Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 8 Aug, 2024

By Dan Lowrey

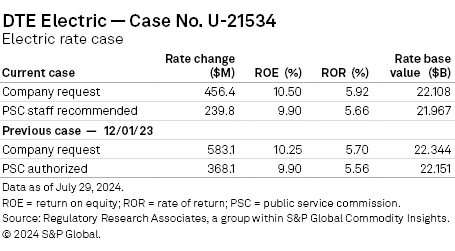

The Michigan Public Service Commission staff on July 26 filed testimony in DTE Electric Co.'s rate case proceeding, recommending that the commission authorize the company a $239.8 million electric rate increase, just over half of DTE's request. The staff's recommendation is premised upon a 9.90% return on equity, which is above national averages tracked by Regulatory Research Associates.

The company (DTE-E), a DTE Energy Co. subsidiary, requests the rates become effective as early as Jan. 28, 2025. Hearings are scheduled for Sept. 4–10.

➤ The Michigan Public Service Commission staff support a $239.8 million rate increase versus DTE-E's $456.4 million request. Differences in net operating income accounted for most of the revenue requirement difference

➤ Staff recommends an unchanged 9.90% return on equity (ROE) for DTE-E. Staff's recommended ROE exceeds national averages tracked by RRA but is below DTE-E's 10.50% ROE request.

➤ Staff supports DTE-E's request to continue its infrastructure recovery mechanism focused on certain distribution capital expenditures that address customer safety, customer reliability, and the integration of increasing levels of electric vehicle and distributed energy resources, but at the staff's proposed lower rate of return.

➤ RRA views the regulatory climate in Michigan as somewhat constructive from an investor perspective. In recently decided rate cases, the PSC has adopted ROEs above the prevailing industry averages when established. In addition, several constructive practices have been in place, including a streamlined rate case process and a framework for using forecast test years to reduce regulatory lag.

Staff's proposed rate increase is premised upon a 9.90% ROE (39.23% of regulatory capital structure) and a 5.66% overall return on average rate base valued at $21.97 billion and a test year ending Dec. 31, 2025.

The staff-supported ROE exceeds recent national averages; according to RRA, the average equity return authorized for electric utilities, including limited-issue rider proceedings, was 9.66% for all cases decided in the first quarter of 2024, approximating the 9.60% average for cases decided during full year 2023. For a discussion of ROE authorization trends and other rate case parameters, refer to RRA's "Major Rate Case Decisions Quarterly Update."

Staff does not support DTE-E's request for regulatory asset treatment for certain costs associated with a proposed storm restoration cost sharing mechanism. Staff testified that the mechanism should not be approved because staff is supporting the full-service restoration expense for the test year. The commission rejected similar mechanisms in three prior cases, and staff would like to see results from the third-party audit to further determine cost savings in storm restoration expenses. The PSC hired Liberty Consulting Group to conduct a comprehensive audit of DTE-E's electric distribution system to identify steps it could take to reduce the number and duration of power outages in the state. That report is due in late summer or early fall 2024.

Staff is somewhat supportive of the company's proposal for a battery energy storage and demand response pilot but recommended the company limit the current pilot to a single participant, given the difficulty DTE-E has experienced in finding a willing second participant to date. DTE-E is proposing to install two batteries on large customer sites. Each battery will be up to 250 kW/1 MWh in size with the potential to be located at up to two customer sites to reduce peak customer and system demand for an event of up to four hours. Given this recommendation, staff recommends a $2 million disallowance for this program, which is broken down as $1.4 million during the bridge and $0.6 million in the forecast test year.

Staff testified that it is increasingly concerned about DTE-E's EV Charging Hubs plans, stating, "Staff wants the company to either offer a more complete charging hub analysis and explanation in its reply testimony or hold an interested parties meeting to discuss why there has been such slow momentum to this pilot."

DTE-E is requesting almost $25 million in this proceeding to fund its proposed EV efforts. Staff recommends an $8 million disallowance to the company's business and efleet charger rebates program. Additionally, staff recommends a $1 million disallowance for its residential customer rebate program.

Rate of return

RRA calculates that differences in rate of return between that requested by the company and that recommended by staff accounted for about $80 million of the $216 million revenue requirement difference between the requested and recommended rate changes.

Staff estimated DTE-E's ROE using a group of 18 publicly traded electric utility companies to form a comparable proxy group for its analysis, whereas DTE-E's proxy group included 25 utilities. There are 13 overlapping companies between the two proxy groups. The company and staff had similar criteria to determine its proxy group, with staff's generally being more restrictive.

Staff used the proxy group's data in both discounted cash flow and capital asset pricing model analyses to determine a reasonable cost of equity. Additionally, a risk premium model and a review of electric ROE authorizations from other state jurisdictions from 2023–2024 are utilized in this case.

"Based on the results of the multiple analyses done, along with other factors such as credit metrics, company requested 10.50% ROE, and currently approved 9.90% ROE, it is staff's judgement that a reasonable range for DTE Electric's cost of equity to fall within is 9.30% - 10.30%. Within that range, staff recommends a value of 9.90%, which is the midpoint of staff's range, is a reasonable ROE for DTE Electric and is appropriate for this rate case," staff testified.

Rate base

RRA calculates that PSC staff adjustments to the company-proposed rate base accounted for about $12 million of the $216 million revenue requirement difference between the requested and recommended rate changes.

Staff supported a rate base for DTE-E of $21.97 billion, which was $141 million less than the rate base supported by DTE-E. Staff's adjustments included a $130.3 million reduction in total utility property and plant and a $10.7 million reduction in allowance for working capital. Reductions in total utility property and plant included a $49.5 million reduction in steam production plant, a $36 million reduction in nuclear production plant and a $37.7 million reduction in information technology in the test year.

Net operating income

The PSC staff's adjustments to DTE-E's proposed net operating income accounted for the remaining $124 million difference in revenue requirement between the requested and recommended rate changes.

Unlike a previous rate case for DTE-E, staff took no issue with the company's test year sales forecast. However, staff made adjustments to reduce operations and maintenance (O&M) expense for DTE-E, including about a $39.2 million reduction to incentive plan compensation expense related to achievement of financial performance, a $9 million reduction associated with restricted stock as a reward to employees for assisting the company in reaching its financial performance goals, a $14 million reduction related to pension and benefits costs, and a $19 million reduction associated with steam power generation expense.

Staff explained that the reduction in O&M steam power generation expense was due to such costs being calculated using a 2023 adjusted historical test year instead of the 2022 adjusted historical test year that the company used. "There are several reasons staff determined that using an adjusted historical 2023 test year as the starting point for determining these categories of O&M expenses was more reasonable than beginning with 2022. First, DTE Electric experienced several major changes to its generation fleet in 2022," staff testified.

Rate case background

DTE-E filed a formal application (Case No. U-21534) March 28 requesting that the commission authorize an increase in electric base rates of $456.4 million for continued distribution infrastructure investments to improve customer power reliability and generation investments to bring cleaner energy to the state.

The company's request is premised upon a 10.50% return on equity (39.23% of regulatory capital structure) and a 5.92% overall return on rate base valued at $22.11 billion and an average test year ending Dec. 31, 2025.

The company indicated a higher ROE was warranted, given that since filing its last rate case in February 2023, key measures of debt cost, such as Treasury yields, have increased, while utility bond yields and investors' perception of the risk premium they require to hold equity rather than debt has remained relatively constant. Further, the company indicated inflation remains high, and the Federal Reserve has been increasing the federal funds rate. "Thus, capital markets' data as well as utility specific risk characteristics indicate that the cost of equity is higher today than in the recent past," DTE-E's witness testified.

DTE-E's request is primarily driven by the company's continued distribution infrastructure investments to improve customer power reliability and generation investments to bring cleaner energy faster to the state. DTE-E indicated its goals are to reduce power outages in its service territory by 30% and cut outage time in half in the next five years.

|

The request includes strategic infrastructure investments in substations, poles, wires, transformers and other electric distribution assets to modernize equipment, support growth in customer demand in specific areas, improve worker and public safety, and reduce the frequency and duration of power outages. In addition, the company's filing supports the continuation of the multiyear tree trimming "surge" program, conversion of the Belle River power plant's fuel source from coal to natural gas, and plant removal associated with the retirement and decommissioning of power generation assets at Harbor Beach, Conners Creek, River Rouge, St. Clair and Trenton Channel power plants.

As part of the application, DTE-E is reclassifying $2.1 billion of net plant associated with the Monroe coal generating station to a regulatory asset. Retirement of the plant is expected in 2032. The commission has previously ordered the company to securitize about $845 million after retirement, and that portion to be securitized will remain classified within plant in service until retired. The balance of the plant not securitized is to be recovered as a regulatory asset over 15 years. Therefore, about $2.1 billion will be reclassified as a regulatory asset effective Dec. 31, 2024.

The company also requests the continuation, extension and expansion of its infrastructure recovery mechanism, which focuses on certain distribution capital expenditures that address customer safety, reliability, and the integration of increasing levels of EV and distributed energy resources. DTE-E also requests approval of certain accounting requests, including regulatory asset treatment for certain costs associated with a proposed storm restoration cost sharing mechanism.

RRA's view of Mich. regulation

RRA reviews the regulatory climate in Michigan as somewhat constructive from an investor perspective. In recently decided rate cases, the PSC has adopted ROEs above the prevailing industry averages when established. In addition, several constructive practices have been in place: a streamlined rate case process, a framework for using forecast test years to reduce regulatory lag and a framework that permits a cash return on certain construction work in progress, thereby reducing the uncertainty of cost recovery.

Retail competition for electric generation is in place but is limited, and attempts to raise this limit have not been successful. Electric utilities have retained their generation assets, and customers who do not select a competitive supplier receive service on a regulated, traditional cost-of-service basis. Adjustment mechanisms are in place for fuel costs for customers served under bundled service. However, the courts have ruled against authorizing revenue decoupling mechanisms for electric utilities. Michigan's regulatory and political environments continue to support significant capital investments and timely recovery of these costs.

RRA accords Michigan regulation an Above Average/3 ranking.

For additional information concerning the regulatory climate in Michigan, refer to the Michigan Commission Profile.

For additional detail concerning RRA's regulatory rankings, refer to the latest "Quarterly State Regulatory Evaluations" report.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.