Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 23 Feb, 2023

By Ruilin Wang

In the monthly Commodity Briefing Service report, or CBS, S&P Global Commodity Insights discusses the copper market within the broader macroeconomic environment and provides rolling five-year supply, demand and price forecasts.

Key findings

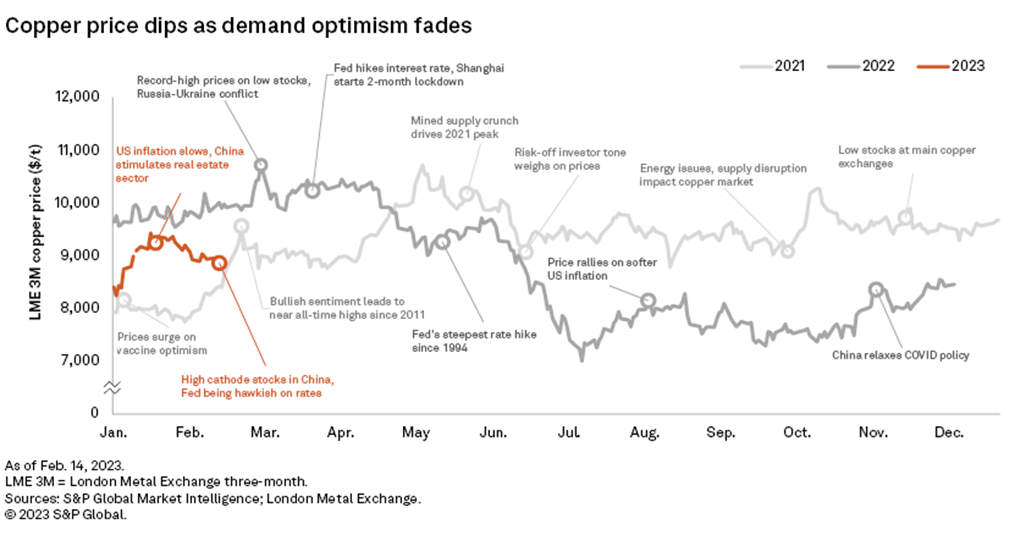

* Shanghai Future Exchange, or SHFE, copper stocks reached 241,991 tonnes two weeks after the Lunar New Year holiday, close to the 2018 high of 266,437 tonnes. Large wire and cable producers in China have returned to normal production levels, while small and medium-sized manufacturers will likely continue to operate at a slowed rate until the end of February due to weak demand from the domestic real estate sector.

* An increase in scrap availability, thanks to relatively high copper prices of about $8,900 per tonne and the absence of COVID-19-related restrictions, has also contributed to the oversupply in the Chinese market.

* Ex-China copper supply is tighter, however, with cathode stocks at London Metal Exchange and COMEX continuing to fall. European consumers' low acceptance of Russian materials and global supply-side disruptions may be contributing to tightened cathode availability.

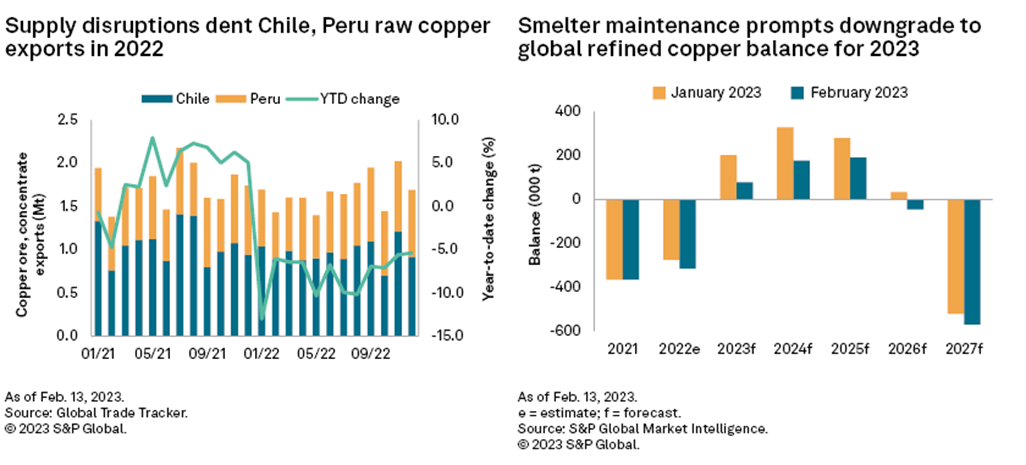

* Increased maintenance activity at smelters outside China has led us to downgrade our global refined copper balance for 2023 from a surplus of 202,325 tonnes to 77,325 tonnes.

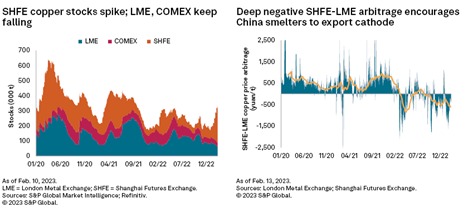

* Mine supply issues in Chile and Peru and a recent production halt at Grasberg in Indonesia due to heavy rainfall and flooding have put additional pressure on copper smelters to secure concentrate to meet their requirements. These factors have led us to downgrade our forecast concentrate surplus to 268,281 tonnes in 2023.

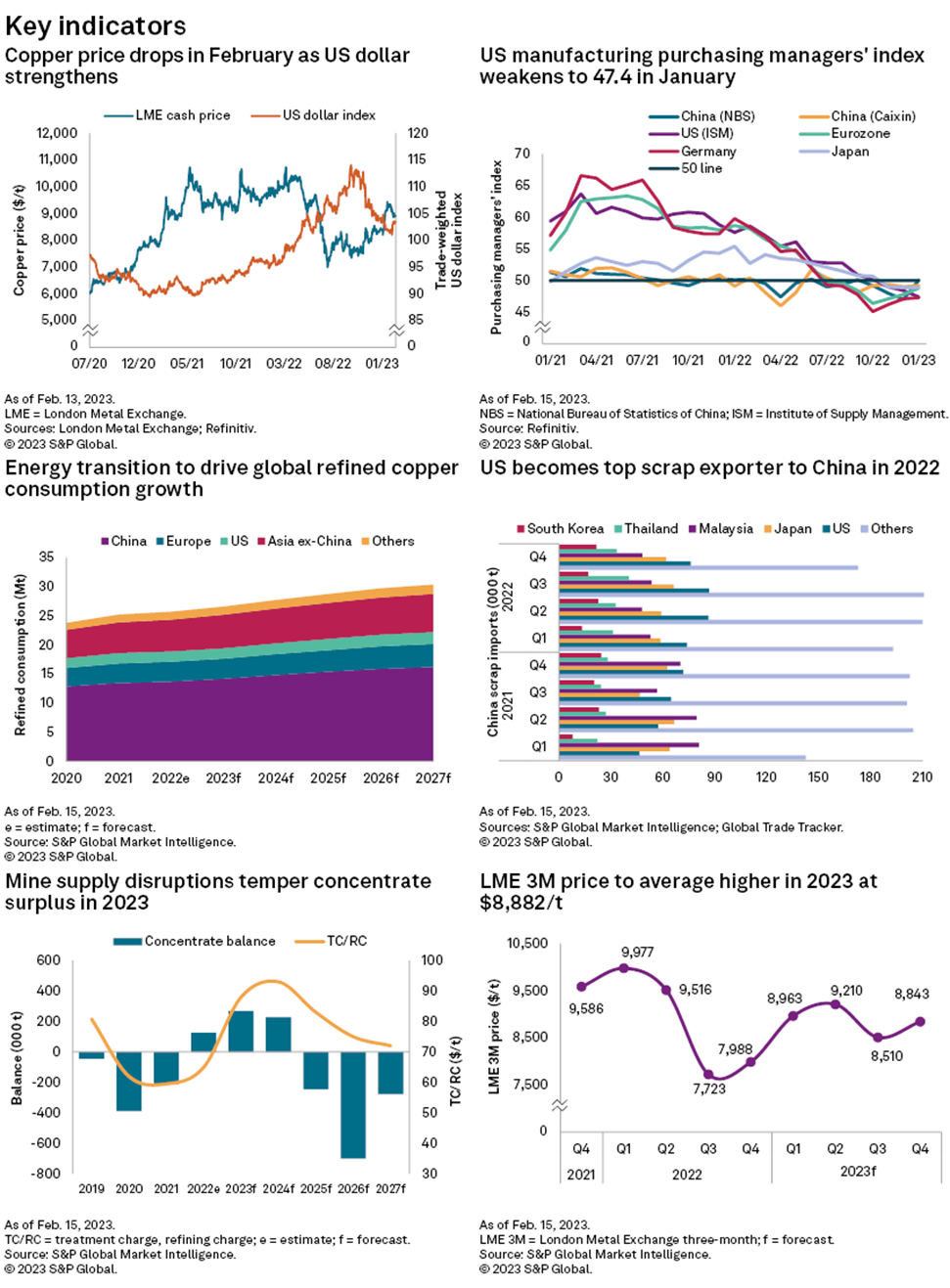

* We have upgraded our London Metal Exchange three-month, or LME 3M, price forecast for 2023 to $8,882/t on the expectation that global copper demand will strengthen from April. Meanwhile, cathode output will start to be constrained by a seasonal maintenance period for Chinese smelters. Therefore, we expect the LME 3M copper price to peak in the June quarter at $9,210/t.

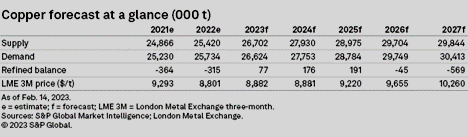

Copper prices have come down since late January due to a slower-than-expected demand recovery following the Lunar New Year holiday and the U.S. Federal Reserve's more hawkish tone on U.S. interest rates. An increase in scrap availability has also contributed to an oversupply in the Chinese market. In contrast, copper supply outside China is tighter, with major maintenance outages at key smelters prompting us to downgrade our global refined copper balance for 2023 from a surplus of 202,325 tonnes to 77,325 tonnes. We have upgraded our LME 3M price forecast for 2023 to $8,882/t and kept price forecasts after 2023 unchanged from the January edition of the CBS.

Analyst comment

The LME 3M copper price closed at $8,862/t Feb. 15, down 5.4% from $9,365/t Jan. 27 as optimism for the demand outlook faded. A slower-than-expected demand recovery in China following the end of the Lunar New Year holiday resulted in a spike in cathode stocks. Sentiment was also dampened by U.S. economic data as the Federal Reserve adopted a more hawkish outlook for U.S. interest rates when inflation came in slightly above expectations at 6.4% in January.

In China, SHFE copper stocks rose to 241,991 tonnes two weeks after the Lunar New Year holiday, which is close to the peak level of 266,437 tonnes from the same period in 2018. So far, the expected post-holiday surge in pent-up demand following the easing of COVID-19 restrictions has failed to materialize. While large wire and cable producers have resumed a normal pace of production, small and medium-sized manufacturers are expected to operate at lower rates until the end of February due to insufficient orders from the real estate sector. Increased availability of copper scrap has also contributed to the oversupply in China, bolstered by relatively high copper prices and the absence of COVID-19-related restrictions. Many scrapyards and consumers in China have reported an increase in their scrap stocks over the past month.

In contrast, the combination of European consumers' reluctance to accept Russian metals and of numerous global supply-side disruptions for copper has tightened cathode availability ex-China, with cathode stocks at the LME and COMEX continuing to fall in February. The supply constraints are reflected in a deep negative SHFE-LME copper price arbitrage. Any consumer in China importing cathode in late January would have lost more than 1,000 yuan per tonne; this encouraged a few Chinese smelters to export cathode to Shanghai-bonded warehouses or Asian LME warehouses to maximize profitability.

Based on our expectations for tightened supply, we have downgraded our global refined copper market balance for 2023 from a surplus of 202,325 tonnes to 77,325 tonnes. The 135-day maintenance at Codelco's Chuquicamata smelter in Chile will not end until mid-March. Additionally, unplanned maintenance at Rio Tinto Group's Garfield smelter in the U.S. has already lowered its cathode production this quarter, and the facility is set to undergo a major rebuild during a three-month outage in the June quarter. Production at LS-Nikko Copper Inc.'s Onsan in South Korea has been hampered by technical difficulties with one of its smelting lines since August 2022, necessitating a two-month maintenance stoppage from the end of February. The Gresik plant in Indonesia, jointly owned by Mitsubishi Materials Corp. and PT Freeport Indonesia, will also undergo a maintenance outage when it closes for 75 days in March to expand its concentrate feed capacity 30% from its current capacity of 1 million dry metric tonnes per year.

While mine supply issues in Chile and Peru have eased, heavy rainfall and flooding in Indonesia have triggered a halt to production at Freeport-McMoRan Inc.'s Grasberg mine, putting additional pressure on copper smelters to secure concentrate from elsewhere to meet their requirements. These factors led us to downgrade our forecast concentrate surplus to 268,281 tonnes in 2023. Lastly, CMOC Group Ltd.'s Tenke Fungurume refinery in Democratic Republic of Congo, with stocks assessed at 100,000-200,000 tonnes, is still under a ban to export cathode.

Despite a decline in LME and COMEX stocks, we have not heard of any semi-fabricators in Europe or the U.S. having major difficulty in purchasing copper materials. Increased availability of scrap is somewhat easing supply constraints as a high LME price since January is attracting increased flows into scrapyards. Slowing demand further helped to relieve the tightness in the copper market, with the U.S. manufacturing purchasing managers' index weakening 1% month over month to 47.4 in January, due partly to poor weather. Robust data on the U.S. job market and retail sales is fueling expectations for more aggressive interest rate hikes to tame inflation, which would weigh on economic growth. In Europe, sluggish copper demand from the real estate sector continues to offset positive performance from the automotive and power sectors.

Outlook

We have upgraded our LME 3M price forecast for 2023 to $8,882/t, with estimates thereafter unchanged from those in the January CBS. The cathode stock increase in China is likely to persist until early March when copper consumption is expected to gradually pick up ahead of a seasonal rise in global copper demand from April. Meanwhile, cathode output will start to be constrained by a heavy period of maintenance activity for smelters in China, and as a result, we expect the LME 3M copper price to peak this year in the June quarter at $9,210/t.

Downside risks remain, however, from an economic slowdown possibly resulting from China's property sector slump and the Fed's hawkish tone on U.S. interest rates.

We forecast copper prices to fall in the September quarter, with the global refined copper market balance shifting to a surplus of 131,000 tonnes. Prices are expected to end the year on the rise as stimulus of the real estate sector in China could begin to support copper consumption. The local government in Henan province recently announced that projects supported by government loans should be completed by the end of October 2023, which is also when copper tube producers in the country expect to see an increase in demand.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Research

Research