Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 15 Mar, 2022

Introduction

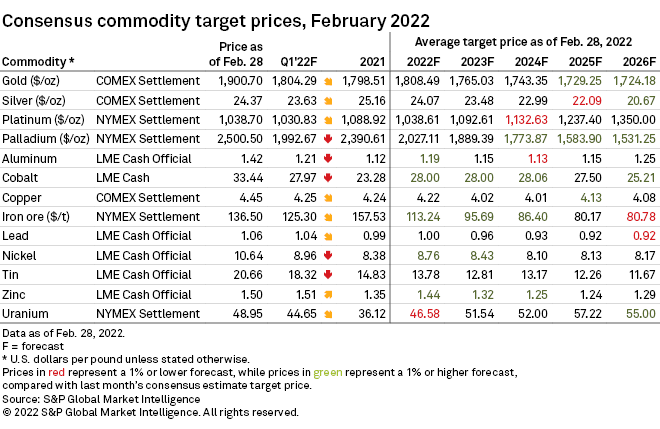

S&P Global Commodity Insights discusses consensus price forecasts for precious metals, including platinum group metals, and industrial metals amid broader market trends. The escalating Russia-Ukraine conflict in February sparked buying into safe-haven metals gold and silver and heightened supply risks to nickel, aluminum, iron ore and steel.

Russia's ongoing invasion of Ukraine has dominated the headlines and metals markets in late February and early March, overshadowing the influence of a shifting macroeconomic environment. Gold and silver are safe-haven assets with prices boosted in times of uncertainty; palladium, nickel and iron ore are key Russian exports threatened by supply disruptions; and energy-intensive zinc production could be affected by gas supply cuts in Europe. Meanwhile, inflation remains high, driven by power prices; to combat it, key ex-China central banks are putting into effect ever-tightening monetary policies. Amid much uncertainty, however, consensus price forecasts for the month may not as yet reflect the full impact of the Russia-Ukraine conflict.

Metals and energy markets were shaken by the escalating tensions between Russia and Ukraine throughout February, culminating in Russia's large-scale invasion of its neighbor Feb. 24. With one or both countries major producers of important commodities such as gold, nickel, palladium and iron ore and steel — in addition to oil, gas and coal — disruptions can be expected in production and exports, exacerbated by retaliating sanctions by the U.S. and other NATO member states and the EU. The threat of severed gas supply to Europe could affect the most energy-intensive processes, namely the smelting of zinc and aluminum.

The heightened risk to gas supply, coupled with already high power prices, might accelerate the green revolution in Europe through the deployment of renewable energy technologies and expansion of the electric vehicle, or EV, market. This, however, will also depend on key metals produced by Russia, especially nickel, which may result in less severe or even no sanctions by the EU. Countries are acknowledging the growing importance of these metals, as shown by the addition of nickel as a key component of electric vehicles to the 2022 list of critical minerals by the U.S. Geological Survey.

The escalating geopolitical tensions in February caused the COMEX gold price to gain 6% month over month, despite the increasingly hawkish stance adopted by a growing number of central banks. For the first time in over a year, gold breached $1,900 per ounce, benefiting from its status as a safe-haven asset amid market volatility caused by the Russia-Ukraine conflict and multidecade-high inflation in key economies, which could prompt an accelerated tightening of monetary policies. Expectations for the gold price in the short term is the status quo, however, with the consensus price forecast upgraded a mere 0.3% and 0.2% for 2022 and 2023, respectively. The rapidly evolving conflict seems likely to prompt further upward revisions to consensus gold price forecasts in the months ahead.

The precious metals market saw another high, with silver prices rising to a multimonth peak in February as the metal regained some of its safe-haven status amid the conflict. Demand is also expected to come from the green energy transition, as silver is a key material in the manufacture of solar panels. Though both sets of circumstances may support the silver price, the consensus price forecast for 2022-24 has been downgraded an average of 0.4% annually.

The palladium price hit a six-month high just a day before the invasion on fears of supply disruptions. This marks a significant turnaround for the worst-performing precious metal of 2021, when the electronic chip shortage stalled car production globally. Palladium, of which Russia is a major producer, is used both in semiconductors and catalytic converters, and any further disruption in the supply chain would negatively affect the auto sector. Despite the recent spike, consensus price forecasts were downgraded for 2022-23, but a positive longer-term outlook led to an average annual upgrade of 1.3% annually through to 2026. The outlook for platinum, which is also used in cars, is for an average annual consensus price downgrade of 0.9% over 2022-26.

The London Metal Exchange three-month, or LME 3M, copper price was range-bound in February, albeit around the $10,000-per-tonne mark, as contrasting forces were at play, affecting both the macroeconomic environment and the physical copper market: diverging monetary policies by major central banks, a stronger U.S. dollar and copper supply concerns in Latin America. As demand is expected to grow steadily with the deployment of renewable energy technologies and the ramp-up in EV production, the refined copper market is projected to be in deficit over the forecast period. As a result, the copper consensus price forecast has been upgraded 1.2% annually over 2022-25. Amid the rapidly evolving conflict, the LME 3M copper price surged to $10,465/t on March 3, amid concerns that supply might be affected.

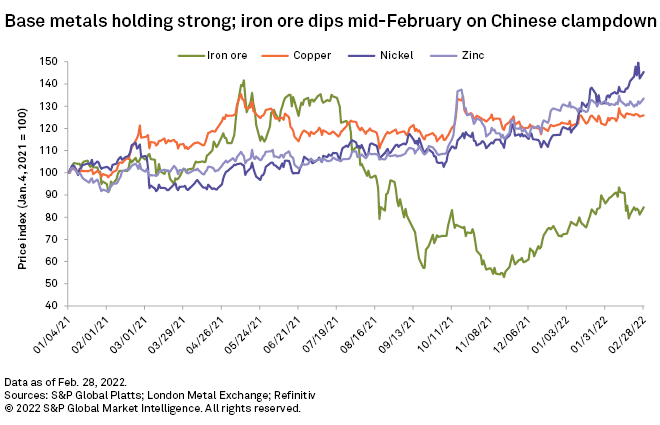

Supply scarcity drove zinc prices yet higher in February and early March as the LME 3M benchmark hit a 15-year high. Ongoing power restrictions in China and elevated energy costs in Europe have drastically reduced or altogether stopped production at the energy-intensive zinc smelters, constraining refined zinc supply. This vulnerability to power costs will put zinc supply at further risk, and drive prices to new highs should the war cut off gas supplies to Europe. The consensus zinc price forecast included two of the largest annual increases, 4.3% and 3.7% for 2022 and 2023, respectively, and at 2.6% was the highest average annual upgrade over the forecast period.

The LME 3M nickel price hit a new 11-year high of $27,980/t on March 3 as a direct market response to the invasion. Russia is a leading producer of primary and refined nickel, and the possible supply redirection as a consequence of the incursion and/or potential trade sanctions could disrupt nickel exports. This could derail the decarbonization plans of major economies, as Russia is a key supplier of primary nickel to meet growing demand from traction batteries in EVs in Europe and China. Supply relief might come from Indonesia, where growth in mined output should be enough to shift the market into surplus in 2022. Consensus price forecasts were significantly upgraded for 2022-23, with prices expected to average higher than in 2021.

Demand for cobalt outpaced supply growth in February. Scheduled mine ramp-ups in Democratic Republic of Congo and expected logistical improvements will improve supply in the second half. Demand for the battery metal will nevertheless remain strong in the short and long terms. Expected EV subsidy cuts in 2023 and automakers attempting to hit their full-year sales targets will boost demand for cobalt in the fourth quarter of 2022, while the worldwide transition to green energy and electrification, likely accelerated by a heightened geopolitical desire to pivot away from Russian energy, will further support cobalt demand over the next few years. Changes to the consensus price forecast are positive across 2022-26, with the cobalt price expected to trend higher than the 2021 average.

After an initial rally at the beginning of February, to a six-month high of $153.75/t on Feb. 10, the S&P Global Platts IODEX 62% Fe iron ore price retreated midmonth amid a clampdown by the Chinese government on perceived speculative activity in the market. Chinese blast furnace production rose after the end of the Beijing Winter Olympics and is expected to pick up the pace on the announcement that the target date for peak emissions was pushed to 2030 from 2025 initially. While this bodes well for iron ore demand, and consequently prices, China's state planner is keeping a close eye on market activity. Given that Russia is a major exporter of iron ore (and steel), the commodity merits closer attention as prices could climb oversupply concerns if the conflict becomes more prolonged and intense. The consensus iron ore price has been upgraded an average of 1.7% annually over the forecast period.

S&P Global Platts is an offering of S&P Global Commodity Insights. S&P Global Commodity Insights is owned by S&P Global Inc.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.