Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 25 Mar, 2024

By Henry Chiang, Liam Hynes, and Daniel J. Sandberg

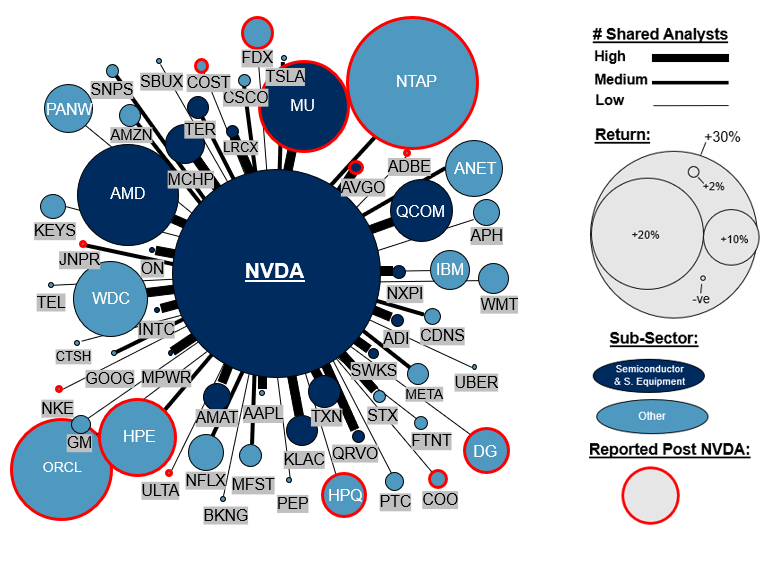

AI, geopolitics, labor ‘rightsizing’ (and other layoff euphemisms), and a sanguine tone characterized the Q4’23 earnings season. Nvidia is riding the AI wave and pulling its connected network along with it. An NLP analysis of earnings call transcripts was used to quantify the discussion.

Figure 1: NVIDIA’s Connected Company Returns 3 weeks post Q4’2023 earnings.

Source: S&P Global Market Intelligence Quantamental Research. Data as Data as at 03/18/2024.

Key takeaways:

(with your S&P Global Marketplace Login)

TDA was launched in October 2019 and is productized from Quantamental Research’s previous publications with an advanced suite of analytics and metrics added in May 2022. It is an off-the-shelf NLP solution that tailors to our Machine-Readable Transcripts and outputs 800+ predictive and descriptive analytics for equity investing and various data science workflows. The analytics could be accessed via SQL, Snowflake or (DataBricks) Workbench.

This dataset aggregates data from earnings calls delivered in a machine-readable format for NLP applications with metadata tagging. Among its key features, the data set captures the different segmentations of earnings calls in the follow ways:

Read the Full Report