Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 5 Jul, 2023

By Alice Yu

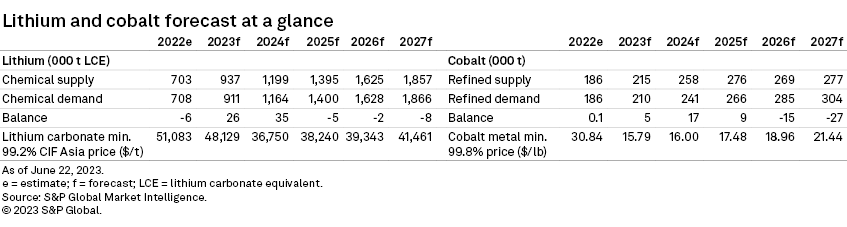

In its monthly Lithium and Cobalt Commodity Briefing Service (CBS) report, S&P Global Commodity Insights discusses the lithium and cobalt markets within the broader macroeconomic environment and provides rolling five-year supply, demand and price forecasts.

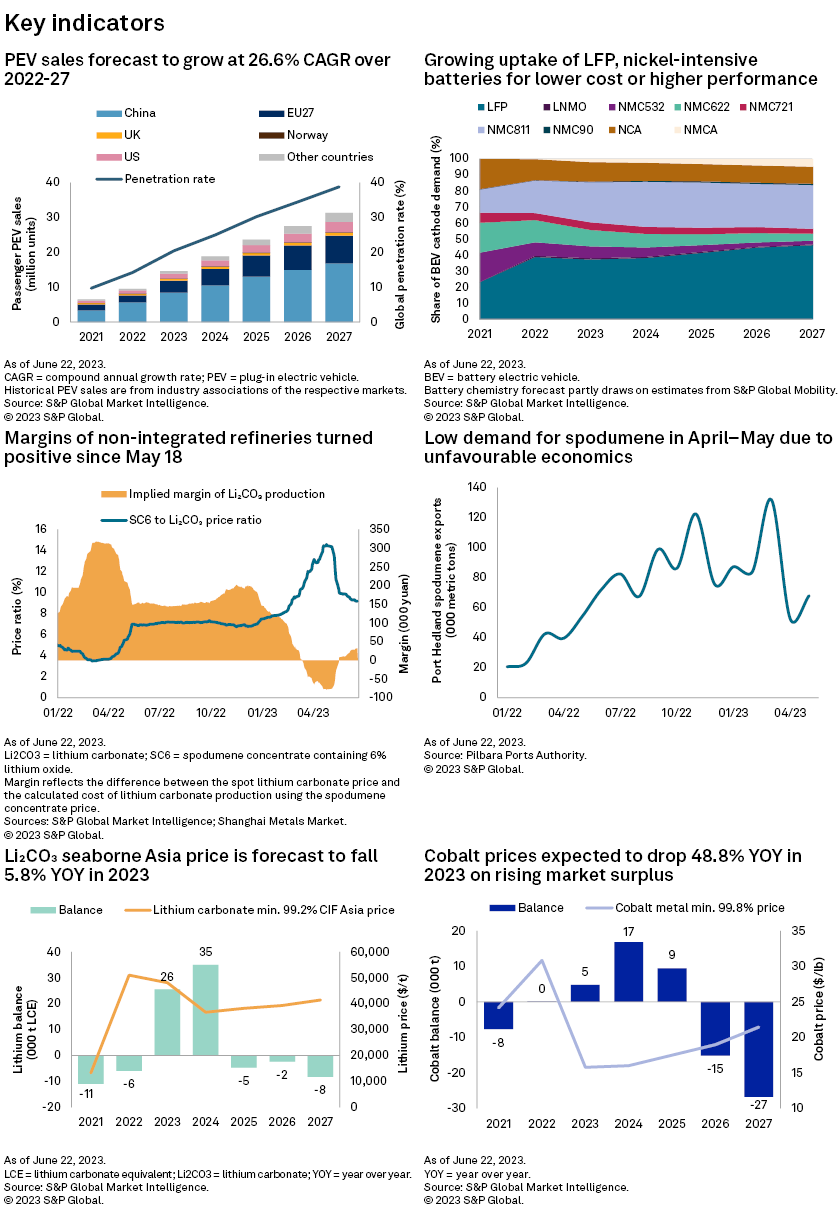

➤ Passenger plug-in electric vehicle (PEV) sales rose across all top markets in May; total sales were up 12.7% month over month.

➤ China's traction battery production rose 20.4% month over month in May to 56.6 GWh, the highest monthly production in 2023 to date.

➤ The rebound in China's lithium carbonate price slowed in June; the price rose 4.5% month-to-June 19 before slipping 0.3% to 313,000 yuan per metric ton June 21.

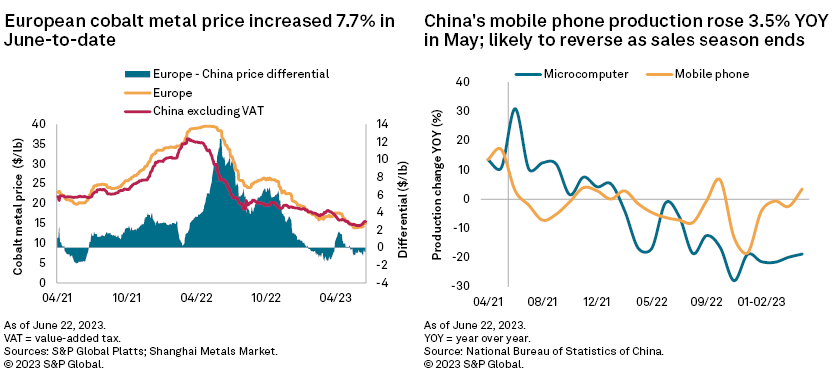

➤ The Platts Cobalt 99.8% European price rose 7.7% month-to-June 22, closing at $15.30 per pound on improved demand for cobalt-containing traction batteries and on tightness in cobalt availability.

➤ Lithium and cobalt producers' confidence in demand improvement underpins price recoveries across both metals. The battery downstream has yet to pass on the rise in lithium and cobalt costs, however, signaling resistance to the price increases.

➤ We expect both the cobalt and lithium prices to be range-bound until a clear indication of the sales strength of PEVs emerges in the second half.

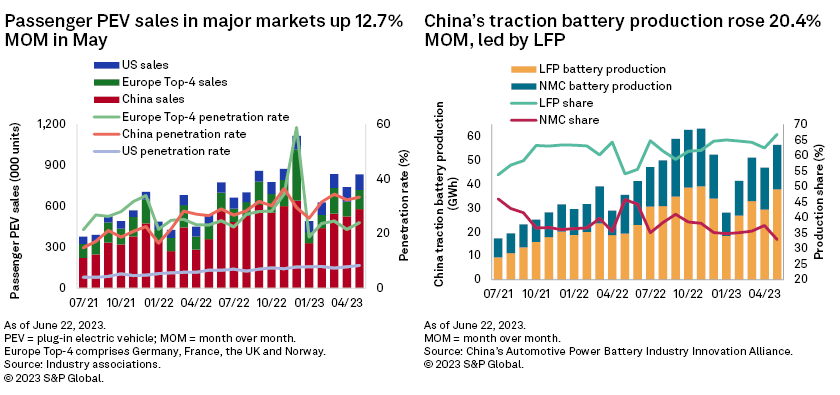

Plug-in electric vehicles

Passenger PEV sales rose across all top markets in May, with total sales up 12.7% month over month, led by China in volume terms. The country's passenger PEV sales rose 10.5% month over month in May, while the penetration rate hit 33.3% — the highest since December 2022. PEVs accounted for 30.5% of China's passenger car exports in May, with Europe and Southeast Asia the largest destination markets.

China's traction battery production rose 20.4% month over month in May to 56.6 GWh, the highest monthly production so far in 2023, on the recovery in PEV sales. Lithium-iron-phosphate batteries led the increase, with the share of this battery chemistry rising 4.4 percentage points to 66.9%, providing relatively stronger support for lithium demand than for cobalt. Elsewhere, passenger PEV sales in Europe top-4 markets and the US rose 28.1% and 8.0%, respectively.

China has extended by four years the value-added tax (VAT) exemptions for new energy vehicles, which are now expiring at the end of 2027. The extension will provide policy continuity for the next few years and will help cushion the impact of the central government terminating PEV purchase subsidies in January. The full tax exemption will also be capped for vehicles priced at about 339,000 yuan from 2024 and 170,000 yuan from 2026 to better target those consumers where affordability concerns are more acute while encouraging an ongoing reduction in PEV costs. The 339,000 yuan vehicle price cap for VAT exemption is broadly aligned with the vehicle price eligibility cap of 300,000 yuan for the state subsidy prior to its termination. The support for PEVs can be viewed in conjunction with cuts this month to key policy rates, which lower the cost of borrowing for financial institutions, households and enterprises. The policies signal a willingness to support the broader economy and consumption.

Lithium

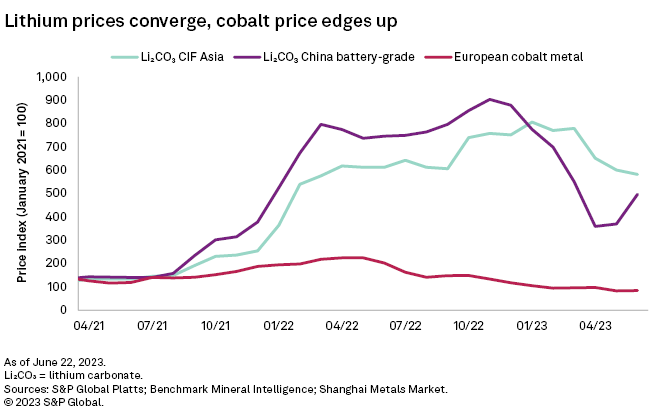

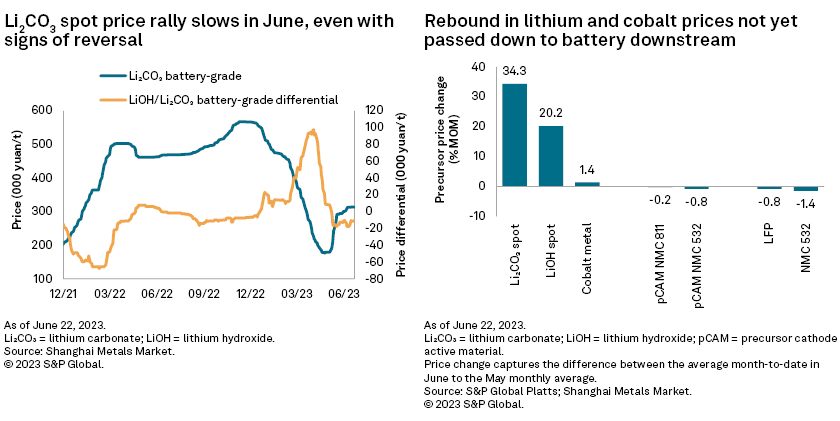

The rebound in China's lithium carbonate price slowed in June, rising 4.5% month-to-June 19 compared with 62.7% during the same period in May. The price then slipped a marginal 0.3% June 19–21 to 313,000 yuan/t. The spot lithium price is up 77.3% from the April 25 bottom but still down 44.8% from the peak Nov. 9–21, 2022.

Lithium producers are holding offer prices firm due to recovering demand, which will likely further improve in the second half, typically a period of seasonal strength for PEV sales. Several auctions held in China since March 11 for lepidolite concentrate and lithium carbonate from brines in Qinghai province have solidified the price recovery, with the lithium carbonate settlement price equivalent to 300,000 yuan/t. Rising battery production is reviving the need to restock lithium and cobalt chemicals.

The battery downstream has yet to pass the rise in lithium and cobalt costs to their customers, however, signaling resistance to the metals price increases. Battery precursor and cell costs declined in June, compared with increased lithium chemical and cobalt prices.

Lithium supply is also on the rise. Nonintegrated refineries procuring spodumene from the spot market have returned to being profitable since May 18 due to the rebound in the lithium carbonate spot price and a drop in the spodumene-to-carbonate price ratio. The ratio had risen to more than 11% in May, a record high, from 3%-6% in 2021, before dropping to 7.5% in June. The rising trend reflected miners getting greater value from the industry, especially after a severe shortage of lithium units.

The commissioning of greenfield lithium projects will help balance the market and moderate prices over the next two years. Five greenfield projects — North American Lithium , Grota do Cirilo , Cauchari-Olaroz , Arcadia and Finniss — have achieved first product this year after delays in 2022. Untapped reserves in Bolivia have a brighter prospect of being unleashed as a Chinese consortium that includes Contemporary Amperex Technology Co. Ltd. (CATL) could start construction work on plants to extract lithium from the Salar de Uyuni and Oruro salt flats as early as July for production by 2025, according to reports.

Cobalt

The cobalt market is experiencing very similar dynamics to the lithium market, with metal prices rising in June on improved demand for cobalt-containing traction batteries, supported by restocking activities and tightness in cobalt units. Cobalt sellers are unwilling to offer at low prices, reducing the number of available cobalt units and leading to higher cobalt chemical and metal production costs.

The Platts Cobalt 99.8% European price rose 7.7% month-to-June 22, closing at $15.30 per pound. The cobalt price appears to have bottomed out after hitting a 33-month low of $13.90/lb May 18–20. China's cobalt metal price rose 7.2% to 274,500 yuan/t ($15.35/lb, excluding VAT), over the same period in June, maintaining a small premium over the Platts European price since May 9.

Consumer electronics demand in China is expected to stabilize after the sales period ended June 18, following an uptick in May. This sector, which is more susceptible to the macroeconomic environment than the PEV one, faces a challenging outlook due to monetary tightening in the US, EU and UK, coupled with slower-than-expected pent-up recovery in China. While consumer electronics accounted for one-quarter of global cobalt demand in 2022, the strength of PEV sales will be the key support to cobalt demand in the second half of 2023.

Outlook

We expect cobalt and lithium prices to be range-bound until a clear indication of the actual strength of PEV sales emerges in the second half. Lithium and cobalt producers' confidence in demand improvement underpins price recoveries across both metals. The battery downstream will nevertheless keep the price increase in check to limit rises in the cost of batteries and PEVs and avoid hurting sales, given macroeconomic headwinds.

We forecast supply expansions will move the lithium market into a surplus this year. Project development is not without its challenges, however. Following Democratic Republic of the Congo revoking the mining license for the Manono lithium project, operator AVZ Minerals Ltd. launched an arbitration against the decision; there is also ongoing arbitration over the asset's ownership between AVZ and Zijin Mining Group Co. Ltd. These uncertainties will likely delay the timeline for what is the largest project on the continent. The definitive feasibility study for the project details a production plan of over 100,000 metric tons of lithium carbonate equivalent, amounting to 13.4% of the 2022 lithium raw material supply. Zambia and Namibia have banned the export of unprocessed lithium ore to secure greater value from their resources and avoid the repeat surge in the export of direct-shipping ore that emerged toward the end of 2022. The ban increases the lead time for supply to enter the market.

After a comprehensive review of the project pipeline, we expect the lithium market surplus to widen in 2024 and have downgraded our price forecast to $36,750/t — $6,500/t lower than before. We now anticipate the market to enter a prolonged period of deficit from 2025, a year later than previously forecast. We maintain our view on the cobalt market and expect a surplus over the next three years before the market returns to deficit from 2026.

N otes

Historical lithium carbonate CIF Asia prices refer to Benchmark Mineral Intelligence's assessments. Historical cobalt metal prices refer to the Platts Cobalt 99.8% European benchmark; historical refined cobalt supply figures draw partly on the work of the Cobalt Institute.

As of June 26, $1 was equivalent to 7.24 yuan.

Platts Cobalt 99.8% European benchmark is an offering of S&P Global Commodity Insights. S&P Global Commodity Insights is a division of S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.