Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 17 Feb, 2022

By Brian Bacon

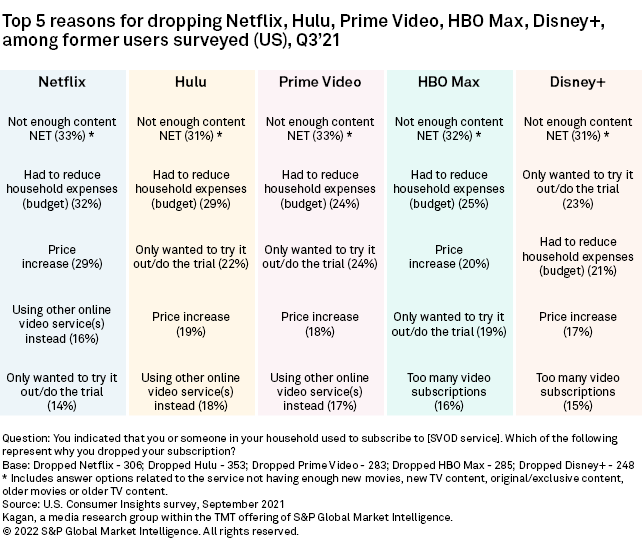

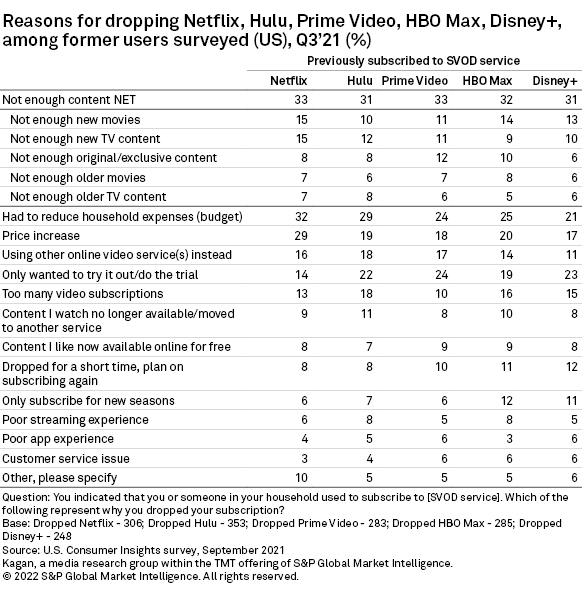

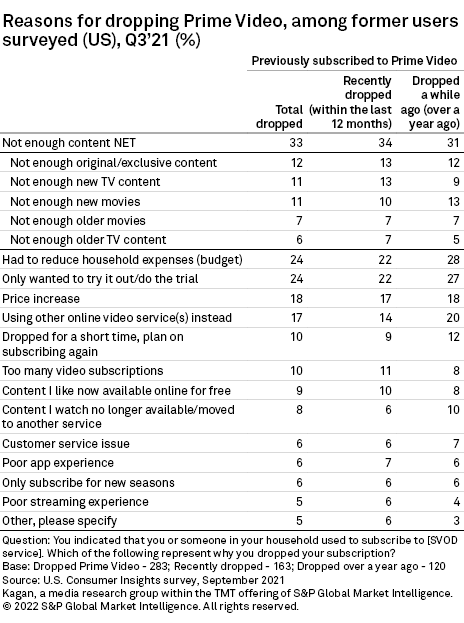

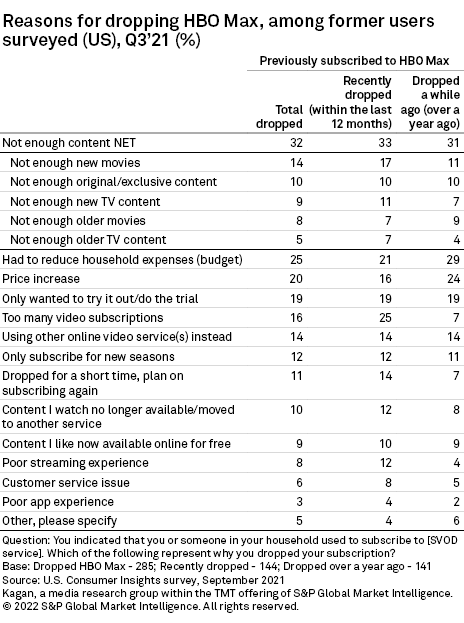

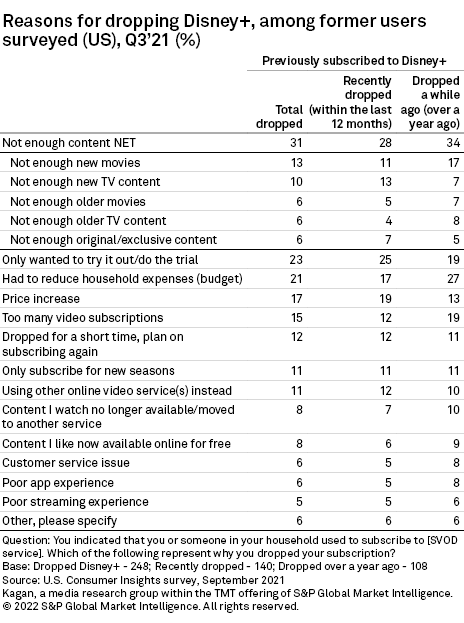

Around a third of former subscribers to Netflix Inc., Walt Disney Co.'s Hulu, Amazon.com Inc.'s Prime Video, AT&T Inc.'s HBO Max and Disney+ indicated that they dropped their subscriptions because of a lack of content. Besides content, according to data from Kagan's U.S. online consumer survey conducted in September, the most selected reason for dropping was reducing household expenses (budget), except among former Disney+ subscribers where that reason came in third. Instead, former Disney+ users were a little more likely to indicate they dropped because they only wanted to try out the service, at 23%, which was also a top reason among former users of Prime Video (24%), Hulu (22%) and HBO Max (19%).

* Of the content types found lacking for respondents to Kagan's September online consumer survey, new movies was the most selected among former Netflix, HBO Max and Disney+ subs, new TV content was tops for Hulu, and original/exclusive content was first for Prime Video.

* The length of time since a service was dropped seems to have an impact on the reasons selected for dropping across the various services.

Many former subscribers also cited price increases as a reason for dropping. Netflix (29%) increased prices for all offered plans in 2019, and again in 2020 for the Standard and Premium plans, with another increase in January 2022 after this survey was fielded. Hulu actually lowered the price of its ad-supported plan from $7.99/month to $5.99/month in 2019. However, the 19% of former subscribers surveyed who selected this reason for dropping may be referencing price increases for Hulu + Live TV. Hulu did have a price increase in October, which was also after this survey was fielded.

Prime Video's stand-alone subscription price has not changed since it launched in 2016, and the broader Amazon Prime plan has not increased since 2018, but 18% of former users still cited a price increase as their reason for dropping. HBO Max kept the same price as HBO NOW ($14.99/month) but 20% of former subscribers indicated a price increase as their reason for dropping, which could be tied to those who used to receive the service as a subscriber perk to another service such as select AT&T wireless plans. Disney+'s monthly subscription cost increased from $6.99/month to $7.99/month in March 2021, which was selected by 17% of former subscribers surveyed as the reason they dropped.

As for the specific content types found to be lacking on each service, new movies (released within the past two years) was the category most often cited as a reason for dropping a service, especially among former subscribers to Netflix, HBO Max and Disney+ at 15%, 14% and 13%, respectively. Those who chose this reason among former HBO Max and Disney+ subscribers could have dropped prior to theatrical releases simultaneously being available on the service. Former Hulu subscribers were a little more likely to select new TV content at 12%, while former Prime Video subscribers were just as likely to select not enough original/exclusive content at 12%.

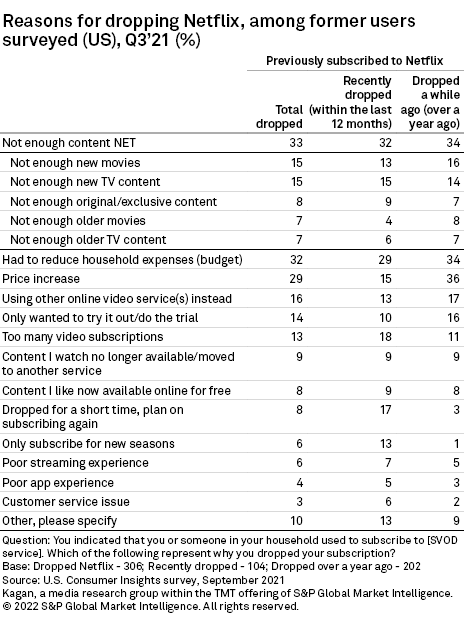

Those who recently dropped Netflix (within the past year) were much more likely to indicate they dropped for a short time and plan on subscribing again at 17%, compared to those who dropped a while ago (over a year ago) at only 3%. Those who recently dropped were also much more likely to indicate they dropped because they only subscribe for new seasons of content at 13%, compared to only 1% of those who dropped a while ago. Also, those who recently dropped were a little more likely to indicate they dropped because they had too many subscriptions at 18%, compared to 11% of those who dropped a while ago.

Those who dropped Netflix a while ago were more than twice as likely to indicate they dropped due to a price increase at 36%, compared to those who recently dropped (15%), which makes sense given Netflix's price increases in 2019 and 2020. Only wanting to try out the service was also a little more common among those who dropped a while ago at 16%, compared to 10% of those who recently dropped, most likely impacted by Netflix discontinuing free trials in the U.S. in October 2020.

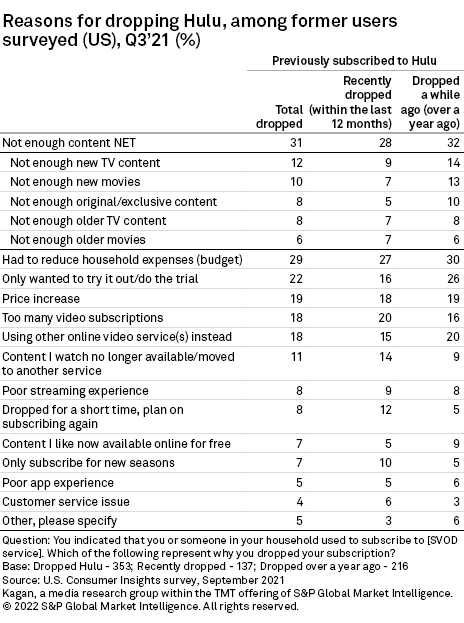

Subscribers who dropped Hulu a while ago were a little more likely to indicate the reason was because of not enough content at 32%, compared to those who recently dropped at 28%. Specifically, they were more likely than recent droppers to indicate not enough new TV content (14%), new movies (13%) or original/exclusive content (10%). Those who dropped a while ago were also more likely to indicate they had to reduce household expenses at 30%, only wanted to do the trial at 26%, or use other services instead at 20%, compared to those who recently dropped Hulu at 27%, 16% and 15%, respectively.

Those who recently dropped were more likely to indicate they dropped for a short time and plan on subscribing again compared to those who dropped a while ago, at 12% and 5%, respectively, or only subscribe for new seasons at 10% and 5%, respectively. Price increases and too many video subscriptions were also popular selections regardless of when respondents dropped the service.

Among those who dropped Prime Video, reducing household expenses and only wanting to do the trial were selected a little more among those who dropped a while ago than those who recently dropped. Similarly, those who dropped a while ago were more likely to indicate they use other services instead at 20%, compared to 14% of those who recently dropped. Those who recently dropped were more likely to indicate there was not enough new TV content on the service at 13%, compared to 9% of those who dropped a while ago.

Besides not having enough of the content respondents wanted, reducing household expenses was a commonly selected reason for dropping HBO Max among both those who recently dropped and those who dropped a while ago. Price increase was another commonly selected reason for dropping, despite HBO Max keeping the same price from HBO NOW.

Too many video subscriptions was the most selected reason among those who recently dropped HBO Max at 25%, much higher than those who dropped a while ago at 7%. Those who recently dropped were also more likely to indicate they did so due to poor streaming experience at 12% or dropped for a short time at 14%, compared to those who dropped a while ago at 4% and 7%, respectively.

Users who dropped Disney+ a while ago were more likely to indicate a lack of content at 34% than those who recently dropped at 28%. The second-most selected reason for recent droppers was only wanting to try it out at 25% versus 19% of those who dropped over a year ago, while the number two reason for dropping a while ago was "had to reduce household expenses" at 27%. Those who recently dropped were more likely to indicate their decision was due to a price increase at 19% or not having enough new TV content at 13% compared to those who dropped a while ago, at 13% and 7%, respectively. Those who dropped a while ago were also more likely to indicate that they dropped due to too many video subscriptions and not having enough new movies, compared to those who recently dropped.

Data presented in this article is from Kagan's U.S. Consumer Insights survey conducted in September 2021. The online survey included 2,529 U.S. internet adults matched by age and gender to the U.S. Census. The survey results have a margin of error of +/-1.9 ppts at the 95% confidence level. Percentages are rounded up to the nearest whole number.

Consumer Insights is a regular feature from Kagan, a media research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.