Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 12 Apr, 2022

By Neil Barbour, Milan Ringol, and Erik Keith

Introduction

Technology sectors continue to struggle with supply chain bottlenecks, even as the world gradually recovers from the effects of the COVID-19 pandemic. Supply chain hiccups are not new, but the pandemic and its aftermath exposed glaring weaknesses in the digital device and broadband infrastructure segments that will take some time to iron out.

* The technology industry is dealing with several pandemic-related supply chain challenges. Foremost is an ongoing semiconductor shortage, with manufacturing and transportation issues also roiling the industry.

* The disruption has impacted high-profile consumer segments such as smartphones, game consoles and wearable devices; a growing number of tech vendors have admitted that their revenues have been negatively affected.

* Tech executives broadly agree that the pandemic-related challenges to their supply chains are slowly improving. However, the broader technology market will continue to be stressed until at least the second half of 2022.

The following overview of select leading market segments as tracked by Kagan, a media research group within S&P Global Market Intelligence, underlines specific challenges the tech industry faces.

Smartphones, TV sets: The limited quantity of components — including some shared across multiple products — has prompted manufacturers to sacrifice some products for others that are more profitable. Smartphone and TV vendors have adjusted their product mixes to allocate more shared components to higher-margin products.

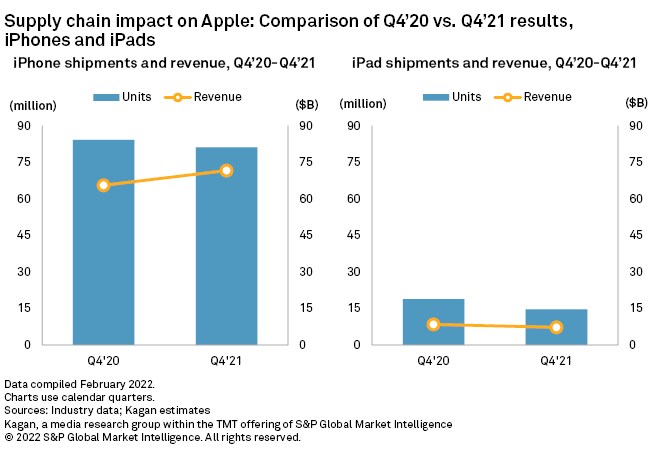

Apple reportedly sacrificed iPad production in favor of the iPhone 13 release by allocating more of the components shared between them to iPhone assembly. This decision resulted in a noticeable fourth-quarter year-over-year drop in iPad revenue and estimated shipments, in exchange for a bump in iPhone segment revenue and a minimized dip in estimated shipments.

Broadband infrastructure: The global chipset shortage has had a substantial negative impact on shipments of broadband access gear.

Over the past year in the converged cable access platform, or CCAP, market, vendors saw shipments drop to the point of quantifiable revenue impacts. Casa Systems Inc., a key provider of CCAP services, saw a $29 million drop in revenues due directly to supply chain shortages. With the chipset shortage expected to last through 2022, its CEO noted that "we do not expect to see growth in our cable revenue during 2022."

Vendors of fiber-to-the-home, or FTTH, equipment now face up to 60-week lead times for chipsets, with no relief expected during 2022. Even for Nokia Oyj, which manufactures its own networking Quillion chipsets, constraints in the raw materials supply chain are challenging its ability to meet the booming increase in customer demand for FTTH equipment orders, which have exceeded what Nokia experienced in recent years.

Consumer internet of things devices: Among leading wearable tech and smart home product vendors, the most visible supply chain disruptors have been manufacturing and assembly issues.

The integration of new components into next-generation products can cause production slowdowns as a retooling of existing assembly processes is required. The Apple Watch Series 7 comes with a larger OLED display, and according to industry observers, there were problems integrating this new display. In late 2021 that problem, combined with pandemic-induced labor shortages, delayed the Series 7 release by about a month.

Game consoles: Despite consumers clamoring for more units throughout the pandemic, Microsoft Corp., Nintendo Co. Ltd. and Sony Group Corp. kept pace with their historical shipment cadences.

In the fourth quarter of 2021, however, they fell behind. Sony's PlayStation 5 shipments declined 13.3% year over year, and the console now has a smaller installed base than the PlayStation 4 did at the same point in its lifespan. That means there is a smaller addressable audience for premium software than in the previous console cycle, reducing the vendor's revenue and margin opportunities. Sony has warned that its supply challenges could persist through the first half of 2022.

Key supply chain disruptors

Kagan is tracking several supply chain disruptors. These include manufacturing and logistical issues due to a lack of components and workforce, as well as supply-and-demand imbalances from consumer behavioral changes.

Semiconductor scarcity

Many technology executives point to the chip shortage as the primary issue among ongoing supply chain challenges. The shortage resulted from a rapidly changing supply-and-demand dynamic coupled with lockdowns shuttering fabrication facilities. Compounding the chipset deficiency is the relatively small number of companies that produce basic chips used across large swaths of electronic devices.

Consumer behavioral changes

The shift to working from home and remote education created a spike in demand for computing, consumer electronics and network peripheral products. This led to a massive imbalance in supply and demand. A long-held belief in the tech industry has been to reduce costs by maintaining minimal inventory levels of both key components and finished products, leaving the segment particularly vulnerable under these conditions.

Manufacturing challenges

The pandemic forced factory shutdowns from Asia to North America and across Europe as manufacturing facilities ceased producing components and finished products. These closures created a huge imbalance in product supplies, which the gradual reopening of manufacturing facilities in 2020 and 2021 is still struggling to overcome. Directly related to facility shutdowns has been a reduction in the number of skilled and semiskilled laborers necessary to produce tech devices.

Transportation challenges

Both long-haul and short-haul transportation challenges impact everything from air freight to trucking, with most transport bottlenecks commonly blamed on personnel shortages. Maritime shipping is particularly significant as many tech supply chains originate with assembly and manufacturing in Asia, followed by a voyage to overseas markets. These ships arrive at port facilities that are overwhelmed by the sheer volume of imports, forcing them, in some cases, to anchor offshore for months.

Technology is a regular feature from Kagan, a media research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.