Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 25 Mar, 2020

By Chris Rogers and Eric Oak

Highlights

COVID-19 continues to disrupt global supply chains in unprecedented ways. Leveraging maritime shipping data from Panjiva, this report includes a review of trade and financial data to analyze the impact of the COVID-19 coronavirus outbreak.

The impact on supply chains has been widespread with autos, electronics, capital goods, commodities and apparel firms all facing headwinds from reduced availability of parts.

Retailers including Costco and Target are gaining from increased sales of health- and personal care products. Yet, supply shortages are rapidly emerging in part due to medical supply export restrictions in several countries.

COVID-19 continues to disrupt global supply chains in unprecedented ways. Leveraging maritime shipping data from Panjiva, this report includes a review of trade and financial data to analyze the impact of the SARS-CoV-2 / COVID-19 coronavirus outbreak.

This report takes two approaches to analyzing the fallout from the SARS-CoV-2 / COVID-19 coronavirus outbreak on global trade and corporate supply chains. The first part of the report identifies 11 themes emerging on an event-driven basis from over 50 Panjiva Research reports. The second section considers the impact of exposures to Asia in firms’ U.S. supply chains on sector-neutral stock returns since the start of 2020.

A few of the paper’s findings:

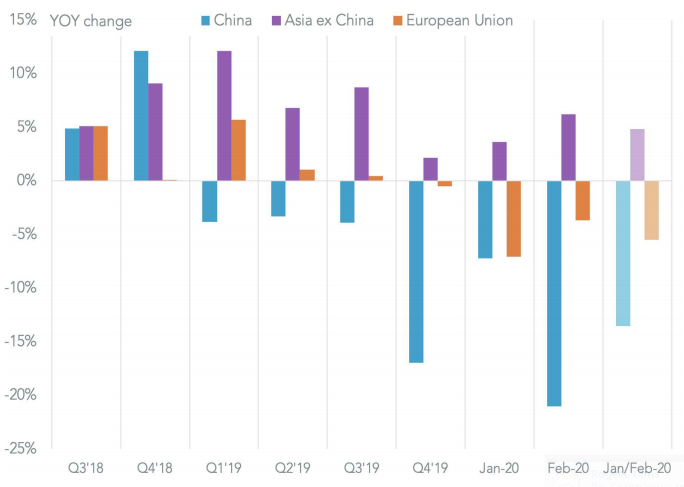

Figure 1: China-Led U.S. Import Drop in February

Chart segments change in U.S. seaborne imports by origin. Source: S&P Global Market Intelligence Quantamental Research. Data as of Feb. 29, 2020.

Download the full report

Research

Topics