S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 2 Aug, 2023

By Joe Mantone, Annie Sabater, Anna Duquiatan, and Peter Brennan

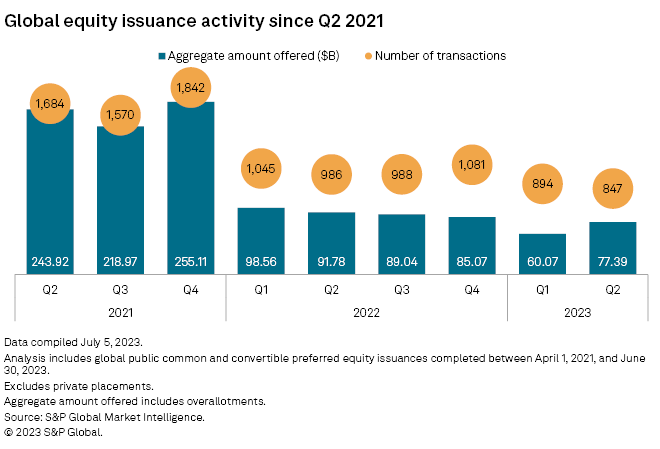

For dealmakers hoping for a recovery, second-quarter equity issuance activity offered a reason for optimism.

The total value of global equity deals increased 28.8% sequentially, making the second quarter the first period to record a quarter-over-quarter increase in more than a year. Still, the $77.39 billion raised in the second quarter fell below levels reached in each quarter during 2022 and was two times lower than the quarterly average of 2021, according to S&P Global Market Intelligence's latest global M&A and Equity Offerings Market Report.(opens in a new tab)

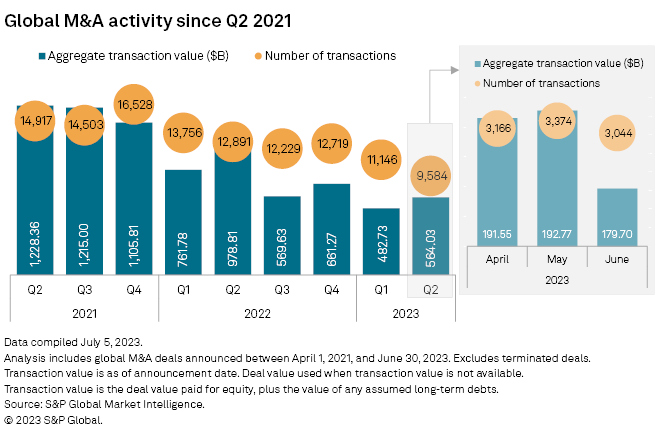

Announced M&A also provided some quarter-over-quarter growth, increasing 16.8% to $564.03 billion in the second quarter. But the total equates to a 42.4% decline from the year-earlier period, and the output is reminiscent of the lows reached during the height of the COVID-19 pandemic.

Access the latest global M&A and Equity Offerings Market Report.(opens in a new tab)

A rapid recovery in the dealmaking environment is not on the horizon. The rising rate environment will continue to increase the cost of acquisition financing, limit economic growth potential, and plague M&A and equity transactions. Still, the lack of issuance and acquisitions over the last six quarters has led to pent-up demand, and the low base of activity creates opportunities for some pockets of growth. This occurred in the second quarter, when the total value of global announced M&A increased 16.8% sequentially and the total value of global equity issuance increased 28.8% sequentially.

Investors remain risk-averse, but the large IPOs that found support included businesses with proven track records, such as those split off from large corporates. The regulatory environment, especially in the US, is acting as a deterrent to large-scale M&A. Microsoft Corp. prevailed in a court battle with the US government over its deal for Activision Blizzard Inc., but the challenges involved in the process underscore the difficulties companies face when pursuing big-ticket transactions.

Investment bankers are cautiously optimistic that the equity issuance activity will lead to some sustained momentum. Deals from mainland China helped boost the global equity totals, with the number of transactions increasing 12.1% quarter over quarter to 102 and the total value of deals increasing 55.5% quarter over quarter to $22.01 billion. Larger deals came to market in the region with four valued at more than $1 billion, including two semiconductor industry IPOs: a $1.66 billion deal from Nexchip Semiconductor Corp. and a $1.39 billion deal from Semiconductor Manufacturing Electronics (Shaoxing) Corp. Issuance from China is expected to remain active as the IPO pipeline has built up, and regulatory changes can make it easier for companies to go public.

Along with mainland China, issuance in the US helped drive global quarter-over-quarter growth. While investors remain risk-averse, some companies that have been involved in spinoffs are finding support when issuing shares. A spinoff of Johnson & Johnson's consumer health business, Kenvue Inc., was the largest global IPO of the first half, at $4.40 billion, and ranked as the largest US IPO in more than a year. Three other recently split-off companies — Corebridge Financial Inc., Nextracker Inc. and GE HealthCare Technologies Inc. — returned to the market and executed follow-on offerings that ranked among the top 10 US equity issuances of the second quarter.

When it comes to announced M&A, larger deals have been more challenged, especially in the US where President Joe Biden's administration has made antitrust reviews a priority. The US government was dealt a setback when a court ruled against the Federal Trade Commission's attempts to block Microsoft's $68.99 billion proposed acquisition of Activision Blizzard.

Still, the government opposition to the deal underscores the challenges that companies face when seeking regulatory approval on larger transactions, and some have abandoned the process. In May, The Toronto-Dominion Bank and First Horizon Corp. terminated their $13.67 billion deal because of lack of clarity over regulatory approval.

The difficulties in getting approvals will continue to be a deterrent to large-scale M&A. Those involved in smaller deals in the US also face the prospect of having to extend more resources to getting M&A approval. The US Justice Department and FTC released a proposal that if enacted would substantially increase the information that many companies involved in M&A need to provide to government when seeking approval.

With the US being the largest M&A market, an increase in the regulatory burden for smaller transactions would only add another obstacle to the dealmaking recovery.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.