Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

6 Jun, 2023

By Paul Manalo

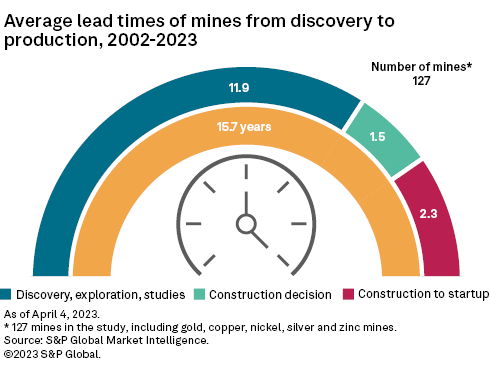

There is increasing global demand for minerals critical to the ongoing decarbonization revolution. Unlike other industries, metallic mines are notorious for their long development periods, sometimes taking several decades to proceed from discovery to production. This study confirms this reputation, showing that a mine takes an average of more than one-and-a-half decades from discovery of the deposit to production startup.

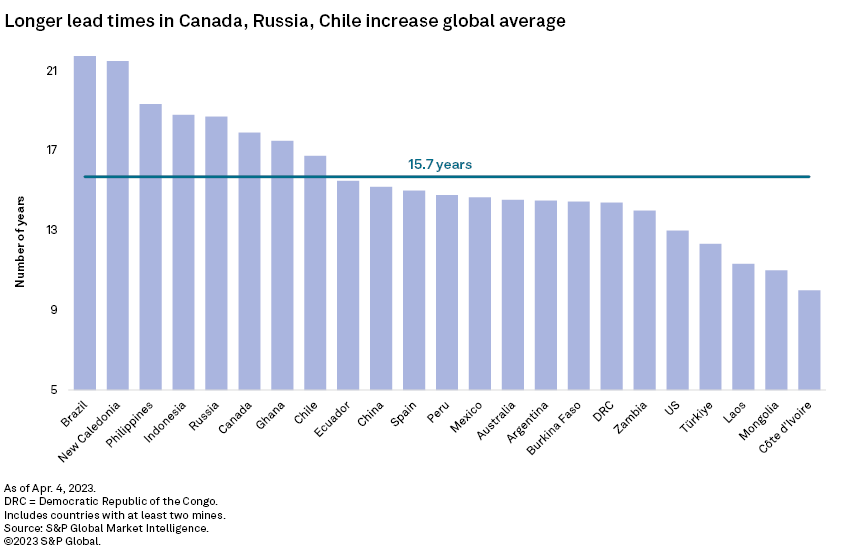

The lead time varies greatly based on a number of factors. For example, there are shorter lead times for mines in Africa compared with Canada due to the latter's stricter regulatory frameworks, along with differences in the nature of deposits.

The urgency of transitioning to a more carbon-free economy has required many governments to revisit their laws and regulations to create more streamlined processes that allow faster building of mines to supply critical minerals.

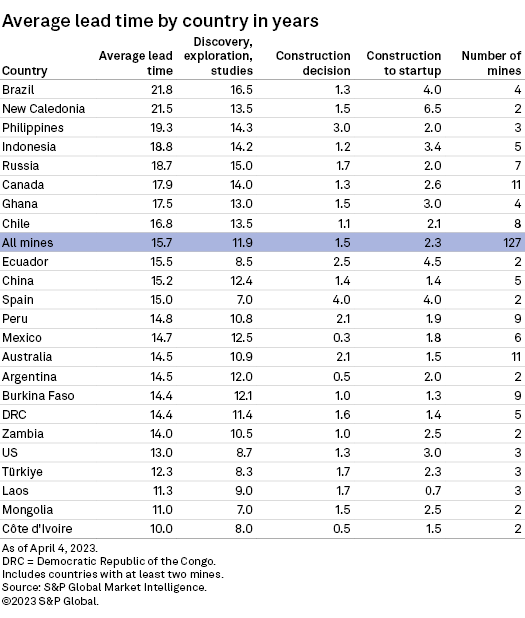

The lead time of mines from discovery to production varies greatly depending on factors such as the mining and processing method, location and regulatory environment. In this article, we have expanded the scope of our previous article by including more mines to have a more comprehensive view of the time from the discovery of a deposit, followed by exploration, studies and mine construction, to the start of production. We calculated the average lead time for 127 precious and base metals mines that began production between 2002 and 2023 and were discovered from 1980 onward.

The 127 included mines have an average lead time of 15.7 years from discovery to commercial production, with a range of six to 32 years. This is not a comprehensive list of the mines that have begun operating since 2002 as not all operations have enough detail on the dates of important milestones. Some operations were excluded as they are satellites and would use existing infrastructure.

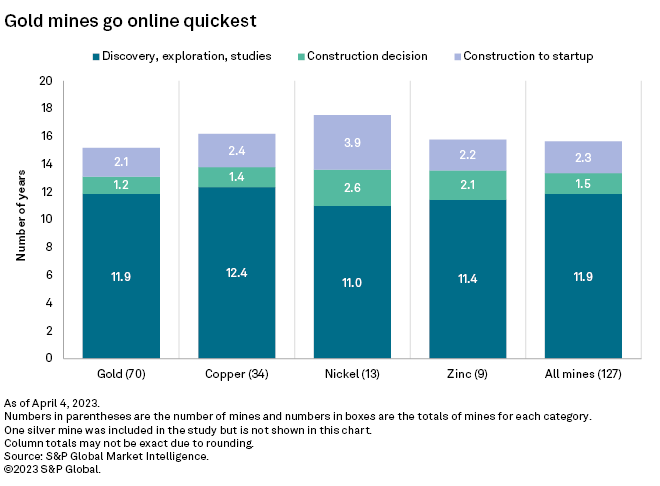

Shorter lead times for gold, underground mines

Our data shows that the 70 gold mines in our list have an average lead time of 15.2 years — six months less than the average for all commodities and 12 months longer than copper mines. Depending on the global region, gold deposits are generally smaller, high-grade underground mines that require less infrastructure or are larger, near-surface deposits for which exploration, studies and construction are less complex and faster. For copper, development over the past few decades has focused on deeper, low-grade porphyry deposits, which require intensive exploration to define and substantial infrastructure to bring into production.

Nickel mines have the longest average lead time among the commodity groups at 17.5 years, with a range of 11 to 29 years. Most of the nickel mines in the study are in the Asia-Pacific region, mostly in the Philippines and New Caledonia. The Celestial mine in the Philippines had the longest lead time at 29 years, including 12 years between the end of feasibility studies and production startup. The project underwent a number of ownership changes over the years and was delayed by difficulties in accessing capital. The Goro mine in New Caledonia, which took 28 years, experienced similar issues, including funding, changes of ownership and protests by local communities. Nickel mines that pushed up the lead times were discovered in the mid-80s to mid-90s during a time of lower nickel prices, which may have caused tighter access to capital.

Interestingly, the exploration and studies phases of nickel mines are notably shorter, with an average of 11 years compared with 11.9 years for gold and 12.4 years for copper. However, the average time to nickel production was increased by the longer time to reach a construction decision after the end of feasibility studies and the longer construction phase.

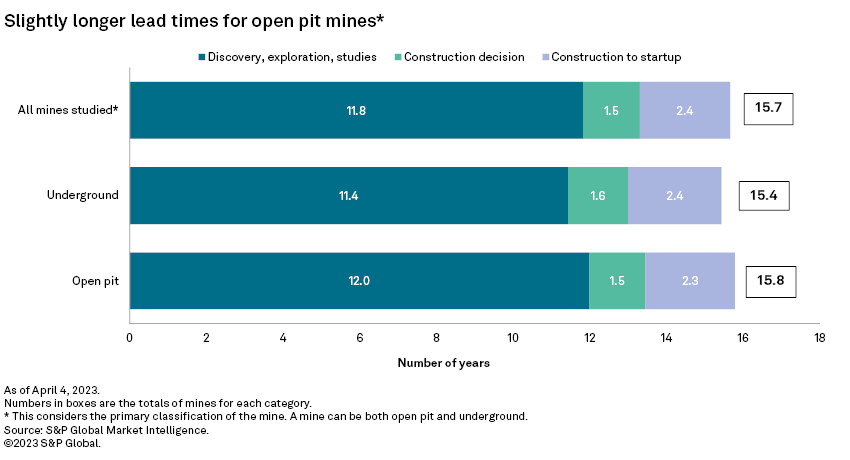

In terms of mine type, open pit mines' lead time is slightly longer than underground mines' lead time at almost five months, which can be attributed to the permitting and studies phase. However, the construction time for open pit mines is slightly shorter than for underground mines due to less complexity of infrastructure.

Half of the underground mines included in the study are in Canada, Australia and the US. The total number of underground mines in Canada and Australia outnumbered the open pit mines in the study that went online during the period, compared with the remaining countries where open pit mines are dominant, especially in countries in Latin America, Africa and Asia. This can largely be attributed to the nature of deposits in places such as Canada, where gold vein deposits are often deeper, smaller, high-grade deposits warranting the construction of underground mines, compared with shallower deposits in regions such as Africa. The strict permitting process in developed jurisdictions also pushes mining companies to opt for underground mines over open pit mines to speed up and ensure the approval of permits.

Canada pushed average upward

The total of 26 mines in Canada, Russia and Chile pushes the average lead time upward. Canada leads with 11 mines, mostly gold mines, with lead times ranging from 10 to 26 years. The lead time from discovery through feasibility studies is nearly 26 months longer in Canada than the global average, while construction to startup is slightly longer at 2.6 months.

The permitting process in Canada is often regarded as the cause of the longer lead times for new mines. Mining projects are subjected to federal and provincial requirements. Each province has its own permitting regime specific to mining, regulating construction, operation, closure and reclamation. There is a growing consensus among stakeholders that Canada needs to optimize the process to reduce the lead time of mines in order to support the development of domestic supply chain for critical minerals, coinciding with US green energy spending plans. The province of Ontario recently proposed amendments to its mining laws in order to fast-track the development of critical minerals projects.

With an average lead time of 13 years for three mines, the US outperformed most nations in the study, including the mining powerhouses of Australia and Canada. The Eagle nickel-copper mine in Michigan had a lead time of 12 years, nearly four years faster than the global average. In 2007, a mine permit was issued to then-owner Kennecott Exploration Co. just over one year after the completion of feasibility studies. This particular decision was the first issued by the state government under the newly legislated Part 632, which governs the regulation and permitting of surface and underground nonferrous metallic mines in the state.

Unfortunately, the Eagle case was more of an exception than the rule. The US is known for protracted and tedious permitting processes that can take seven to 10 years, compared with Australia and Canada, which have more efficient processes that limit permitting to around two years. This study only considers mines that have already come online. The US ranking could easily fall in a future update of the study as mines such as Donlin and Back Forty will be included. Both are under construction and were discovered in 1990 and 2002, respectively.

As in Canada, there is a strong push in the US to change current laws around permitting of new mines to meet the goal of boosting independence in critical minerals important in the electrification and decarbonization revolution.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.