Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Apr, 2018

Risk Analysis, Regulation, & Governance

By Baby Verma and Helgi Gudmundsson

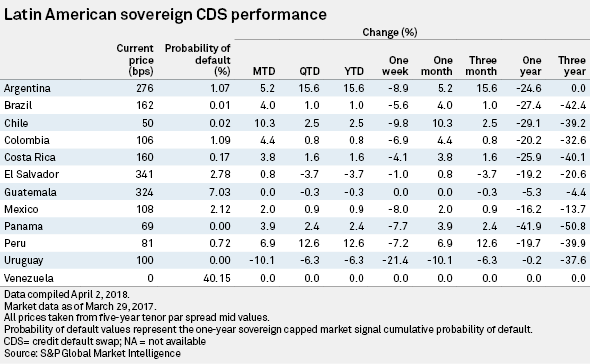

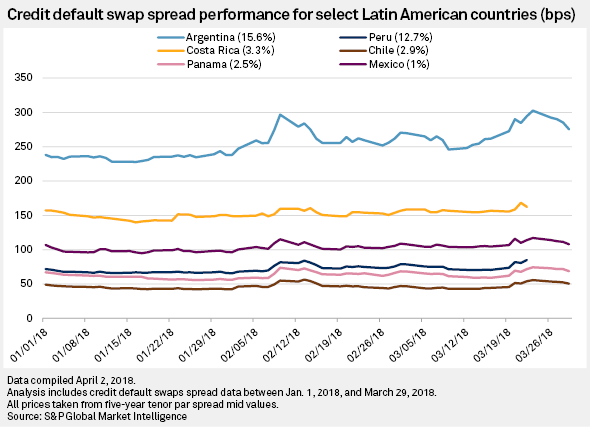

Latin American sovereign credit default swap prices and sovereign ratings generally stood still in most countries during the first quarter of 2018 as the region continued to see economic recovery as it prepares for a historic election cycle during the year.

Brazil, Mexico, and Colombia – which will all elect new presidents in 2018 – saw CDS prices rise around 1.0% in the quarter, reflecting relative economic stability after several Latin American countries saw CDS spreads decline more than 40% in 2017.

Argentina's sovereign credit default swaps, however, fell 15.6% in the first quarter of the year from 238 points at the end of last year to 276 points as of March 29. Its central bank raised interest rates at the beginning of 2018 to tackle Argentina's still high inflation, which has slowed the momentum of President Mauricio Macri's government in returning the country to free market policies and economic growth.

Peru, meanwhile, saw its CDS price rise by 12.6% to 81 basis points, in a quarter during which the Andean country was thrown into political turmoil leading to the resignation of President Pedro Pablo Kuczynski on March 21 over an alleged corruption case tied to the massive Odebrecht scandal.

Colombia's CDS spreads ticked 0.8% higher during the quarter to 106 basis points as it gets ready to cast a vote in presidential elections set for May 27. Conservative Iván Duque and Gustavo Petro, a leftist ex-mayor of Bogotá, will head their respective coalitions for the presidency.

Despite lingering doubts over the future of the North American Free Trade Agreement, or NAFTA, and the upcoming general elections in July, the price of CDS for Mexico slightly increased by 0.9% to 108 basis points in the first quarter. Left-wing presidential front-runner Andrés Manuel López Obrador has said he will not employ extreme politics and that he plans to support the country's banking sector without pushing the country deeper into debt.

Brazil's CDS spreads reached 162 basis points after the first quarter, increasing 1% from the end of 2017. The biggest Latin American country will vote on a new president in October, but an early campaign has been dominated by an ongoing political crisis tied to corruption probes and leaving it unclear who will be at the forefront in the elections.

Already a client? Continue reading>