Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 29 Nov, 2023

The uranium spot market rally started in early 2022 due to geopolitical instability, continued supply cuts and utility companies renewing their long-term uranium supply contracts. Other factors influencing the now-bullish market include changing global sentiment, with plans announced to restart or extend the operational life of nuclear power plants, for example, in Japan, together with the construction of 63 new reactors, notably in China, India and Turkey.

➤ Uranium spot prices continued rebounding through year-end 2022, increasing 15.2% year over year, before rising a further 16.6% by the end of October 2023.

➤ Fears of sanctions on Russia due to the war in Ukraine and a gloomy global economic outlook only affected prices in the short term, with 2022 closing out at a 10-year high.

➤ A spate of significant M&A activity has been ongoing in the mining sector, with a total of seven deals in 2022 valued at almost $824 million at completion. One deal per quarter in 2023 makes for 11 consecutive periods with at least one uranium-focused deal announced.

➤ Exploration budgets are slowly rising on market tailwinds, reaching a six-year high in 2023.

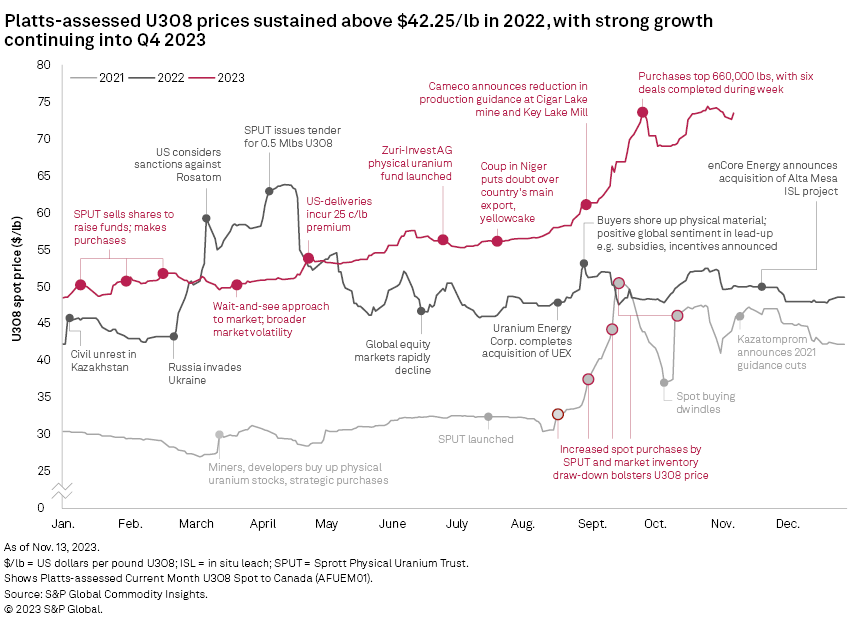

Uranium prices rose in 2022, marking a shift in sentiment to the nuclear commodity. The Platts-assessed price reached $48.60 per pound at year-end, compared with $42.20/lb at year-end 2021. The highest recorded value of $63.80/lb in 2022 was a 26.3% increase against the 2021 peak of $50.50/lb; the high in 2023 to date of $74.40/lb on Oct. 31 is 16.6% greater than the full-year 2022 high. With a little over one month remaining in the year and external influences affecting the market, the spot price could continue to rise.

The existence of physical funds in the primary uranium space has a clear hold over the spot price. On July 19, 2021, it was announced that Sprott Asset Management LP — a subsidiary of Sprott Inc. — and the former Uranium Participation Corp. had closed on its deal first announced in April 2021, forming the publicly listed Canada-based Sprott Physical Uranium Trust Fund (SPUT). This helped drive full-year mean NYMEX spot prices to $35.56/lb, up 51.2% against a low of $23.52/lb (NYMEX) in 2017. SPUT's aggressive buying strategy of yellowcake pushed Platts-assessed prices to $50.50/lb in September 2021, a high for the year. The company holds 62.61 million pounds U3O8 in its inventory, with a stated market value of $4.8 billion as of Nov. 17, compared to a launch volume of 18.1 million pounds. Purchase volumes have been comparatively subdued recently, likely due to the exacerbation that even moderate buying could well have on the spot price.

Concerns have been raised regarding the potential monopolization of the uranium market with SPUT's stockpiling of yellowcake; competitors are also joining funds, however. JSC National Atomic Co. Kazatomprom said in 2021 that it had agreed to finance 48.5% of a founder's round investment of $50 million toward the fund Anu Energy Oeic Ltd., while Yellow Cake PLC announced soon after that it intended to raise equity to purchase further physical uranium inventory. Yellow Cake also maintains a strategic partnership with Uranium Royalty Corp., a company that predominantly focuses on uranium royalty interests but also participates in physical uranium transactions.

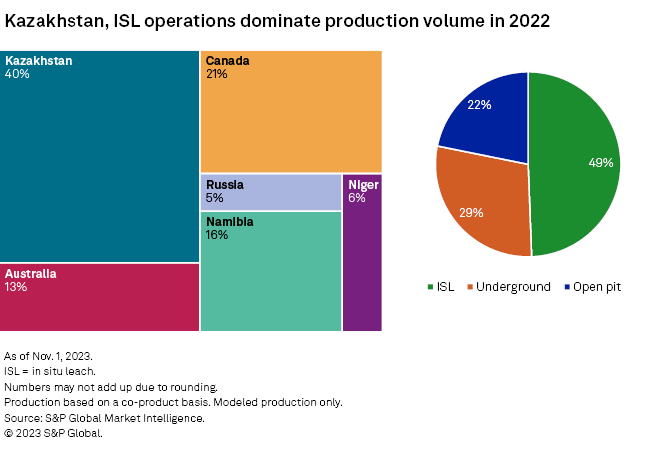

In 2021, company strategies, such as SPUT's aggressive yellowcake purchasing, undoubtedly impacted the uranium spot price, but in 2022 the factors most influencing the market were primarily related to geopolitical tensions. Civil unrest and deadly protests in Kazakhstan began in early January, triggered by a spike in gas prices. The turmoil was short-lived, however, and the potential for a supply deficit drove prices up to $45.75/lb on Jan. 6. Unrest in Kazakhstan, the world's largest uranium producer, underscored the necessity for diversified supply portfolios.

Shortly thereafter, Russia invaded Ukraine, impacting uranium supply and enrichment capacity. Threats of sanctions against Russia's The State Atomic Energy Corp. ROSATOM appeared to factor in to the spot price and buyer attitude, particularly around the second week of March. Ongoing supply chain disruptions impacted the supply side through to the operational level, and wider global pressures, such as a steep decline in equity markets, inflation and recession fears, further hampered the market.

The July 2023 coup in Niger did not significantly impact the U3O8 spot price. Niger was ranked the seventh-largest uranium-producing country in 2022. However, Orano SA said that in anticipating reduced chemical availability and supply corridor closures, it would bring forward maintenance activities at its only operating site in the country, Somair.

Restart of McArthur River signals market rebound

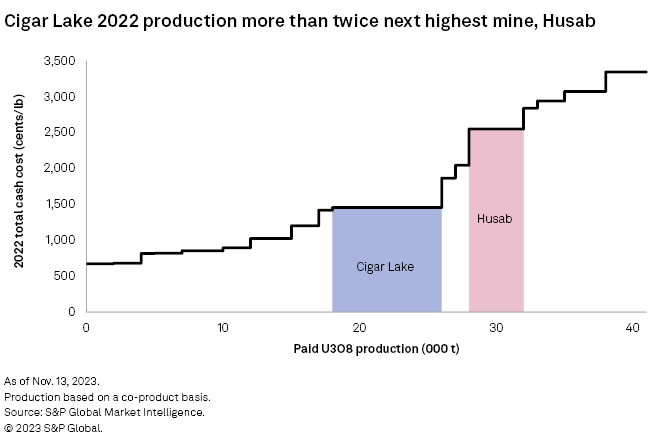

Cigar Lake, Cameco's other underground operation in Saskatchewan, contributed the majority of U3O8 paid production in 2022, supplying 17.6 million pounds to the market, compared to 12.2 million pounds in 2021. The highest-grade uranium mine in the world, Cigar Lake is estimated to have produced slightly more than 13.8% of the global share in 2022. The ongoing effects of the COVID-19 pandemic and wildfires around the mine site hampered production in 2021 and required temporary closures. Mineside disruption has affected guidance in 2023, with a reduction of 1.7 million pounds from planned to 16.3 million pounds. Cigar Lake is anticipated to produce 18 million pounds of U3O8 in 2024, a similar output to McArthur River.

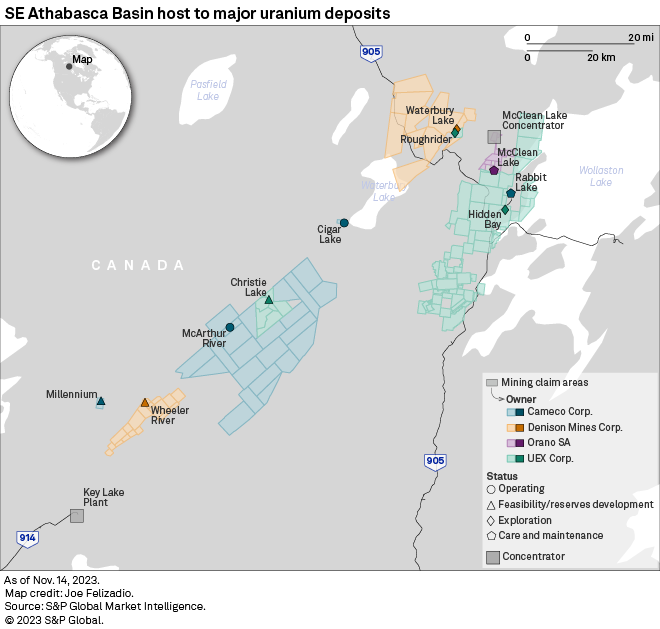

There are no indications that Cameco's suspended tier-two North American sites, including Smith Ranch-Highland in Wyoming and Rabbit Lake in Saskatchewan, will be restarted in the short term. It seems that the company intends to hold onto its idled Rabbit Lake operation; it was recently confirmed that the Canadian Nuclear Safety Commission approved license renewals for McArthur River, Key Lake and Rabbit Lake, with the latter extended until October 2038.

The closures in 2021 through depletion of reserves of the long-running Ranger mine in Australia and the Cominak operation in Niger — owned by Energy Resources of Australia Ltd. and Orano SA, respectively — also highlight the lack of new projects coming into development in the short term. Of significance, the Honeymoon in situ leach deposit recently made a notable advancement: In June 2022 owner-operator Boss Energy Ltd. said a final investment decision had been made in favor of the project in South Australia. Development of the site is proceeding as planned, with first production expected in December 2023. Life-of-mine costs have been reduced on the back of the Enhanced Feasibility Study through measures including replacing the historic solvent extraction circuit with ion exchange technologies. Although requiring a greater initial capital outlay, introducing this change in processing method from the outset reduces the ramp-up time, increases nameplate capacity and reduces technical risks.

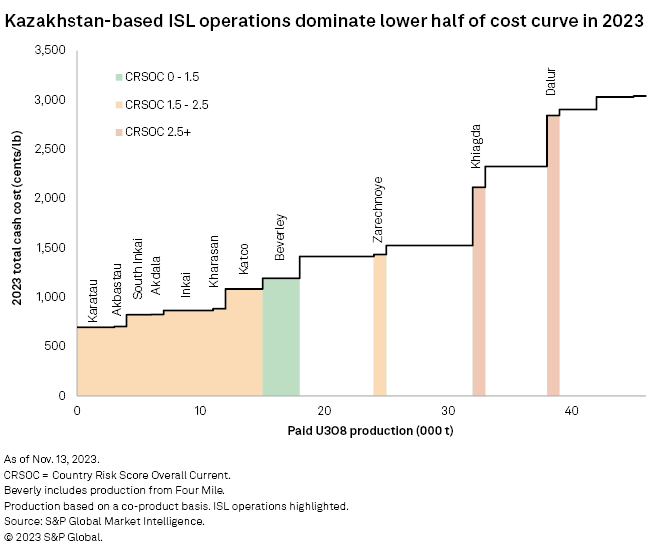

In situ leach operations are expected to continue dominating the lower half of the cost curve into 2023, with most of these mines in Kazakhstan. Even with the warning signs of 2022 around supply security and geopolitics, it is clear that for now, buyers rely on Kazakhstan's cheap, large-scale and reliable uranium production. S&P Global models that JSC National Atomic Co. Kazatomprom operations supply 35.8% of total paid U3O8 production in 2023, and this may well increase in 2024 with the announcement that Kazatomprom is reducing its production cuts against capacity to 10%, compared to the 20% of previous years in response to a then-saturated market.

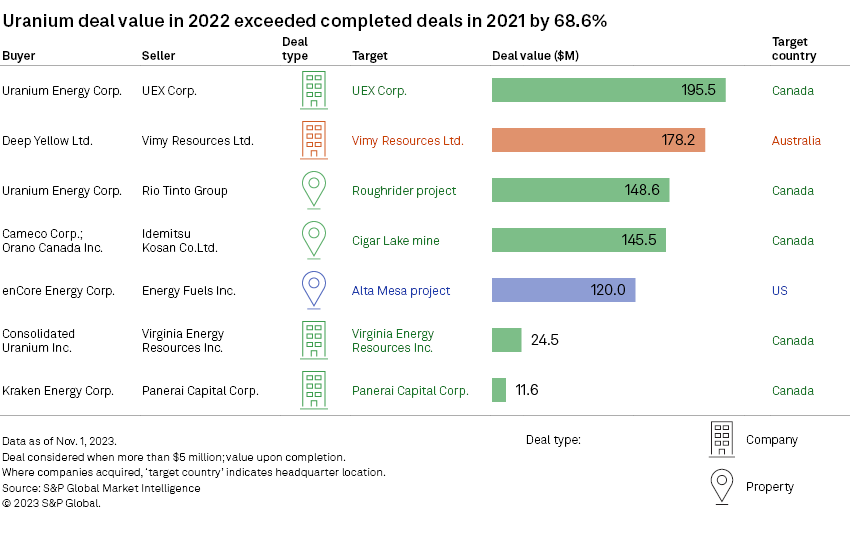

M&A deal value increased 68.6% YOY in 2022

The number of deals declined to seven in 2022 from nine in 2021. Total deal value at the time of announcement amounted to slightly below $925.64 million, an 80.9% increase compared to 2021. Total deal value upon completion adjusted to $823.81 million in 2022 compared with $488.53 million in 2021. The target of transactions centered around established uranium mining jurisdictions, with five deals focused on projects or companies headquartered in Canada and one apiece in the US and Australia.

Uranium Energy Corp.'s acquisition of UEX Corp. topped out deals completed during the year, amounting to $195.46 million upon completion. Announced at the end of March, a bidding war ensued, with Canadian competitor Denison Mines Corp. stepping in with a counteroffer. UEX's portfolio was centered around the prolific Athabasca Basin in Saskatchewan and Alberta with desirable projects such as its Hidden Bay and Christie Lake exploration targets. Had Denison been successful, it would have resulted in the company acquiring the outstanding 5% equity of its feasibility-stage Wheeler River project, also in the Athabasca Basin.

The acquisition of assets accounted for just over 50% of deal value allocation, amounting to $414.04 million in 2022. Uranium Energy Corp. had a busy year, also buying the Roughrider asset that Rio Tinto Group owned. The exploration project is a group of unconformity-related deposits in the Athabasca Basin and is planned to be mined via underground mining methods, including long-hole open stoping and cut-and-fill; current indicated resources across the project area sit at 27.8 million pounds grading 3.25% U3O8, with a further 36.0 million pounds in inferred resources.

Cameco, which in 2011 also bid for the Roughrider project before Rio Tinto purchased it, and Orano Canada Inc. — a subsidiary of France-based Orano SA — secured an additional 7.875% stake in the Cigar Lake mine. Idemitsu Kosan Co. Ltd. sold its share in the northern Saskatchewan operation for US$145.49 million, resulting in Cameco and Orano co-owning 95% of the mine.

EnCore Energy Corp.'s purchase of the Alta Mesa in situ leach operation in Texas was the only US-based deal announced in 2022. With an already-established processing facility, the project, previously owned by Energy Fuels Inc., is fully permitted and was operational from 2005 to 2013. Annual processing capacity sits at 1.5 million pounds. Alongside the Rosita and Kingsville Dome complexes, all three are planned to operate as Central Processing Plants, whereby the closest of the three receives loaded resins from nearby and remote wellfields.

Even though only one deal has been announced per quarter so far in 2023, there have been 11 consecutive quarters with a uranium-focused deal. The total of these three 2023 deals amounts to $226.15 million at announcement. A major deal of note is one announced during September with Toronto-listed IsoEnergy Ltd. targeting Consolidated Uranium Inc. The deal value at announcement amounted to US$182.95 million and is expected to close in early December 2023.

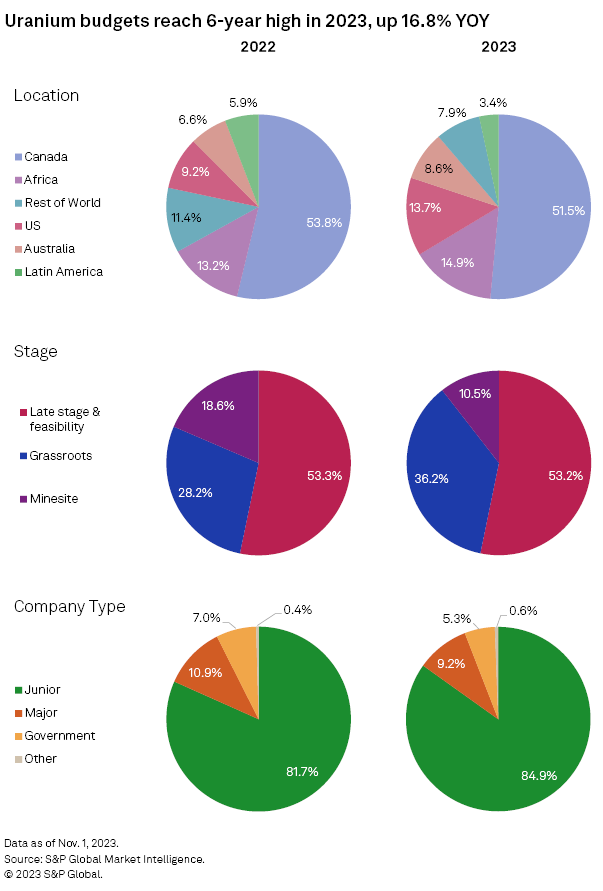

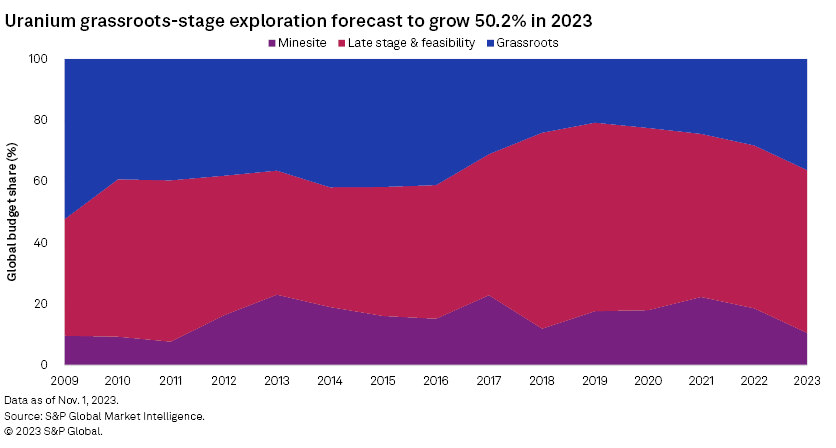

Junior sector commands uranium exploration

Total global exploration expenditure in 2022 totaled $212.2 million, a 56.6% increase year over year. The focus centered on Canada with 53.8% of the capital share, amounting to an almost 70.3% growth compared to the previous year's spend. Juniors made up 81.7% of budget allocation by company type, amounting to $173.3 million, while majors contributed $23.1 million. Late-stage and feasibility-level exploration also shored up a substantial proportion of the capital, amounting to $113.0 million. Nearly 28.2% of exploration spend was allocated to grassroots exploration in 2022. The efforts were concentrated in Canada by juniors such as Azincourt Energy Corp. and Skyharbour Resources Ltd. with their respective Hatchet Lake and Moore Lake properties around the Athabasca Basin.

Exploration budgets for 2023 have recently been published and have increased 16.8% year over year, a difference of $35.6 million. Notable movements include an increase in spend in the US, growing 73.5% from $19.6 million in 2022. In addition, grassroots exploration rose $30.0 million to $89.8 million, and the junior sector increased 21.4% to total $210.3 million in 2023.

Idled capacity analysis

In the short term, it is anticipated that mines on care and maintenance or operating below production capacity will be able to meet any immediate market shortfall. As already stated, Kazatomprom will operate at 10% below licensed capacity in 2024, with a return to 100% output planned in 2025, and Cigar Lake will produce at its 2024 annual capacity limit of 18 million pounds. The McArthur River mine and Key Lake mill have a licensed capacity of 25 million pounds per year on a 100% basis. For Cameco to expand this capacity limit, it has said market conditions would have to be favorable and that it would require more capital. In addition, the processing plants at the idled Rabbit Lake, Smith-Ranch Highland and Nebraska-situated Crow Butte deposits have licensed capacities of 16.9 million, 5.5 million and 2 million pounds, respectively.

Further key operations that are not in production include the Kayelekera and Langer Heinrich hard-rock operations that are exploiting uranium via open pit methods in Malawi and Namibia, respectively. Kayelekera, owned by Lotus Resources Ltd., was last in production in 2014. The company released a definitive feasibility study in 2022 covering a restart of the mine, with production peaking at 2.5 million pounds per annum and averaging 2.4 million pounds of U3O8 per year for the first seven years of operation. The restart hinges on a final investment decision and is incentivized by sustained increases in the uranium price. Production ceased in 2018 at the Paladin Energy Ltd.-owned Langer Heinrich mine due to depressed market prices. Marking a change, the company announced a restart of operations that is projected for early 2024. During the mining phase, the mine is forecast to produce about 6.0 million pounds of U3O8 per year.

Outlook

Nuclear power is increasingly important in the global shift toward decarbonization, and the uranium market appears the most optimistic it has in over a decade. With physical fund vehicles devouring much of the excess inventory since 2021, the upstream sector faces an ever-increasing supply gap. Major operators also play a part by securing yellowcake at a discount to fulfill contractual obligations outside their immediate pipeline, enabling them to command higher prices from their reserves in the future; with long-term contracts due for renewal and renegotiation, the spot price is only expected to go up.

Unless otherwise stated, all prices refer to Platts-assessed U3O8 spot to Canada (AFUEM01), an offering of S&P Global Commodity Insights. S&P Global Commodity Insights is a division of S&P Global Inc.

Prices prior to 2021 are from NYMEX. Historic NYMEX prices can be found on the S&P Capital IQ Pro platform.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.