Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 7 Mar, 2023

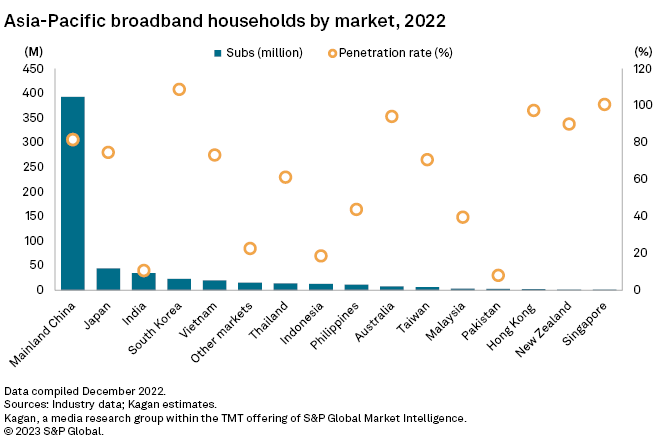

Fiber deployment across markets and the demand for fast and reliable internet connection increased Asia-Pacific's customer base to 596.5 million as of year-end 2022, which translates to a 50.7% household penetration rate. Our recent surveys show that fixed broadband service providers earned $82.83 billion in subscription revenues, representing growth of 7.2% year over year. Average blended broadband revenue per user, however, remained nearly flat at an estimated $11.91 per month in 2022 compared with $11.95 per month in 2021.

Key 2022 fixed broadband market developments in the Asia-Pacific region:

We forecast that the number of fixed broadband subscriptions in the region will rise to 726.0 million by 2027 and broadband revenues will reach $101.36 billion over the same period.

Aggressive rollouts of fiber infrastructure in recent years, through the initiatives of several national broadband plans, have come to fruition and have made FTTH the leading broadband technology across the region. Mainland China and emerging territories in South Asia and Southeast Asia have invested in fiber network development, which has resulted in more homes passed in 2022.

Fiber's share of broadband subscribers increased from 21.4% in 2012 to 84.1% in 2022, driven by growing demand for reliable and high-speed internet in the region. By year-end 2022, fiber had become the leading broadband platform in the majority of Asia-Pacific markets.

Fixed wireless and satellite, considered niche broadband technologies, are particularly useful in residential and rural areas where an internet connection is deemed to be inaccessible, pricey and inadequate. Telcos are investing in FWA, satellite broadband and 5G technologies, as the potential for growth is evident.

In the region, FWA had 9.3 million subscribers, while satellite had 237,000 subscribers by year-end 2022. Over the next five years, our model indicates that fixed wireless and satellite will sustain their growth in the long term.

Asia-Pacific is steadily recovering from the COVID-19-related slump, with the World Bank and other national government agencies reporting regional gross domestic product growth in 2021 after a contraction in 2020. Factors such as the reopening of economic sectors, infrastructure investments, manufacturing and services sectors' performance, and progressive easing of domestic and international travel restrictions have boosted consumer spending in 2021 and 2022.

Of the 15 markets we analyzed in 2022, Taiwan had the most affordable broadband services while the Philippines had the most expensive services. In general, fixed broadband services in Asia-Pacific are modestly priced.

Already a client? Click here to access the full research, including detailed data presentations and market analysis, updates on fiber deployment, and potentials of fixed wireless access.

Global Multichannel is a service of Kagan, a solution within S&P Global Market Intelligence's TMT offering.

Blog