S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 29 Feb, 2024

By Keith Nissen

With the exception of China, cinema attendance has been gradually returning to near historic levels. However, the percentage of frequent movie-goers varies greatly across the markets surveyed in S&P Global Market Intelligence Kagan's Asia, Europe and US Consumer Insights surveys.

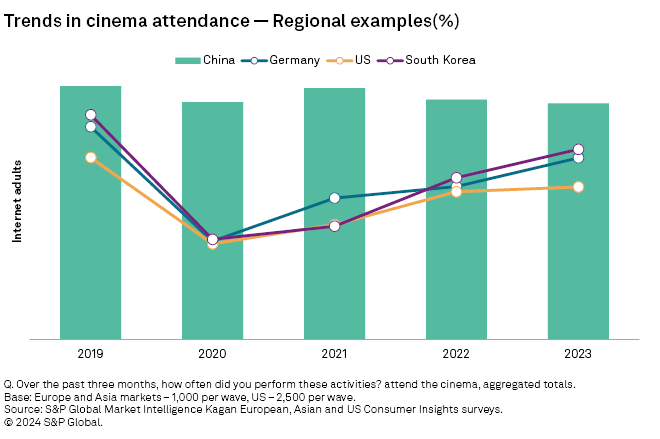

➤ Cinema attendance in China has remained very stable over the past four years, according to Kagan's Consumer Insights surveys. Most other surveyed markets in Asia, Europe and the US showed a steep decline in 2020 (due to the pandemic), followed by a gradual increase in attendance in each following year.

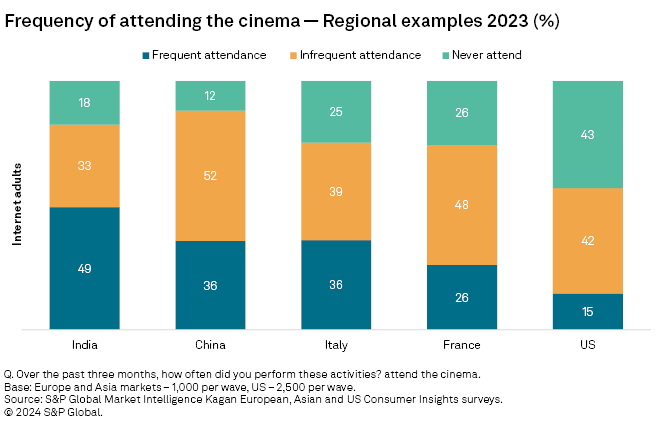

➤ The percentage of frequent movie-goers (those attending the cinema more than once a month) varies greatly from market to market, ranging from 49% in India to only 15% in the US.

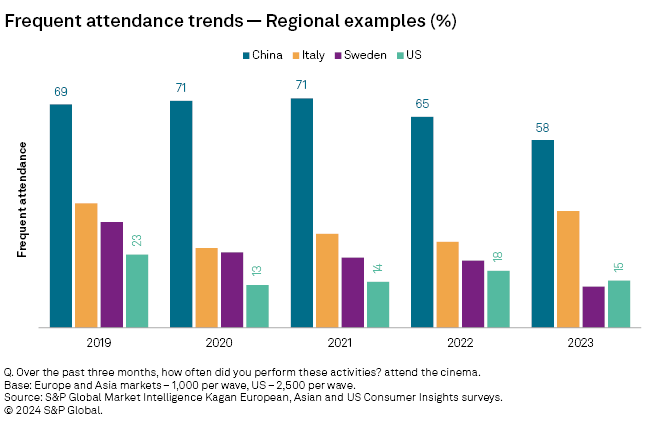

➤ With the exception of India, the percentage of frequent movie-goers has remained essentially flat or has declined over the past four years. China (-29 percentage points) and Sweden (-20 percentage points) showed the largest declines.

Cinema attendance has been challenged over the past decade as more and more titles have become accessible for at-home viewing. On top of this, in many markets around the world, the COVID-19 pandemic halted film production, temporarily closed movie theatres and delayed new releases. With this as a backdrop, Kagan international and US Consumer Insights surveys conducted over the past four years can be used to highlight and compare cinema attendance trends in key global markets.

The historic survey data from China shows that cinema attendance has remained extremely strong over the past four years, with 9 in 10 internet adults reporting attending the cinema over the previous 90 days. Movie theatres in China did not close countrywide during the pandemic and as a result, cinema attendance showed only a marginal drop during 2020.

In South Korea, the US and European markets, where the pandemic forced widespread closure of movie theatres at various points, the historic survey data shows cinema attendance falling by half in 2020 compared to the previous year. The data indicates that cinema attendance has gradually rebounded in subsequent years, but as of 2023, it still has not returned to pre-pandemic levels. In South Korea, 79% of internet adults attended the cinema in 2023, compared to 84% in 2019. In Germany and the US, 68% and 57% of internet adults, respectively, attended the cinema last year, both representing an 11 percentage point decline from 2019.

While the majority of internet adults in all surveyed markets report attending the cinema during 2023, the frequency of movie-going varies from market to market. For example, in India, approximately half (49%) of surveyed internet adults cited attending the cinema more than once a month (frequent attendance) during the previous three months in 2023. In China, the majority (52%) of surveyed internet adults revealed they attend the cinema once a month or less (infrequent attendance). In Italy, the percentage of frequent and infrequent movie-goers is split fairly evenly, compared to France, where those indicating infrequent attendance outnumber frequent movie-goers nearly 2 to 1. The variance in frequency of cinema attendance is even more pronounced in the US, where only 15% reported visiting a movie theatre at least once a month, compared to 42% attending on an infrequent basis.

The historical data also reveals a trend toward declining numbers of frequent movie-goers across nearly all surveyed markets. Even though overall cinema attendance in China was unaffected during the pandemic years, the percentage of frequent movie-goers dropped 7 percentage points year-over-year and 11 percentage points since 2019 to 58%. In the US, the percentage of frequent movie-goers has declined 8 percentage points since 2019, while in Sweden, frequent movie-goers have declined by a substantial 20 percentage points, dropping to only 13% in 2023.

In contrast, Italy is an example where the percentage of frequent movie-goers has remained stable over the past four years. India was the only surveyed market where the percentage of frequent movie-goers increased, growing from 41% in 2019 to 49% in 2023.

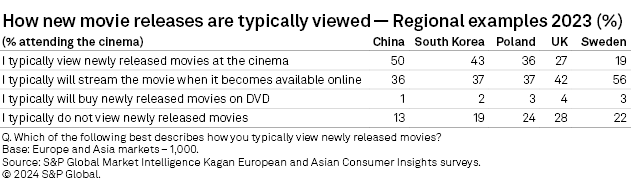

As mentioned earlier, access to in-home viewing of new movie releases has detrimentally impacted cinema attendance. The 2023 survey data shows that in China, half (50%) of movie-goers said they typically view new movie releases at the cinema and another 36% typically stream new movies online. By comparison, only 19% of movie-goers in Sweden indicated they typically will view new movie releases in the theatre and 56% view new titles online. Across all surveyed markets, the data shows that at least 7 in 10 movie-goers will typically view new movie releases either in the theatre or online and very few will wait to buy a DVD of a new title before viewing.

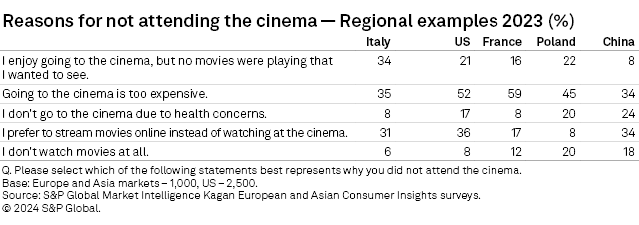

There are also a variety of reasons why consumers do not attend the cinema. For instance, in France, 59% said that going to the cinema was too expensive. Among Americans who are not movie-goers, the cost of movie theatre tickets (52%) was also a top reason for not attending. About one-third of non-movie-goers in Italy, China and US said they prefer watching new movie releases at home instead of at the cinema. A portion of non-movie-goers in Poland (20%) and China (24%) also cited health concerns, suggesting the residual effects from the pandemic may still be somewhat present.

The Kagan European and Asian Consumer Insights surveys were conducted during December 2019-2023 with each wave consisting of approximately 1,000 internet adults per market in the UK, France, Germany, Italy, Sweden and Poland, as well as China, South Korea and India. Each survey has a margin of error of +/-3 ppts at the 95% confidence level. Kagan US Consumer Insights surveys were conducted during the third-quarter of 2019-2023, consisting of approximately 2,500 internet adults per wave. Each US survey has a margin of error of +/-1.9 ppts at the 95% confidence level. Percentages are rounded to the nearest whole number. Survey data should only be used to identify general market characteristics and directional trends.

To submit direct feedback/suggestions on the questions presented here, please use the “feedback” button located above, directly under the title of this article. Note that while all submissions will be reviewed and every attempt will be made to provide pertinent data, Kagan is unable to guarantee inclusion of specific questions in future surveys.

Consumer Insights is a regular feature from S&P Global Market Intelligence Kagan.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.