Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 26 Apr, 2023

By Ying Li

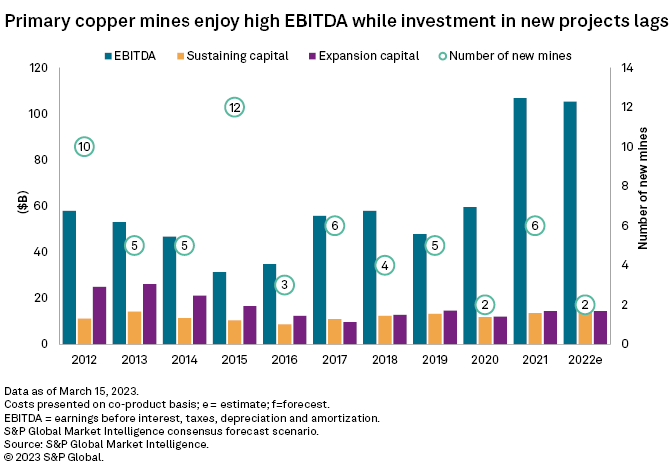

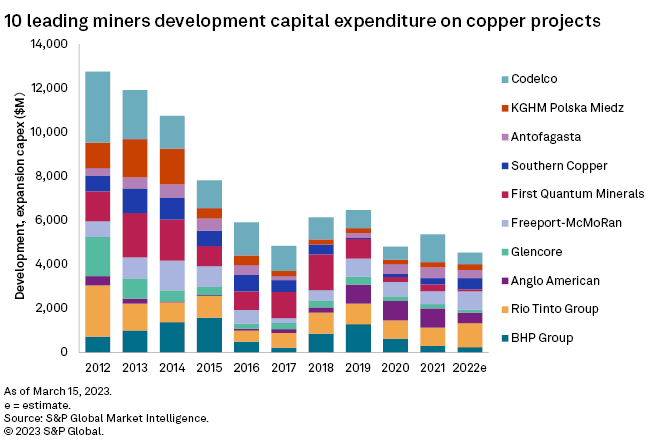

Global development and expansion capital for primary copper mines peaked in 2013 at $26.13 billion, almost halved in subsequent years and has not recovered since. Capital spend on copper projects is estimated to have been only $14.42 billion in 2022, based on Mine Economics' universe of coverage. There was an estimated 0.1% reduction year over year in development capital expenditure for copper projects in 2022, and a further decrease of 18.7% is projected for 2023.

The Take

– The copper mining industry has seen a significant rebound in earnings, boosted by higher copper prices since 2021.

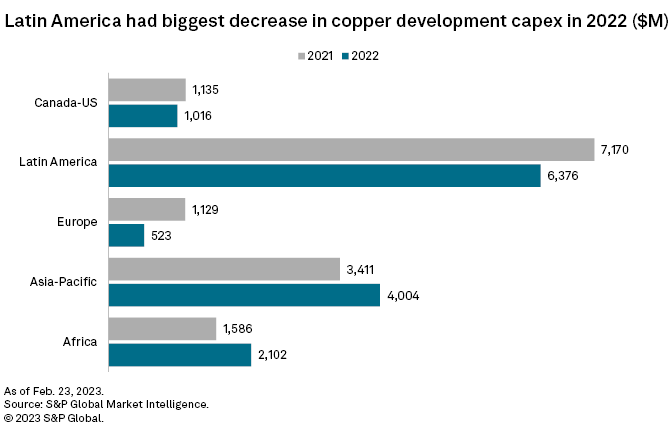

– With only two new projects committed, global capex in copper mines dropped 0.1% year over year in 2022, driven mainly by a decline in expenditure in the Latin America region.

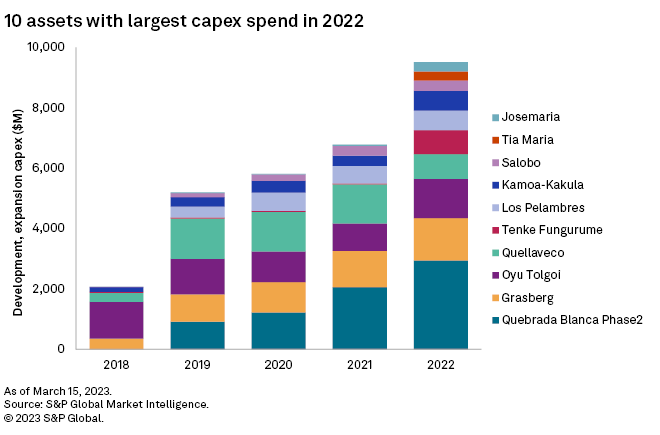

– Quebrada Balance Phase 2 and Grasberg were the two highest-capex copper projects in 2022. Tenke Fungurume and Quebrada Blanca Phase 2 are expected to be the highest-capex copper projects in 2023.

– The copper projects we studied took an average of 23 years to go from discovery to production.

Copper miners have become conservative about investing in new projects. It takes a long time to discover, explore, permit, finance and develop new mines. Companies have been focusing their capital expenditures on extending the mine life of operating high-grade, profitable projects that are already producing, rather than investing in exploration and development of new projects to meet increasing demand. It could take a long time to reverse this trend, as most copper companies have enjoyed record earnings from high copper prices.

The market copper price reached a historic high of $4.42/lb in 2021. The previous record of $3.59/lb in 2012 was much higher than the level required for new and expansion projects to be profitable, with a total cash margin averaging $1.79/lb. Post 2011, the copper price went through a prolonged downturn, which, along with high debt levels carried by producers, discouraged approval of new mines and drove a gradual reduction in development spending.

Copper prices have largely rebounded after bottoming out in the COVID-19 period. EBITDA for copper miners exceeded the 2012 peak for the first time in 2021, supported by recovering copper prices and tighter capital management by miners. Nevertheless, capex is lagging; we project a 0.1% decline in capex year over year in 2022. We expect development capex to decrease further in 2023, while EBITDA increases 12.9% year over year to $118.86 billion, mainly due to lower operating costs.

In 2022, Latin America had the world's largest copper reserves, highest production and the industry's largest capital expenditure, despite a significant decrease from 2021 as several large projects in the region moved from the construction or expansion phase to production. These include Quellaveco in Peru, El Teniente in Chile and Chuquicamata in Chile.

Africa saw copper development capex grow year over year in 2022, mainly due to CMOC Group Ltd.'s $2.51 billion investment to roughly double copper and cobalt production at Tenke Fungurume's 10K project in the Democratic Republic of the Congo (DRC) by 2023.

With copper playing an important role in the global green energy transition, dwindling reserves and a long copper mine development cycle, we are also seeing a trend toward copper companies increasing reserves through M&A activity.

Despite soaring copper prices, investment in new projects is lagging. Of the 10 largest development projects in 2022, just two are new mines and the rest are expansions or significant development work at existing producers. At one of the new mines, Anglo American PLC's Quellaveco in Peru, production started in 2022 and is forecast to be 320,000-370,000 metric tons of copper per year in 2023 and 2024, with an expected all-in sustaining cost of $1.50/lb in 2023.

Teck Resources Ltd.'s Quebrada Blanca Phase 2 project in Chile will begin production in 2023, with full-year production of 150,000-180,000 metric tons of copper. Production is expected to increase over the following two years, with annual production of 285,000-315,000 metric tons per year across 2024–2026. S&P Global Commodity Insights expects total development capex to remain unchanged at $7.40 billion-$7.75 billion.

Global copper production increases in 2023 and 2024 mainly come from expansion projects. Rio Tinto Group's Oyu Tolgoi mine in Mongolia, BHP Group Ltd.'s Spence mine in Chile, Ivanhoe Mines Ltd.'s Kamoa-Kakula and CMOC Group Ltd.'s Tenke Fungurume mines, both in DRC, are among the largest projects expected to deliver more copper in the next two years.

Oyu Tolgoi is expected to have the highest capex in 2023. Underground commercial mining began March 13, with a development capex of approximately $7.06 billion and sustainable production of approximately 500,000 t/y from 2028 to 2036 from the open pit and underground.

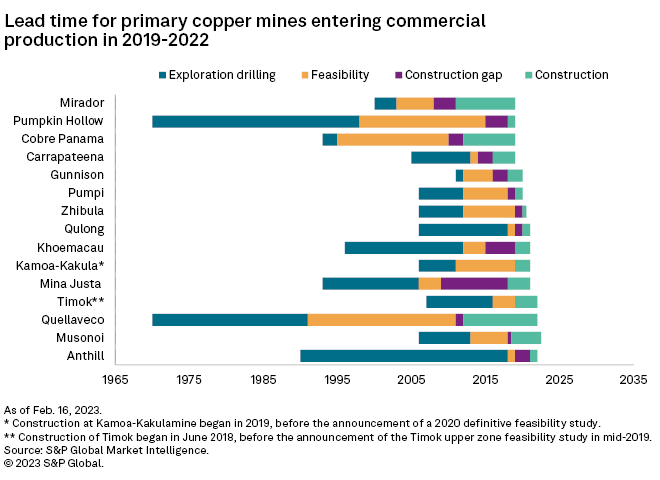

New primary copper mines starting up between 2019 and 2022 had an average lead time of 23 years from discovery to commercial production. Within this period, nearly half of the time was spent on initial exploration work, including historical exploration.

The time to conduct feasibility studies averaged nearly 6.6 years, which includes all work from preliminary economic assessment to a definitive feasibility study. For multiphase development mines, such as Kamoa-Kakula and Timok, feasibility work will continue to be updated after the first phase of development or production begins.

After definitive or bankable feasibility studies were completed, there was a gap averaging two years before construction began. Government requirements, capital financing, changes of equity interest, and environmental permitting can contribute to longer feasibility studies or construction decision periods.

Changes in copper prices may also delay project construction. The Cobre Panama production decision was put on hold in 2002, pending lower capital costs or higher copper prices. Quellaveco has been suspended many times since 2001 due to opposition by local communities over water supply, environmental and social development issues.

The time between the start of construction and commercial copper production averaged 3.2 years, with underground mines having a longer construction period than open pit mines. We see little correlation between the mine construction period and designed capacity, however. Even for large-capacity mines, such as Kamoa-Kakula and Timok, the construction time was within three years, whereas in Latin America, mines took about eight years to construct. Cobre Panama, Mirador and Quellaveco were all put on hold due to governmental and local community environmental concerns.

We expect a small surplus of copper supply between 2023 and 2026, when it will turn to deficit. New copper projects expected to enter commercial production in 2023 include Quebrada Blanca Phase 2 in Chile, Kisanfu in DRC, Kalongwe in DRC, Tshukudu in Botswana, Anthill in Australia, Serrote in Brazil and Udokan in Russia, potentially adding around 550,000 metric tons of copper production in 2023. The bulk of future copper supply growth will come from planned expansions at current mines, however, rather than the development of new operations.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Campaigns