Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 19 Oct, 2023

By Ying Li

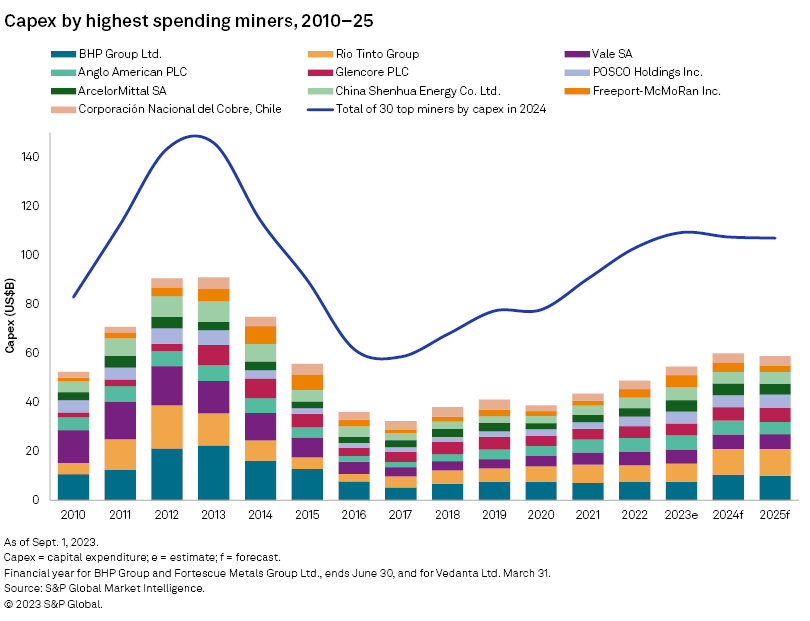

Capital expenditure of the 30 top miners globally is expected to grow 6.2% in 2023 to an estimated $109.2 billion, following increases of 13.8% in 2021 and 16.3% in 2022. The large companies may not have reached the peak of their investment and expansion efforts, however, as 2023 planned capex is still $36.5 billion short of 2013's peak of $145.7 billion. We expect investment in the next two years will become more challenging against a backdrop of high inflation and interest rates and slowing economic activity, leading the group's capex to decrease 1.8% in 2024 and 0.7% in 2025.

Capex of the diversified companies covered in our analysis may go towards items such as smelters, steel production, logistics or power generation, meaning the total spend of each company is not directly comparable. This analysis focuses on the capex for metals and mining projects.

➤ Capital expenditure of the 30 biggest-spending mining companies is expected to grow 6.2% in 2023 to an estimated $109.2 billion.

➤ Miners are forecast to reduce their capex after 2024 and are likely to face a growth dilemma in the next two years.

➤ The largest mining companies are prioritizing critical minerals, energy transition, climate strategy and decarbonization of operations in future investment plans.

➤ Total capex by the top 10 leading miners is expected to account for about 50.8% of the total capex of the top 30 mining companies in 2023.

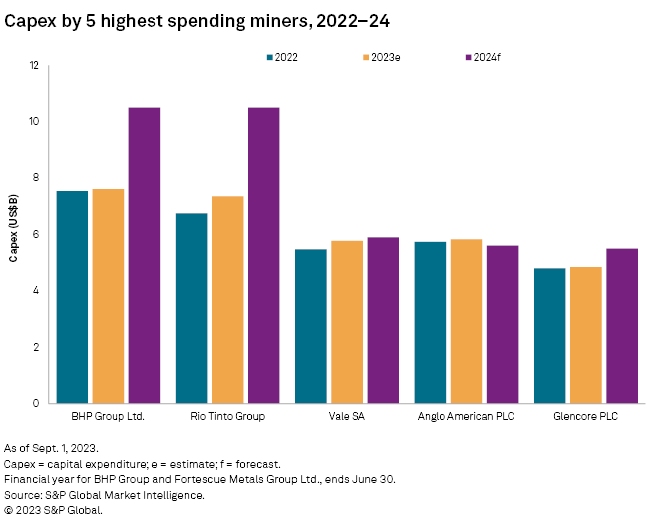

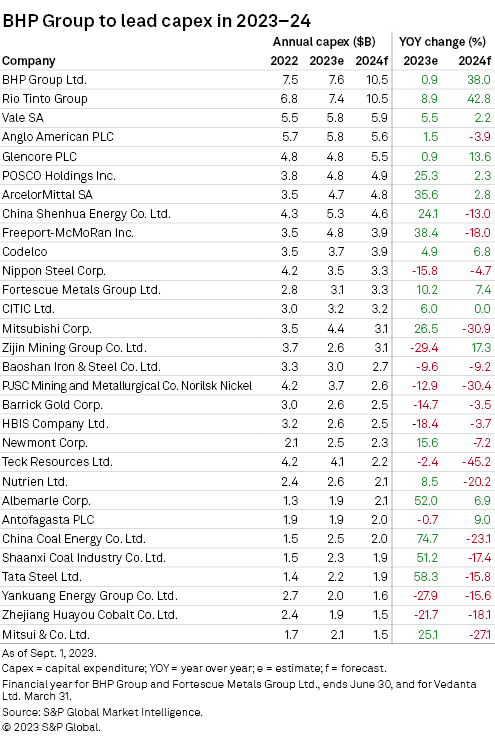

According to S&P Global Market Intelligence research and company guidance, the highest capital budget spend in financial year 2023 is expected to come from BHP Group Ltd. at $7.6 billion. The company has increased its capex outlook for fiscal 2024 to $10 billion from a previous management projection of $9 billion. Capex for stage 1 of BHP's Jansen mine in Canada was $647 million in fiscal 2023, and the project was 26% complete as of the close of the financial year. BHP expects its capex for stage 1 to increase to approximately $1.0 billion in fiscal 2024 and total capex for the project to reach $5.7 billion. First production is likely by the end of 2026. The feasibility study for stage 2 of Jansen is expected to be completed during 2024, with first production possible as early as 2029.

BHP increased capex guidance to $11 billion per year for the medium term, of which approximately $4 billion in aggregate will be channeled to operational decarbonization before the end of 2030. The company approved a number of potential projects to begin in the next few years and will give an update on investment for its Escondida copper mine in Chile and iron ore operations in Western Australia, which will account for 71% of the total development capex in fiscal 2023–24.

Rio Tinto Group's latest capex guidance is $7.4 billion in 2023 — including about $1.5 billion in growth capital — to be used to ramp-up projects, including Guinea's vast Simandou iron ore deposit, the underground expansion of Oyu Tolgoi copper-gold mine in Mongolia and Argentina's Salar del Rincon lithium project. Rio Tinto's investment over the next two years is starting to tilt more toward growth, with its total capital investments guidance for 2024 and 2025 set at up to $10 billion, which could vary depending on the rate of development at Simandou. It is worth noting, however, that even with the company's capital spending growing a projected 42.8% in 2024, putting it three times higher than the 2016 low, it is still below the 2012 peak.

Anglo American PLC trimmed its 2023 capex outlook to $6.0 billion in midyear reporting from previous guidance of $6.0 billion to $6.5 billion. This includes growth spending of $1.5 billion, of which $700 million is planned for the Woodsmith polyhalite project in the UK, expected to enter production by 2027. Anglo American's share of the ramp-up associated with the Quellaveco copper mine in Peru is planned at approximately $100 million in 2023. We assume that capex will average $5.3 billion per year in 2024 and 2025, with sustaining capital planned to remain between $4 billion and $5 billion each year.

Vale SA's capex totaled $5.5 billion in 2022 but was 8% higher than guidance due to investment in some projects in Brazil, namely the Sol do Cerrado solar energy complex, the Serra Sul iron ore expansion of 120 million metric tons per annum, the Capanema and Tubarao Briquette iron ore projects, and the Salobo III copper project expansion. The company plans to spend approximately $6 billion in 2023 on projects, including the Onca Puma mine's second furnace, the Thompson phase 1 part of Manitoba Division and the construction of Voisey's Bay underground mine expansion project, the continuing ramp-up of the Serra Sul operation, as well as the Morowali nickel project in Indonesia, also known as Bahodopi, which is expected to start in 2025. The start-up of the Onca Puma second furnace operation is expected for the first half of 2025, with a total planned investment of $555 million. The company pumped $150 million into the Thompson phase 1 project to extend current mining activities in Manitoba for 10 more years. The Thompson mine extension is a two-phase project, and the startup of phase 1 is expected by 2023. Thereafter, the company expects its 2024–27 annual capex to remain between $6 billion and $6.5 billion.

Posco Holdings Inc.'s capex has been trending downward for the past 10 years since the onset of China's steel surplus. Recently, Posco has been restructuring its business by focusing on being more eco-friendly. The company has extended its ambitious expansion into the battery value chain and strengthened its raw materials business, with its capex expected to reach about $4.8 billion in 2023. Posco plans to increase its annual production of cathode to 1 million metric tons, anode to 370,000 metric tons and lithium materials to 43,000 metric tons by 2030. The company also plans to increase its annual production of high-purity nickel to 240,000 metric tons by 2030 and produce 70,000 metric tons of metals, including lithium, nickel and cobalt, by 2030 from recycled batteries.

ArcelorMittal SA's capex is expected to be between $4.5 billion and $5 billion, of which about $1.3 billion to $1.6 billion is planned for decarbonization, with a target to reduce their global CO2 emissions 25% by 2030. The total capex for Liberia Mines' 15 MMt/y expansion project has been revised to $1.4 billion, with additional output estimated to begin in the fourth quarter of 2024.

China Shenhua Energy Co. Ltd.'s total capex in 2022 amounted to around $4.7 billion, of which the coal segment accounted for 33.3% and the power segment accounted for 34.7%. While the company's main product is thermal coal, it is involved in operating power stations and associated logistics. The capex plans of the company for 2023 increased to $5.3 billion, mainly due to the rise in capital for the company's subsidiaries in coal, power and transportation segments and the acceleration of project construction.

Glencore PLC is due to invest approximately $4.8 billion in 2023. Capex at Glencore's industrial assets is expected to average $5.6 billion per year between 2023 and 2025, with $1.1 billion per year for metals portfolio expansion activities, $3.2 billion per year for sustaining metals assets, and $1.3 billion per year for supporting the continued operations of the energy portfolio in line with the climate commitment. Key investment projects over the next few years include the desalination project at the Collahuasi copper joint venture in Chile, the extension of Sudbury integrated nickel operations in Canada, the Zhairem zinc project in Kazakhstan, and the commissioning of Canadian Raglan phase 2 in 2024 and that of Onaping Depth in 2025.

Compared to $2.1 billion in 2021 and $3.5 billion in 2022, Freeport-McMoRan Inc.'s capex for 2023 is expected to increase significantly, even as the company lowered its 2023 forecast to about $4.8 billion from $5.2 billion, which includes $2 billion for major mining projects and $1.6 billion for the smelter projects in Indonesia. Construction of the Manyar greenfield smelter in Indonesia was approximately 75% complete as of June 2023 and is expected to commence commissioning in mid-2024 at an estimated cost of $3.0 billion, with a capacity to process 1.7 MMt/y of copper concentrate. The expansion of PT Smelting, a joint venture between Mitsubishi Corp. and Freeport Indonesia to process concentrate from the Grasberg mine will boost the plant's capacity to 1.3 MMt of copper concentrate from the current 1 MMt and is expected to be completed by the end of 2023. The company's Indonesian Precious Metal Refinery construction is in progress, with commissioning expected during 2024 at an estimated capital cost of about $525 million. S&P Global Market Intelligence expects Freeport-McMoRan's total capex to drop back to $3.9 billion in 2024, with the smelter projects ramping up.

Codelco's capital investment in 2022 amounted to $3.4 billion, and we expect 2023 to be slightly higher than last year. The main investment projects over the next 2 years include phase 2 of the Chuquicamata Underground Mine in Chile; the El Teniente New Mine Level, which aims to extend mine life by 50 years and enable deeper mining; and the Salvador open pit to underground in the Atacama region, which, as of June 2023, reached an overall development progress of 55%.

PJSC Mining and Metallurgical Co. Norilsk Nickel had planned to raise its 2023 capex by 10% year over year to a peak of $4.7 billion in December; however, the company has narrowed its full-year 2023 capex guidance to between $3.5 billion and $3.8 billion due to the optimization of contractor payments by foreign equipment and technology suppliers and the rescheduling of investment projects.

Our forecast 2023 capex for Barrick Gold Corp. of approximately $2.6 billion will go toward several important growth projects, including the expansion of Pueblo Viejo's processing plant in the Dominican Republic and the undeveloped Reko Diq copper-gold deposit in Pakistan, which could double Barrick's copper production with first production targeted in 2028.

Teck Resources Ltd.'s capex in 2023 is to be close to that in 2022, at about $4.1 billion. With the Quebrada Blanca mine's phase 2 in Chile ramping up and completing its first shipment in the second quarter of 2023, capex for the project will reduce in 2023 and is expected to range between $1.65 billion and $2.2 billion in 2024.

The combined capex of the top 10 mining companies is expected to account for 50.8% of the 30 leading miners' capex in 2023. While the latter's financials are set to remain strong in fiscal 2023 amid forecasts of production increase across commodities and elevated metals prices, the major mining companies are facing a growth dilemma. Critical metals, clean energy transformation and decarbonization of operations to keep up with the global changing demand for commodities remain priorities for these companies for future investments.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Campaign