Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 20 Sep, 2024

By Iuri Struta

While the broader tech M&A landscape struggles to find a stable footing, datacenters are experiencing an unprecedented wave of deal-making.

Last week, Blackstone Inc.-managed funds agreed to acquire Asia-Pacific-focused datacenter operator AirTrunk Operating Pty Ltd. for about $16.0 billion. That megadeal comes on top of a $6.4 billion investment in Vantage Data Centers Management Company LLC from Silver Lake Technology Management LLC and Digital Bridge Holdings LLC earlier this year.

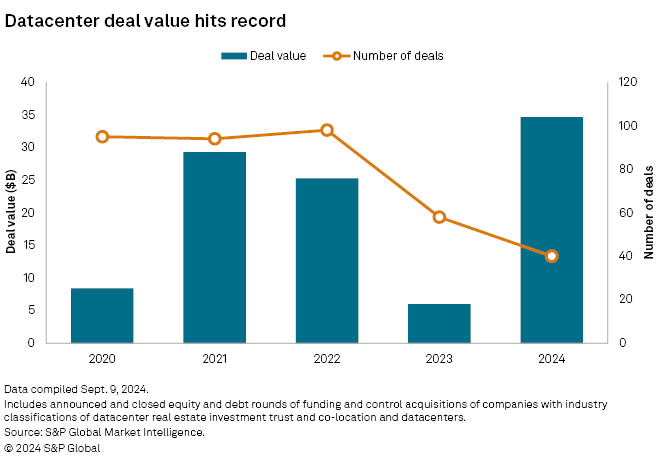

All told, the total value of funding and M&A in the datacenter sector is now at an all-time high, nearing $35 billion year to date, according to S&P Global Market Intelligence. This figure surpasses even the peak levels seen during the post-pandemic boom of 2021 and 2022.

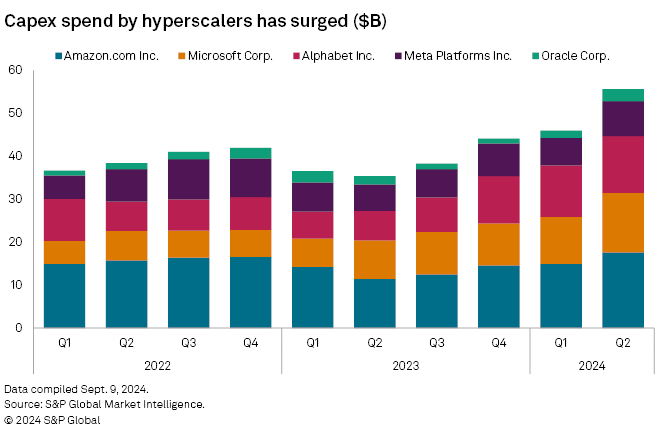

Interest in datacenters is expected to persist as hyperscalers such as Microsoft Corp., Alphabet Inc. and Amazon.com Inc. increase capital outlays to secure a position in the burgeoning generative AI sector. Capital expenditures by the five largest cloud infrastructure providers increased by 57% in the second quarter of 2024 year over year to $55 billion, Market Intelligence data shows. Most of the capex spend is directed to datacenters that host AI infrastructure.

"Blackstone's $16.1 billion pickup of AirTrunk is yet another sign that datacenters make an attractive asset category, especially as hyperscalers shell out for AI infrastructure that is hosted in these facilities," said S&P Global Market Intelligence 451 Research analyst Soon Chen Kang. "Across many markets in the Asia-Pacific region, cloud suppliers have leaned on third-party operators such as AirTrunk and its international and regional rivals such as Digital Realty Trust Inc."

Blackstone said datacenters are its "highest conviction theme" in the current environment as it seeks to become "the leading digital infrastructure investor in the world across the ecosystem, including datacenters, power and related services." Blackstone has about $55 billion of datacenters in its portfolio and another $70 billion in the pipeline. The firm has over $1 trillion of assets under management, according to Market Intelligence.

Valuations of most operators in the Asia-Pacific datacenter sector, excluding China, have surged in recent years. For instance, Australia-listed NEXTDC Ltd. has seen its total enterprise value to EBITDA ratio skyrocket to 62x, up from 32x two years ago, according to Market Intelligence. Tokyo-listed SAKURA Internet Inc.'s TEV/EBITDA surged to 32x from less than 6x two years ago. AirTrunk is valued at 87x EBITDA, according to the Australian Financial Review, which cited investment bankers.

To justify these valuations, investors are estimating strong growth in the coming years. AirTrunk has more than 800 megawatts of committed capacity from customers, and it owns land that can be used to develop one gigawatt of additional capacity.

"[The] AI boom is likely to drive some of the higher valuations," Kang said. "AirTrunk, in particular, has a portfolio of assets in the Tier 1 metros and many of its data centers have hyperscalers such as Microsoft and AWS as tenants."

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.