Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 16 Apr, 2024

By Frank Zhao and Mengmeng Ao

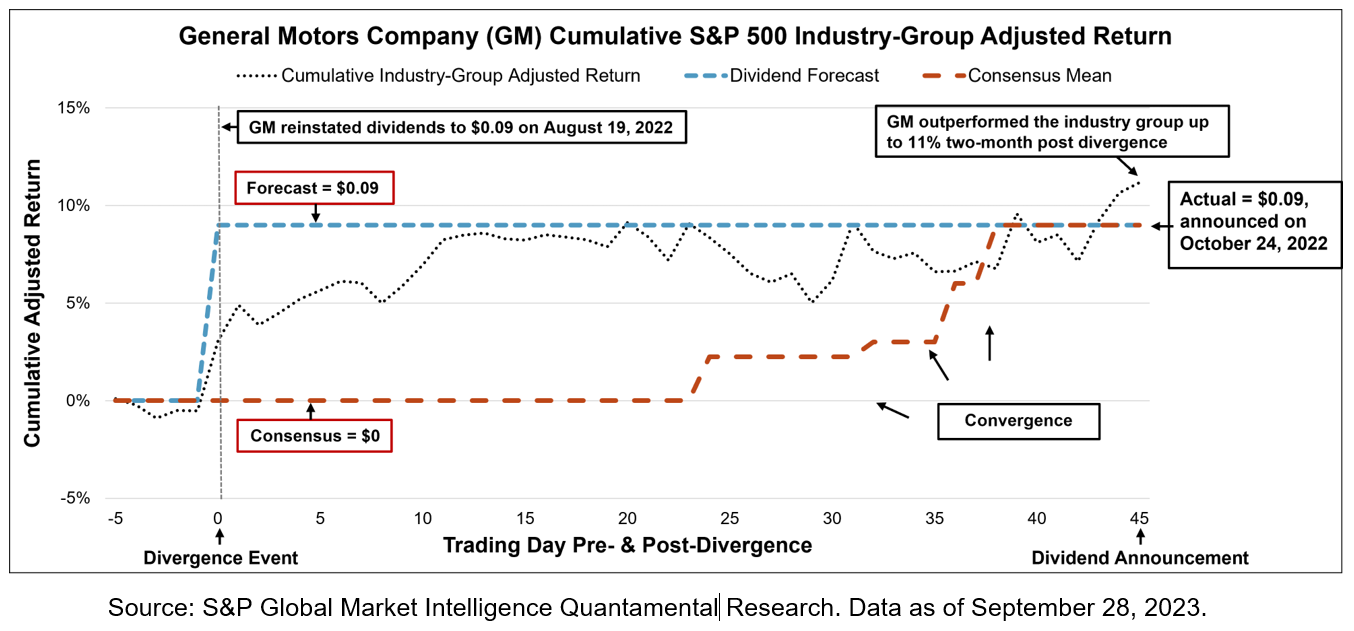

Sell-side forecasts tend to focus on the top- and bottom-line and are often slow to reflect new dividend policies. Our empirical results have shown that S&P Global Market Intelligence’s Dividend Forecasting dataset has historically captured these dividend revisions in both a precise and timely manner, providing investors with an informational edge. This publication details how practitioners can leverage the dataset for equity investing in the U.S. market when the in-house FQ1 forecasts diverge from their sell-side counterparts.

Key findings in the U.S. equity market between January 2012 and June 2023 are:

Explore the data used to conduct this research

The Dividend Forecasting dataset contains independent dividend amount and date estimates for 28,000+ global stocks, ETFs and ADRs up to five years in the future. A global team of 40 dividend analysts deliver precise forecasts of the size and timing of payments based on bottom-up fundamental research, the latest company news and insight from a proprietary advanced analytics model. Investment banks, hedge funds, quants and asset managers utilize these forecasts to confidently price derivatives, enhance their investment strategies and better understand dividend risk.

This dataset consists of comprehensive global estimates based on projections, models, analysis, and research. This dataset can be used to evaluate earnings estimates to select stocks and manage investment performance and to track the direction and magnitude of upgrades and downgrades and more.

READ THE FULL REPORT