S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 30 Sep, 2021

By 2025 worldwide:

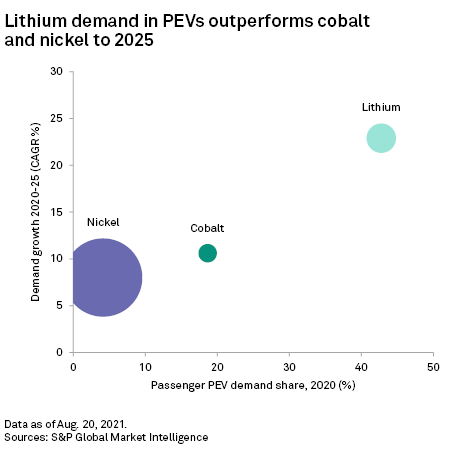

The focus on the renewable energy transition has intensified since March 2020, with the world's major economies — the U.S., China and Europe — establishing carbon-neutrality goals through to 2060. As policymakers injected unprecedented amounts of stimulus into the global economy toward recovery from the COVID-19-induced downturn, some of this investment was directed toward boosting the rollout of green energy technologies to reduce global carbon emissions. Based on S&P Global projections for the rollout of solar, wind and EVs to 2025, together with analysis of metals intensities in these use cases, S&P Global Market Intelligence forecasts demand to grow by a CAGR of 15% for copper, 35% for lithium, 28% for cobalt and 35% for nickel.

In this article, Market Intelligence assesses the impact of the renewable energy transition and EV market growth on demand for key industrial metals out to 2025. We begin by outlining capacity growth assumptions for solar and wind energy and EV sales over the forecast period.

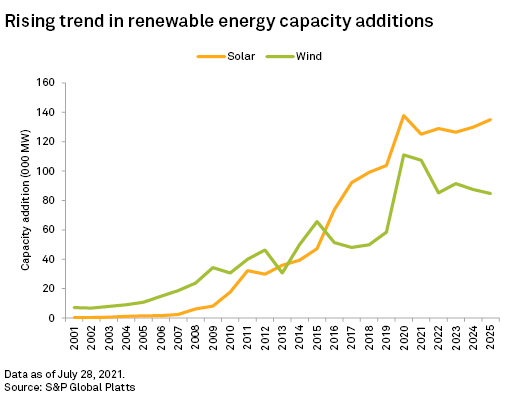

Future of global solar and wind generation

The most prominent technologies related to renewable energy generation are solar photovoltaic, or PV, panels and wind turbines. Installed capacity of solar and wind energy worldwide increased 19% annually from 2016 to 2020, according to S&P Global Platts, spurred by government incentives and improved cost competitiveness. Data from the International Energy Agency, or IEA, shows that installation of solar PV panels is consistently cheaper than building new coal- or gas-fired power plants in most countries. While the COVID-19 pandemic is estimated to have reduced global energy demand by 4%-5% in 2020, data from S&P Global Platts indicates that solar and wind energy saw a record 249 GW of net installed capacity additions as policy deadlines sped up the pace of investment in renewable energy. Net additions to global solar capacity were up by one-third while wind capacity almost doubled year over year in 2020, dominated by Chinese growth. Forecast net capacity installations for solar and wind combined are estimated at 217 GW annually over 2021-25, according to S&P Global Platts.

Plug-in electric vehicles

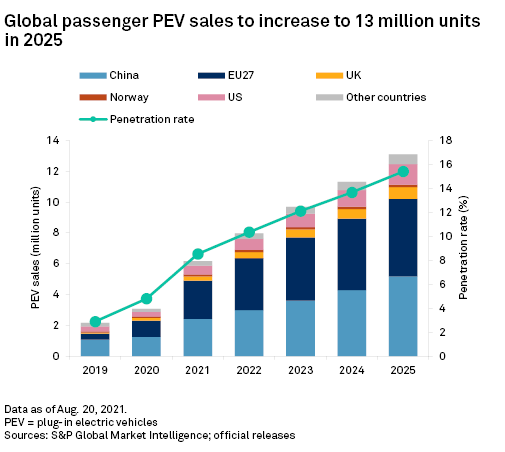

Market Intelligence estimates global passenger PEV sales reached 3 million units in 2020, a 42% increase year over year despite a 16% decline in overall passenger car sales. We forecast a 101% rise in global PEV sales to 6.2 million units in 2021 on expected strong second-half sales. Buoyed by increasing PEV model choices, and the full implementation of the EU's fleet emissions penalty, the PEV penetration rate is expected to hit 8.5% in 2021, up from 4.8% in 2020. Downside risks to PEV sales in 2021 include the global shortage of electronic chips, which has now impacted PEV production after having recently dampened overall auto sales in Europe and China.

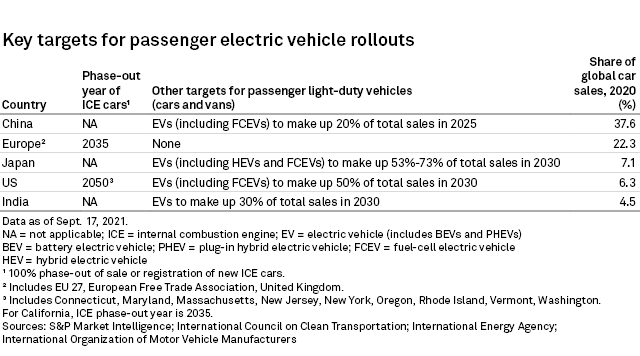

We forecast global PEV sales to increase to 13.1 million units in 2025, with China regaining the top position as the world's biggest PEV market with 5.2 million sales, compared with 5.0 million for the EU. PEV sales in the U.S. are expected to benefit from enhanced policy support under the current administration and rise to 1.3 million in 2025 from an estimated 720,000 units in 2021. PEV sales will continue benefitting from favorable consumer-side incentives including subsidies and public funding for charging infrastructure as well as producer-side "sticks" compelling lower emissions and higher fuel economy. The culmination of policy momentum has intensified the race to win market share by offering cost competitive mass-market models and increasing PEV investments at the expense of reducing or phasing out internal combustion vehicles, thus accelerating global automakers' transition to PEVs.

Beyond passenger PEVs, it is worth noting the increasing penetration of electric buses, or e-buses, in the market, with average annual global sales of 100,000 units from 2016 to 2020. In 2020, China accounted for most, or 27%, of e-bus sales globally, according to the IEA. In 2025, global e-bus sales are expected to reach 333,341 units, according to the IEA, supported by policy initiatives to electrify public transport fleets.

Industrial metals demand impact

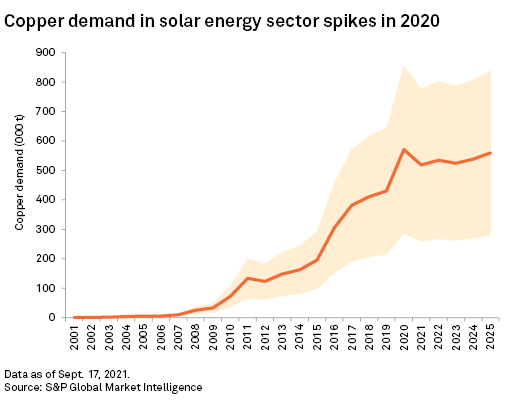

Copper is mainly used for electrical purposes in green technologies. In solar PV panels, copper is used in wiring, cabling, earthing, inverters, transformers and ribbons. As the copper intensity in solar PV panels depends on their size and model, demand could vary from 280,000 tonnes to 840,000 tonnes in 2025. We project global copper demand in solar PV panels in 2025 of 560,000 tonnes, which is very similar to 2020 demand when net additions to global solar capacity reached a record high. Given our base-case scenario of a tight copper market balance, however, the wide demand variation could have a significant impact on copper prices.

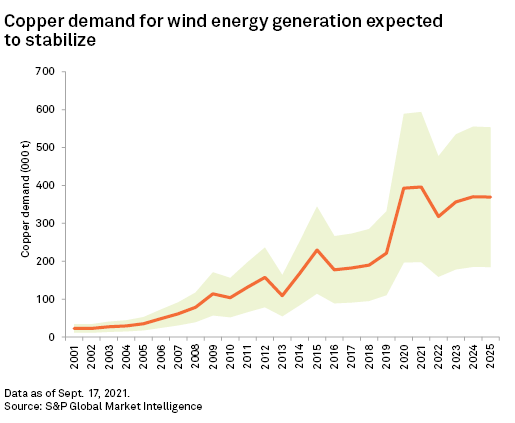

Copper intensity in wind turbines varies with the technology, which can impact copper demand conditional on the evolution of market share. While direct-drive turbines require on average 30%-90% more copper than gearbox models, they are most commonly deployed in offshore wind generation, which is projected to increase to 18% of the net installed wind capacity in 2025 from an estimated share of 8% in 2021, according to S&P Global Platts. We forecast global copper demand in wind generation to reach 370,000 tonnes in 2025, lower than the estimated 393,000 tonnes in 2020. This is driven through net additions in onshore wind energy having surged in 2020 and which are expected to average 27% lower annually over the 2021-25 period. In a high-copper-intensity wind generation scenario, copper demand reaches 553,000 tonnes, while deployment of low-copper-intensity technologies result in 184,000 tonnes of copper demand in 2025.

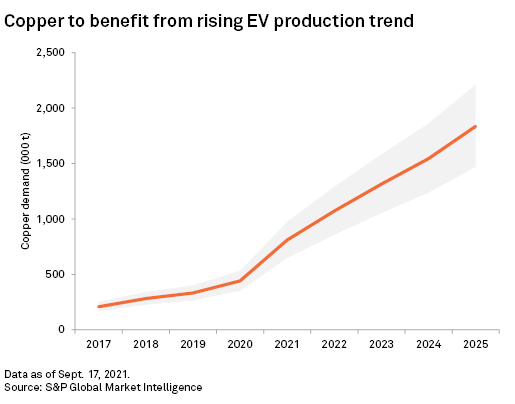

Copper is a major component of EVs; it is used in the anode current collector of lithium-ion batteries, in the stator and rotor of induction motors, in inverters and wiring. Pure battery electric vehicles, or BEVs, which are powered exclusively by the electricity stored in their battery, are more copper-intensive than plug-in hybrid electric vehicles, or PHEVs, which have both a battery-powered motor and an internal combustion engine. We project that BEV sales will account for 78% of total PEV sales by 2025. Combined, BEVs and PHEVs will demand 1.74 Mt of copper in 2025 from an estimated 772,000 tonnes in 2021; copper demand in electric buses is projected to account for approximately 92,000 tonnes in 2025, compared with 37,000 tonnes in 2021.

In addition, global copper demand will be positively impacted by an expansion in electrification infrastructure to support growth in energy demand, as well as from the expansion and upgrade of telecommunications and EV charging networks, particularly in China and the U.S.

Battery materials

Our demand analysis for lithium, cobalt and nickel in this study is focused on usage in lithium-ion batteries for electric vehicles.

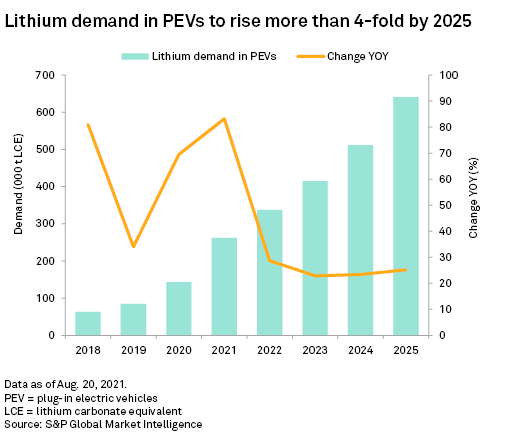

Lithium-ion batteries are used in electronic products and as rechargeable batteries in PEVs. These batteries are expected to remain the dominant battery technology for PEVs, at least to 2025, given the sharp reduction in its production cost over the past couple of decades. We forecast global lithium demand in PEV batteries to increase from 143,222 tonnes of LCE in 2020 to an estimated 262,343 tonnes and 640,517 tonnes of LCE in 2021 and 2025, respectively.

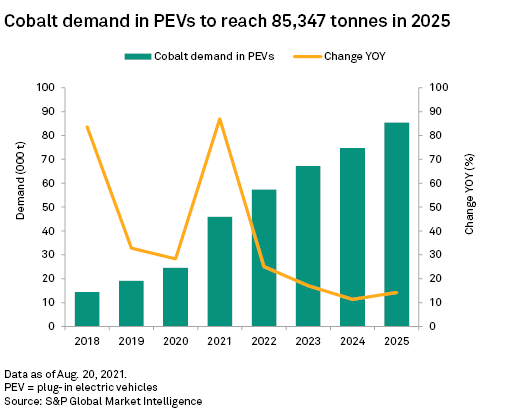

Cobalt and nickel are key metals used in lithium-ion battery cathodes, with the former to ensure battery stability and safety, while the latter enhances energy density and vehicle range. Cobalt has a range of metallurgical applications including super-alloying, hardened cemented carbides and plating; usage in the chemical sector includes PEV batteries, electronics, catalysts, other batteries, ceramic dyes and tires.

Common battery chemistries in PEVs today are the nickel-manganese-cobalt, or NMC, NMC532 and NMC622 batteries as well as lithium-iron-phosphate, or LFP, batteries. Currently, lithium-ion battery innovation is focused on improving energy density and lowering costs, leading to two key trends: the development of nickel-intensive NMC chemistries for premium BEVs and improvements in the energy density of pack-level LFP batteries that contain no nickel or cobalt for entry- and mass-market BEVs.

In particular, the shift to more nickel-intensive NMC batteries has been driven by cobalt's comparatively high cost and supply concentration risks, as well as from nickel's ability to increase battery energy density. With around 70% of global cobalt supply coming from Democratic Republic of Congo, the inherent risks to the supply chain have prompted battery makers to reduce the amount of cobalt used in lithium-ion batteries. The broader adoption of nickel-intensive batteries, however, has been hampered by safety concerns, with numerous reports of vehicles catching fire.

We expect continued relevance of cobalt in PEV battery chemistries in the foreseeable future and forecast global cobalt demand in PEV batteries to increase from 24,520 tonnes in 2020 to 45,857 tonnes in 2021 and 85,347 tonnes in 2025. Our recent scenario analysis(opens in a new tab), however, suggests that future cobalt demand could be drastically lowered by the higher uptake of low- or no-cobalt batteries.

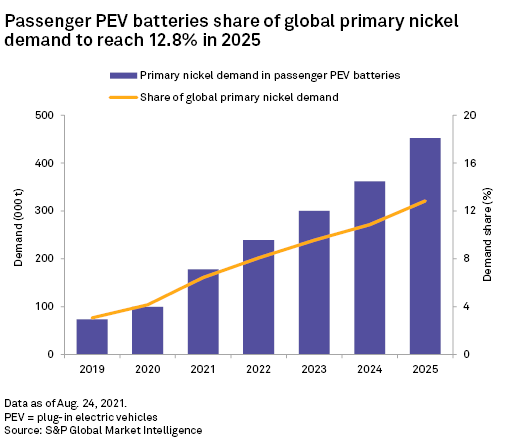

Nickel demand will benefit from both rising passenger PEV sales and higher usage in passenger PEV batteries as producers seek to maximize driving ranges, especially for more premium vehicles. We forecast primary nickel consumption in PEV batteries to increase at a CAGR of 26.2% between 2021 and 2025, from an estimated 178,000 tonnes to 451,995 tonnes over the period. We consequently expect passenger PEV batteries' share of global primary nickel demand to grow from 6.4% in 2021 to nearly 13% in 2025. Global EV producers such as Tesla, however, have expressed concerns regarding the shortage of environmental, social and governance-friendly battery-grade nickel for use in lithium-ion batteries. If not addressed, such concerns could allow technologies such as LFP to gain market share at the expense of nickel-containing batteries, which would have a negative impact on nickel demand from passenger PEV batteries in the long term.

Conclusion

Copper demand from solar and wind energy and from EVs, including e-buses, is projected to account for 2.8 Mt in 2025, which represents approximately 10.8% of the total forecast global copper demand. The wide variation in copper usage intensity in the renewable energy sector, however, simultaneously poses significant upside and downside risks to copper demand to 2025. Lithium demand will benefit from stable intensity of use in lithium-ion batteries and from high passenger PEV demand share over 2020-25. The lithium and cobalt markets are expected to grow faster than the larger nickel market, though cobalt is most at risk of substitution among these industrial metals.

Theme

Products & Offerings