Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 28 Aug, 2024

By Cesar Pastrana

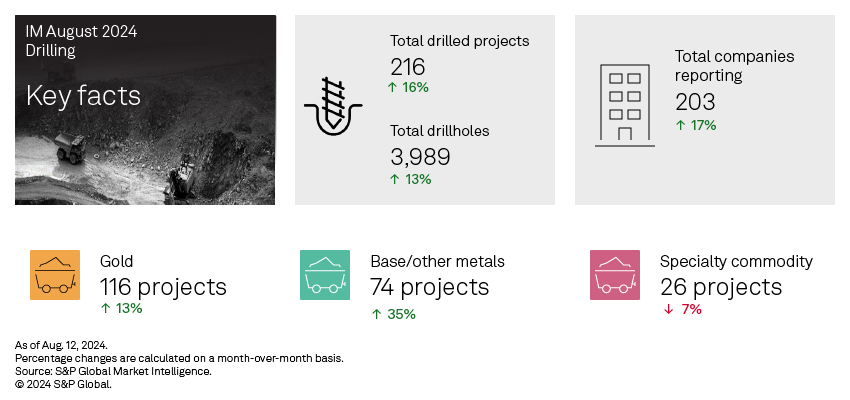

After a slight setback in June, total project drilling rebounded 16% in July, up to 216 projects, pushed by increases in copper and gold projects reporting. Drilling also increased at all project stages aside from minesite; early stage is up 40% and late stage 8%, while minesite is down a marginal 5%. Total reported drillholes increased 13% to 3,989.

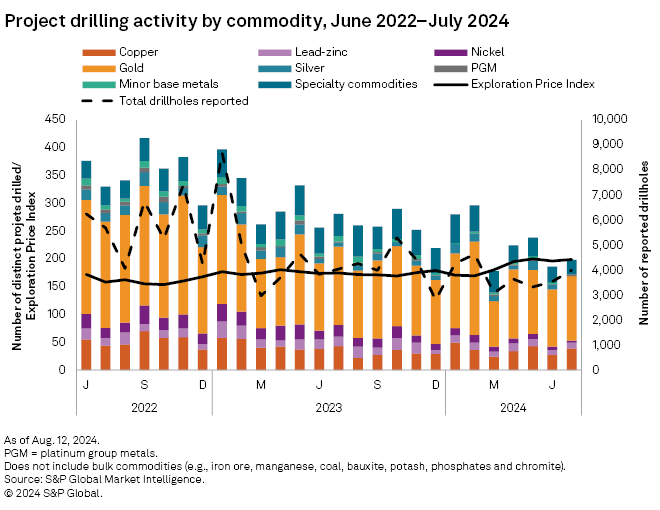

Access July drill results data in the accompanying Excel spreadsheet.

Almost all commodities increased drilling activity in July. After a three-month low in June, copper bounced back with a 44% increase to 39 announcements. Gold was up 13% to 116. Minor base metals increased 167% to 8, while lead-zinc, silver and platinum group metals had marginal increases of one to two projects reporting. In contrast, nickel recorded a 33% decline to 4 projects, the lowest since September 2019, while specialty metals fell to a 27-month low, decreasing 7% to 26 projects. Despite the decline in the number of specialty metal projects reporting drilling, the category's total drillholes increased significantly in July, up 131% to 1,155 — an 18-month high. Small increases in drillhole numbers were reported for copper, platinum group metals, minor base metals and lead-zinc, while gold, nickel and silver all declined.

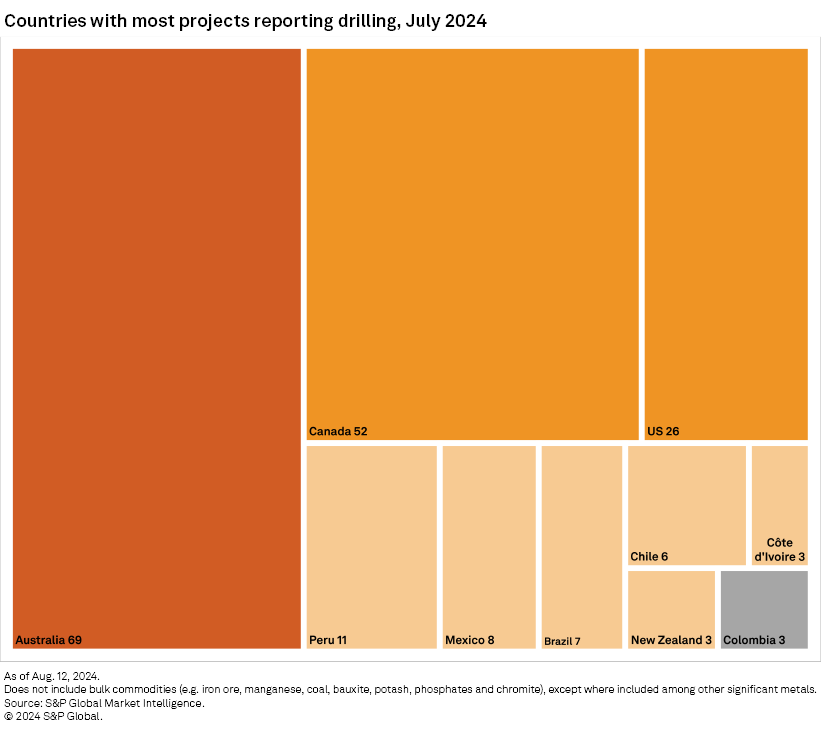

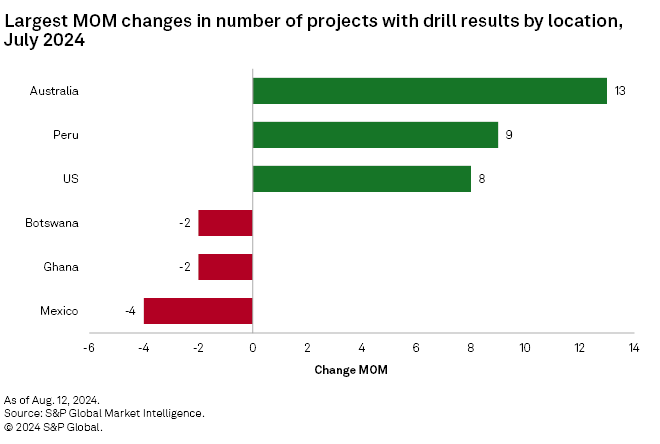

Australia, up 23% month-over-month to 69 projects, continues to top all countries after taking the lead from Canada in June. Projects reporting drilling in Canada increased a slight 6% to 52. The US also recovered, with a 44% rise to 26 projects.

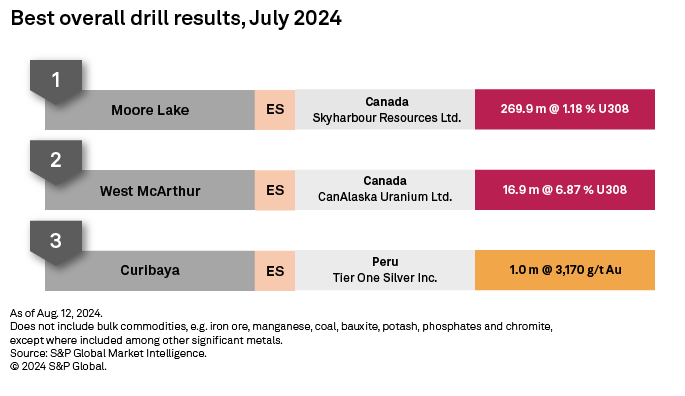

July's top result came from TSX Venture Exchange-listed Skyharbour Resources Ltd.'s Moore Lake project in Saskatchewan. The company reported an intersect of 269.9 meters grading 1.18% uranium. A fully funded 2,500-3,000-meter drilling program at the Maverick and Maverick east zones is planned to further expand, characterize and define the extent of the mineralized zones for the company's drilling program for summer and fall 2024.

The second-best result was from TSX Venture Exchange-listed CanAlaska Uranium Ltd.'s greenfield West McArthur uranium project, also in Saskatchewan. The company reported an intersect of 16.9 meters grading 6.87% uranium. The company's summer drilling program on West Macarthur is progressing with two diamond drills and aiming for approximately 9,000 meters of drilling to achieve an estimated 10 to 14 unconformity target intersections. It is expected to be completed in September.

TSX Venture Exchange-listed Tier One Silver Inc.'s Curibaya silver and gold project in Peru rounded out July's top three results, with a 1.0-meter intersect grading 3,170 grams of gold per metric ton. President, CEO and director Peter Edward Dembicki announced that the focus of the exploration program and upcoming drilling is the Cambaya corridors, which are higher in elevation and where there is potential for high-grade silver mineralization and scale.

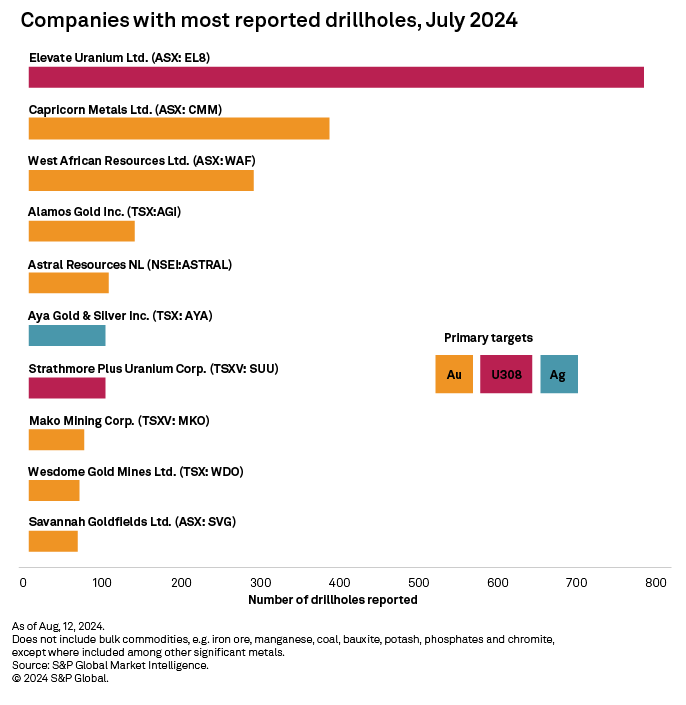

ASX-listed Elevate Uranium Ltd. reported the most drillholes in July, with 755 at its Koppies uranium project in Namibia. As of July 12, the company has drilled 1,278 holes at the project for a total of 34,892 meters. The ongoing drilling is intended to improve confidence and classification of the mineral resource, which is expected to be updated later this year.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.