Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 7 Sep, 2023

By Katherine Matthews and Jason Holden

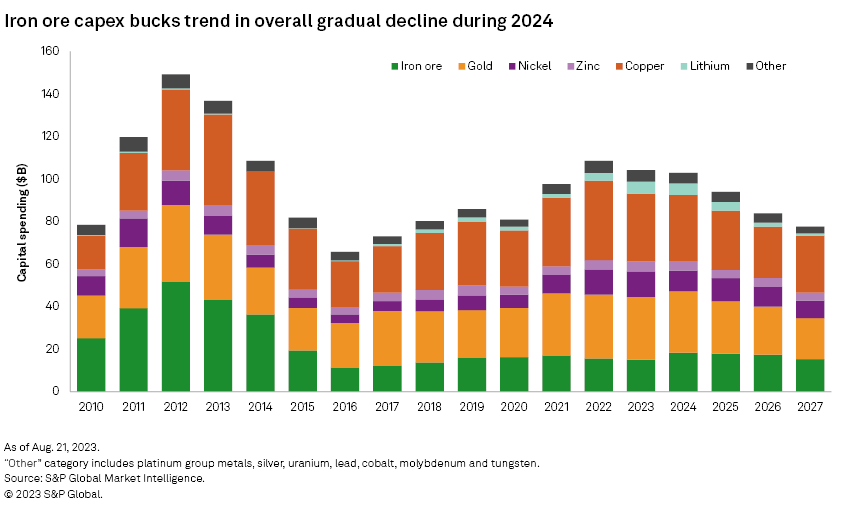

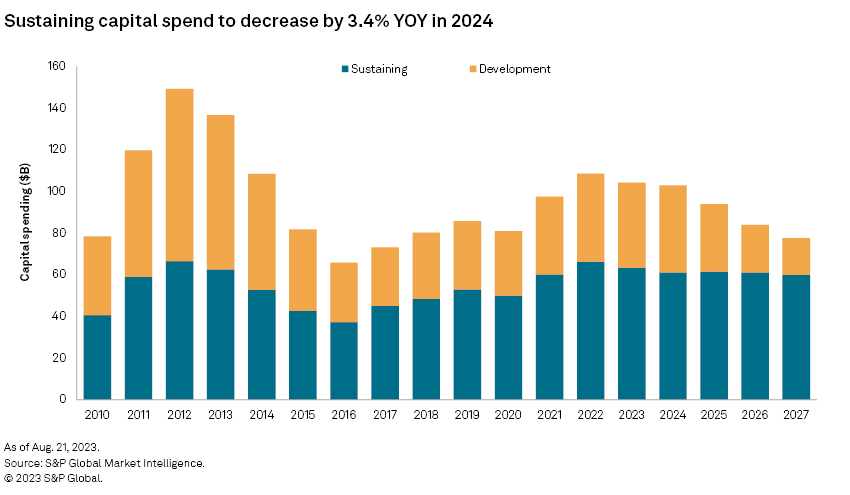

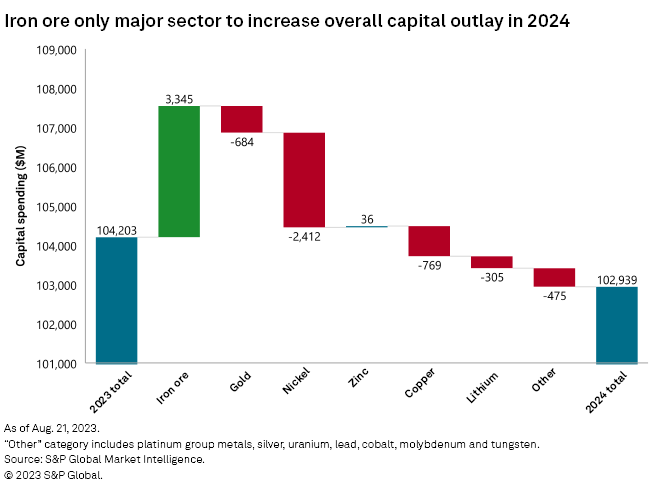

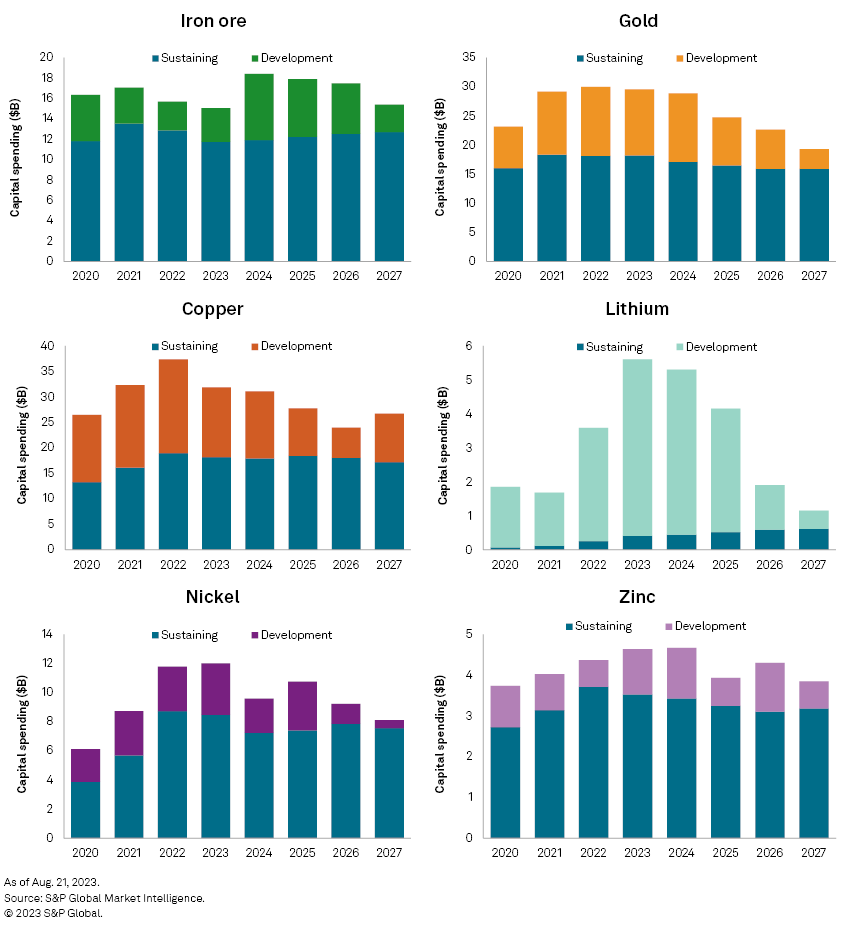

Total capital expenditure is forecast to drop approximately $1.26 billion in 2024, with all sectors except iron ore and palladium subject to spending cuts. The impact of construction delays, operators' focus on late-stage or minesite projects over greenfield exploration, and the comparative lack of new projects transitioning from approval to build continue to dampen development capital outlay. Sustaining capital cuts are also forecast across most commodities, with only some "green" metals, such as lithium and cobalt, insulated against the general downward trend.

Our data, derived from the Mine Economics product and supplemented with global estimates, shows that total capital spending is expected to further decline in line with previous estimations, with over 25.5% reduction expected between 2023 and 2027.

➤ The total capital expenditure continues to decline in 2024 and beyond, in line with previous estimations.

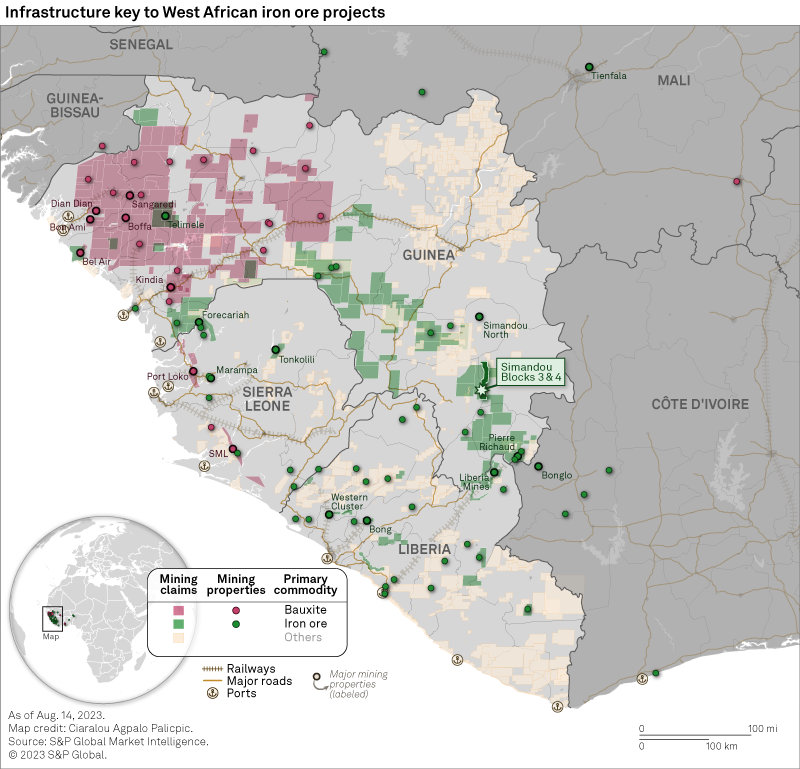

➤ The iron ore development capital spend is expected to buck the general downward trend, bolstered by positive tailwinds for Guinea, with the progression of the Simandou project.

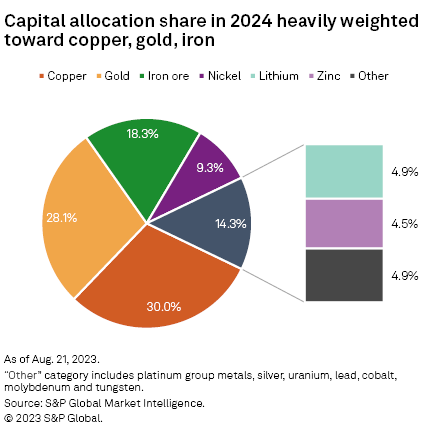

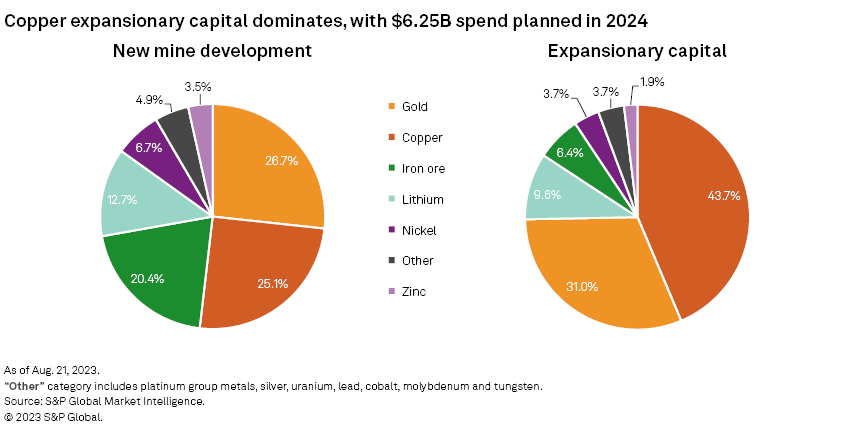

➤ The capital allocation share for 2024 is heavily weighted toward the copper, gold and iron ore industries, which together account for over 75% of the total spend.

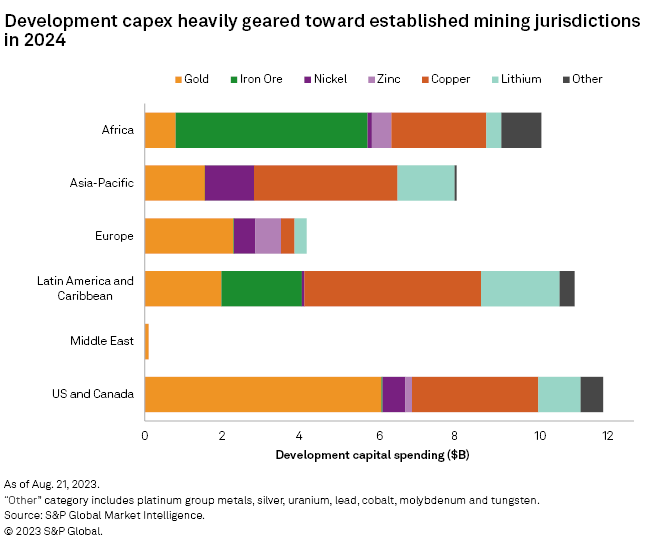

➤ Significant expenditure is forecast to be allocated to Africa, Latin America and the Caribbean, and the US and Canada regions in 2024, each shoring up approximately 25% of development investment.

Total capex in the mining industry is expected to fall by over $1.26 billion in 2024 across 14 commodities, primarily driven by a drop in sustaining capital for gold and nickel operations as well as significant cuts in development capex within the nickel and silver sectors.

Sustaining capital spend in the gold sector is expected to drop 6.2% year over year with a number of operations transitioning to closure activities, for example, Pantoro Ltd.'s Halls Creek operation in Western Australia and Noche Buena in Mexico, owned by Fresnillo PLC.

Although development capex totals are in gradual decline over the coming years, they will be buoyed in 2024 by a near doubling of spend in the iron ore sector. Forecast development outlay is just shy of $6.51 billion versus $3.33 billion in 2023, primarily driven by progress at Rio Tinto Group's Simandou Blocks 3 & 4 project in Guinea and Strike Resources Ltd.'s Apurimac operation in Peru. Simfer SA, a Rio Tinto subsidiary, recently announced an agreement with the government of Guinea and Winning Consortium Simandou on the development of infrastructure for the Simandou projects. As part of this study, we only consider capital for the development of Blocks 3 & 4 (herein Simandou). As of 2022, reserves and resources at Simandou stood at 2.8 billion metric tons at 65.8% iron, and with the orebody having similar metallurgical characteristics to deposits in the Carajás mineral district of Brazil, it is seemingly one of the most desirable iron ore projects in the world.

Commodity analysis

Copper, gold and iron ore assets account for the majority of capex allocation, contributing 30.0%, 28.1% and 18.3%, respectively, of the total spend in 2024. Given these three commodities account for over three-quarters of the overall capex, changes within these sectors have a disproportionate impact on the overall figures.

Gradually rebounding since the low of $65.80 billion in 2016, capex peaked in 2022 at just over $108.53 billion, a growth of 64.9%. This figure still pales in comparison, however, to the 2012 outlay of $149.23 billion. Estimates for 2023 of $104.20 billion indicate a steady fall through to 2027, with spending declining $26.58 billion during this period.

With lithium mining still considered an emerging industry, 91.6% of the total capex allocation in 2024 is focused on development, amounting to $4.86 billion. This is comparable to the 2023 apportionment, with $5.20 billion equating to 92.7% of the total. Delays in the commissioning of projects in recent times, including Argosy Minerals Ltd.'s Rincon brine operations in Argentina, have contributed to this ongoing skew. In S&P Global's coverage universe, there are 25 mines in operation and this is forecast to grow to 43 by 2027, leading to an increase in the sustaining-to-development capex ratio to 53.0%.

The nickel industry is forecast to curtail capex outlay significantly in 2024, with a more than $2.41 billion drop-off in spending when compared with 2023 figures. The cuts are approximately equal between sustaining and development capex. These industry responses are unsurprising, given the nickel price has taken a hit since the start of 2023 and the average London Metal Exchange nickel price is forecast to decline 13.0% year over year in full year 2023 along with supply projected to outweigh demand through to 2027.

Construction versus expansionary development capex

Nearly two-thirds of the total development expenditure has been allocated to new mines in 2024, with the weighting toward gold, iron ore and copper projects. Over $27.46 billion is forecast to be spent on the construction of these mines, with 26.7% allocated for gold projects. Significant investments included $1.0 billion at Donlin, an intrusion-related vein system in Alaska under development by Barrick Gold Corp. that is forecast to start production in 2025. Other noteworthy capital projects include US$890.7 million at Cote, a deposit in Ontario under construction by Iamgold Corp., and the Horne 5 orebody in Quebec, where US$428.3 million is estimated to be spent by Falco Resources Ltd. during the year.

Expansionary development capital in 2024 is heavily skewed toward copper operations, accounting for 43.7% of the total at almost $6.25 billion, correlating with a shift away from generative programs toward minesite-focused exploration. Sizeable outlays are planned at Batu Hijau in Indonesia, operated by PT Amman Mineral Nusa Tenggara, and at Red Chris in Canada, which is operated by Newcrest Mining Ltd. and is due to release a feasibility study in 2024 assessing block cave potential. The miner is developing an exploration decline to assist in the progression and delineation of the Block Cave, with the first ventilation rise nearing completion.

Regional analysis, 2024

Significant expenditure is forecast to be allocated to Africa and Latin America as well as the US and Canada regions in 2024, each shoring up about 25% of development investment in 2024. In Latin America, copper and lithium development capex will contribute close to $6.05 billion to the region out of the $10.19 billion total. Noteworthy projects include the Santo Domingo and Tia Maria copper porphyries in Chile and Peru, respectively, and growth initiatives at Sociedad Química y Minera de Chile SA's Salar de Atacama lithium brine deposit in Chile.

Almost half of the $11.78 billion gold sector development investment is planned to be spent in the US and Canada, with over 72.8% of this total allocated to new developments. Nearly $1.53 billion is to be spent on expansions at current operations, amounting to over a third of global expansionary capital for the gold sector.

European development outlay is decreasing; a decline of 7.9% against the 2023 total of $4.17 billion is expected for 2024. Gold development spend accounts for 54.7% of the total development capex in 2024, and close to 80.5% of this is to be allocated to the construction of new projects. The Skouries project in Greece is expected to be ready for commercial production in 2024. The deposit, under construction by Eldorado Gold Corp., hosts 3.6 million ounces in reserves and is forecast to sustain mine life for 20 years.

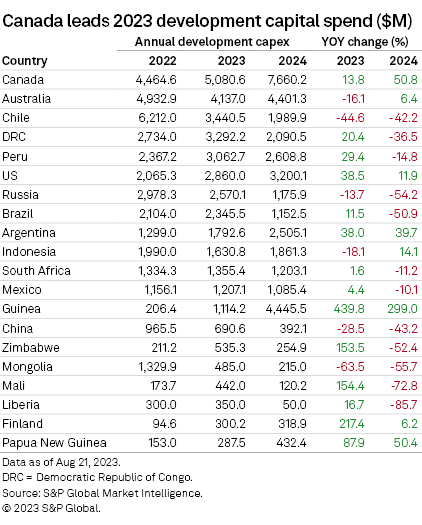

Country-level analysis, 2023

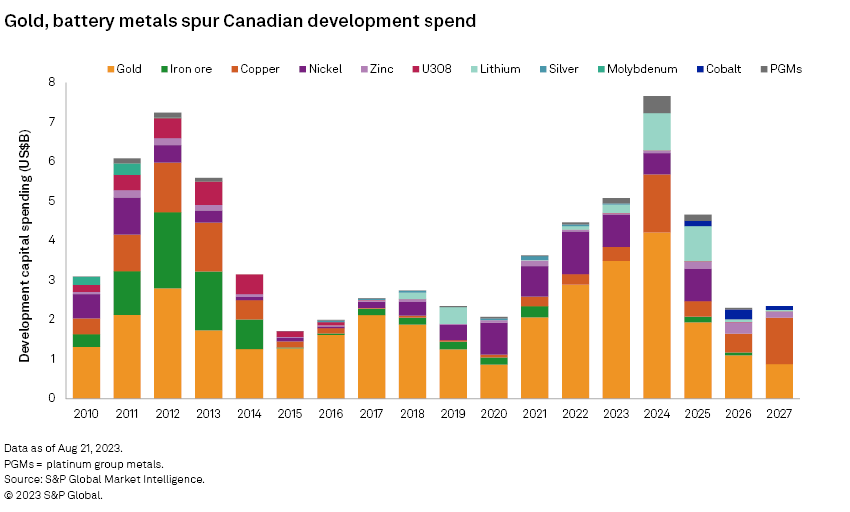

Reviewing the updated 2023 expectations by country, Canada is predicted to be the top-ranked country in terms of mining development spend in 2023, comfortably overtaking Australia and Chile. Expenditure is estimated to reach US$5.08 billion with Australia at US$4.14. billion and Chile at $3.44 billion. Canada is likely to increase capex again in 2024, rising a further 50.8% on top of a 13.8% increase in 2023.

Chile, the highest-ranked country in 2022, will undergo continued sharp declines of 44.6% in 2023 and 42.2% in 2024. Several major projects are due to complete construction and enter production during this period. In 2023, Chile will see a larger proportion of money spent on the development of lithium projects, such as the Salar de Atacama expansion, with outlay expecting to reach $500 million. Some of the large copper deposits developed over the previous few years — such as Teck Resources Ltd.'s Quebrada Blanca joint venture and Salares Norte, owned and operated by Gold Fields Ltd. — are maturing and will no longer need sizeable capex spends. Expansion capital spent at copper behemoths like El Teniente and Chuquicamata is also forecast to be reducing in future years.

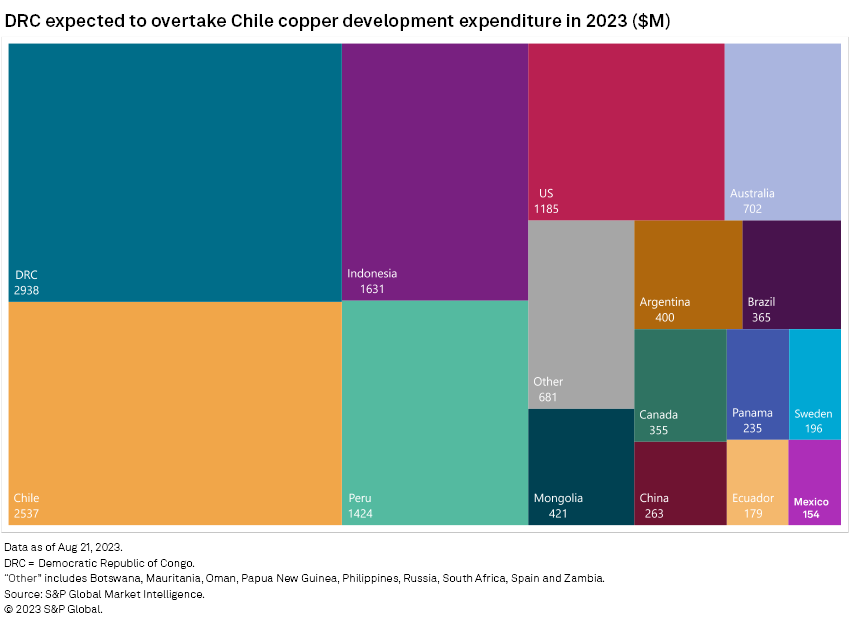

Democratic Republic of the Congo (DRC) is expected to overtake Chile with the greatest copper development outlay in 2023. This stems from significant spending at Kisanfu and Tenke Fungurume, both controlled by CMOC Group Ltd., and further development cost incurred in the ramp-up and commissioning of Kamoa-Kakula. After 2025, further capex is to be spent by Ivanhoe Mines Ltd.'s and Zijin Mining Group Co. Ltd.'s joint venture on a smelter with a capacity of 500,000 metric tons per year; it is expected to utilize approximately 80% of concentrate produced from the operation. Total copper development capital spend in the DRC during 2023 is expected to top $2.94 billion but will decline 36.4% in 2024.

Guinea is another big mover with major increases in the proposed capex for the development of the Simandou iron ore deposit, currently anticipated to total $4.44 billion next year. The development of Simandou has been estimated between $15 billion-$22 billion, with a startup tentatively given as 2027, although this is likely to be pushed back. In its 2023 first-half results presentation, Rio Tinto forecast $500 million capex during 2023, which will increase to $2 billion in 2024. Due to the operation's remote nature, the bulk of the spending will be used to build infrastructure, namely the port facilities and a railway line extending more than 600 kilometers. These figures mean the Simandou project will absorb as much capex in 2024 as all the development projects in Australia this year.

With joint venture partner Aluminum Corp. of China holding 39.95% of the project, an additional benefit of building further railways in Guinea is that it could open up further areas of the mineral-rich country. The fact that China controls a project of this magnitude will help, although only slightly, reduce its dependence on Australia and Brazil for iron ore. At the full capacity of 95 million metric tons, Simandou would make up about 4.0% of the iron ore supply, enough to meet only 6.9% of China's current demand in 2023.

Development capital in Russia has fallen in recent years, with further declines expected in 2024. Most of the capex has been at Norilsk, a large part of which is allocated to environmental, energy and infrastructure projects. Looking further into the future, the Sukhoi Log project in the Irkutsk region of Russia is set to become one of the largest gold mines in the world. Owned by PJSC Polyus, the project hosts 67 million ounces of contained gold in its measured and indicated resource. The estimated startup date is in 2027, and the final feasibility study is underway. The most recent prefeasibility study estimated the initial capex at $3.30 billion.

Argentina has several significant projects underway, predominantly in the copper and lithium sectors. These include the Josemaria copper porphyry deposit in San Juan Province. Owned by Lundin Mining Corp., the current reserves are estimated to support production for 19 years once operational. Development capex for the project is forecast to total $400 million in 2023, rising 222.5% to nearly $1.29 billion in 2024. Capex for the development of lithium projects is estimated to decrease slightly from the 2023 high of $1.27 billion to $995.6 million. This tallies with construction due to be completed at a number of projects including Salar de Olaroz. Notable development outlays in 2023 include $350 million at Cuenca Centenario-Ratones, $300 million at Tres Quebradas and $271 million at Salar del Hombre Muerto. Combined, these projects make up almost three-quarters of the total forecast development spend for the lithium sector in Argentina for the year.

Canada's capital spend has been focused mostly on gold, with Agnico Eagle Mines Ltd. pushing ahead with several new operations, including Wasamac, and expansions of existing mines, including Canadian Malartic. Of these, many are small, lower-capex projects. As can be seen below, there has been a resurgence in the capex spent on nickel, the majority being spent at Vale SA's Voisey's Bay for the Eastern Deeps extension project, which is estimated to reach $580 million in 2023. The Eagle's Nest project, owned by Noront Resources Ltd., also has approximately $556.3 million set to be spent before 2026 when it is forecast to reach commercial production. Notable projects driving lithium development capex in 2023 include Allkem Ltd.'s James Bay and the Livent Corp.-operated Nemaska projects.

Long-term outlook

Multiple commodity supply pipelines — including critical metals, such as copper and lithium — are forecast to be insufficient to meet growing demand in the coming years. The additional challenge of significant lead times also impacts future supply, as well as the burden of exploration expenditure allocated to late-stage or brownfield projects in order to reduce risk. This is particularly evident in the copper sector, where a declining number of major new discoveries has been seen. With global decarbonization at the forefront, critical minerals are essential to the transformation, and this dearth needs immediate attention.

The declining trend is evident when reviewing capital spends through to 2027. With the comparative lack of exploration projects reaching construction, development capital outlays are estimated to decrease 56.6% from 2023 to just over $17.72 billion in 2027. Sustaining capex also declines, but not by the same degree, falling about 5.4% over the same time frame. With the effect of falling development spend out past 2027, it is expected that this, along with with many operations forecast to close during this period, including Bald Mountain and Kensington in the US, will have a knock-on effect with longer-term sustaining capital outlay.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.