S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Blog — 30 Apr, 2021

By Francisco Aldaya and Rehan Ahmad

Brazil's five biggest banks maintained their positions as the largest lenders by assets in Latin America and the Caribbean, with one Chilean major making its way into the top ten, in part due to the Chilean peso's strong appreciation against the U.S. dollar through 2020.

Brazil's Itaú Unibanco Holding SA, Banco do Brasil SA, Banco Bradesco SA, Caixa Econômica Federal and Banco Santander (Brasil) SA, Mexico's Grupo Financiero BBVA Bancomer SA de CV and Colombia's Grupo Aval Acciones y Valores SA all retained the top seven spots on the latest edition of S&P Global Market Intelligence's regional bank rankings.

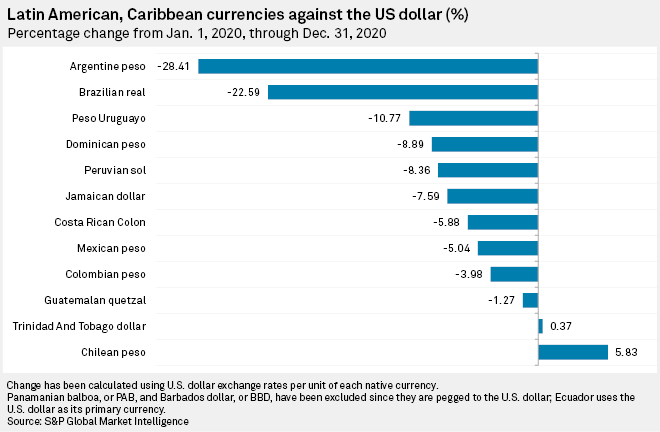

But with the Brazilian real losing 22.59% of its value against the U.S. dollar, the second-worst performing currency out of the region's major economies, the combined assets of the country's five largest financial institutions slid by 8.9% to $1.484 trillion, year over year.

Depreciation through 2020 was far milder for the Mexican and Colombian currencies, on the other hand, allowing both BBVA Bancomer and Grupo Aval's total assets to edge up by by 8.5% and 5.0%, respectively.

The latter now trails Santander Brasil by $44.35 billion, down from $64.35 billion in 2020 and $71.59 billion in 2019.

Completing the top ten, Grupo Financiero Banorte SAB de CV lost its position as the largest publicly listed lender in Mexico to Banco Santander México SA Institución de Banca Múltiple Grupo Financiero Santa. As a group, Mexico's three biggest banks saw their aggregate total assets tick up to $318.13 billion as of end-2020, up 10.9% from the year-ago period.

Chile's Banco de Crédito e Inversiones, which last year completed the acquisition of its third bank in the U.S., climbed two spots this year to No. 10, displacing Grupo Financiero Citibanamex SA de CV from the list of top ten banks in the region.

Driven in part by soaring copper prices, Chile's most important export, the Chilean peso was by far the best-performing currency in 2020, appreciating by 5.83% against the U.S. dollar.

On the back of anemic 0.2% economic growth in 2019, Latin America and the Caribbean's 7.0% contraction in GDP in 2020 was the sharpest of any region in the world, according to the International Monetary Fund. Despite the ongoing impact of the COVID-19 pandemic, the fund projects a 4.6% recovery for 2021.

A gradual economic recovery could mitigate the slowdown in lending growth expected in 2021 in some of the major economies, following an initial spike in credit demand at the onset of the pandemic.

Among other notable changes in the ranking, Banco Nacional de Panamá, which issued its first-ever international bond in 2020, jumped 15 spots to No. 34 thanks to a total asset count of $16.87 billion, a 55.9% increase from a year earlier.

All told, Brazil and Mexico are still home to the majority of the region's largest banks, with 11 and 8 institutions, respectively. They are followed by Chile, Colombia and Peru with seven, five and five, respectively.

Mohammad Abbas Taqi contributed to this article.

Click here to read more in our worldwide bank ranking series.(opens in a new tab)

Research

Research

Theme

Location