Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 22 May, 2024

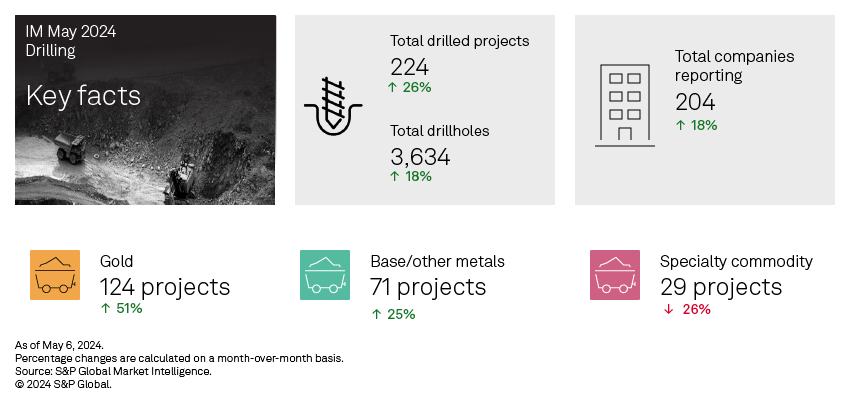

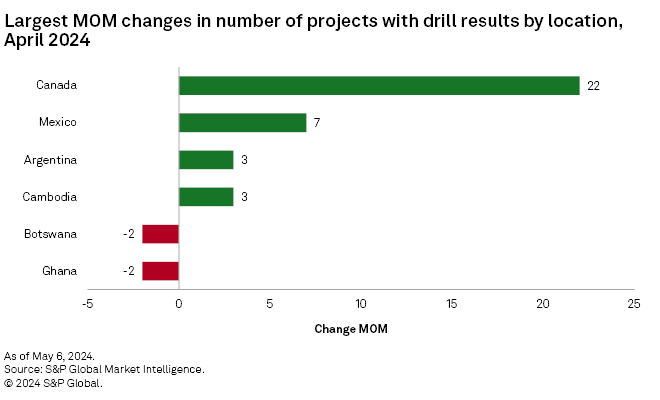

Drilling in Canada led to an upswing in overall drilling metrics for the month of April. Projects drilled increased by 46 to 224 projects, while the number of drillholes was up 562 to 3,634. Nearly half of the increase in drilled projects and 90% of the additional drillholes are attributable to projects in Canada. All drilling stages were also up month over month in April, with minesite projects jumping 65%, late-stage projects up 25% and early-stage projects up 7%.

Access April drill results data in the accompanying Excel spreadsheet.

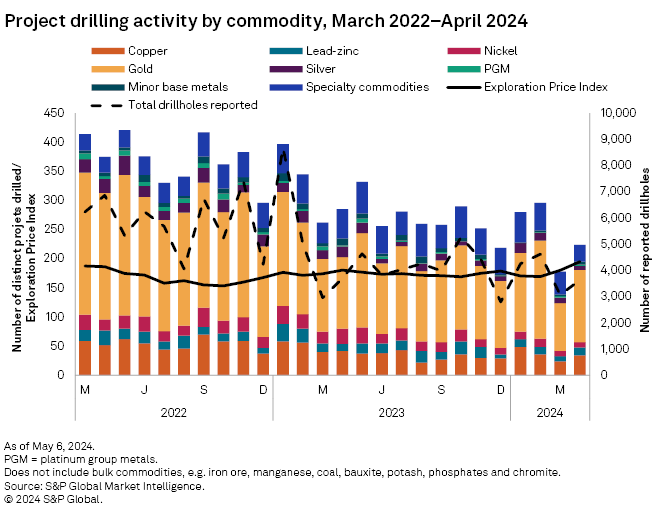

After an eight-year low in March, gold projects reporting drilling rallied in April, up 51% to 124. Copper also increased, jumping 42% to 34 projects. Lead-zinc and minor base metals had small increases, up five projects to 14 and two projects to five, respectively. Nickel projects remained unchanged month over month, with nine projects reporting. Only three commodities had decreases in projects reporting drilling. Specialty metals fell 26% to a two-year low of 29 projects reporting, silver dropped by two projects to seven, and platinum group metals had two projects reporting drilling, one fewer than last month.

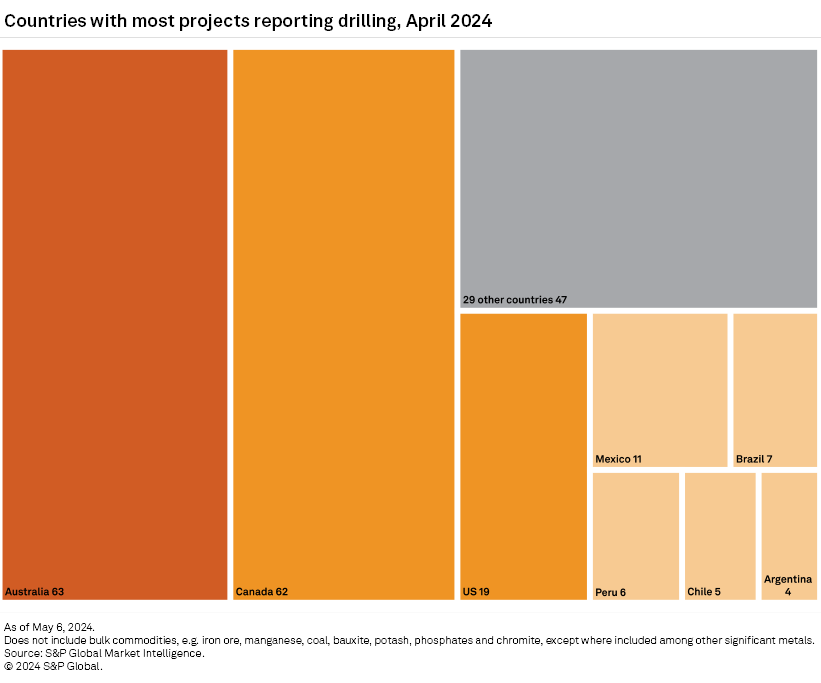

Although Australia still had most projects reporting drilling, it was Canada that drove the overall jump in drilling metrics in April. Increasing 55% to 62 projects reporting, Canada was just one project shy of the 63 projects drilled in Australia in April. The US stayed flat, reporting 19 projects for the month.

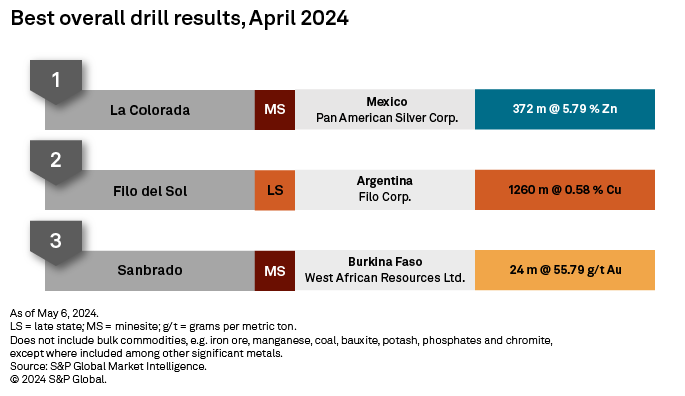

April's top result came from Toronto Stock Exchange-listed Pan American Silver Corp.'s La Colorada silver mine in Mexico, which reported an intersect of 372.1 meters grading 5.79% zinc, 3.91% lead, 77.0 grams of silver per metric ton and 0.11% copper. Of late, the company has reported some of the highest-grade intersects since the discovery of the skarn in 2018, with the highest silver grade to date reported in April. Pan American is expecting to present an updated mineral resource estimate in August 2024.

TSX-listed Filo Corp.'s flagship copper project, Filo del Sol in Argentina, was April's second-best result, with an intersect of 1,260.0 meters grading 0.58% copper. Filo continues with its summer drill program in search of the limits of the deposit, which remains open in several directions.

Australian Securities Exchange-listed West African Resources Ltd.'s Sanbrado gold mine in Burkina Faso rounded out the top three results, with a 24-meter intersect grading 55.79 g/t gold. Recent drilling at the mine has strengthened confidence in 2024 production and the 10-year production plan of the mine, where West African plans to produce 4 million ounces of gold over the next decade.

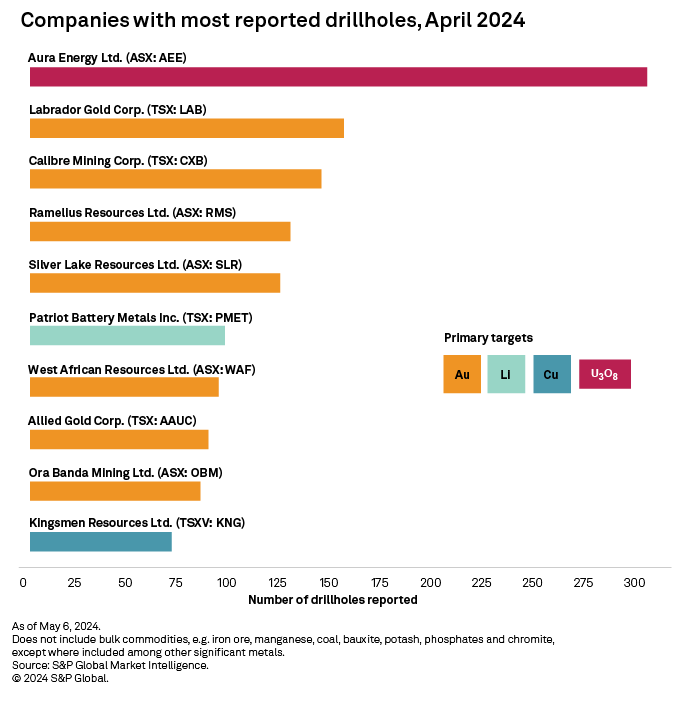

For the second month in a row, ASX-listed Aura Energy Ltd. reported the most drillholes in April, with 301 holes drilled at its Tiris uranium project in Mauritania. The company is conducting a 15,500-meter drill program in hopes of extending mine life in addition to expanding production capacity once operating. An updated mineral resource is expected in the June quarter of 2024.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.