Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 19 May, 2021

By Paul Manalo

Highlights

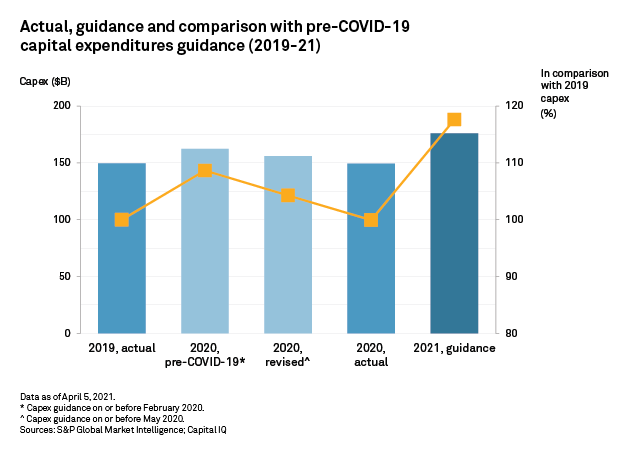

2021 mining capital spending forecast of $176 billion is up 18% from 2020 and 2019 spends.

Chinese companies exceed original guidance for 2020 capex

Precious metals companies estimate capex will jump one-third in 2021

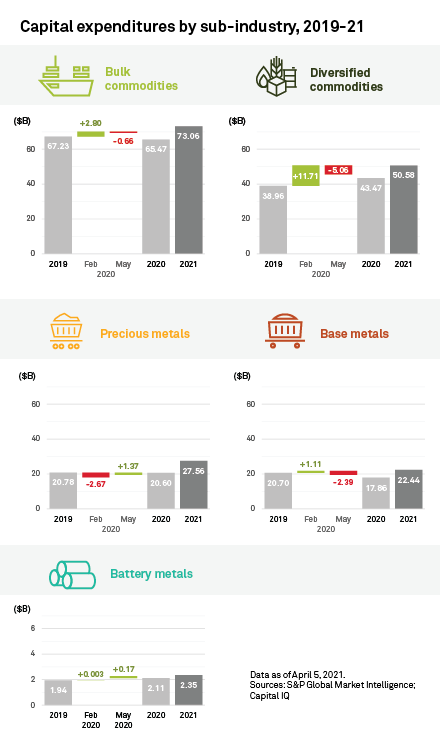

At the beginning of 2020, the mining companies examined by S&P Global Market Intelligence were forecasting capital expenditures of $162 billion, or 9% higher than 2019 spending. As the COVID-19 pandemic set in globally, however, regional lockdowns forced work stoppages and supply chains were in upheaval. This led companies to revise their spending plans 4% lower to $156 billion for the year — though still well above 2019 levels. Miners struggled to hit these revised plans, however, with actual spending in 2020 coming in at $149.5 billion — 8% and 4% lower than pre-COVID-19 and COVID-19-revised forecasts, respectively, and even slightly lower than 2019 reported spend.

As the world begins to navigate its way out of the pandemic, capital spending is expected to increase significantly. The 2021 forecast of $176 billion is up 18% from 2020 and 2019 spends. This is a result of delayed programs resuming as well as a general ramp-up in activity spurred by strong metal prices.

We have examined more than 400 public companies in the mining industry that reported capital spending in 2019 and 2020 and planned expenditures in 2021. In addition, we compared the guidance that companies released during the first quarter 2020 prior to the onset of COVID-19 and their revised guidelines during the height of lockdowns and restrictions in the second quarter. Though there was a general decrease in planned and actual expenditures in 2020, budget cuts varied by company headquarter location, market capitalization and target commodities.

Chinese companies exceed original guidance for 2020 capex

Despite being the first country affected severely by the coronavirus, the strict lockdown in China during the first quarter of 2020 enabled the country's economy to recover in the following quarters. Original capex guidance for 2020 of China-based companies was 8% lower than their 2019 spend, which partially reflects the lockdowns and restrictions that China imposed early in the year. Nevertheless, revised guidance — up 8% on 2019 spend — through the middle of the second quarter painted a sign of recovery, and actual reported capex in 2020 was up 15%.

Precious metals companies estimate capex will jump one-third in 2021

Precious metals companies, which had set a 13% lower capex guidance for 2020 prior to the pandemic, reported spending in 2020 on par with 2019 levels, with companies based in Australia and China leading the recovery. In 2021, precious metals companies are expected to increase their capex by one-third compared with 2019 levels, led by Newmont and Gold Fields.

Largest market-cap companies expected to ramp up capex in 2021

The three company groups based on market capitalization, those with less than $1 billion, between $1 billion and $10 billion, and between $10 billion and $50 billion market capitalizations, have showed almost the same capex trends despite slight variations in guidance in February and May 2020, with reported spend 3% lower on average than in 2019. The largest market-cap companies with more than $50 billion market capitalization has surpassed everyone else in guidance and reported capex. Prior to the pandemic, the group's 2020 guidance was for an increase of 35% compared with 2019. Following events brought on by the pandemic, capex guidance was revised to just 28%, and actual spend was 22% in 2020.

Estimated capex in 2021 further widened the gap between the largest market-cap group and the other three groups, expected to be 51% higher than 2019 spend, while guidance for the other three groups remained similar, averaging 12%.

Like our content? Subscribe to receive our monthly Essential Metals & Mining Insights newsletter delivered directly into your inbox.

Blog

Event

Products & Offerings

Segment