on the drivers of reserve development.

For State Farm Mutual Auto, the company said that it suffered $2.35 billion in unfavorable prior-year loss development through the first nine months of 2022, offset by $2.64 billion in favorable loss adjustment expense, or LAE, development. We calculate, however, that $1.17 billion of the unfavorable loss development but only $175.3 million of the favorable LAE development were attributable to the third quarter, resulting in net unfavorable loss and LAE development of $997.2 million. In the third quarter of 2021, we estimate, the company recorded $242.9 million in favorable loss and LAE development, making for a year-over-year swing of $1.24 billion.

This magnitude of unfavorable development is highly unusual for State Farm in a third quarter. We estimate that the company generated $100 million or more in favorable prior-year loss and LAE development 11 times in the previous 15 third quarters prior to 2022. Only twice during that stretch, in 2007 and 2009, did it have unfavorable loss and LAE development in any amount.

Looking at it another way, State Farm Mutual Auto's current accident year direct incurred losses increased by 26.2% in the third quarter but its direct incurred losses for both current and prior accident years surged by 39.0%.

Thanks to the outsized underwriting loss, State Farm Mutual Auto posted a net loss of $2.83 billion for the third quarter. That marked the company's fifth consecutive net loss and by far its largest in any quarter since the start of 2001 prior to adjusting for inflation. When combined with a net change in unrealized capital gains and losses of $3.79 billion, the top-tier mutual's surplus slipped to $124.00 billion as of Sept. 30 from $130.61 billion on June 30 and $143.18 billion at year-end 2021. On a relative basis, the 13.4% decline in surplus through the first three quarters of 2022 stands as State Farm Mutual Auto's most significant such retreat since 2002.

A perusal of third-quarter statutory filings already received by S&P Global Market Intelligence finds that large negative changes in net unrealized capital gains and losses were widespread in the U.S. P&C industry through the period, reflecting the impact of broad pressure on both stock and bond valuations.

Methodology

Group-level results for the third quarter reflect the manual collection of data reported by 12 distinct State Farm group members for the first nine months of 2022, less electronic results tabulated by S&P Global Market Intelligence for the first half of the year. Statutory financials for State Farm Classic Insurance Co. have not been publicly disseminated and are excluded.

For individual business lines, private auto physical damage results are only available on a quarterly basis since the start of 2022. Private auto liability quarterly results for 2022 reflect the combination of data for the other private auto liability and personal injury protection lines; prior to that, the quarterly results for the two lines were reported on a consolidated basis.

References to reserve development for the third quarter reflect the difference between year-to-date results through Sept. 30 and June 30. Quarterly statements include a brief discussion of changes in incurred losses and LAE on Note 25 and data on development across business lines for accident years 2020 and 2021 as well as the combination of accident year 2019 and all prior periods.

S&P Global Market Intelligence's group-level results for State Farm include historical data for MGA Insurance Co. Inc., which State Farm acquired in 2020. Where applicable, this article uses combined annual statement data for State Farm to eliminate MGA Insurance's results prior to the year of the acquisition.

Manually tabulated results are subject to change upon the receipt of electronic data for the third quarter. S&P Global Market Intelligence expects to release the initial round of Sept. 30 statutory financials on Nov. 19.

Terry Leone contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.