S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 24 Jun, 2021

Highlights

Metals prices have recovered faster from COVID-19's initial impacts compared with the GFC recovery.

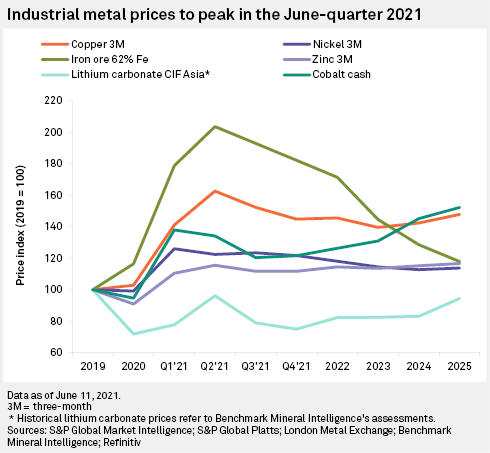

We expect industrial metals prices to peak in the June quarter, however, although the key drivers differ by commodity.

S&P Global Economics forecasts GDP growth to slow from 2022 onward.

In March 2020, the COVID-19 pandemic triggered acute declines in metals prices, mainly due to a collapse in metals demand. Short- and long-term supply were also disrupted by mine closures and a wave of capital spending cuts in the mining sector. One year later, industrial metals market fundamentals are in a very different place, with copper and iron ore prices reaching historic highs.

The strong metals demand and price recoveries have outperformed our expectations. Unprecedented levels of government stimulus have boosted demand growth beyond supply growth, providing momentum for metals prices to recover past pre-COVID-19 levels.

We nevertheless expect industrial metals prices to peak in the June quarter, before easing in the second half, with varying magnitudes of price adjustment depending on unique fundamentals in markets for copper, iron ore, zinc, nickel, lithium and cobalt.

Industrial metals prices recover faster from COVID-19 than from Global Financial Crisis

Our research(opens in a new tab) in March 2020 compared the potential impacts of COVID-19 with the impacts of the Severe Acute Respiratory Syndrome, or SARS, epidemic in 2003. SARS cases were concentrated in Asia, while COVID-19 evolved into a global pandemic. Lockdown measures implemented worldwide to curb the spread of COVID-19 led to an acute global economic downturn, rising unemployment and government stimulus.

The global nature of COVID-19, and the scale of economic fallout and government policy responses to cushion the effects and kickstart a recovery, suggested a more appropriate comparison with the impacts of the Global Financial Crisis, or GFC, of 2008-09. The GFC was triggered by bursting of the U.S. housing bubble, which cascaded into an international banking crisis. Governments and central banks worldwide responded by injecting liquidity into the money market and bailing out failing financial institutions. The GFC was considered the most serious financial crisis since the Great Depression of the 1930s.

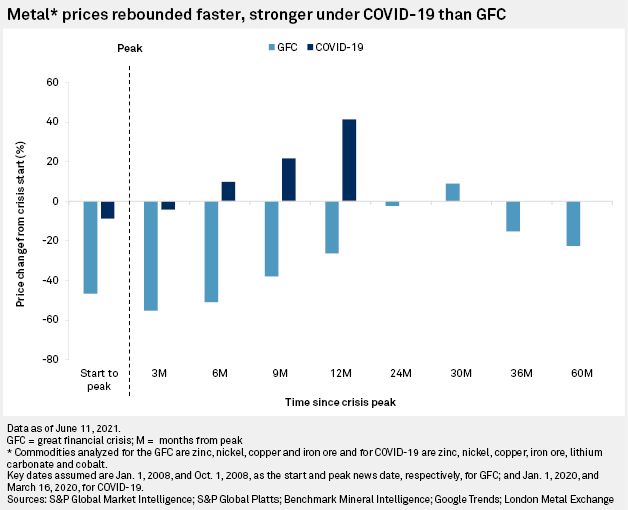

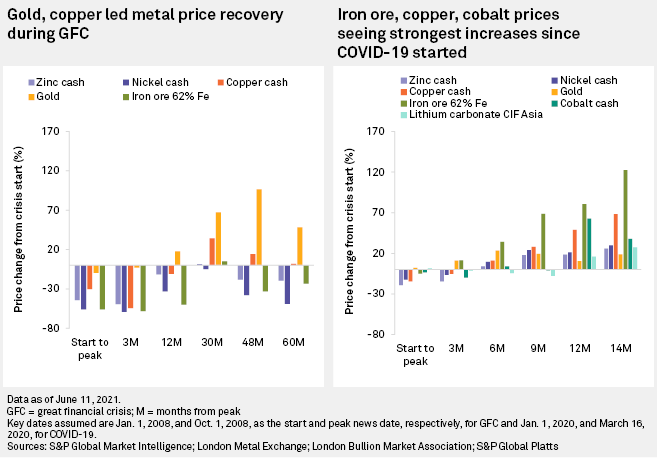

Metals prices have recovered faster from COVID-19's initial impacts compared with the GFC recovery. The basket of industrial metals prices bottomed one month after the peak COVID-19 news date of March 16, 2020, and recouped all their losses since the January 2020 start of COVID-19 by September of that year. In the GFC, metals prices bottomed three months after the peak news date of Oct. 1, 2008; however, it was not until April 2011 — 30 months from the crisis peak — that most industrial metals prices recovered to their pre-GFC levels.

Unprecedented stimulus during COVID-19 propelled economic rebound, metals price recovery in 2020

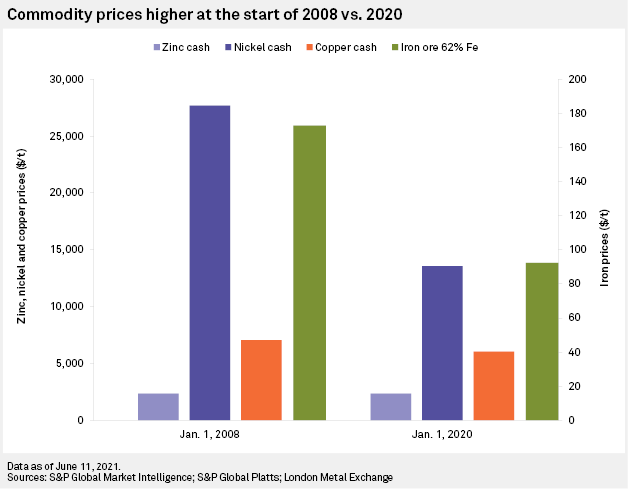

The quick recovery under COVID-19 compared with the GFC was due to government stimulus measures and disruptions to metals supply as well as demand. Weaker pre-pandemic industrial metals prices at the beginning of 2020 than pre-GFC prices in 2008 also made it comparatively easier for prices to recover.

Unlike the GFC, which mostly impacted metals demand, lockdowns to prevent virus spread also fed through to a pullback in supply, after triggering a slump in metals prices over concerns about prolonged weakness in demand, especially from China.

The lockdown measures affected industrial metals supply through closures at refineries, smelters and mines, and restrictions on worker movement and activity. Zinc and copper were the worst hit in South America, with one main supplier, Peru, imposing the longest government-enforced mine closures, from March to early June of 2020. Iron ore, nickel, lithium and cobalt mines were comparatively less affected(opens in a new tab) by stoppages and restrictions globally.

The mine closures caused a small and temporary impact on short-term supply but have had a bigger impact on long-term supply. Project pipelines were hit by challenging financing conditions and difficulties in accessing and working at mine sites, delaying project development that would have helped meet pent-up demand today and over the medium-to-long term.

Our Corporate Exploration Strategies research(opens in a new tab) shows COVID-19 pushed the global exploration budget down 10% year over year in 2020, during a period of enforced inactivity due to lockdowns as well as explorers exercising caution despite the swift metals price recoveries after April 2020.

Our 2020 demand and supply estimates for iron ore, copper, nickel and zinc were all lower in our May 2020 forecasts than in our December 2019 forecasts, with the downward revisions averaging 6% for demand and 4% for supply. The full commodity-by-commodity forecast revisions can be accessed here(opens in a new tab).

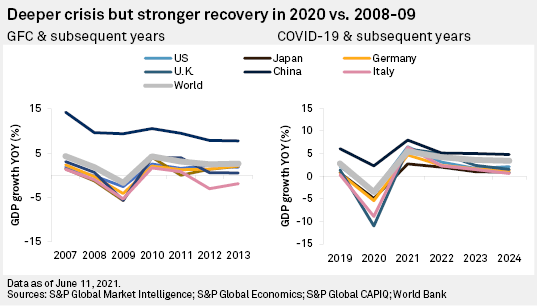

Demand in 2020 rose again above our May 2020 estimates across five — iron ore(opens in a new tab), copper(opens in a new tab), nickel(opens in a new tab), lithium and cobalt(opens in a new tab) — of the six metals (including zinc) covered in our Commodity Briefing Service reports. The demand-led metals price recovery to date has been supported by larger fiscal stimulus(opens in a new tab) packages in 2020 compared with 2008-09, in response to a deeper crisis.

The recovery in industrial metals prices gathered momentum in the second half of 2020, benefiting from resurgent Chinese demand propelled by an infrastructure-led stimulus drive since the June quarter of that year. This initially boosted demand for iron ore, copper and zinc, followed by nickel and cobalt as the recovery in consumer spending picked up in the second half. In the summer of 2020, abating first-wave infection rates across Europe and the U.S., along with stimulus measures, kick-started the recovery, boosting sentiment and industrial metals prices. The pace of economic recovery increased in the December quarter in the U.S. and Europe, with metals prices benefiting from an injection of positive sentiment driven by news of vaccine approvals and rollout plans in the final month of the year.

Investor optimism over nickel and cobalt was buoyed by rising vehicle fleet electrification and an escalation of the green revolution, while supply concerns amid an expected long-term shortage of battery-grade nickel and cobalt logistical bottlenecks in Africa supported higher prices.

Industrial metals prices to peak in June quarter

This year has seen a continuation of buoyant Chinese demand, accompanied by an accelerating economic recovery in ex-China markets, fueled by broader vaccine rollouts, ongoing support from stimulus measures passed in 2020, the $1.9 trillion stimulus measure in the U.S passed in March and the Biden administration's proposed $2.3 trillion infrastructure plan. With supply struggling to meet demand, cobalt prices peaked in March, and copper and iron ore prices both hit record highs in May. Prices for zinc, nickel and lithium continue to be supported by ex-China demand recovery.

We expect industrial metals prices to peak in the June quarter, however, although the key drivers differ by commodity. Prices for iron ore, copper, zinc and nickel are expected to moderate in the second half, albeit at various levels, as tighter credit restrictions in China bite and stimulus declines, which in turn is likely to temper China's demand for metals.

The copper supply's short-term difficulty in reaching the market and challenges for Brazilian iron ore supply to increase over the medium term will support prices trading above historical norms for the rest of the year. We expect the zinc market surplus to be smaller year over year, with potential downside risk to prices from mining tax changes in South America.

The London Metal Exchange three-month prices for battery metals nickel and cobalt reached seven- and two-year highs in late February and early March respectively, driven by COVID-19-induced concerns over a long-term battery-nickel shortage and cobalt supply logistics bottlenecks. Prices for both metals have since trended downward as these supply concerns have been addressed.

Coming out of the 2015-20 price cycle, the seaborne CIF Asia lithium price has increased year-to-May, but we expect a downward trend in the second half from rising supply spurred by the high year-to-date prices.

A detailed commodity performance recap for 2020 and the 2021 outlook can be found here(opens in a new tab).

Green Transition supports metals demand as stimulus tapers off after 2022

Industrial metals demand fundamentals will continue loosening on expectations that demand growth will slow over 2022-25 as stimulus declines and ex-China economies return to steady growth levels.

Policy drives supporting the energy transition, and the resulting increase in renewable energy generation and electric vehicle uptake, will support bullish expectations for long-term industrial and battery metals demand, counteracting the slowdown in demand growth as pent-up recovery momentum dissipates. Energy transition is an area of policy consensus among Europe, China and the U.S.; the European Union anchored its COVID-19 recovery fund on the Green Transition, China declared the country's first carbon neutrality target in September 2020 and green agendas are at the forefront of U.S. President Joe Biden's policy goals.

S&P Global Economics forecasts GDP growth to slow from 2022 onward. The energy transition will strengthen copper, cobalt and nickel demand and prices, while supply constraints will continue to support iron ore prices. We expect all commodity prices, except for lithium carbonate, to be higher by 2025 than their January 2020 pre-COVID-19 levels.

The metals market rebound from the initial price and demand collapse in March 2020 has been extraordinary, with government stimulus measures also intensifying metals price increases in 2021. The prices are forecast to ease from the second half onward, however, from improving supply responses amid the high-price environment, and as the key industrial economies return to steady-state growth. In addition, the pandemic has heightened the significance of health, outdoor space and the environment. In the past 12 months, we have seen strong efforts by China, the U.S. and Europe in support of the green transition, which will continue to support long-term metals demand as current stimulus measures are wound down.

S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.

Blog

Blog