Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 11 Oct, 2023

By Ronald Cecil

S&P Global Commodity Insights discusses consensus price forecasts for industrial and precious metals, including platinum group metals, amid broader market trends.

See S&P Global Commodity Insights' most recent market outlooks for copper, gold, iron ore, lithium and cobalt, nickel and zinc.

Policy announcements, designed to fix imbalances in the major economies, have continued to drive metals price volatility. Industrial metals rallied in the early weeks of September on news of further stimulus for China's economy, with recent measures mostly aimed at boosting demand in the lackluster domestic property sector — a key consumer of iron ore, copper and zinc. Signs of recovery in the manufacturing sector also bolstered optimism, although nickel prices slid under pressure from rising supply. The US Federal Reserve's hawkish commentary following September's interest rate pause with higher-for-longer sentiment triggered a sharp retreat for gold prices and downgrades to consensus price forecasts for industrial metals.

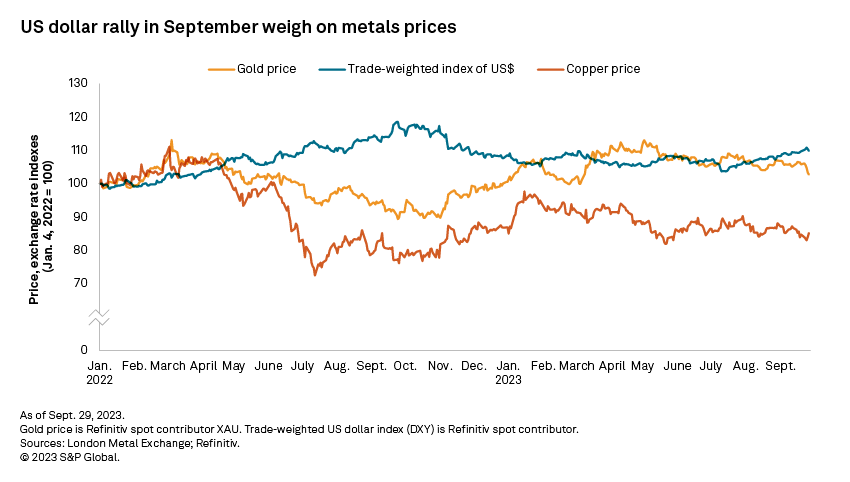

Industrial metals prices moved higher early September as sentiment firmed on further stimulus support for China's property sector and signs of a manufacturing recovery. Nevertheless, the Federal Reserve's hawkish pause to US interest rate hikes in September failed to sustain momentum, with rising US inflation, a stronger dollar and a Treasury yield rally pressuring metals prices. The Fed's increasingly hawkish sentiment over 2024 interest rate levels forebodes downside pressure on metals demand and underlies downgrades to consensus price forecasts.

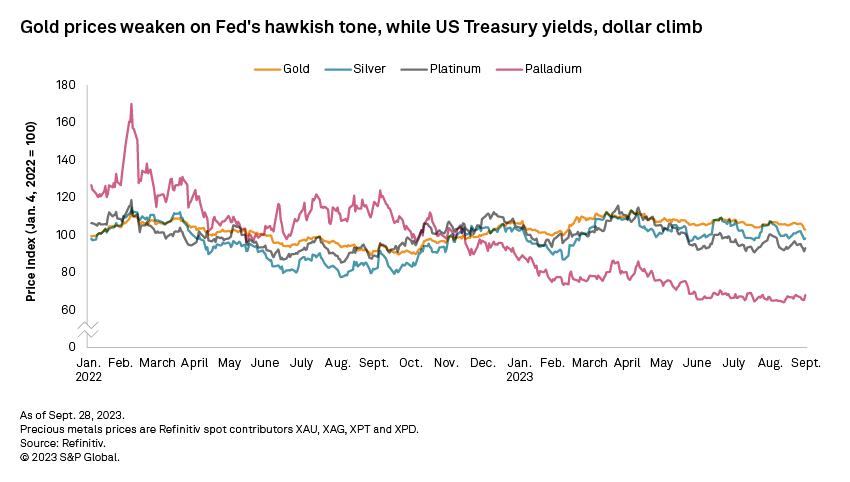

Changing expectations toward the prospect of another US interest rate hike before the end of 2023 and a higher-for-longer sentiment have resulted in the consensus gold price forecast being trimmed in the final quarter to $1,904 per ounce. Mixed signals from the US economy have continued to impact price volatility. Rate expectations were doused in the first half of September as US job openings slowed faster than anticipated in July while the US consumer confidence index had its sharpest drop in two years in August. The gold price subsequently climbed to $1,943 per ounce Sept. 20 when the Fed decided to keep interest rates on hold. Sentiment turned abruptly as hawkish commentary in the Fed's announcement centered on the likelihood of rates remaining elevated through most of 2024, which triggered a pullback in the equity market and drove COMEX gold prices down to $1,866/oz on Sept. 29. Swayed by an uncertain economic outlook, however, consensus gold price forecasts average 0.2% higher across 2023–27.

Silver prices broadly tracked gold price movements through September, albeit with the gold/silver price ratio widening midmonth before narrowing toward month-end as gold prices tumbled. Both precious metals prices came under pressure from a strengthening US dollar and the US 10-year Treasury surging to a 14-year high of 2.3% in late September as investors adjusted expectations after the Fed hinted at a looming interest rate hike. In contrast to gold, the consensus price forecast for silver is expected to rise in 2024 to $23.68/oz, supported by a 0.4% upgrade in September.

As expectations for US rate cuts in 2024 have subsided, the slowing global economy has heightened concerns around weakening demand. With a potential negative impact on the automotive sector, platinum prices briefly retreated below $900/oz in late September. The consensus price forecast, however, has risen 0.1% in 2023 with the platinum market expected to be in a larger deficit. Meanwhile, having been on a downward trend throughout this year, deteriorating fundamentals hamper palladium prices as increased platinum usage continues to make inroads into the traditional palladium-intense diesel vehicle sector. The weaker demand trend underlies the 0.5% downgrade to the 2023 palladium consensus price forecast.

Copper prices moved higher in the first half of September as China's stimulus boost and better-than-expected US economic data propelled investor optimism. The London Metal Exchange three-month (LME 3M) copper price then pulled back to $8,231 per metric ton at month-end as robust demand in China and India was countered by stronger supply, stiffening macroeconomic headwinds and the trade-weighted US dollar index rallying to a six-month high of 106.7 on Sept. 27. With further interest rate hikes expected as rising oil prices heighten inflation concerns, copper demand is expected to fall in the US and Europe in 2023. With the near-term supply response moving the copper market into surpluses through to 2025, consensus copper price forecasts have been downgraded by an average of 0.3% across 2023–27.

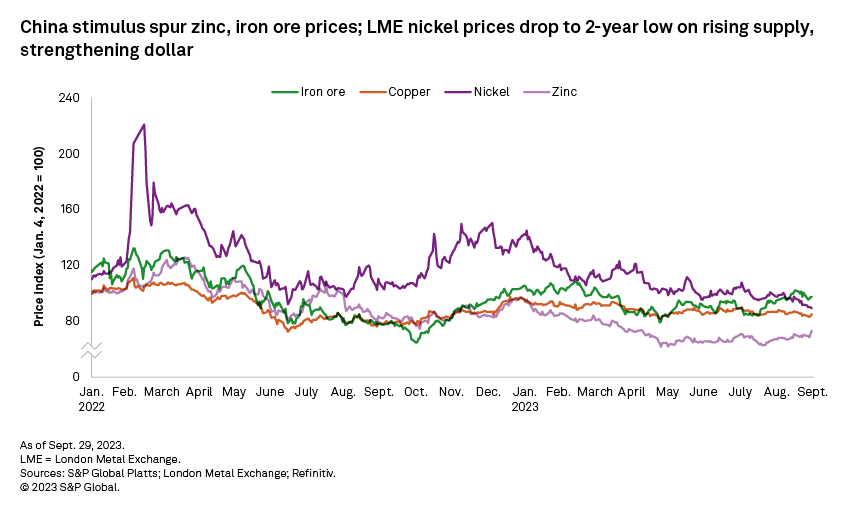

Contrasting with copper, the LME 3M zinc price moved higher on renewed China optimism and destocking at major exchanges. Prices rallied sharply from late August through to mid-September as Beijing eased home purchasing policies to stimulate demand in the country's property sector. Improved sentiment in China's manufacturing sector garnered further support as the Caixin purchasing managers' index for August moved into expansion territory. A rising dollar, alongside a shift in US interest rate expectations, failed to derail prices, which hit a four-month high of $2,641/t on Sept. 29. Nevertheless, consensus price forecasts for zinc have been downgraded by an average of 0.6% across 2023–27 due to expectations for looser market balances ahead.

The LME 3M nickel price dropped to a two-year low of $18,510/t on Sept. 29 as the dollar rose to a six-month high and fundamentals loosened. Nickel stocks have continued to rise amid a deterioration in the near-term demand outlook. Prices briefly gained some support from Glencore saying it would stop funding its loss-making Koniambo nickel mine in New Caledonia in February 2024. Rising supply from Indonesia, however, is expected to keep the nickel market well supplied over the medium-term, with downgrades to consensus price forecasts averaging 1.5% over 2023–27.

Cobalt prices drifted lower in September under pressure from sluggish demand. In China, a lack of restocking ahead of the National Day holiday week in early October suggests a delay in peak-season demand and a possibly more muted response than in previous years. Further, cobalt raw material availability could swell the current market surplus because of improvements in the export capacity of Democratic Republic of the Congo and the resumption of shipments from the Tenke Fungurume operation since May. Set alongside decelerating growth in China's passenger electric vehicle sales and with affordability issues in US and Europe hampering EV uptake, the 2023 consensus price estimate for cobalt is downgraded 0.6% to $17.84/lb.

Iron ore prices responded positively to news of further stimulus from Beijing directed at lifting consumption in China's economy, including support for the domestic property sector — a key driver of steel demand. The Platts IODEX 62% Fe iron ore price reached a six-month high of $124.65 per dry metric ton Sept. 20 as China's iron ore imports had surged in August on the back of strong domestic steel production. Anticipated curbs to China's steel output to better align with demand, alongside a seasonal rise in seaborne iron ore supply, are expected to lower prices in the final quarter of 2023. Spurred by improved data on China's economy, however, consensus price forecasts have been upgraded by an average of 1.0% across 2023–27.

Platts IODEX 62% Fe iron ore benchmark is an offering of S&P Global Commodity Insights. S&P Global Commodity Insights is a division of S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.