Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 19 Jul, 2024

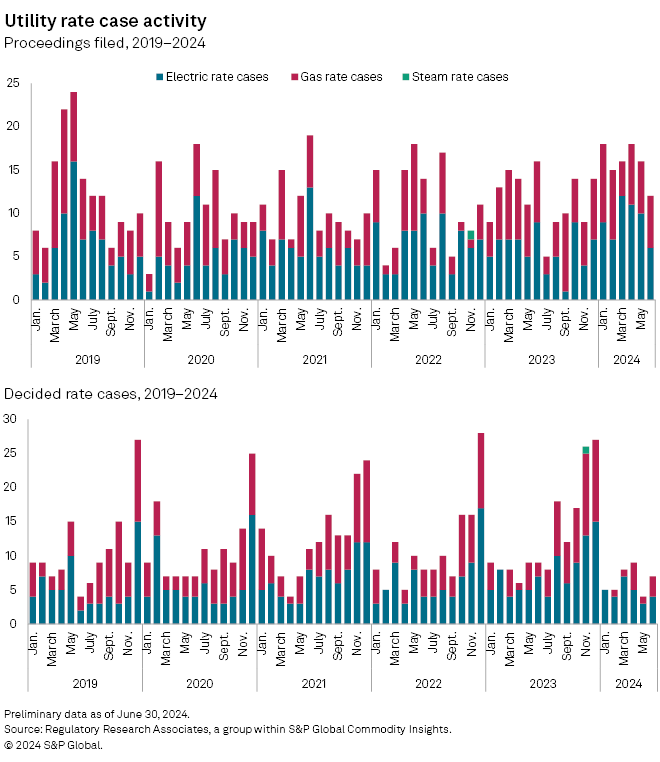

While the number of rate case initial filings submitted to state regulators in June was the lowest observed for the month in the last five years, aggregate rate increase requests reached nearly $1.8 billion.

➤ Six electric and six gas rate case filings were submitted in June, somewhat below the combined five-year average of 16.2 electric and gas cases for the month and less than the 16 proceedings initiated in May.

➤ Seven cases were decided in June, up from the four cases decided in May but below the 2019–23 average of 7.8 average decisions in June.

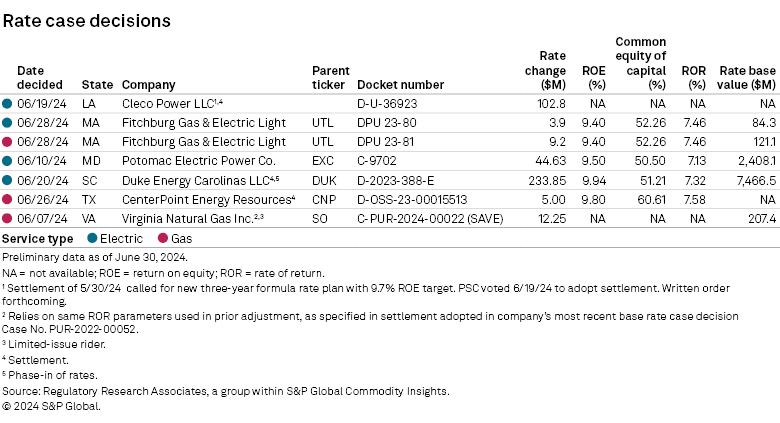

➤ Regulators authorized five returns on equity (ROEs) in June, ranging between 9.40% and 9.94%.

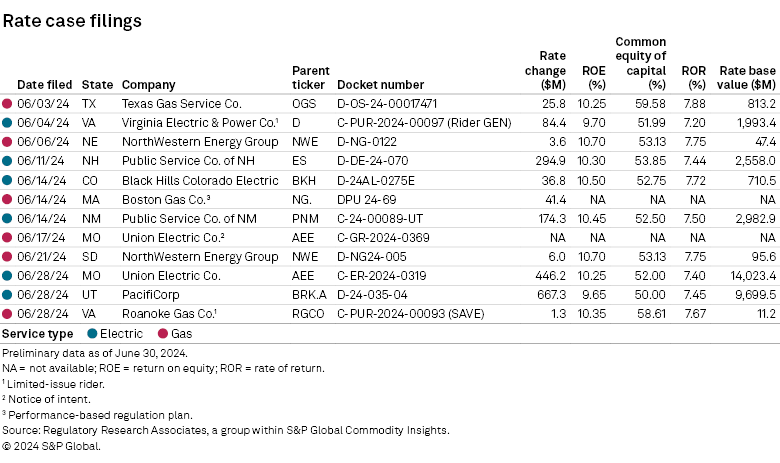

➤ In 10 of the 12 cases filed in June, utilities seek discrete ROEs ranging from 9.65% to 10.70%.

Energy utilities across the US filed for $1.78 billion of rate increase requests in June. There were six electric rate increase requests that aggregated to $1.70 billion. Five of the six gas cases totaled $78 million in rate increase requests; the remaining gas case is a notice of intent, and the filing did not disclose a rate increase amount.

The $1.78 billion in June rate increase requests was approximately $130 million lower than the $1.91 billion observed in May.

Authorized rate changes for June totaled $411.6 million across seven cases — four electric and three gas — up from $198.2 million in May, comprising three electric decisions and one limited-issue gas case.

A moderate level of other regulatory activity and a few alterations to utility commission membership occurred in June.

Utility-related M&A or reorganization activity in the month was minimal.

Rate case initial filings

The accompanying table details the six electric and six gas rate proceedings initiated in June. The rate changes requested aggregated to an increase of approximately $1.78 billion, with $1.70 billion net sought by electric utilities and about $78 million in the newly filed gas cases.

Resolved rate cases

The following table details the four electric and three gas rate proceedings that concluded in June. The rate changes approved in the electric cases aggregated to an increase of $385.1 million, while the three gas cases totaled $26.4 million.

Significant rate case activity

New multiyear performance-based rate plans

New Hampshire — Public Service Co. of New Hampshire filed with the New Hampshire Public Utilities Commission on June 12 to implement a new four-year performance-based ratemaking plan as an alternative to the recurring general rate case and step adjustment filings traditionally used by the state's energy utilities.

Performance-based regulation — also known as incentive regulation — operates in several states, rewarding or penalizing utilities for exceeding or underperforming on operational performance targets, customer service metrics, reliability standards, or demand reduction targets under energy conservation programs or for meeting or exceeding renewable portfolio standards. In contrast, traditional cost-of-service regulation is a baseline approach reflecting the total amount a utility must collect in rates to recover its costs and earn a reasonable return.

Other multiyear rate plans face resistance

District of Columbia — Intervenors have requested dismissal of Potomac Electric Power Co.'s (Pepco) pending multiyear rate proposal. A June 10 motion by the Office of People's Counsel (OPC) and the Apartment and the Office Building Association requested that the commission issue a summary judgment denying the utility's applications for a traditional test year filing and multiyear rate plan and requiring the utility to refile its applications with updated actual data. On June 28, the Public Service Commission responded with an order that maintains the legislative-style hearing scheduled to start July 30 and solidifies a procedural schedule to support the hearing. The commission simultaneously denied the intervenors' request to direct Pepco to refile its rate plan with updated data. Additionally, the commission ordered Pepco to provide supplemental data, including a detailed explanation of adjustments made in its updated filings, by July 18.

Maryland — The Maryland PSC rejected the multiyear plan of Pepco based on concerns raised by the Maryland OPC about cost-ineffective and unsupported investments leading to increased rates for customers. The PSC acknowledged the importance of the OPC's issues but noted that the multiyear rate plan framework was still in a pilot phase and had not been determined as the new norm for ratemaking. The commission found that Pepco should have included a proposal based on a traditional historical test year but determined that the data provided by Pepco could be used to develop a just and reasonable revenue requirement for the first year of the proposed multiyear rate plan. The commission emphasized the need for rigorous scrutiny of Pepco's future costs.

Inflation, higher interest rates drive rate-increase submissions

South Dakota — Citing increased operating costs due to inflation and recovery of natural gas infrastructure investments, NorthWestern Public Service Corp. filed its first gas rate case in South Dakota in more than 13 years on June 21. NorthWestern said the rate case is necessary because the company is not recovering the costs associated with its capital investments over the past 13 years. It also cited inflationary increases in operating costs in areas such as business technology, regulation and labor as a driver for the rate hike.

Staff reject inclusion of transmission costs arising from contested legacy power plant issue

Missouri — While the staff of the Missouri Public Service Commission backs a rate hike for Evergy Missouri West Inc., it does not support recovering transmission costs associated with a plant in Mississippi that the company's predecessors constructed in 2002. The plant has been a controversial issue in prior rate cases, and the staff's stance on the matter echoes the commission's findings in those proceedings.

Wildfire costs drive rate increase application even as prior rate case heads to state Supreme Court

New Mexico — Public Service Co. of New Mexico filed a new rate increase case request less than six months after the conclusion of its prior case, which the utility has appealed to the state Supreme Court. The utility said the main drivers of the new rate increase request are increased capital expenditures, recovery of the energy storage agreement costs, an increase in the cost of capital, modified depreciation rates and increasing wildfire-related costs.

Significant non-rate-case activity

Energy storage plans

New York — The New York Public State Public Service Commission approved a plan for the state to reach 6 GW of battery storage by 2030, requiring the state to procure an additional 4.7 GW of storage projects. Gov. Kathy Hochul proposed the 6-GW battery storage goal in December 2022. Previously, the state's 2019 Climate Leadership and Community Protection Act had called for 3 GW of battery storage by 2030. The 6-GW storage goal represents 20% of the state's peak electricity load.

Commission, commissioner activity

Alaska — Robert Doyle began serving his first full term as the chairman of the Regulatory Commission of Alaska on July 1 after being unanimously elected by fellow commissioners. Doyle has served as the head of the agency since November 2023, completing a partial term following the resignation of then-Chairman Keith Kurber. The agency remains partially staffed, with Gov. Mike Dunleavy yet to fill two vacancies. Legislators have recently expressed concerns about utility commissioner qualifications, and legislation worked on during the 2024 legislative session tackles the issue.

Kentucky — Kentucky Public Service Commission Chairman Kent Chandler left the commission when his term expired June 30. Gov. Andy Beshear has not yet named a replacement. The term of the next appointee would extend to June 30, 2028.

Maryland — Commissioner Anthony O'Donnell retired in early June. O'Donnell was appointed to the commission in 2016 and reappointed in 2021. O'Donnell arrived with a working knowledge of the energy sector, having served on the House Environmental and Transportation Committee during his 20-year tenure in the Maryland House of Delegates and having done a stint at the Calvert Cliffs Nuclear Plant. O'Donnell's retirement creates an additional measure of uncertainty in terms of the commission's future policy direction. The election of a new governor brought with it considerable change in the commission's makeup, including a new chairman who was previously a lead attorney for the OPC. As a result, three of the five serving commissioners have little regulatory experience.

New York — The New York Senate confirmed Gov. Kathy Hochul's appointment of Radina Valova to the New York Public Service Commission on June 6. Valova's appointment is for a term set to expire Feb. 1, 2030. Valova is an attorney with considerable experience in the energy sector. Valova's confirmation brings the agency back to seven members as it works through a robust regulatory agenda.

Texas — Gov. Greg Abbott appointed consumer advocate Courtney Hjaltman to the Public Utility Commission of Texas to fill the vacancy created by the departure of former commissioner Will McAdams in December 2023. The leadership changes are occurring at a time when the commission has an active agenda. In addition to the traditional complement of rate case activity and ongoing activity related to 2021 market reform legislation, energy-related legislation enacted during the 2023 session creates additional regulatory responsibility for the PUC, including the administration of the Texas Energy Fund, which is intended to incentivize the development of dispatchable generation within the Electric Reliability Council of Texas.

Delaware — A bill supporting offshore wind went to the governor's desk June 30. Senate Bill 265 outlines the solicitation process for procuring up to 1,200 MW of offshore wind energy for the state. The bill signals Delaware's commitment to offshore wind and its transition to clean energy and provides guidance for state agencies in developing the solicitation process, including specific conditions for participation. The bill encourages offshore wind proposals that serve only Delaware or involve regional collaboration. The State Energy Office will be responsible for developing and conducting the solicitations, ensuring they align with the state's renewable energy goals. The bill also authorizes the Public Service Commission to include costs associated with policy initiatives, such as compliance costs and renewable portfolio standards, on regulated utility billing statements. Moreover, the bill establishes requirements for obtaining a certificate of public convenience and necessity for renewable energy interconnection facilities. The State Energy Office must approve the proposed facilities and ensure they align with the state's energy plan and greenhouse gas reduction targets before they apply.

Massachusetts — On June 25, the Massachusetts Senate approved S.2829, a clean energy reform bill designed to accelerate the siting process for new renewable energy projects in the state. The bill now moves to the Massachusetts House of Representatives. S.2829 allows permits for clean energy projects with a capacity greater than 25 MW to be consolidated into a single permitting process. The siting board would then have 15 months to issue a final decision on the permit application. The bill included several measures designed to regulate natural gas-providing utilities in the state, including Eversource Energy and National Grid PLC. If the bill is enacted, gas utilities would be required to file annual plans that include targets for public safety upgrades, reliability and greenhouse gas emissions reduction. Fines could be levied against companies that fail to meet their targets.

Federal matters

Advanced nuclear on the agenda

US Senate — The US Senate passed the ADVANCE Act with an 88-2 vote June 18 to support development of advanced nuclear power reactors. A companion bill received similar bipartisan support in the US House of Representatives. Advanced small modular nuclear reactors, which have relatively small footprints, are seen as a potentially affordable source of 24/7 carbon-free electricity, but US nuclear developers have struggled to secure financing due to uncertainty over permitting times and cost overruns. The ADVANCE Act directs the US Nuclear Regulatory Commission to reduce the fees it charges companies seeking to license advanced reactor technologies. It also creates a prize incentive equal to the licensing fees assessed by the commission for the first advanced reactor permit issued to a nonfederal entity or the Tennessee Valley Authority.

Court activity

US Supreme Court

Is Chevron deference dead?

The Supreme Court's recent decision to overturn the legal concept of Chevron deference will have widespread implications for the interpretation of energy utility regulatory policies. In a specific case involving the Federal Energy Regulatory Commission and the Public Utility Regulatory Policies Act of 1978 (PURPA), the Supreme Court vacated and remanded a lower court's decision that had favored FERC's interpretation. The case involves a dispute between NorthWestern Corp. and Broadview Solar LLC, where Broadview sought FERC's approval to certify a hybrid facility as a qualifying small power production facility under PURPA. FERC initially denied the application, saying that it exceeded the statutory limit, but later reversed its decision. The case made its way to the DC Circuit, which invoked Chevron deference in deferring to FERC's interpretation. However, the Supreme Court's recent ruling has sent the case back to the DC Circuit for further consideration without relying on Chevron deference. This has raised questions about how and when Chevron should apply and whether courts must exhaust other statutory interpretation tools before deeming a statute ambiguous. While the ultimate outcome of the case is still uncertain, it highlights the changing landscape of administrative law and regulatory interpretations in the energy sector.

Clean Air Act final rule regarding interstate 'good neighbor' plan on indefinite hold

The US Supreme Court voted 5-4 on June 27 to stay a Biden administration plan for curbing interstate smog emissions, indefinitely putting the final Clean Air Act rule on hold pending further judicial review. The US Environmental Protection Agency finalized its good neighbor plan in March 2023. The final rule originally established a federal implementation plan for 23 states using the EPA's four-step interstate transport framework for smog-forming nitrogen oxide emissions. The court's majority opinion held that the US Environmental Protection Agency failed to adequately explain whether and how its good neighbor plan might change if it does not cover all of the 23 initially affected states. The ruling stays the plan pending further judicial review at the US Court of Appeals for the District of Columbia.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.