Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 17 Apr, 2024

Highlights

Over-the-top fragmentation is driving operator evolution into super-aggregators.

The challenges of an operator-OTT partnership include content integration, bundle discounts and data sharing.

While some operators chose to cut hardware costs with an app-only approach, others see opportunities in proprietary set-top boxes and TV sets.

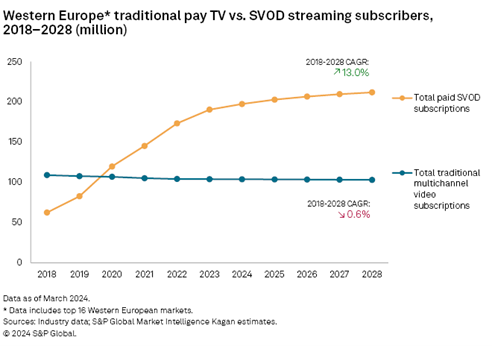

Pay TV operators across Western Europe have seen their subscribers dwindle and profit margins decrease in the past few years as viewing patterns change and new streaming platforms continue to launch. During the Connected TV World Summit in London, panelists discussed how the entire TV landscape is facing fragmentation and how operators are shifting to a new role as content aggregators.

Clients can access Kagan’s latest overview of the European SVOD market. To view detailed regional and country-level forecast data on the pay TV and OTT markets, go to Kagan's TMT Geography Knowledge Base.

Fragmentation is an increasing issue in the premium video space. The launch of OTT platforms (ad-based video on demand and subscription video on demand) has fragmented content, which in turn has fragmented TV audiences and viewing data. Operators are stepping in, integrating those platforms into their set-top boxes (STBs) and bundling them with TV and broadband offers, alleviating part of the content discovery challenge and providing streamers with a more stable customer base. Kagan tracked 60 operators in Western Europe that currently integrated 94 unique on-demand platforms, subscription, transactional and advertising OTT providers. Operators such as Vodafone España SAU, Telecom Italia SpA and Swisscom AG have launched TV offers with discounted subscriptions to platforms including Paramount Global's Paramount+, Walt Disney Co.'s Disney+ and Amazon.com Inc.'s Prime Video.

Speaking at the Connected TV World Summit, Malte Probst, chief product officer for fiction at Swisscom's Blue Entertainment AG, highlighted the role Swisscom has played in aggregating content in the market. In the fourth quarter of 2023, the company launched a new TV bundle, which includes Disney+ and Paramount+, at a 35% discount rate. With Swisscom's blue TV reaching 1.5 million subscribers, accounting for almost 40% of Switzerland's households, the bundle provides the streamers with the opportunity to increase reach.

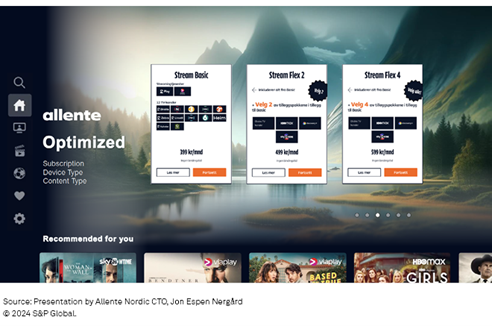

Netflix Inc. continues to be the leading SVOD service integrated to some level on 40 out of the 56 major pay TV platforms in Western Europe. However, for Jonas Gustafsson, CEO of Allente Group AB, a partnership with Netflix was not an attractive proposition as the ubiquitous streamer is not seen as a differentiator and the company "demands too much." Despite this, OTT remains a key part of the operator's offers, which are platform-agnostic and allow customers to switch between streaming apps each month, including Warner Bros. Discovery Inc.'s HBO Max and Discovery+, as well as Comcast Corp.'s SkyShowtime.

Multiple speakers at the conference expressed the difficulties of "arm-wrestling" with the major streamers for more favorable partnership deals, with data-sharing posing significant challenges. As well as access to information on customer usage, operators require access to application programming interfaces (APIs), which are essential to enable content suggestions across multiple services — a key benefit of the super-aggregator business model as it improves discoverability and customer experience.

The ability to provide discounts on bundle offers was also cited as a pain point during negotiations, with operators arguing that discounts are necessary to attract customers and help reduce churn. For Vanda Rapti, Executive Vice President of Viaplay Select & Content Distribution at Viaplay Group AB (publ), discounts in operator bundles need to be balanced well on the commercial side. She cited, as an example, cases in which adding Viaplay Select, the group's portfolio of content for partner platforms, to their bundles allowed operators to justify increasing prices.

Set-top box, own-brand TV, or just an app?

While pay TV providers have focused on aggregating content, integrating that content, for search and discoverability (content curation), from third-party applications on their own pay TV platforms remains a costly challenge. As a result, many operators such as Eircom Holdings (Ireland) Limited d/b/a Eir and Vodafone Group PLC have opted to gradually move away from producing their own STBs in favor of standardized boxes such as Alphabet Inc.'s Android TV box and Apple Inc.'s Apple TV. Having unified operating software where apps are already compatible/integrated enables operators to significantly lower costs and accelerate go-to-market TV strategies.

According to Frank Rippl, Head of TV Product at Vodafone, adopting Android TV across its markets was essential, especially in minor markets such as Greece and Ireland where more bespoke offers are required. Switching from proprietary Linux platforms to Android means various features are built into the STBs and don't have to be developed by the operator, making third-party integration easier and allowing the company to focus on making content more accessible. It also minimizes the time and cost of adding new services to your bundle and replacing discontinued streaming services, which has been an issue in the past, as there is no need to develop your own app store or app integration.

Other operators see the appeal of maintaining control over the user experience. The most extreme case is that of Sky Ltd. with its own-brand TV set, Sky Glass. The company has since begun developing a syndication model for its operating system, Entertainment OS, helping Australia operator Foxtel Cable Television Pty Ltd. launch its own multi-device platform and retail TV set, branded Hubbl Glass, in February 2024. Sky's white-label super aggregator platform for operators allows smaller operators that normally would not have the scale or development budget for it to offer products.

Germany satellite FTA provider Hd Plus Gmbh has long adopted a different approach, partnering with manufacturers to make their content available on multiple retail STBs, removing the need for platform or UX development. The SES SA-owned company changed this strategy in 2019 when it launched a proprietary smart TV app, which is today embedded in 80% of UHD TV models sold in Germany. HD+'s Chief Architect for Consumer Electronics Solutions, Lennart Sohst, says that having their own UX opens up access to customer usage data, as well as new features that enrich HD+'s services.

Ultimately, the most important thing is to make sure you have a product that is tailored to different customer types: Allente has the same packages over three platforms; VMED O2 UK Ltd. has TV 360 and Stream, which is app-centric but includes linear programming; and HD+ eventually went the app route. For Vodafone's Frank Rippl, while operators may want to avoid hardware fragmentation, it is still important to maintain a product for the 50+ age group, which is served by more traditional pay TV services.

Global Multichannel is a regular feature from S&P Global Market Intelligence Kagan.

Research