S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 5 Apr, 2023

By Keith Nissen

Over 60% of internet adults in the US and Europe report being open to altering their lifestyles to help battle climate change, according to recent Kagan US and European Consumer Insights surveys.

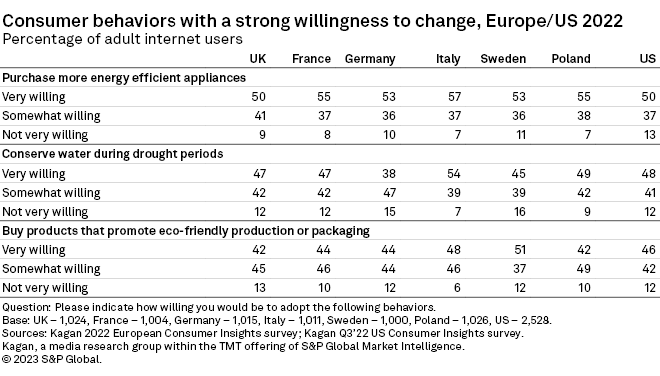

Most consumers on both sides of the Atlantic were, for example, very willing to purchase more energy-efficient appliances but more resistant to consuming less meat in their diets.

➤ Consumer attitudes on proposed lifestyle changes aimed at addressing climate change are generally aligned between the US and Europe, according to recent Kagan Consumer Insights surveys.

➤ Consumers tend to be more willing to change behavior when the actions also save money on future expenses, like buying energy-efficient appliances, or when no viable alternatives are available.

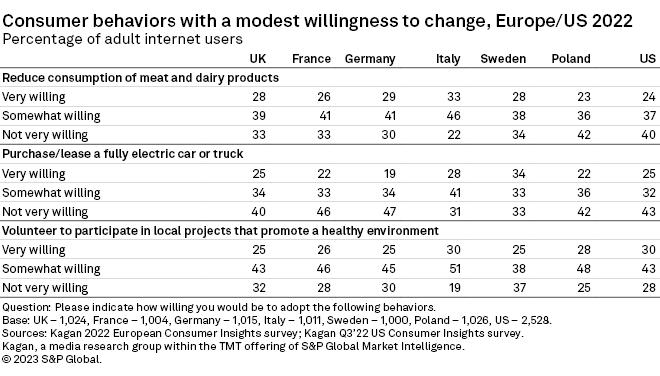

➤ Consumers tend to be less willing to change behavior when asked to invest in high-priced products, including electric vehicles or solar panel systems, or alter to their diets, such as by eating less meat and dairy.

➤ Willingness to change one's lifestyle to combat climate change tends to be skewed towards college-educated and younger adults, or those under 40 years old.

Much of our ability to combat climate change will be driven by technical innovation, such as various methods of capturing carbon or improving electric car batteries. Governments will also play a vital role by subsidizing technology research and deployment, establishing effective regulations and incentivizing consumer uptake. But understanding the consumer's willingness to voluntarily alter their lifestyles will also be an important piece of the puzzle. This article sheds some light into consumer attitudes and preferences related to addressing climate change.

Respondents to the Kagan 2022 European Consumer Insights survey and the US third-quarter 2022 Consumer Insights survey were asked how willing they would be to alter their lifestyles to help address climate change. Specifically, respondents were asked about their willingness to:

– Buy products that promote eco-friendly production or packaging

– Reduce consumption of meat and dairy products

– Purchase/lease a fully electric car or truck

– Install solar panels

– Reduce air travel when alternative transport is available (train, electric vehicle)

– Purchase more energy-efficient appliances

– Take alternative local transportation (e.g. rideshare, carpool, mass transit)

– Conserve water during drought periods

– Volunteer to participate in local projects that promote a healthy environment

The surveys found that consumer attitudes and preferences in the US and Europe were similar. For example, across all seven surveyed markets (the US, UK, Italy, France, Germany, Poland and Sweden), the majority of consumers expressed a strong willingness to purchase more energy-efficient appliances that have the potential to save them money. Likewise, consumers tended to be willing to conserve water during drought periods. While consumers do not control how products are packaged, the survey data suggests that a large portion of consumers are willing to buy products that feature eco-friendly production or packaging. Overall, about 90% of consumers were either very willing or somewhat willing to alter their lifestyles in these areas.

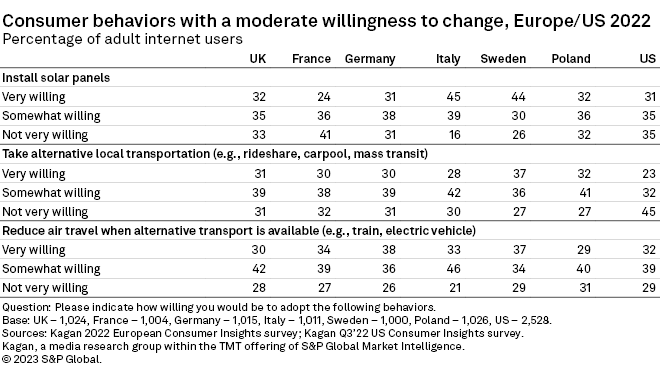

Interestingly, the surveys found that consumers were slightly less willing to voluntarily install solar panels to combat climate change. Substantially more consumers in Italy (45%) and Sweden (44%) said they were very willing to install solar panels than in France (24%). Local electricity rates and regulations may have impacted these survey results in individual markets, as well as the fact that France generates most of its electricity from nuclear power plants, reducing the need for residential solar power generation.

Consumer attitudes toward using alternative local transportation were similar across the six European markets where access to public transportation is much more prevalent than in the US. Consumer dependence on car transportation in the US is evidenced by the 45% who said they were not very willing to use alternative local transportation. Yet, it is significant that the majority of consumers across all seven markets expressed at least some willingness to use alternative local transportation.

About one-third of consumers in Europe and the US also said they were very willing to reduce air travel when an alternative means of transportation is available. In Europe, trains are more of a viable option to air travel than in the US. At least 70% of consumers on both continents expressed some willingness to consider alternative forms of transportation to flying.

Beef production is a major source of greenhouse gases worldwide, so we asked respondents about their willingness to reduce meat consumption and dairy products. About one-quarter of consumers in the US (24%) and Poland (23%) said they were very willing to reduce their meat and dairy consumption. Those in Italy proved the most willing, at about one-third (33%). Rising meat prices may be more of a driver behind these results than a linkage with climate change. About 30%-40% of consumers in Europe and the US were very unwilling to consider this type of lifestyle change.

There was also a general lack of willingness in Europe and the US to switch to fully electric cars or trucks. With the transition to electric vehicles already taking hold, it seems odd that 40% or more of consumers in the US, UK, France, Germany and Poland were not very willing to make the switch to electric. However, prices for fully electric vehicles still tend to be higher than gasoline-powered vehicles. This and other factors, such as restrictive battery performance and recharging issues, may be suppressing consumers' willingness to switch.

Survey respondents were also asked how willing they would be to participate in local projects that promote a healthy environment, such as planting trees, picking up trash or other projects designed to build consumer awareness of environmental issues. In general, about seven in 10 consumers said they were very willing or somewhat willing to volunteer. As always, the degree to which consumers are willing to donate their time to charity or social causes is often dependent on how passionate they are about the issue.

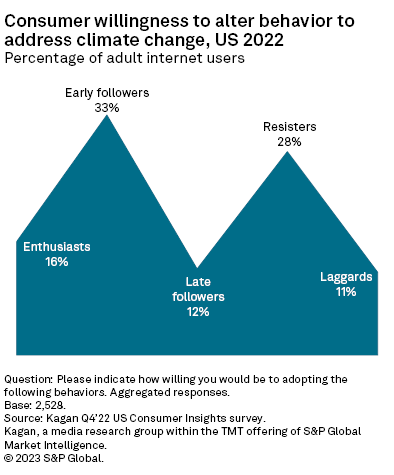

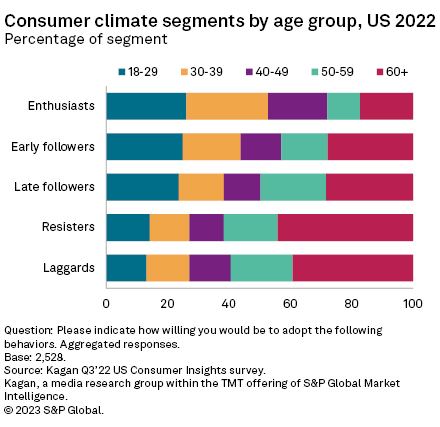

To put the survey results into greater context, we aggregated individual responses and identified five distinct consumer segments. These segments ranged from climate enthusiasts, who typically were very willing to alter their lifestyles in many ways, to climate laggards, who were most resistant to lifestyle changes.

In the US, the data shows a twin peak landscape, with about half (49%) of respondents falling into one of the two segments that were most willing to alter their lifestyles: climate enthusiasts (16%) or early followers (33%). Another 39% of US respondents fell into one of the two segments that were least willing to alter their lifestyles: resisters (28%) or laggards (11%). The five consumer segments were about the same size for each of the six surveyed European markets, suggesting that European attitudes toward battling climate change are generally in line with those of the US.

The survey data shows that the willingness to alter one's lifestyle to battle climate change tends to correlate with age. For example, the majority of climate enthusiasts (53%) were individuals under 40 years of age. Adults under 40 also made up 44% of early followers and 39% of the late followers category. Conversely, the majority of those in the resisters and laggards categories, who were least willing to alter their lifestyle, were adults 50 years of age and older.

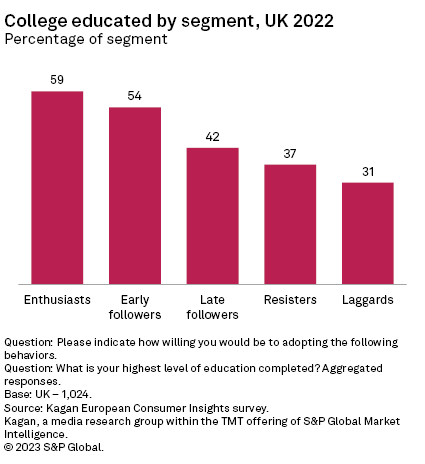

Finally, education tends to correlate with one's willingness to change their lifestyle to address climate change. Using the UK as an example, 59% of climate enthusiasts reported having a four-year college degree or post-graduate degree, while less than one-third (31%) of those in the laggards category reported having attained a college degree.

The Kagan European Consumer Insights surveys were conducted during December of 2022 with approximately 1,000 internet adults per country in the UK, France, Germany, Italy, Sweden and Poland. Each survey has a margin of error of +/-3 percentage points at the 95% confidence level. The Q3'22 US Consumer Insights survey, conducted in September 2022, totaled 2,528 internet adults and has a margin of error of +/-1.9 percentage points at the 95% confidence level. Percentages are rounded to the nearest whole number. Survey data should only be used to identify general market characteristics and directional trends.

Consumer Insights is a regular feature from Kagan, a media research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.