S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 22 Nov, 2023

By Annie Sabater

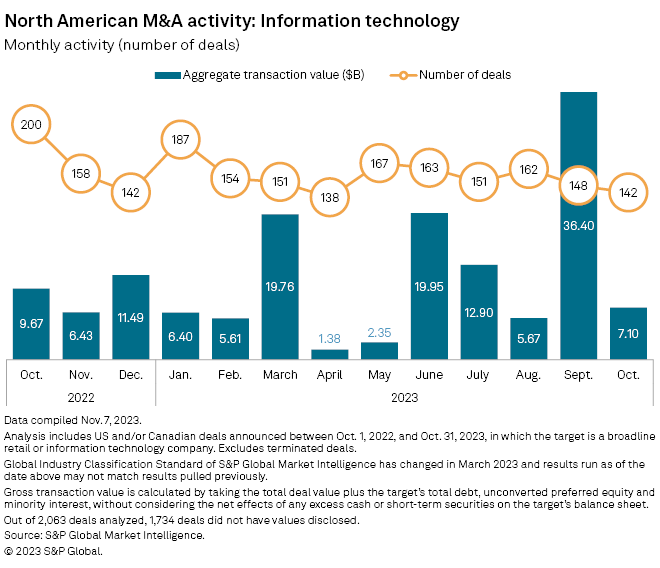

M&A deal value among North American IT companies declined to $7.10 billion across 142 transactions in October, marking an 80.5% drop from the year-to-date high of $36.40 billion in September, which saw 148 deals, according to S&P Global Market Intelligence data.

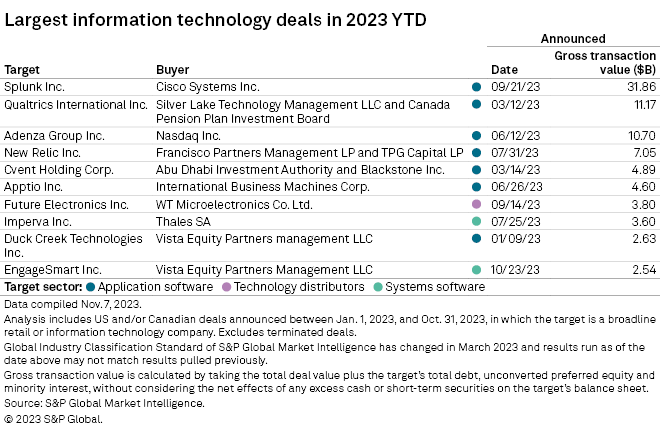

The sharp decline, however was primarily influenced by a notable September mega deal — Cisco Systems Inc.'s proposed $31.86 billion acquisition of cybersecurity software company Splunk Inc. — the sector's largest deal announcement through Oct. 31.

The total M&A deal value also declined from October 2022 when 200 deals, totaling $9.67 billion, were announced.

The two largest deals announced in October each surpassed the billion-dollar mark and involved the participation of private equity players.

In the largest deal of the month, an investor group comprising General Atlantic Service Co. LP and Summit Partners LP agreed to sell EngageSmart Inc., a provider of vertically tailored customer engagement and integrated payments solutions, to Vista Equity Partners Management LLC for $2.54 billion.

The transaction, the 10th-largest infotech deal so far in 2023 based on deal value, is expected to close in the first quarter of 2024, subject to customary closing conditions and other approvals. Upon deal closing, Vista affiliates will hold about 65% of the outstanding equity in EngageSmart, while General Atlantic affiliates will hold approximately 35%.

EngageSmart enlisted Goldman Sachs & Co. LLC and Evercore Group LLC as financial advisers for the transaction.

Hubbell Power Systems Inc.'s deal to acquire Northern Star Holdings Inc. from Comvest Advisors LLC for $1.10 billion ranked second for October. The transaction is expected to close by the end of 2023.

Morgan Stanley & Co. LLC is advising Hubbell, while Harris Williams LLC and Lincoln International LLC are serving as financial advisers to Northern Star on the transaction.

The Cisco-Splunk deal, which is expected to close by the end of the third quarter of 2024, overtook software company Qualtrics International Inc.'s $11.17 billion sale to private equity firm Silver Lake Technology Management LLC and Canada Pension Plan Investment Board as the sector's biggest M&A deal in the year-to-date rankings.