Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 19 Jul, 2024

By Terry Leone and Tim Zawacki

Commercial lines writers dominated S&P Global Market Intelligence's US property and casualty industry performance rankings for a second consecutive year as 2023 statutory financial results for a number of market participants benefited from the combination of strong top-line growth and continued favorable underwriting profitability.

|

– Access the performance rankings for the top P&C insurers in the analysis – Access our interactive US P&C insurance performance ranking template. |

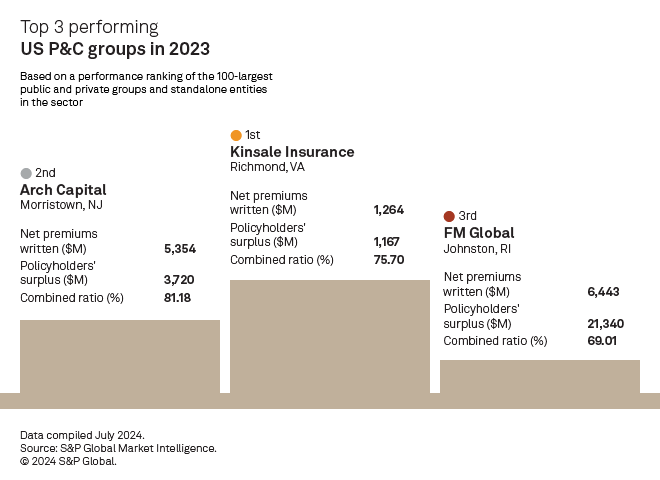

Richmond, Va.-based Kinsale Capital Group Inc. again ranked as the top performer, according to Market Intelligence's analysis of the top 100 US P&C groups based on net premiums written, followed by the US subsidiaries of Arch Capital Group Ltd. and FM Global Group.

All but three of the entities that comprised the top 25 in the performance rankings are deemed by Market Intelligence to have a commercial lines focus. The commercial lines continued to benefit in 2023 from an underwriting margin that outperformed the long-term average even as year-over-year growth in direct premiums written slowed from the double-digit pace established in both 2021 and 2022.

Nine of the top 20 produced at least a quarter of their 2023 direct premiums written on a nonadmitted basis led by Kinsale, a pureplay writer of hard-to-place risks as an excess-and-surplus (E&S) lines company. E&S direct premiums written growth outpaced the P&C industry's overall expansion in 2023 for the seventh consecutive year in 2023, though the extent of the outperformance narrowed relative to the previous four years.

Only two companies we classify as having a personal lines focus ranked among the top 50 performers: The Progressive Corp. and Berkshire Hathaway Inc., the holding company for No. 3 US private-passenger auto insurer Geico Corp. The private auto businesses of both Progressive and Berkshire materially outperformed their peers in 2023 on the basis of their combined ratios in that line.

Strikingly more positive results for the private auto business to begin 2024 might foreshadow a different look and feel to our performance rankings next year following the recent commercial lines dominance.

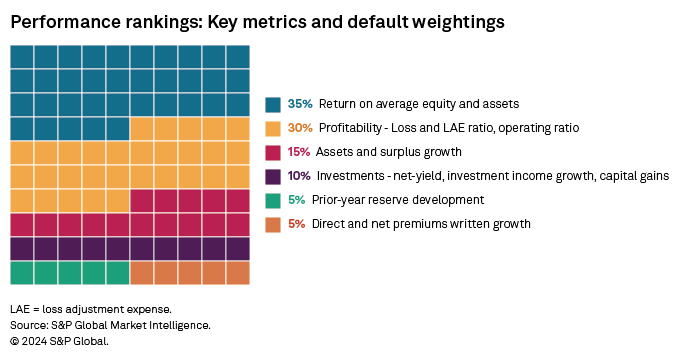

The performance rankings are determined using 13 financial metrics from 2023 statutory filings grouped into six buckets: rates of return, underwriting profitability, balance sheet expansion, investment performance, prior-accident-year reserve development and premium growth. We assign the buckets distinct weightings to calculate performance scores for each of the 100-largest US P&C groups and stand-alone P&C entities based on 2023 net premiums written.

Top of the list

Kinsale not only ranked as the P&C sector's top performer for a second straight year, but it once again claimed that mantle by a wide margin. The company scored particularly high on the basis of growth in premiums, assets and policyholders' surplus. Direct premiums written growth of nearly 42.4% was the highest among the top 100 P&C entities, and Kinsale's $1.57 billion in 2023 volume marked an increase of 105.2% from only two years prior.

According to the management's discussion and analysis section of Kinsale's 2023 annual statement, casualty business accounted for 67.3% of the company's full-year total, with property business accounting for the remaining 32.7%. That represented a significant shift from the 77.2%-to-22.8% mix in favor of casualty business that Kinsale reported in 2022 as the company continued to benefit from what executives had referred to as a "crisis-like environment" in the property markets through the early part of 2023.

Arch Capital, meanwhile, fared particularly well in the performance rankings on the basis of returns on both assets and average capital and surplus. Its return on average surplus of 38.4% trailed only Assurant Inc. among the top 100, for example.

The Bermuda-based company writes a wide range of insurance and reinsurance business through its US subsidiaries, and Arch Insurance Co. credited its programs, property, national accounts and construction lines for its portion of the group's 25.9% increase in net premiums written. Arch Reinsurance Co., meanwhile, said that it achieved 40% net premiums written growth in 2023 as it "deliberately" wrote more business in a hardening reinsurance market.

FM Global, the group led by Factory Mutual Insurance Co., generated its largest net underwriting gain on record at $1.64 billion in 2023, up from its previous high of $1.09 billion in 2022. Its combined ratio of just 69.0% ranked as FM Global's lowest in 14 years. That result is especially noteworthy in that it is inflated by the company's accounting for membership credits to eligible policyholders. FM Global in April 2023 declared $800 million in credits, which it records as an offset to premium at the time of a policy's renewal as opposed to a policyholder dividend.

President and CEO Malcolm Roberts, writing in FM Global's annual report, said 2023 was "one of the most successful years" in the company's history. That's no small statement, considering that the company traces its roots back to 1835. FM Global's loss and loss adjustment expense ratio, excluding prior-year reserve development of 40.5%, ranked lowest among the 100 largest P&C groups. Its operating ratio placed second best.

Our other top-10 performers in 2023 were as follows: the US P&C subsidiaries of Aspen Insurance Holdings Ltd., Assurant, RLI Corp., Trupanion Inc., American Financial Group Inc. (doing business as Great American Insurance), Skyward Specialty Insurance Group Inc. and Berkshire.

Personal lines performance

Although industry-level underwriting losses in the private auto line narrowed in 2023 from a historically poor 2022, Progressive and Berkshire were two of the three entities among the top 18 private auto groups to have produced combined ratios in that business of below 100% in 2023, excluding policyholder dividends. Berkshire's overall score in the performance rankings also benefited from the shifting of investments between its insurance and non-insurance entities, which in 2023 resulted in an extraordinary level of net realized capital gains.

In addition, both Progressive and Berkshire generated much higher percentages of their 2023 personal lines direct premiums written business from the private auto business. The top 15 US personal lines writers collectively generated 71.1% of their personal lines direct premiums written from the private auto business, while Progressive's and Berkshire's concentrations were 94.2% and 98.6%, respectively. Natural catastrophes, particularly severe convective storms, made for a challenging 2023 for companies that write homeowners and farmowners business on a national basis or in those geographies that experienced high levels of weather-related losses.

Select other residential property insurers fared better due to a relatively benign year for catastrophes in a state known for hurricane-related volatility. The Florida-based and focused HCI Group Inc. stood as the No. 1 personal lines-focused writer when running our performance ranking including a population of the top 50 personal lines-focused groups and stand-alone entities based on 2023 net premiums written. Primary subsidiary Homeowners Choice Property & Casualty Insurance Co. Inc. incurred nearly $21.8 million in net losses in 2022 due to hurricanes Ian and Nicole but only $1.8 million in net losses in 2023 owing to a single hurricane.

Methodology

To determine the performance scores of the individual P&C groups, we calculated the mean results for each of the 13 performance metrics and then determined each company's deviation from those means. The deviation from the mean was standardized using a Z-test so the different metrics chosen could be compared. To minimize the effect of outliers, we set a range limiting the amount of deviation recorded for each company. The metrics reflect consolidated statutory financials for each group, which are limited to US-domiciled entities that file annual statements with the National Association of Insurance Commissioners.

The 13 weighted deviations were then added together to calculate a final score. The final scores were then ranked from highest to lowest for the 100 companies.

In addition to the 35% weighting assigned to rates of return, we applied the following weightings to the other five buckets: 30% to underwriting profitability, which includes the loss and LAE ratio adjusted for reserve development, and operating ratio; 15% to asset and surplus growth; 10% to investment performance was weighted 10%; and 5%, apiece, to reserve development and premium growth.

The respective weightings with a heavy emphasis on returns and underwriting profitability reflect our view that strong earnings represent the most important measure of a company's performance. Our weightings deemphasize investment results as the varying liability profiles and liquidity requirements of the various business models that are active in the sector inevitably lead to a wide array of outcomes in the metrics that contribute to our investment results bucket. These include growth in investment income, the net yield on invested assets and the ratio of realized capital gains and losses to average surplus.

Companies deemed to have an accident-and-health or commercial financial lines focus are excluded from this analysis. In the case of Arch Capital, the company's significant mortgage insurance presence undoubtedly contributed to its overall score in the performance rankings though it constituted only 15.4% of the group's 2023 direct premiums written. The No. 2 US writer of mortgage guaranty direct premiums written in 2023, Arch Capital's combined ratio for its mortgage insurance business through its US P&C subsidiaries was negative 9.3% in 2023 as compared with a positive 99.0% for the rest of its book.

Our interactive template allows users to adjust weightings for each of the six buckets to emphasize or deemphasize particular categories. Scores generated by the template may differ from those referenced in this article due to the receipt of new statutory financial information and/or revisions to our group structures.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.